Introduction

The view that RI principles do not apply to systematic investments is beginning to look outdated.

Financial derivatives and the machines that trade them have historically not lent themselves towards responsible investment (‘RI’) considerations. However, since humans design the algorithms that drive systematic strategies, it is perhaps reasonable to expect that these same humans can construct a framework for the machines to invest responsibly. The traditionally held view – that responsible investing is not applicable to a systematic macro manager – is starting to look outdated and significant progress is being made to address the challenges. Investors, too, are certainly beginning to hold their systematic strategies to a higher standard in terms of environmental, social and governance (‘ESG’) factors. This ranges from the simplest index investments, such as equity index trackers, where products may exclude some of the worst performing names from an RI standpoint, all the way to fully-fledged systematic hedge funds that have become more active stewards of their investors’ capital.

In this article, we aim to go beyond the realm of traditional single-name equities (which typically make up either none, or a small portion, of a systematic macro manager’s risk budget) to focus on other instruments which have historically been ignored from an RI perspective. We hope we can provide food for thought on how systematic managers can integrate ESG in their investment process.

What Are the Challenges for Systematic Managers?

Firstly, let’s consider why investors make an allocation to systematic macro strategies, such as trend-following (‘CTA’). On the list of possible reasons, we expect diversification is near the top. The addition of an investment strategy with a positive expected return, yet near zero correlation to traditional assets, has the potential to boost returns, reduce volatility and soften drawdowns. Since a good systematic macro strategy possesses these attributes, it’s a powerful tool in the investment toolbox. So, from a financial perspective, it makes sense, but what are the issues when trying to also incorporate RI principles?

Systematic macro managers cast a wide net across hundreds, if not thousands, of positions, aiming to gain broad exposures to multiple markets and alpha signals across a universe that includes equities, fixed income, commodities and currencies. Whether long/short or long only, directional or market neutral, the tool kit is predominantly built from index futures and other broad market instruments. While this is great for achieving the diversification that investors crave, it does not naturally lend itself nicely to the in-depth single position analysis that is usually expected when incorporating RI into the process.

Engagement is a particular challenge when your portfolio may hold over 3,000 individual stock positions.

The number of holdings is also a clear differentiator, particularly with regards to company engagement. For example, using computers, CTAs trade thousands of markets, gaining breadth as opposed to the depth a discretionary manager is looking for. Many CTAs also do not trade single-name equities and those that do typically group companies together in sector baskets, resulting in a portfolio of up to 3,000 individual stock holdings. In practice, therefore, a discretionary long/short equity manager can more easily meet management and engage with their book of, for example, 100 stocks (with typically long holding periods). However, this is not realistic for the CTA portfolio with thousands of stocks that may only be held for days or weeks at a time.

We’ve previously written1 about the RI challenges faced by macro managers. Some of the most prominent are: disagreements over how to treat certain derivative allocations, in particular FX and commodities; how to account for the lack of standardisation in ESG data; and whether to differentiate on long versus short positions across asset classes. These challenges are well recognised across the asset management industry, which is why separate RI frameworks are recommended for discretionary and systematic approaches.2

What Tools Are Available to Address the Challenges?

Single-name equity positions typically make up less than one third of a systematic macro manager’s risk budget.

Let’s begin with exclusions – the most straightforward, and probably least contentious, way for a systematic macro manager to incorporate some form of RI integration in their portfolio. Typically, this applies to single name holdings (such as individual equities) and limits the investible universe by excluding certain names based on their ESG characteristics, such as the worst polluters or because they belong to a particular industry, such as tobacco. This has been written about extensively and we expect most systematic strategies that trade single names already do this, since the equity universe is large and removal of a small percentage of names still maintains the desired overall portfolio risk and return properties. The next step may be to build capabilities to be an active steward of these positions, for example via proxy voting and company engagement, which we discuss in more detail here.3 The issue with discussing exclusions and engagement is that many systematic macro portfolios trade futures instead of individual stocks. Even where single-stock names are traded, they may make up a third (or less) of the risk budget.

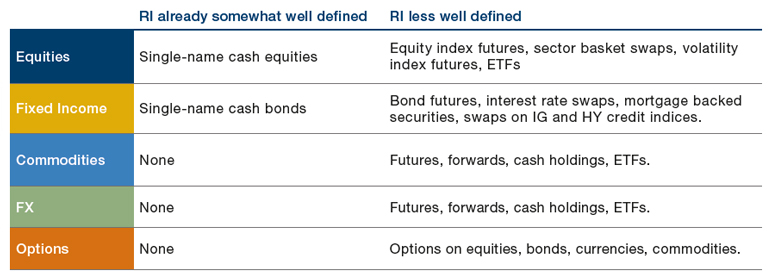

What we must do then, is move the conversation onto index futures and other derivatives, which make up a far higher proportion of the assets traded by a typical systematic macro manager and where it is generally accepted that RI considerations are less well defined.1 Figure 1 illustrates this diverse mix.

Figure 1. Illustrative Investment Universe for a Systematic Macro Manager

Source: Man Group. For illustrative purposes only.

Let’s begin with equity index futures, which are extensively used by systematic investors since they provide highly diversified and low-cost, low-margin exposure. However, from an RI perspective, they are inflexible. Holders of an S&P 500 Index future, for example, have no power to exclude constituents or attempt to over/under weight names based on RI considerations. A recent innovation to address this is in the creation of equity index ESG futures, which exclude a portion of the standard universe to better align ESG factors with the underlying investment exposure.

Increased adoption of ESG futures should lead to liquidity improvements over time.

One prominent example is the E-mini S&P 500 ESG index future, which excludes tobacco, coal and controversial weapons, along with a portion of the worst ESG performers from each GICS industry group, while up-weighting the best performers. The ESG-compliant future seems a useful tool for a systematic manager looking to incorporate more ESG factors into their process, while maintaining the benefits of investing in futures, such as high capital efficiency and diversification. As the market adoption of ESG futures increases, so will their weights in systematic portfolios, in our view. One current limiting factor is liquidity, so systematic macro managers will hold them at a relatively low-risk weight for now. However, over time, as market adoption increases, we expect ESG futures to become a more meaningful piece of an RI macro portfolio.

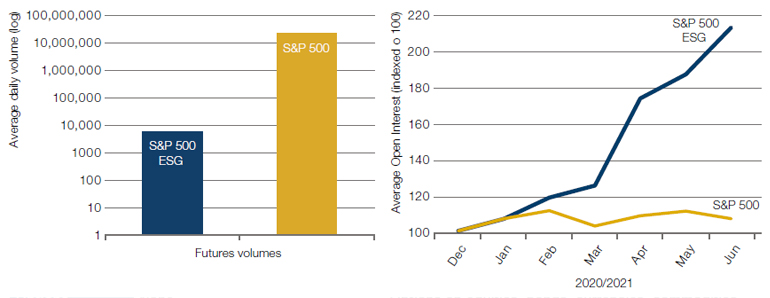

Indeed, we are already seeing a rapid increase in ESG futures volumes. CME Group, for example, reported a +320% year-over-year increase4 in average daily volumes for the E-mini S&P 500 ESG futures in 2020. Figure 2 compares the average daily volume (log scale) of the regular S&P future against the ESG version on the left-hand side. On the right-hand side, it shows the recent change in the average open interest in the ESG future versus the regular future. While it is obvious that liquidity is currently better in the traditional S&P 500 future, it is encouraging to see sharp growth in the ESG version, with open interest almost doubling in the last six months. We are seeing similar volume and open interests gains in other ESG-oriented futures, namely the Stoxx-Europe 600 ESG and the OMX Stockholm 30 ESG.

Figure 2. Futures Volumes in 2021 (Left) and Growth in Futures Average Open Interest in 2021 (Right)

Source: Man Group database, CME; as of 30 June 2021.

S&P 500 ESG represented by E-mini ESG future. S&P500 represented by E-mini future.

Staying with indices, another method to incorporate RI principles is to apply an ESG scoring framework to the index constituents. The spirit of this approach is to tilt portfolios towards indices where the underlying companies score highly, and tilt away from those who score poorly to better align capital allocations with RI values. This can be a useful tool for portfolios that do not trade any cash investments where individual company exclusions or engagement is difficult or impossible to implement. It also extends to other asset classes, such as government bond futures, where allocations can be tilted towards governments that score well from an ESG perspective, and away from those that score poorly. The overarching idea is that by allocating resources to those countries that are, for example, better aligned with long-term heating reductions or other RI objectives, the country’s cost of capital is reduced. This should create a virtuous cycle where it becomes cheaper to continue to invest positively. On the other hand, it sends a signal to countries not aligned from an RI perspective that their cost of investment will rise if they do not change.

How far to tilt the portfolio is a question for investors using ESG scoring on index allocations.

While this method sounds simple on the surface, there are a couple of nuances that must be carefully considered in the research process. The most important is how to score the individual assets and whether third-party, proprietary or a combination of scoring data should be used. The next consideration is to what extent the tilts are applied to the portfolio weights, where too much deviation could begin to materially alter the risk/return profile of the fund. If this is affected, it may begin to call into question the fiduciary duty of a manager to their investors. In our opinion, as with every tool described in this note, the key is adequate transparency on the process so that investors can make up their own mind on the right balance for them.

Figure 3 is a stylised example of how this works in practice. The two equity indices shown (S&P 500 and Euro Stoxx 600) are two of the most liquid equity index futures and begin with an equal allocation in the example portfolio. Each future is then graded based on the weighted average MSCI score of the companies that make up the index. Using this methodology, the Euro Stoxx 600 scores higher from an ESG perspective (based on MSCI data) when compared with the S&P 500, giving it a higher weighting in the overall portfolio.

Problems loading this infographic? - Please click here

Source: Man Group database, MSCI. For illustrative purposes only.

A scoring framework for index derivatives may compliment the use of ESG futures.

This methodology may compliment the use of ESG futures, where their weight will naturally be increased by the tilt versus the other non-ESG equity futures traded. However, it can be applied to any asset class where a scoring framework can be set up and is not limited to equities. For example, this process could also work in fixed income or commodities, using data such as a country’s human rights record or environmental data on the impact of commodity extraction and utilisation.

In the same spirit as allocating to ESG futures or applying scoring methodologies, custom equity baskets are another option in the quant toolkit. Equity baskets can be constructed and accessed via swaps, allowing managers to gain diversified exposure to a sector or region, while integrating bespoke requirements on ESG. While the end goal is typically to allocate more to higher scoring companies and less (or none) to lower scoring companies from an ESG perspective, the additional flexibility offered through customisation can result in a more refined implementation. For example, exclusions can be applied based on the manager’s or client’s own views, in a similar vein to a cash equity portfolio. The cost to this flexibility is the additional fees required to set up a bespoke swap. Taking this thought process to its end game ultimately results in a portfolio that predominantly trades single name cash instruments where RI is best defined1, and fewer derivatives, which allows the most flexibility in applying the manager’s RI principles. Here, instead of trading equity and fixed income futures with thousands of underlying names, the portfolio might be limited to, say, 500 names at any one time.

Adopting a higher weight to single name instruments allows for easier application of RI principles.

Having a higher weight to single names not only allows RI staples such as an exclusion list to be applied, but affords more sophisticated methods, such as applying RI factor tilts and individual company ESG scores to achieve a better integrated RI portfolio. It also facilitates better stewardship of capital through enhanced voting and engagement. Again, there is a drawback and that is the shift away from derivatives increases trading costs. For faster trading strategies, that require quick changes in long and short exposure with an average holding period measured in weeks and not months or years, this cost is likely to prove prohibitively expensive.

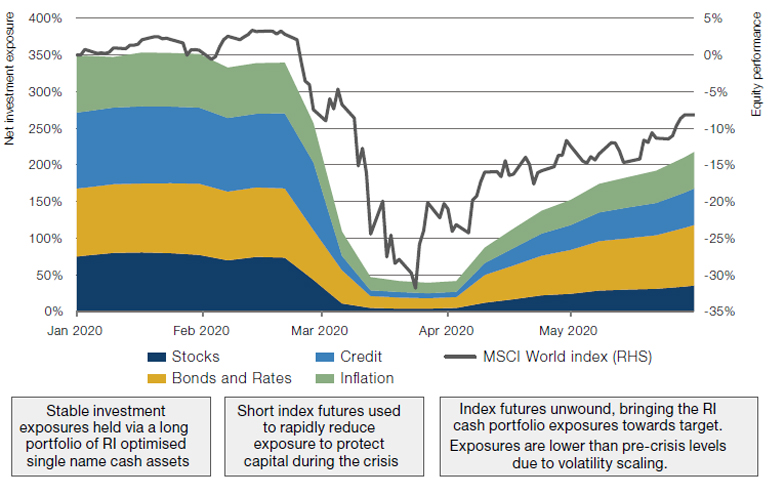

However, for slower-moving strategies, in particular long-only multi-asset type portfolios such as risk parity, this could prove a useful addition providing there is still a way to quickly adapt exposures when markets turn south. In this sense, investors may need to permit futures investment from time-to-time, if only as an exposure management tool and most likely held short only. This is illustrated in Figure 4, which takes the Covid-19 crisis as an example where a rapid cut in investment exposure is necessary to navigate the difficult market environment and protect investor capital. Here, futures are hypothetically held short as the crisis deepens, taking investment exposures from a relatively stable 350% to around 50% in a matter of weeks. The short futures unwind as the outlook improves, leaving the RI-focused long portfolio in place and ensuring the portfolio participates in the recovery.

Figure 4. Example Investment Exposure of a Risk Managed, Long Only Multi-Asset Strategy Against Equity Performance During the Covid-19 Crisis

Source: Man Group database, MSCI; as of 31 May 2020.

Short futures positions may need to be permitted to manage investment exposure in difficult markets.

As more systematic investors embrace RI, it is more important than ever to educate investors on the differences in emphasis between discretionary and systematic strategies. Without widespread understanding on how RI practice differs, innovative new solutions, such as the systematic multi-asset cash strategy described above, are unlikely to get off the ground. To provide a more concrete example, there is still an open question on the treatment of shorts. We take the view that holding an RI optimised portfolio long, while shorting regular futures to dynamically manage exposure, leads to a better integration of RI into the investment strategy as compared to a derivative only portfolio. It is important for asset owners and managers to discuss questions like this as the conversation on RI in systematic investing moves forwards.

Moving onto commodities, the conversation becomes a little trickier. It is difficult to define which commodities are ‘good’ and which ones are ‘bad’ since the ultimate economic use for any one of these markets can be considerably nuanced. Take copper for example. This is often cited as a key element in the green revolution, with multiple renewable technologies dependant on the metal.5 However, copper mining and smelting have well-documented negative environmental impacts6 and will still be used for decades in the wiring of fossil fuel plants and other ‘bad’ activities.

So how should it be viewed through an ESG lens? In our view, ultimately collaboration between stakeholders – such as investors, governments and manufacturers – is likely to be the key to lowering the ESG impact from the extraction and use of commodities in the long term.

But what about the short term?

Perhaps, akin to scoring index futures, similar commodity futures could be graded on their attributes. Both Brent and West Texas Intermediate crude futures offer systematic investors a way to express a view on the oil market. However, the process of refining, transporting and eventual consumption of the oil from each market is different. If one type of crude oil could be judged to be less aligned with ESG values, a lower participation in this market may encourage the transition to the other.

Judging which commodities are ‘good’ and which are ‘bad’ from an RI perspective will pose a challenge.

Investment strategies that allocate to commodities for their general properties, such as the potential to perform in periods of rising inflation7, can take this further, with those markets deemed not aligned to a low carbon future (for example) being removed entirely. Here the allocation would typically be a diversified basket of commodities, so removal and re-weighting can be done while preserving the general risk and return characteristics required. Other commodities deemed better aligned can be upweighted. A diversified basket may therefore shun livestock in favour of crops and remove fossil fuels entirely, based on climate considerations.

As discussed above, implementation and transparency are key. A large deviation from the ‘optimal’ allocation could begin to materially alter the risk/return profile of the fund, underscoring the need for alignment between financial and ESG outcomes.8

Reporting and Transparency

Pre-defined rules and appropriate transparency should help quant funds avoid greenwashing.

As finance practitioners, we must be humble and accept that responsible investment is a learning journey on which we are still near the start. To make progress, the conversation between managers and investors on RI best practice must continue. This is only possible with adequate RI reporting and transparency, which ensures data and methodologies are available to help investors decide whether the ESG values incorporated into the portfolio align with their own. It should also help systematic macro funds avoid any allegations of greenwashing, since anyone can peek into the transparent box that is the investment process. For example, the fund prospectus may state that RI views are integrated via:

- Allocating to ESG futures;

- Exclusion lists applied to single name investments;

- ESG scoring framework for equity and bond indices in the asset allocation; process;

- Proxy voting of positions;

- Enhanced ESG reporting, including carbon data and third-party scoring;

- Position level transparency.

Specific regulation has been set up by the EU to address the prevalence of greenwashing in the asset management industry and to assist investors with making an informed choice. The Sustainable Finance Disclosure Regulation (‘SFDR’) aims to categorise funds based on their level of ESG integration, with Article 6 the least integrated and Article 9 the most. Over time, more systematic macro funds may aspire to Article 8 (or better). However, to achieve this, a greater level of disclosure than managers are currently used to will be required. It should, for instance, be clear what additional steps the manager is taking versus a ‘plain vanilla’ systematic strategy. Enhanced ESG reporting might be, for example, providing third-party ESG scores at a portfolio level or proprietary scoring on individual positions. Typically, these will be available for single-name securities, but index decomposition is becoming more common, which provides a fuller picture of the entire portfolio impact.

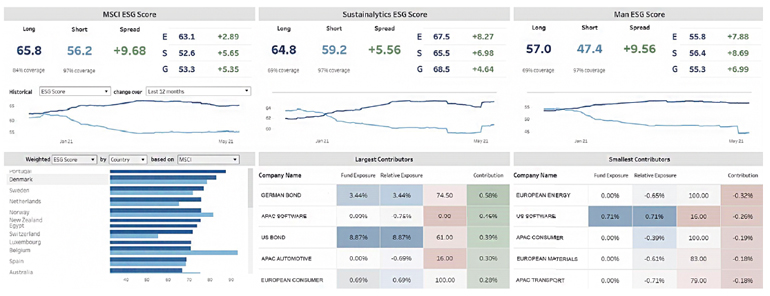

Investors may also have their own proprietary scoring systems, so require adequate transparency to complete their own analysis. For example, we raised earlier the challenge of how to treat shorts. One can only approach this question once appropriate data on both the long and short side of your portfolio is available. Man Group, for example, has developed a proprietary scoring methodology and illustrates this alongside third-party metrics via an ESG analytics dashboard. Figure 5 shows an example portfolio output of environmental, social and governance metrics on both the long and short side with the spread shown.

Figure 5. Example RI Reporting

Source: Man Group database, MSCI, Sustainlytics. For illustrative purposes only.

Conclusion

It is encouraging to see new innovations and the possibility of more choice to help align systematic macro investments with RI values. We expect there will always be demand for the diversifying properties of systematic strategies, and we expect further pressure from investors to keep systematic investors progressing on the RI journey.

While it is unrealistic to expect clarity on how systematic investors treat certain asset classes in the short term (FX and commodities being the most notable here), we see constant innovation. Hopefully, we will soon have better-defined solutions which properly account for the unique RI challenges of different asset classes, but until that nirvana is reached, it is imperative to continue developing new tools to ensure a future where systematic macro investors can’t plead the fifth on responsible investment.

References

1. A. Forterre. Gatecrashing the party: can (systematic) macro managers invest responsibly? Available on Man Institute, 2019.

2. P. Parkins-Godwin. The Wheat and the Chaff − A Guide to Rating an RI Fund Manager. Available on Man Institute, 2021.

3. S. Desmyter and J. Mitchell. Systematic strategies as a force for good in responsible investment. Available on Man Institute, 2017.

4. CME Group. Equity index review. https://www.cmegroup.com/newsletters/ monthly-equity-index-product-review.html

5. Copper Development Association. Copper in the Technologies of Tomorrow and Today. https://www.copper.org/

6. United States Environmental Protection Agency. Copper mining and production wastes. https://www.epa.gov/radiation/tenorm-copper-mining-and-productionwastes

7. H. Neville et al. The Best Strategies for Inflationary Times. https://papers.ssrn. com/sol3/papers.cfm?abstract_id=3813202

8. C. Harvey et al. Academic advisory board: ESG investing. Available on Man Institute, 2021

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.