Executive summary

We explore how trend-following, a multi-asset strategy that exploits persistent price movements, can be aligned with sustainable investment goals. We propose a novel approach to integrating sustainability criteria into trend-following signals, without compromising its risk-return profile or diversification benefits. We also discuss the practical challenges and opportunities of implementing responsible investment (RI) trend-following in real-world portfolios.

Introduction

Trend-following has performed as well as equities in the long term yet is uncorrelated and tends to perform best when equities are at their worst.

In our ‘Path Less Travelled’ series on multi-asset sustainable investing, we delve into less-explored asset classes. Our first set of papers addressed the underappreciated potential of commodities1 and government bonds2 , before turning to how responsible multi-asset investors might use green bonds3 in their portfolio. Here, we combine some of these ideas to look at another popular strategy, trend-following.

Trend-following has performed as well as equities in the long term yet is uncorrelated and tends to perform best when equities are at their worst. Historically, it has not been at the forefront of RI considerations due to its requirement for short positions, alongside its need for derivative instruments and thirst for diversification. These characteristics create challenges for incorporating RI into systematic macro portfolios, such as trend-following, and were the subject of a 2021 paper.4

We know, then, this won’t be a walk in the park. We’ll consider how cost of capital and risk sharing effects may present opportunities for investors to have influence, both long and short via a trend-following strategy. We will look at how investors may combat the loss of diversification RI restrictions may impose by adding additional markets to their portfolio. There are other novel considerations too, such as what to do with the high levels of cash that come along with a trend-following approach.

What is trend-following?

Trend-following aims to capitalise on the observation that market prices exhibit trends.

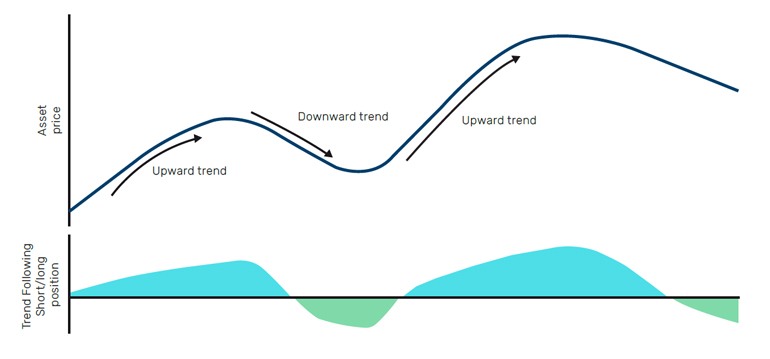

Trend-following aims to capitalise on the observation that market prices exhibit trends. Trends are formed when assets that have performed well in the past continue to perform well, and conversely, assets that have performed poorly in the past continue to perform poorly. Capturing trends involves the systematic purchase of assets that are trending up and selling those that are trending down, based on predetermined rules, with the aim of generating returns that are uncorrelated to traditional markets (Figure 1).

Figure 1. Illustration of a trend-following signal. In an upward trend, the signal buys (blue shaded area). In a downward trend the signal sells (green shaded area)

Source: Schematic illustration.

Diversification is key, and managers of trend-following strategies will typically trade tens, if not hundreds, of markets to maximise their chances of success. We have written extensively about trend-following and would point interested readers to Trend-following: Equity and Bond Crisis Alpha5for an introduction on how to build a straightforward trend-following programme and the AHL explains series6 for further information.

The role of trend-following in an investment portfolio

Despite trend-following’s popularity – with over US$300 billion invested – it is often overlooked from a sustainability perspective.

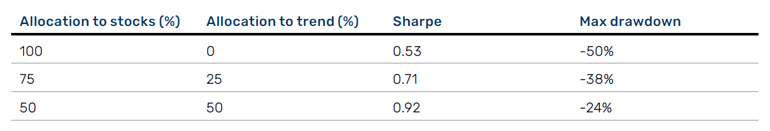

As we illustrate in our Man Institute paper Trend-Following: What’s Not to Like7 trend-following strategies have been traded for around four decades, during which time they have performed broadly as well as equities, but with zero correlation to other asset classes and, importantly, they have demonstrated the ability to perform well during sustained market crises. These features make trend-following an attractive proposition alongside traditional portfolios, as we illustrate in Figure 2, showing how trend-following can boost risk-adjusted returns while reducing maximum drawdowns.

Figure 2. Potential improvements to traditional portfolios from the inclusion of trend-following strategies

Why consider RI as a trend-follower?

Our Path Less Travelled series aims to shed light on some of the blind spots in relation to RI. Indeed, despite trend-following’s popularity – with over US$300 billion8 invested – it is often overlooked from a sustainability perspective. Historically the lack of progress has been attributed to difficulties arising from short positions, briefer holding periods and the use of derivatives4 but for investors who want the attractive diversification features, this has meant a holding where sustainability is not considered.

Should we differentiate between asset classes?

One of the attractive features of trend-following is the diversity of assets traded and certainly one of the challenges with integrating RI considerations is maintaining that level of diversification.

The underlying assets in a trend-following strategy have a role to play in society’s global challenges including climate change and global poverty. Governments, for example, set the rules for investors with regards to environmental and social laws and regulations. Currencies and commodities are also crucial to a well-functioning global society, facilitating trade and providing the raw materials for food, energy and shelter. Company’s stakeholders include employees, suppliers, and the local community, all of which are impacted by environmental, social and governance issues. It therefore seems reasonable to consider RI as a trend-follower. We discuss these points in further detail elsewhere in the Path Less Travelled series.1,2,3

One of the attractive features of trend-following is the diversity of assets traded and certainly one of the challenges with integrating RI considerations is maintaining that level of diversification. Investors will typically be exposed to corporate, sovereign and commodity assets, as well as short-term instruments in the cash allocation. Figure 3 shows a typical trend-following allocation.

Problems loading this infographic? - Please click here

In trend-following the channel of influence is less clear, with relatively short holding periods across a range of long and short positions giving allocators a headache.

This is positive from a diversification perspective but creates some potential headaches when thinking about integrating RI principles, particularly outside of equities where the field is less developed. We have contributed to the conversation on government bonds and commodities1,2 and concluded that both asset classes present opportunities for investors to have a positive effect on RI outcomes, although investors need to think carefully about how to select which markets to trade. For example, in governments, environmental policy and renewable energy generation may be metrics used to differentiate between sovereigns. In commodities, the damage in production needs to be weighed against the potential benefits in utilisation. For FX investments, the security is related to a government so the sovereign framework can be used to aid asset selection.

When managing the cash allocation, most large institutional asset managers will allocate to Treasury bills, where, again, the sovereign framework can be used to form a view on both the US and non-US instruments. Commercial paper or certificates of deposit lend themselves to an investor’s corporate asset framework. Further information is provided in the cash section later in this article.

In each of these asset classes, the investor needs a channel of influence to align their asset selection with their RI beliefs. This is well defined in long-only equity investing, for example, where the holder may allocate more to low carbon emitters in their sector or implement an impact strategy to focus on lowering the environmental impact of the biggest emitters. In trend-following it is less clear, with relatively short holding periods across a range of long and short positions giving allocators a headache. There are, however, ways around this.

Cost of capital, risk sharing and having influence as a trend-follower

Cost of capital

The two most notable ways a trend-follower can have influence are, in our opinion, via cost of capital and risk sharing effects.

The two most notable ways a trend-follower can have influence are, in our opinion, via cost of capital and risk sharing effects. Importantly, these effects apply both via long and short positions.

Unless you subscribe to the strong form of the efficient market hypothesis, increased investor demand for a stock or bond should raise the price and therefore lower the issuer’s cost of capital. This is a benefit for a company (which issues both equity and debt) or a government (which issues debt). These effects have been discussed in the academic literature.9,10

As an investor, being long investments deemed to be positive from a sustainability perspective means you are aligned with lowering that issuer’s cost of capital. Equivalently, by being short (or not holding) a particular security, you are aligned with increasing that issuer’s cost of capital. Relating this to a trend-following investment, cost of capital assets include stocks, government bonds, credit and money market instruments. Influence can then be applied via long-only or short-only constraints on the markets traded. Figure 4 shows the modification of a trend-following signal where the more sustainable instrument (OMX Stockholm 30 ESG Index) is long-only and the less sustainable instrument South Africa All Share is short-only.

Problems loading this infographic? - Please click here

On the aligned asset (OMX Stockholm 30 ESG Index), when the trend signal is long, a long position is taken as normal (A). When the trend-following signal is short, no position is taken (B). In the non-aligned asset South Africa All Share, when the trend signal is long, no position is taken (C). When the trend-following signal is short, a short position is taken as normal (D).

Risk sharing

Determining the sustainability impact of going long or short on commodities and currencies can be challenging. Consider copper: its high price can incentivise increased production, benefiting producers but potentially harming renewable energy projects that require the metal. Conversely, a lower price might have adverse effects on production incentives. The situation is similar with oil, where lower prices could unintentionally lead to increased consumption, undermining environmental goals. Thus, applying a one-size-fits-all approach to commodity prices is problematic.

We believe a consensus can be found in the benefits of a robust, liquid hedging market.

We believe a consensus can be found in the benefits of a robust, liquid hedging market. By allowing producers and consumers to lock in prices in advance, futures markets can reduce the exposure to price fluctuations and increase the predictability of cash flows. This can encourage more investment in production capacity and innovation, as well as more efficient allocation of resources. For example, a renewable energy project that relies on copper as an input can use copper futures to hedge against the risk of rising copper prices and secure its profitability. Investors can enhance market liquidity by taking long and short positions, which in turn supports more efficient pricing. For instance, a trend-following manager might prioritise liquidity in copper, while excluding those considered less sustainable, like oil. In practical terms, this would involve trading copper futures at a higher weight in a trend-following strategy, both long and short, and avoiding crude oil futures. One exception is carbon markets, where a higher carbon price is likely preferable in terms of incentivising market participants to cut emissions. In carbon markets, trading long-only would be preferred.

Currency markets share similar complexities. It’s hard to determine if a government would prefer a stronger or weaker currency, but like commodities, they benefit from a deep and liquid hedging market. Both commodities and currencies may therefore see influence via risk sharing effects.

Other avenues for influence

Beyond cost of capital and risk sharing effects, other avenues for influence include perception and sentiment effects, alongside investor engagement. Both are discussed at length in other articles in the Path Less Travelled series.

Transparency

Transparency on the process and implementation is important as different investors will have varying beliefs.

Transparency on the process and implementation is important as different investors will have varying beliefs. We want to promote an active exchange of ideas and have discussed transparency and reporting in previous articles.4,11

We are not suggesting that trend-following is the only or the best way to achieve sustainability goals. On the contrary, we appreciate the insights of Hartzmark and Shue12, who show that engaging with the worst environmental offenders can have a positive impact on long-term carbon emissions. However, our focus here is on how trend-following can align with sustainability objectives across multiple asset classes and shorter time horizons, using a transparent approach, while leaving longer term impact strategies to an investor’s active equity allocation.

What data can be used?

Recent articles in the Path Less Travelled series1,2,3cover examples of data used to form a view across corporates, sovereigns and commodities.

We observe that RI data in equities is already well developed, with sovereign data catching up as providers move to meet demand, while investors can also source data from primary sources such as the World Bank. Data on commodities is trickier, but the space is evolving quickly, with, for example, the launch of the Bloomberg BCOM Carbon in 2023 and the sustainability consultant RFU offering metrics for comparison.

Trend-following’s multi-asset approach therefore requires RI data across a spectrum of asset classes. As discussed in How to Build a Systematic Multi-Asset Climate Portfolio11 , an efficient data platform is useful for cleaning, storing, and processing data to be used in asset selection. Depending on the investor’s RI aims, this data can be combined in a way that aligns with their RI goals. Please refer to the cited papers for a full discussion on RI data.

Optimising the cash account

For a $100 investment, a typical trend-following strategy might deploy US$10-50 in margin to fund futures position. The rest is held as cash, typically in liquid, high-quality, short-dated fixed income instruments. This cash presents a unique opportunity for investment managers to harmonise their cash deployment with RI principles.

Traditionally, trend-followers might place 100% of this cash in US Treasury bills. However, adopting an RI framework expands the horizon, allowing managers to diversify into short-term debt from nations that exhibit strong environmental or social governance. For instance, integrating Man Group’s RI criteria would shift a portfolio’s exposure towards countries like Sweden and Germany, based on their commendable sustainability scores, while reducing US allocations.

Given the significant cash holdings in trend-following portfolios, it is both logical and prudent to include cash as an asset class within RI analysis.

In the realm of corporate cash instruments, such as commercial paper or certificates of deposit, the wealth of issuer information available can guide investment decisions. Here too, RI considerations can influence the weighting process, favouring issuers with positive RI alignment and potentially avoiding those that fall short.

Given the significant cash holdings in trend-following portfolios, it is both logical and prudent to include cash as an asset class within RI analysis. This approach diverges from conventional strategies that typically overlook cash in favour of focusing solely on securities for investment exposure. Such an inclusive stance ensures that every element of the portfolio contributes to the overarching RI goal.

How does integrating RI data impact trend-following portfolios?

To assess how incorporating RI data affects trend-following portfolios we need to examine the changes that are imposed and identify strategies to maintain an acceptable level of diversification.

For stock indices and fixed income futures, adhering to the cost of capital principle suggests we should apply long-only constraints to top-performing markets and sovereigns with strong RI scores, while imposing short-only constraints for the poorest RI performers. These constraints would only be applied to the upper and lower ends of the performance distribution (the top and bottom quartiles, for instance), as markets closer to the average are not as easily categorised as definitively “good” or “bad”, and it prevents the risk of constraints flipping sign due to noise in the data. However, with these restrictions in place, we face an issue: in a global stock rally, short-constrained stocks are capped at a zero position, and the opposite is true in a downturn. Consequently, an RI-aware strategy may consistently carry less risk in stocks than an unrestricted trend-following approach, a situation mirrored in the fixed income space.

To resolve this problem, we can compensate for the lost risk in each sector (stocks, to continue the example) by scaling up the longs and shorts we are allowed to take positions in to match the risk of the unconstrained trend-following strategy. For example, if we want to go long the S&P 500 Index but are restricted to be short-only, we could compensate by increasing long positions in the S&P 500 ESG Index and the DAX, or other stock indices we are allowed to take a long position in. This approach will inevitably introduce some tracking error, but this is manageable due to the high within-sector correlations in stock indices (and government fixed income futures). By employing this risk-matching mechanism, we can closely emulate the portfolio characteristics of the unconstrained trend-following portfolio while adhering to an RI framework.

Given the reduced diversification, we would anticipate an RI-aligned trend-following portfolio to have a lower Sharpe ratio than its unconstrained counterpart on a forward-looking basis.

In the case of currencies and commodities, following the risk sharing principle, we would need to increase portfolio weights for markets deemed more sustainable and reduce or eliminate exposure to the poorest RI performers. By removing key markets such as crude oil and natural gas, this step notably reduces the level of market diversification within the portfolio. Moreover, it is challenging to “reconstruct” these markets using single name stocks, as the universe of stocks that exhibit consistently high correlations to these markets is both very small and unlikely to exhibit sufficiently good RI scores for a portfolio to go long.

Given the reduced diversification, we would anticipate an RI-aligned trend-following portfolio to have a lower Sharpe ratio than its unconstrained counterpart on a forward-looking basis. To regain diversification, additional markets can be considered. New futures markets, such as ESG versions of stock indices (like the S&P 500 ESG Index or OMX Stockholm 30 ESG Index) and European Union Allowances (EUAs) are examples of instruments not typically traded by traditional trend-followers but could find a home here. Even more significantly, a cash equities trend-following strategy could be considered. While it is not a like-for-like substitution for the futures no longer traded, it not only restores portfolio diversification, but also allows the strategy to apply more granular stock-specific RI tilts. Specifically, we can construct an RI long-short factor that goes long high-RI-scoring stocks and shorts the lowest performers, and tilt the portfolio towards this factor, constraining it to never go net short. This aligns our cash equities trend-following strategy with the cost of capital principle, exhibiting a bias towards long positions in better RI performers and short positions in poorer RI performers.

Figure 5 demonstrates the effects of the described RI adjustments on a trend-following portfolio. It presents the simulated performance for three distinct example portfolios: a typical, unconstrained trend-following strategy trading liquid futures (Trend), an RI-aligned trend-following strategy with long/short-only constraints in cost of capital sectors and adjusted market weights in risk sharing sectors (Trend_RI), and lastly, the same RI-aligned trend-following strategy with an additional 10% allocation to an RI-aligned cash equities trend-following strategy (Trend_RI_Plus).

Problems loading this infographic? - Please click here

Conclusion

Once diversification is restored, the long-term performance aligns with that of the unconstrained strategy, indicating that incorporating RI data does not necessarily entail a significant trade-off in returns.

An interesting point of observation is the need to discount the performance of the RI cash equities long-short factor: it exhibits a positive Sharpe over the sample period, and consequently tilting towards this factor seemingly boosts the performance of the cash equities strategy. This artificially arises due to our need to backfill RI data: coverage of RI data only begins to pick up in very recent years, and hence to get a full simulation we need to backfill RI scores, which necessitates a forward-looking bias that inflates performance. Since this performance boost is artificial in nature, we discount it from our analysis, such that the RI tilt introduces no performance gain.

The comparison of these portfolios yields three key insights about integrating RI data into trend-following portfolios:

1. The reduction in diversification resulting from excluding or down weighting non-RI-aligned markets requires the addition of new markets and asset classes, such as cash equities, to reclaim diversification. (We see this as Trend_RI underperforming Trend in Figure 5).

2. Once diversification is restored, the long-term performance aligns with that of the unconstrained strategy, indicating that incorporating RI data does not necessarily entail a significant trade-off in returns, if the manager is willing to do the extra work to boost diversification.

3. Despite some expected tracking error, the fundamental characteristics of a trend-following strategy are preserved – it continues to offer diversification relative to traditional asset classes and provide crisis alpha during market downturns.

In this paper, we have explored the usefulness of trend-following in an investment portfolio, how RI could be considered in such investments, and how investors can exert influence via cost of capital and risk sharing arguments. We found that incorporating RI data can lead to a loss of diversification, and new markets are required to reclaim that lost diversification. With the additional markets, investors can incorporate sustainability considerations without giving up the attractive investment properties found in a trend-following strategy.

Transparency is crucial as different investors will have different beliefs. For a strategy like trend-following, where sustainability principles are in their infancy, it makes it even more important to host a platform for ideas sharing and challenge. We hope that our Path Less Travelled series continues to advance the conversation.

References

[1] E. Hoyle and H. Moore, “The Path Less Travelled: Investing Responsibly in Commodities”, Man Institute, 2023. https://www.man.com/maninstitute/investing-responsibly-commodities

[2] H. Moore and E. Hoyle, “The Path Less Travelled: Investing Responsibly in Government Bonds”, Man Institute, 2023. https://www.man.com/maninstitute/path-less-travelled-investing-responsibly-in-government-bonds

[3] A. Scriven and E. Hoyle, “The Path Less Travelled: Understanding Corporate Green Bonds”, Man Institute, 2024. https://www.man.com/maninstitute/path-less-travelled-green-bonds

[4] H. Moore, “Can Systematic Investors Plead the Fifth on RI?” Man Institute, 2021.https://www.man.com/maninstitute/can-systematic-investors-plead-fifth-on-ri

[5] C Hamill, S. Rattray, and O. Van Hemert, “Trend-following: Equity and Bond Crisis Alpha”, SSRN, 2016.https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2831926

[6] A. Ledford, “AHL Explains Series”, Man Institute. https://www.man.com/maninstitute/ahl-explains

[7] G. Robertson, “Trend-following – What’s Not to Like?”, Man Institute, 2023. https://www.man.com/maninstitute/trend-following-what-not-to-like

[8] AUM data from BarclayHedge. https://www.barclayhedge.com/solutions/assets-under-management/cta-assets-under-management/CTA-industry/

[9] R. Eccles et al, “The Impact of Corporate Sustainability on Organizational Processes and Performance”, 2017. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1964011

[10] Cheng et al, “Corporate Social Responsibility and Access to Finance”, 2014. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1847085

[11] H. Moore and J. Munro, “How to Build a Systematic Multi-Asset Climate Portfolio”, 2023. Man Institute. https://www.man.com/maninstitute/systematic-for-climate-investors

[12] S. M. Hartzmark and K. Shue, “Counterproductive Sustainable Investing: The Impact Elasticity of Brown and Green Firms”, SSRN, 2022. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4359282

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.