Introduction: A Short History Lesson

It’s the late 1990s in Japan. Financial markets are plummeting. Real estate prices are falling. Stock prices are collapsing. The only thing that’s rising? Bad loans. Uneasy about cash flows and over-leveraged balance sheets, Japanese companies resist shareholder return improvements in favour of accumulating cash. The result? A ‘lost decade’ of economic stagnation with no alignment between Japanese corporate governance and global best practices.

The implementation of a stewardship code in 2014 and a corporate governance code in 2015 has warmed Japanese companies to accept corporate governance. Not wanting to be left out of this fight for better governance, and increase in Japan’s corporate value, is the Tokyo Stock Exchange (‘TSE’). In late February, the Japanese bourse said it would request companies trading below book value to come up with capital improvement plans starting this spring.1

While previous campaigns by activist investors to improve corporate governance in Japan and increase shareholder value have met with limited success, we believe this time is different.

In this article, we discuss (1) why this new development pace of change in corporate governance – accentuated by the TSE – makes it is a really exciting time for the Japanese stock market; and (2) specifically for Japanese Value stocks, especially those that trade below book value.

TSE Jumps on the Corporate Governance Bandwagon

As part the nation’s corporate governance drive, there have been three main changes made by the TSE that are significant, in our view.

As part the nation’s corporate governance drive, there have been three main changes made by the TSE that are significant.

Firstly, the TSE has redefined the meaning of ‘tradable shares’. Under the new definition, tradable shares do not include shares owned by Japanese commercial banks, insurance companies, or business corporations, even if their ownership is less than 10%. Shares owned by special interested parties other than directors and officers are also not considered tradable shares.2 This is significant because a long-standing deficiency in Japan’s corporate governance has been the tradition of cross-shareholdings, which has meant less shares are available for public trading, therefore lowering liquidity. More significantly in terms of corporate value, it has resulted in bloated balance sheets and has been a drag on return-on-equity (‘RoE’).

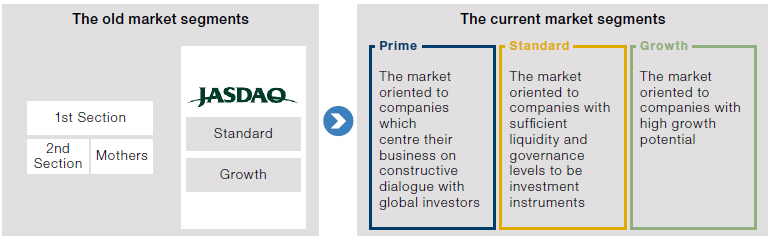

Secondly, the TSE has reorganised the structure of the market, moving from five segments to three in April 2022 (Figure 1): Prime, Standard, and Growth. Each segment has strict listing criteria, including minimum market cap of tradable shares and a minimum tradable share ratio.

As of 20 February 2023, of the 3,788 TSE-listed companies, 1,834 opted to be listed on the Prime Market, 1,444 selected Standard, and 510 Growth. However, there are cases where companies do not meet the listing requirements and will therefore need to go through a transitional period. As of the end of December 2022, about 10-20% of companies in each market segment failed to meet the standards.3

Figure 1. Reorganising Japan’s Market Structure

Source: Japan Exchange Group; for illustrative purposes only.

Companies that do not meet the listing criteria by March 2025 will be given a 1-year period or else labelled as securities under supervision or facing a potential delisting.4

However, as always, the devil is in the detail, which brings us to the third point. As part of the announcement, buried in the footnotes5 to be precise, the TSE put a surprising amount of emphasis on stocks that trade below book value (Excerpt 1).

Excerpt 1:

Companies that trade at a price-to-book ratio less than 1x will be required to disclose their policies and specific initiatives for improvement.

“Considering that the purpose of this market restructuring is to contribute to the improvement of corporate value of listed companies, it

will be meaningless unless we address the fact that about half of all listed companies have a [price-to-book ratio] below 1.”

We believe this to be significant as companies that trade at a price-to-book ratio (‘PBR’) less than 1x will be required to disclose their policies and specific initiatives for improvement. This is regardless of whether they meet or fail to meet the basic listing requirements. While there is no suggestion that low PBR companies are about to be delisted, additional comments from the TSE add to the growing pressure on listed companies that are seen to be underperforming (Excerpt 2).

Excerpt 2:

“In particular,

companies with a PBR consistently below 1x should be required to disclose their policies and specific initiatives for improvement. In addition, the Code of Corporate Conduct introduced by TSE in 2007 should be reviewed and revised as necessary to clarify the responsibilities of listed companies, such as awareness of the cost of capital and respect for shareholders’ rights/protection of minority shareholders’ rights.”

Some of the language used is interesting: it seems to us the TSE is looking to re-educate, or even just educate, management teams on what many would assume to be common wisdom (Excerpt 3). This specifically relates to return on equity, cost of equity, and capital efficiency. Indeed, an 8% RoE is seen as the magic number to reach in order to achieve 1x PBR – something we have written about before.

Excerpt 3:

“Encourage listed companies to raise awareness and literacy regarding cost of capital and stock price/market capitalization and promote efforts to improve them. Require that management and the board of directors properly identify the company’s cost of capital and capital efficiency, evaluate those statuses and its stock price and market capitalization, and disclose policies and specific initiatives for improvement and the progress thereof as necessary. Especially for companies that clearly need to improve, such as those with a PBR consistently below 1x.”

A Focus on Japan Value

To put the opportunity set into perspective, half of the stocks on the Topix still trades below book value, the same level as 20 years ago (Figure 2) and compared with 3% of the S&P 500 Index (Figure 3).

Figure 2. Proportion of Topix Stocks Trading Below Book Value

Problems loading this infographic? - Please click here

Source: Daiwa; as of February 2023.

Figure 3. P/B Distribution of TSE Prime and S&P 500

Problems loading this infographic? - Please click here

Source: Man Group; as of 24 February 2023.

By definition, Value stocks generally trade at a lower PBR than their Growth counterparts. So, with a policy that is targeting companies with low valuations, any resolution should inherently benefit Value stocks.

To add some context to the scale of the opportunity for Japan Value, 65% of Russell Nomura Total Value Index members currently trade below book value. This compares with just 6% of Russell Nomura Total Growth Index members (Figure 4). For sectors which are typically viewed as Value – such as banks, energy and steel – more than 90% of members are currently trading below 1 PBR.

Figure 4. P/B Distribution of Russell/Nomura Total Value and Russell/Nomura Total Growth Constituents

Problems loading this infographic? - Please click here

Source: Man Group; as of 24 February 2023.

Achieving a Higher Price-to-Book Ratio

In general, companies with a PBR that is consistently below 1x tend to have a low RoE (Figure 5).

Figure 5. RoE of Firms Whose PBR Is Continuously Below 1x

Problems loading this infographic? - Please click here

Source: Nikkei Quick, Bloomberg, Citi Research; as of 1 February 2023.

Note: Universe is TOPIX. ‘PBR continuously below 1x’ defined as names whose monthly PBR was below 1x constantly during 2018-2022. RoE is annual actuals.

For shares to trade on a PBR of 1x, companies need to achieve a level of RoE that is higher than their cost of capital. The benchmark estimate for cost of capital is 8%. About half (48% to be exact) of TSE Prime members have an RoE lower than 8%, compared with 13% of S&P 500 members (Figure 6).

Contrasting Japanese Value companies to Growth companies on an RoE basis, 54% of the Russell Nomura Total Value Index have an RoE lower than 8%, compared with 30% of Russell Nomura Total Growth Index members.

Figure 6. ROE Distribution of TSE Prime and S&P 500 Index

Problems loading this infographic? - Please click here

Source: Man Group; as of 24 February 2023.

Potential ways in which Japanese companies can improve RoE include:

- Reducing excess cash and cross shareholdings;

- Increasing the profitability of their operating businesses; and

- Focusing on the core businesses and shedding underperforming subsidiaries.

Improving underlying profitability is a long-term task involving reform of cost structures and business models, while trimming the business portfolio would be a medium-term solution.

In no other major developed market would it be possible for investors to make large returns by simply making an AGM proposal that requests a dividend hike or share buybacks.

However, reducing cash, increasing share buybacks, and making other improvements to capital policy is the low-hanging fruit that can be achieved relatively easily in the short term.

For example, in no other major developed market would it be possible for investors to make large returns by simply making an AGM proposal that requests a dividend hike or share buybacks. There are numerous examples of this occurring in Japan over the last few years, and in particular the last 12 months: Honda, an automaker, saw its shares rally about 10% since it announced plans to repurchase more than $500 million worth of its stock earlier in February; while electronic company Citizen Watch saw its shares surge 35% after announcing to buy back more than a quarter of its shares. We expect this trend to continue, especially as Japan Inc.’s cash pile has continued to balloon as companies prefer to retain earnings rather than putting them to work gainfully or paying out to shareholders (Figure 7).

Figure 7. Percentage of Topix Non-Financials With Net Cash More Than 20% of Equity

Problems loading this infographic? - Please click here

Source: CLSA; as of December 2021.

Conclusion

A years-long effort to improve corporate governance in Japan and increase shareholder value has met with limited success. However, that may all be about to change. Indeed, footnotes in a 2023 Tokyo Stock Exchange document may just be the impetus that Japan Inc. needs to embrace better corporate governance.

The directive by the Japanese bourse for companies trading below book value to come up with capital improvement plans has huge implications for Japanese stocks – specifically Japanese Value – especially considering that almost half of stocks on the Tokyo Stock Exchange trade below book.

This time, it really is different.

1. p1j4l400000014x9.pdf (jpx.co.jp)

2. Details of Continued Listing Criteria | Japan Exchange Group (jpx.co.jp)

3. Source: JPMorgan, TSE & Bloomberg.

4. dreu250000000uqm.pdf (jpx.co.jp)

5. p1j4l400000014x9.pdf (jpx.co.jp)

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.