And cast ye the unprofitable servant into outer darkness: there shall be weeping and gnashing of teeth.

Matthew 25.30

Melancholy days these. Last month a survey by Stifel Financial found that 97% of US corporate executives expected a recession over the next 18 months.1 Similar headlines abound, and indeed, we are no exception to this weeping and gnashing of teeth; our own model now suggests a 71% chance of an NBER recession beginning at some point in the next year (see issue #5 for more details).

But how bearish should an equity investor really be if they believe a recession is coming? We are mindful of the danger of being like the unprofitable servant in the parable of the talents who, for fear of uncertainty, buried his master’s wealth in the ground. The US has already experienced over 8 points of multiple compression since the peak. According to our models US headline inflation is likely to roll over to around 4% in the next 12 months (see issue #1). That would mean we are in DISINFLATION within our Fire & Ice framework. In that episode, historically, equities have run at +14% (real, annualised), versus -7% in FIRE, the environment we have just come out of.

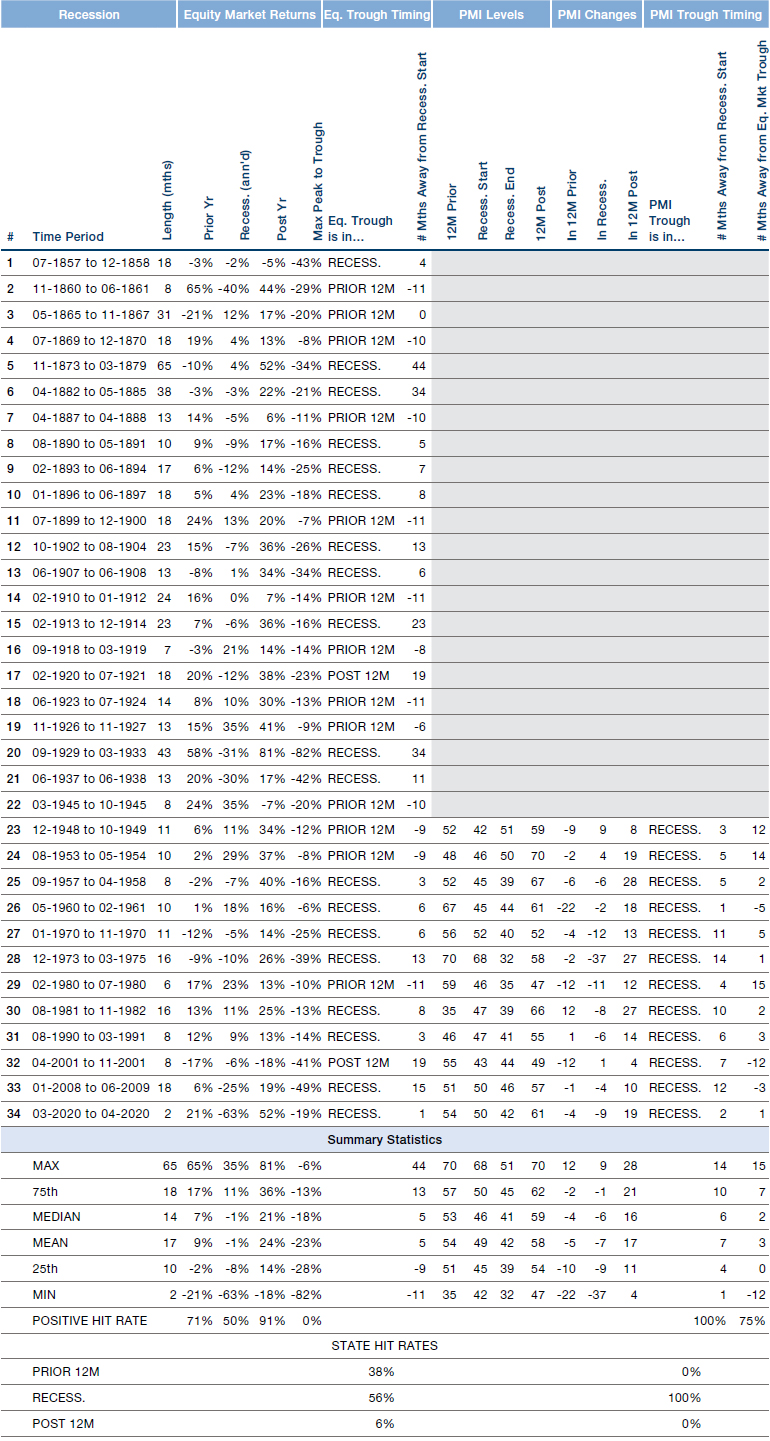

So that all augurs pretty nicely, but is it totally stupid to put money to work now when your base case is a recession beginning in the next 12 months? On the precedent of history, not necessarily. In the figure below we list all 34 recessions defined by the NBER, and detail various data for each concerning movements in US equities, as well as the PMI. There are obviously many ways to cut the timing. For us we like to think about the broader ‘recessionary period’, being the recession itself, the 12 months before, and the 12 months afterwards. When we refer to statistics such as max peak to trough, it is within this timeframe that we are making our observations.

Here are three things which jump out to us as reasons for an equity investor to be like Brian, and look on the bright side of life.

- Knowing absolutely nothing, across the totality of the period encompassing the recession, the 12 months before and the 12 months afterwards, you would rather be invested than not. The median return across this timeframe is 32% and is positive 79% of the time, driven by the fact that the strong returns in the year following the recession (averaging +21%), tend to overwhelm the weak returns within a recession (-1% annualised).

- However, we know a bit more than absolutely nothing. We’ve already had a -24% max peak to trough decline (to the low on 29 September). That puts us on a par with the average declines in historic recessionary periods (median of -18%, mean of -23%). The market troughing prior to the recession is not the majority outcome, but happens in a significant minority (38%) of outcomes. Given the sell-off we’ve already experienced, this could be one of those times. Now, arguably, the sell-off thus far has not been driven by recession fears, but instead concerns around inflation and consequent monetary tightening. Therefore the most bearish of interpretations is that the full typical 18-23% recessionary decline is still ahead of us. While we are sympathetic to this line of reasoning, we note that prizing the two apart is hard. To some extent it must surely be the case that the reason the market does not like the prospect of tightening, is because it leads to the prospect of recession.

- While the PMI ALWAYS troughs after the recession has begun, most (75%) of the time, its low follows the equity market nadir, and by an average of 2-3 months. The market has reached a new low for this bear market over the past few days. The PMI has been falling consistently for the past 12 months, and our models suggest will trough at 46 by the end of the year, which, if the current S&P low is the bottom for this bear market, would be consistent with the precedent of history. It is worth saying that the lags between the PMI and equity market troughs are quite varied, and in a quarter of instances the gap is a year or more. But in any event one can get too involved with the PMI. Not shown, but the median trough to peak within the recessionary period is +56%. Were one to time the market based on the PMI trough, investing the month after its nadir, the median return would be 37%. In other words waiting for the PMI costs you almost a third of the recovery return.

On 18 August, with the S&P at 4,300, we wrote that we thought there was a good chance that the market retested the June 3,666 low (see issue #7). Without wanting to sound like a gloating sell-sider, we are now there, with the S&P on 3,640 as we type (29 September). And our contrarian instincts have been stirred.

To be clear, on an overall allocation basis, we believe investors should be underweight equity risk, a view we have held throughout this year. We also take other considerations into account, two of which are not bullish yet. First, markets tend to trough when policy pivots – and central banks certainly remain very hawkish at the moment, in other words the Fed put is lower than usual in the new world. Second, our valuation models are not telling us to buy just yet– see CVI and CMTI in the Market Radar for detail. But with inflation easing, sentiment low, and the ISM low possibly in sight, it is important to remember that there are also some bullish arguments.

Good stewardship is not always defensive.

Figure 1. US Recessions Since 1850, with Equity Returns and the PMI

Source: NBER, Shiller, ISM, Bloomberg, Man DNA calculations.

1. https://www.investopedia.com/97-percent-of-executives-expect-a-recession

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.