Key takeaways:

- Despite being less volatile than before, cryptocurrencies still present outsized risks to go with their potential returns

- We explain how opting for a volatility-scaled crypto allocation can enhance portfolio construction and manage risk when crypto becomes too hot to handle

- As cryptocurrencies become more correlated with traditional risk assets, particularly equities, volatility scaling becomes even more relevant

Too hot to handle?

With the advent of the second Trumpian era promising a swathe of deregulation – and even the possibility of a US strategic bitcoin reserve - crypto is firmly back in vogue.

Despite the hype, many investors remain cautious of the asset class, often citing the lack of a robust valuation framework (how can you truly value dogwifhat?), as well as high and uncertain volatility as reasons for skirting an allocation to crypto.

However, while cryptocurrencies are still exceptionally volatile, they are significantly less so than previously. As Figure 1 shows, we have seen the range of bitcoin’s volatility decrease from 20-130% in the 2010s (pink dots) to closer to 30-60% over the course of the 2020s (blue dots). But what does this actually mean in terms of expected loss?

To shed some light on this, we plot the 3-month rolling drawdown of bitcoin versus the rolling 3-month volatility in Figure 1. If we were to use this as a yardstick, then based on bitcoin’s current range of volatility, we could expect a drawdown of up to 50%. While this is preferable to the roughly 70% drawdown on the table when volatility approached 130%, it’s still pretty spicy. As the Traveling Wilburys sang, ‘Handle with Care’.

Figure 1. Rolling 3-month drawdown versus rolling 3-month volatility of bitcoin

Problems loading this infographic? - Please click here

Calculated using daily returns. Source: Bloomberg. As at 31 December 2024.

Beyond HODL

We won’t, at present, get tangled up in the problem of valuation, although Harvey et al. (2022) present several, albeit unsatisfactory, methods which you’re welcome to try. Handling high and non-stationary volatility, however, is something we can address. After all, we have extolled the benefits of volatility scaling — sizing positions inversely to a market’s volatility — on numerous occasions across a range of asset classes, including crypto.

The reason we are so enthused is that volatility scaling allows us to target a consistent level of volatility, rather than a consistent level of notional exposure, regardless of the native volatility of the asset class in question. As found in Harvey et al. (2018), the result has the desired effect of stabilising risk – and therefore returns – while also reducing the magnitude of left-tail events by lowering exposure during periods of heightened market volatility.

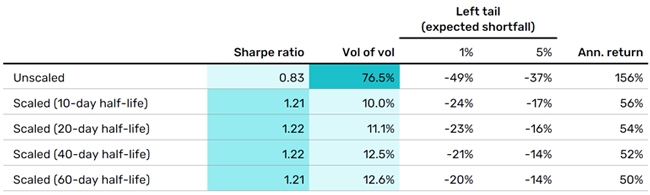

To illustrate this, we follow the same methodology as Harvey et al. (2018) and present the performance statistics for unscaled (top row) and volatility-scaled (other rows) bitcoin in Figure 2. Scaling is done ex-ante to 30% volatility and covers the period from September 2012 to December 2024.

Figure 2. Impact of volatility scaling

Source: Man Group database. Data range, 1 September 2012 to 31 December 2024.

Firstly, we find that scaling achieves an increase of around 40 Sharpe points in each instance, irrespective of the responsiveness, or half-life, of the volatility estimates used. From a risk perspective, the benefits of volatility scaling are equally pronounced, with an improvement in both the volatility of volatility — an indication of how stable the returns are — and the left tail or expected shortfall.

The potential benefit of scaling a bitcoin allocation in the context of a broader portfolio is observed when you compare the share of portfolio risk attributed to a 1% notional allocation to bitcoin, both unscaled and scaled. To show this, we construct two portfolios: the first consists of a 1% allocation to unscaled bitcoin and the remaining 99% allocated to a 60/40 portfolio of equities and bonds, while the second consists of a 1% allocation to scaled bitcoin and 99% to the same 60/40 portfolio. We then plot the 2-year rolling share of portfolio risk attributed to the 1% allocation to unscaled (dark blue) and scaled (light blue) bitcoin in Figure 3.

Figure 3. Share of portfolio risk of an unscaled and scaled 1% allocation to bitcoin

Problems loading this infographic? - Please click here

Source: Man Group database. Data range, 1 September 2012 to 31 December 2024.

From the outset, the benefits of investing in a scaled allocation are clear, with the share of portfolio risk remaining stable within a tight range, while the unscaled allocation oscillates between 0 and 6%. From an allocator perspective, this leaves you with several options. You can either accept that crypto has a wild temperament and, as to a rabid dog, cede territory to it when it barks; or you can attempt to rebalance your portfolio each time it oscillates. The former isn’t for those seeking a quiet life, and the latter comes with a whole host of challenges — from the practical, such as the costs of regular rebalancing, to the ethereal, like the need for near-perfect foresight to scale the allocation such that its future risk contribution is tolerable. Neither of these two is optimal, so why not consider a third: opting for a volatility-scaled allocation?

Cor blimey!

While demonstrating the potential benefits of volatility scaling, Figure 3 also shows that the share of portfolio risk of both the unscaled and scaled bitcoin allocations has been steadily increasing from 2020 onwards. This dynamic is indicative of increasing covariation between bitcoin and the portfolio, which in turn is being driven by higher correlation between bitcoin and equities, as evident in Figure 4.

Figure 4. High frequency 20d correlations for bitcoin against S&P 500 futures

Problems loading this infographic? - Please click here

Uses high frequency correlations for bitcoin against S&P 500 futures. Source: Man Group database, as of 31 January 2025.

Goodall et al. (2024) highlighted that while correlation has moved higher, it remains low during normal times and becomes noticeably elevated during the best and worst periods of equity returns. High correlation is not much of a concern during the good times, but it is during the worst, as the risk of contagion from equity weakness puts crypto directly in the crosshairs of a risk-off move. While volatility scaling cannot directly address the wider causes of increasing correlations, it provides allocators with a tool to maintain a stable share of portfolio risk by targeting a lower level of volatility, thereby helping offset the impact of increasing correlation on the covariance between bitcoin and the portfolio.

Bibliography

Harvey, C, R, Hoyle, E, Korgaonkar, R, van Hemert, O. (2018), “The Impact of Volatility Targeting”, Man Institute, Available at: https://www.man.com/insights/the-impact-of-volatility-targeting

Goodall, R, Hoyle, E, About Zeid, T. (2024) “Cryptocurrencies. If You're Gonna Do It, Do It Right”, Man Institute, Available at: https://www.man.com/insights/cryptocurrencies-if-you-gonna-do-right

Harvey, C, R, Abou Zeid, T, Luk, M, Neville, H, Rzym, A, van Hemert, O. (2022), “An Investor's Guide to Crypto”, Man Institute, Available at: https://www.man.com/insights/investor-guide-to-crypto

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.