Executive Summary

As cryptocurrencies are further brought into the mainstream by the recent launch of spot cryptocurrency exchange-traded products (ETPs), investors should not be complacent about the risks associated with investing in the asset class. We believe that any investor who is looking to gain long-only exposure to cryptocurrency, whatever their motivation, should do so in a way which appropriately manages the risks inherent with the asset class.

A Step Further from the Shadows

The SEC decision to approve multiple US bitcoin spot ETPs earlier this year marked a pivotal moment for the nascent asset class.

After a tumultuous two years, which saw the failure of several crypto firms, the US Securities and Exchange Commission’s (SEC) decision to approve multiple US bitcoin spot ETPs earlier this year marked a pivotal moment for the nascent asset class and helped to push it even further into the mainstream. Investor demand was self-evident, with the newly launched ETPs attracting US$30 billion in inflows over the course of 40 days (Figure 1).

Problems loading this infographic? - Please click here

Any investor looking to gain long-only exposure to cryptocurrency, should do so in a way which appropriately manages the risks inherent with the asset class.

The availability of futures, and now spot, ETPs has removed many of the hurdles previously faced by investors wanting to access cryptocurrencies. Previously, they either would have had to set up a digital wallet or open an account with a crypto trading platform in order to gain exposure to the asset class.

As well as simplifying access to the market, ETPs have mitigated much of the due diligence burden associated with directly holding the coins. In spite of this there are still several important considerations which relate to the characteristics of the underlying asset class that we would like to address.

Broadly speaking long-only investors fall into two camps; those that are believers, who for example, see digital currencies replacing fiat or expect exponential price appreciation (think here of ARK’s Cathie Wood who envisages that bitcoin will exceed $1 million by 20301). And those who are more sceptical but see the benefit of including a long-only allocation to the asset class as part of a diversified portfolio.

Whatever the motivation, we believe that any investor looking to gain long-only exposure to cryptocurrency, should do so in a way which appropriately manages the risks inherent with the asset class.

Diversification

The first consideration for investors weighing the current spot and futures ETP offering is the narrowness of the investible universe, which is currently limited to bitcoin and ether2.

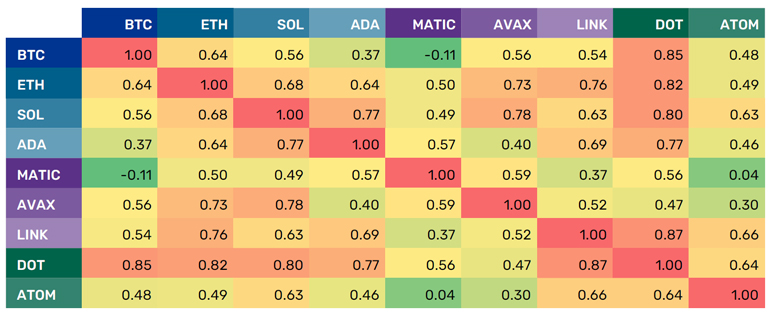

While, in general, the correlation between cryptocurrencies tends to be high, it is not perfectly so. As a result, investors can achieve diversification by expanding the investment universe to include coins and tokens which span multiple applications, from smart contract chains to the Metaverse.

Figure 2. Correlation Matrix of Some Commonly Traded Cryptocurrencies

Source: Man Group database, as of 31 December 2023.

Importantly, correlation to riskier assets such as equities is low, with the average correlation of bitcoin and ether to the S&P 500 Index coming in at 0.15.

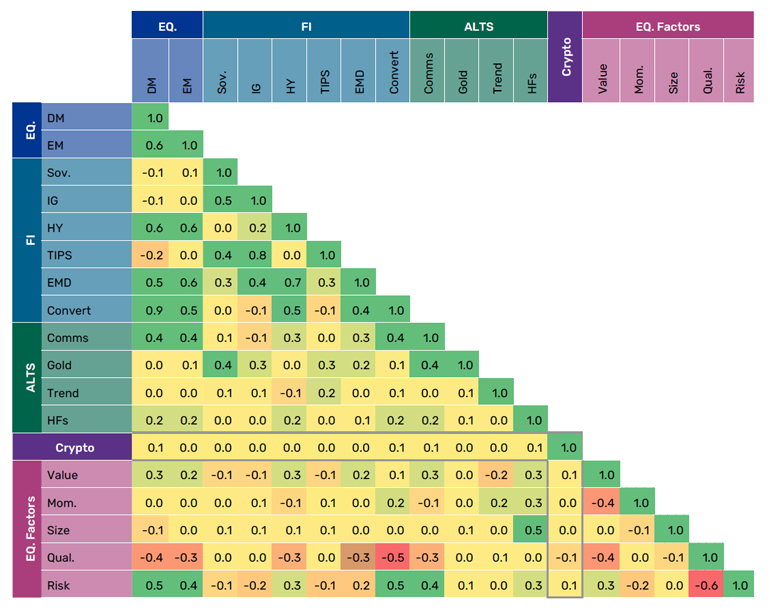

Outside of the crypto sphere there is on average, and based on the relatively short history available, limited correlation to other asset classes, as exhibited in Figure 3. Importantly, correlation to riskier assets such as equities is low, with the average correlation of bitcoin and ether to the S&P 500 Index coming in at 0.15. This diversification further underscores the benefits of including an allocation to digital assets as part of a diversified portfolio. A caveat to this, which we discuss in greater detail in the risk management section below, is that we have observed periods when the short-term correlation between equities and cryptocurrencies has increased rapidly.

Figure 3. Correlation to Other Asset Classes

Source: Man Group database, as of 31 December 2023.

Risk Management

The high and variable volatility of cryptocurrencies underscores the need for active risk management.

The high and variable volatility of cryptocurrencies coupled with the significant drawdowns, which are routinely in the order of 80% (Figure 4), underscores the need for active risk management when investing in cryptocurrencies. This dynamic risk management is not inherently available to those who opt to gain exposure via ETPs, which tend to offer investors unadulterated long exposure to the underlying coins.

Problems loading this infographic? - Please click here

In a previous article, Active Risk Management in Practice, we wrote about three key ingredients to active risk management when investing in traditional asset classes:

1. Volatility – scaling positions to account for persistent or sudden fluctuations in volatility.

2. Momentum – protect against downward trends in prices.

3. Correlation – detect spikes in correlation and subsequent loss of diversification.

The same three ingredients, which we will examine in turn, can provide a useful framework for cryptocurrency investing, where taking a risk-based approach seems all the more important when dealing with such a volatile asset class.

Volatility

While cryptocurrencies undoubtedly suffer from left tail events, it is important to note that these have historically occurred at a lower frequency than the S&P 500.

The observations made Harvey et al. (2022) that, similar to other asset classes, cryptocurrencies exhibit persistence in volatility, affords us the ability to manage the risk of extreme left tail returns. While cryptocurrencies undoubtedly suffer from left tail events, it is important to note that these have historically occurred at a lower frequency than the S&P 500.3

The caveat here is that, although occurring at a lower frequency, the magnitude of a three plus standard deviation move in bitcoin or ether has a much larger P&L impact given the higher volatility.

High volatility, however, can be managed by dynamic volatility scaling given the persistence in volatility from one period to the next. This enables us to target a consistent level of volatility, rather than a consistent level of notional exposure, irrespective of the native volatility of each coin. The result has the desired effect of stabilising returns as well as reducing the magnitude of left-tail events by lowering exposure when markets are volatile, which is when these left-tail events typically occur.

Momentum

Harvey et al. (2022) also confirms that the trend characteristics of cryptocurrencies are analogous to that of other asset classes such as equities, bonds, and commodities. Indeed, the trends in cryptocurrencies may be more pronounced as a result of the high participation of retail investors, who tend to exhibit the behavioural biases associated with trend-following more strongly than their institutional counterparts.

While positively trending prices are of no concern to long-only investors, sustained negative performance is. The risk of this, however, may be mitigated through the use of a trend-based overlay, which reduces exposure when faced with persistently falling prices.

Correlation

In normal times the correlation between cryptocurrencies and equities is low. However, in a ‘risk-off’ event, the risk of cross-asset contagion can become material.

Finally, we consider correlation. As noted above, by expanding the investible universe beyond bitcoin and ether, investors can attain a degree of diversification within the coin portfolio itself. This, however, needs to be monitored as in the event of a crisis the diversification benefit can disappear as market participants look to dump all assets that are perceived to be ‘risk on’. This risk can be managed by monitoring the interaction between cryptocurrencies and other assets. In normal times the correlation between cryptocurrencies and equities is low. However, in a ‘risk-off’ event, the risk of cross-asset contagion can become material as investors cut exposure to risky asset classes, including crypto. This contagion risk is observable in Figure 5, where we compare the correlations between bitcoin and ether to the S&P 500, in each return decile of the index. To guard against this, we can apply a correlation overlay that identifies periods where contagion risk from equity weakness is elevated or when diversification levels within the coin portfolio drops. In the event of either of these being detected the overlay activates, cutting exposure at the portfolio level in response.

Problems loading this infographic? - Please click here

These risk management techniques are sympathetic to the risk characteristics that have been broadly observed across the cryptocurrency universe, and their application, either independently or in conjunction with one another, can help reduce drawdowns and stabilise returns.

Institutional Grade Infrastructure

By implementing institutional-grade infrastructure, the risk of a counterparty default can be mitigated.

Another aspect of risk which can be managed is in respect to the trading and custody of coins. By implementing institutional-grade infrastructure, the risk of a counterparty default à la FTX or the USD1.7 billion stolen from exchanges over 231 incidents in 20234, can be mitigated. There are multiple prongs to this approach. However, a robust vetting process of the coins, exchanges and custodians is undoubtedly the bedrock. This process requires significant resources from across legal, financial crime, compliance, risk, and operations, which may only be available to the largest, most well-established institutions.

Parting Thoughts

Investors are faced with two approaches to improve risk-adjusted returns: (i) increase the investment return, or (ii) reduce the risk. Our approach to long-only investing has always been to focus on the latter, the risk management approach. As we noted in No More Horses!, forecasting returns accurately is a famously fruitless exercise. However, as evidenced in Harvey et al. (2018), we believe that we can forecast risk with some accuracy. This approach has been successfully applied to traditional asset classes and we see no reason why it cannot be applied to cryptocurrencies as well.

1. https://www.nasdaq.com/articles/ark-invests-cathie-wood-says-the-price-of-one-bitcoin-could-rise-to-$1.5m

2. At the date of publication ether is only available via a futures based ETP.

3. Read more here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4124576

4. Source https://go.chainalysis.com/2023-crypto-crime-report.html

Bibliography

Harvey, Campbell R. and Abou Zeid, Tarek and Draaisma, Teun and Luk, Martin and Neville, Henry and Rzym, Andre and van Hemert, Otto, An Investor’s Guide to Crypto (September 1, 2022). Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4124576

Harvey, Campbell R. and Hoyle, Edward and Korgaonkar, Russell and Rattray, Sandy and Sargaison, Matthew and van Hemert, Otto, The Impact of Volatility Targeting (June 25, 2018). Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3175538

Korgaonkar, R., Robertson, G. (2021), “We See Risk Where Others May Not: Active Risk Management in Practice”, Man Institute, Available at:https://www.man.com/maninstitute/active-risk-management-in-practice

Robertson, G. (2022), “No More Horses! The Predictability of Returns and Risk, and Their Use in Asset Management”, Man Institute, Available at: https://www.man.com/maninstitute/no-more-horses

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.