Key takeaways:

- From the pyramids to the iPhone, materials are the foundation of human advancement and the global economy

- Transformative trends are driving change. Renewable energy, deglobalisation, infrastructure upgrades, decarbonisation, and the circular economy are reshaping material demand and production

- Investors must balance generational trends with short-term cycles to capitalise on opportunities in this evolving sector

Materials are the foundation of our daily lives and the global economy. They encompass everything from natural substances like wood, stone, and metals to synthetic innovations like plastics, composites, and semiconductors. Throughout human history, nearly every major advancement – from the pyramids to the iPhone – has relied on materials as a critical input. Their pervasive presence and integral role in shaping progress underscore the importance of understanding the evolving supply and demand dynamics in this sector.

Materials are rarely displaced. While the digital age feels worlds away from the Stone Age, modern society relies on rocks and aggregates more than ever before. Even with the rise of fossil fuels, renewable energy, and alternative materials, global wood consumption for fuel and construction remains at historic highs.

Therein lies the challenge: how do we balance economic and social advancement with the economical and viable production of materials?

In this article, we outline the rapidly evolving supply and demand dynamics of materials, driven by generational trends such as renewable energy adoption, geopolitical shifts, infrastructure expansion, and decarbonisation. For investors, understanding these trends is essential, as they present significant opportunities and risks in a sector that underpins global economic growth and technological innovation.

In this paper, we will explore the six key themes investors need to be aware of, summarising the opportunities and risks in a table at the end:

- The energy challenge: This mega-secular trend requires immense quantities of metals and materials

- Geopolitical power paradigm shift: We are now in a world of deglobalisation, resource wars/nationalism, and securing critical supply chains

- Infrastructure spend: The world requires increased investment in infrastructure globally to upgrade ageing networks in developed markets and expand existing ones to meet demand in emerging markets (EM)

- Cyclical ebbs and flows: Even with rising long-term demand, materials prices are shaped by short-term cyclical fluctuations

- Decarbonising of production: Material production is a major focus for decarbonisation efforts

- Emergence of the circular economy: The world is shifting toward ‘renew/reuse/recycle’

1. The energy challenge

Arguably, the biggest driver of change in metals and materials is the rapidly shifting energy landscape. The global economy is integrating vast amounts of renewable energy, while traditional fossil fuel demand continues to grow. Rather than a pure transition, the energy future is one of diversification – powered by metals and materials as renewables meet an increasing share of demand.

Reducing greenhouse gases (GHG) simply cannot occur without the extensive use of metals and materials for generating, transporting, and storing electricity. These materials range from traditional steel, cement and aggregates to those with newer applications, such as lithium, nickel, and the fluoropolymers used in batteries and electronics. Every metal and material will present investment opportunities, along with risks tied to technological advancements and cyclical disruptions.

Figure 1. Metals demand in the energy transition

Problems loading this infographic? - Please click here

Source: Bloomberg, as of 28 March 2025

Generating electricity

Most of the world’s electricity is currently produced using fossil fuels: oil, gas, and coal. However, the fastest-growing production segments are solar, wind, biofuels, and other forms of renewables. Electricity demand is set to grow by over 3% per year between now and 2050, driven by electrification, population growth, and the increased need in developing countries. This sets up attractive demand stories for various metals and materials.

On the flip side, limited or depleting physical supplies of a material can significantly disrupt growth projections.

For example, a solar panel cannot be made without aluminum, silver, and glass. Every gigawatt (GW) of solar capacity requires between 10-20 tonnes of silver. In 2024, demand for solar applications accounted for 31% of global mined silver supply. Silver demand for solar applications is projected to grow at 7% annually until 2030, yet supply is struggling to keep pace. Mined silver peaked in 2016 and has stagnated due to low prices, which is discouraging investment in new mines. This mismatch between growing demand and stagnant supply has caused market deficits for five consecutive years, with shortages likely to persist. While above-ground stocks have helped bridge the gap, increasing supply will require higher prices to incentivise investment.

This story is also playing out in the copper market and other materials as renewable energy grows its share of total consumption. An average three megwatt (MW) onshore wind turbine can contain almost 4.7 tons of copper, while an average electric vehicle (EV) requires 83 kilograms.

Moving electricity

Fossil fuel generation has the advantage of being location-agnostic; a combined cycle gas turbine (CCGT) power plant operates virtually the same whether it is based in northern Sweden or in sunny Florida. A solar panel, however, needs year-round sunshine, while a wind turbine requires a consistently windy site. The electrical transmission network must therefore be expanded to efficiently transfer this electricity.

Copper is the optimal metal for transporting electrons due to its relative abundance, high electrical conductivity, and low thermal expansion. However, copper supply faces significant challenges. Exploration budgets have declined, and copper deposits are becoming harder to discover. Even when deposits of sufficient size and grade are identified, miners require higher copper prices to justify investment in increasingly capital-intensive greenfield projects. Furthermore, development timelines for greenfield mines have lengthened substantially, often exceeding 15 years, driven by rising regulatory and permissions hurdles, owing to rising NIMBYism (not in my backyard). These supply challenges are creating a looming deficit in copper, and opportunities for those already producing copper.

Storing electricity

One of the key challenges for renewable energy adoption is the difficulty of storing electricity, with energy storage demand expected to grow rapidly. Significant storage capacity is required to manage daily intermittency (e.g., the sun shines only during the day and wind is variable), seasonal imbalances (e.g., higher heating demand in winter when solar output is lower), and the need to power devices away from plug sockets, such as electric vehicles. Batteries are likely to be a primary solution for energy storage, particularly in mobile applications. Lithium, the charge carrier in most battery chemistries, is critical to this effort. Its demand is projected to grow at a compound annual growth rate (CAGR) of over 15% by 2030 – a pace far exceeding that of most other metals.

Technology shifts and substitution

The future of energy technology is in constant flux – technological breakthroughs will power Javon’s Paradox, whereby lower prices drive wider adoption and increased demand. Battery chemistry will continue to evolve. China currently favours lithium iron phosphate (LFP) batteries, while the West prefers nickel manganese cobalt (NMC) batteries. Solid state batteries are still in development, adding another layer of uncertainty to which materials will be needed to meet our energy storage needs. This uncertainty will benefit select metals, whilst negatively impacting others. Even older proven technologies are subject to improvements.

One example is solar panels, which are currently manufactured from polysilicon; eventually the current material technology will hit conversion yield ceilings (how much sunlight is converted to electricity) and emerging technologies/materials like perovskite solar cells (lightweight, flexible, and highly efficient next-generation photovoltaic technology) will drive the next stage of efficiency gains. Higher material prices and demand will spark new technology shifts in production methods, such as copper sulfide source ore processing or lithium clay extraction.

It is also important to note that in the world of natural resources, higher prices and physical scarcity will often bring forth substitution. As an example, if or when copper demand ultimately outstrips supply, the copper price will move up and manufacturers will look to cut costs. Thrifting is one option but has physical limits, leaving substitution as the likely solution. Aluminum is the next best material in many applications (ignoring silver and gold due to their price and scarcity) as it has a high electrical conductivity and is abundant. Each of these examples of technological shifts and substitution effects may mean less consumption of a certain material but also increased demand for another.

2. Geopolitical power paradigm shift

The Pax Americana era of the past century is rapidly shifting to a fragmented geopolitical world, one shaped by multi-polar forces and competing spheres of influence. In this new power paradigm, the materials universe will play a key role, where trade routes and supply chains are likely to be reshaped, commodities weaponised and a shift to displace the mighty US dollar will alter supply and demand of natural resources for decades to come.

Deglobalisation

The world is gradually deglobalising, driven by rising geopolitical tensions (most notably the US-China rivalry), the desire for supply chain security, and the rise of economic nationalism. This trend will drive significant material demand as supply chains are redrawn. COVID and rising geopolitical tensions have exposed the vulnerability of global supply chains. For example, electric vehicle manufacturers outside of China depend on battery components from China, Chinese steel mills need Australia’s iron ore, and many of the West’s nuclear reactors use fuel processed in Russia.

To address these vulnerabilities, countries are increasingly focused on reshoring to secure their supply chains. This process is driving material demand as nations invest in building extraction, processing, and manufacturing facilities domestically. The US has emerged as a leader in this effort, with policies like the Inflation Reduction Act (IRA) and the CHIPS and Science Act fueling a wave of investment and heightened material demand.

De-dollarisation

Sovereign entities have shown a clear desire to reduce reliance on the US dollar, highlighted by a surge in physical gold purchases since the Russia-Ukraine war. While Russia and China have been leading buyers, other nations have also significantly increased their gold reserves. The war in Ukraine accelerated de-dollarisation, as central banks witnessed Russia's dollar reserves being effectively wiped out overnight, with the US weaponising the dollar to sanction Russian assets and restrict trade. In a world where the impartiality and dominance of the US dollar is under question, gold emerges as a key beneficiary, serving as a safe haven for central banks and investors for centuries. Gold is the only globally accepted currency that remains impartial and neutral amid rising geopolitical tensions.

Central banks have been purchasing gold at record rates to diversify their reserves away from the dollar. This will likely continue, particularly if US-China tensions continue to sour and globalisation stalls or reverses. While the dollar remains a core pillar of the global economy, the US debt path is seen as unsustainable by many. Rising fiscal deficits and increasing interest costs are pushing US debt-as-a-percentage-of-GDP up.

Weaponisation of natural resources

Commodity dominance can be used as a negotiating tactic, or even as an economic weapon. China mines approximately 70% of the world’s rare earths, but controls 99% of the processing capacity of the heavy rare earths, which are essential for producing permanent magnets used in EVs, wind turbines, and military applications. In 2010, China weaponised this dominance in a dispute with Japan that resulted in a tenfold price surge. While China is a net importer of many important raw commodities, the country has astutely built out refining, smelting and processing capacities for many materials. Copper, aluminum, lithium, solar panels are prominent examples of this downstream dominance. However, the friction is not limited to China, as we have seen with the US imposing trade barriers by implementing tariffs on steel, copper and other metals and materials. As geopolitical tensions continue to rise, commodities with concentrated supply chains are increasingly at risk of being weaponised by all major players.

3. Infrastructure spend

The seven largest emerging markets are estimated to account for nearly all of the recent demand increases in global metals markets. As rising wealth in these countries drives consumption patterns similar to the West – cars, mobile phones, air conditioning, and more – the demand for materials will be immense. Additionally, EM nations will require significant infrastructure development, which is highly metals- and materials-intensive. Building bridges, roads, data centres, and manufacturing facilities will call for vast quantities of steel, cement, and aggregates.

The need for materials is not limited to EMs. Years of underinvestment in infrastructure have left the West, particularly the US, with ageing systems. The US has begun addressing this issue through initiatives like the Infrastructure Investment and Jobs Act (IIJA), a US$1.2 trillion package focused on transportation and infrastructure spending, alongside the Inflation Reduction Act (IRA) and CHIPS and Science Act, which will further drive demand for basic materials. Another urgent challenge is the ageing power grid in many parts of the world. In the US, for example, the average power transformer is 40 years old, forming part of a patchwork grid designed for a different era. Modernising this grid over the next decade will require enormous amounts of copper, aluminium, and power equipment, creating yet another major source of material demand.

4. Cyclical ebbs and flows

If materials demand consistently increases, why is there price volatility? When analysing materials demand, it is important to understand that even powerful long-term trends will experience shorter-term cyclical waves.

Take lithium for example. The demand growth for lithium remains significant, but it also creates volatility, partly due to the rapid supply growth needed to meet demand – subject to operational setbacks – and partly due to the challenges of accurately forecasting demand. As seen last year, predicting electric vehicle adoption remains difficult given the current stage of the adoption S-curve, where growth is accelerating but infrastructure and consumer behaviour remain key constraints. Similarly, producers struggle to forecast demand, with either overproduction or excessive caution resulting in large surpluses or deficits. And if that isn’t enough volatility, lithium is hard to store, which means it is difficult to build reserves in times of plenty, and there is little to fall back on in times of scarcity.

5. Decarbonising of production

While materials such as steel, aluminium, and cement are essential for decarbonising the broader economy, their production generates significant GHGs, making these processes prime candidates for decarbonisation.

Decarbonisation of material supply chains will create challenges and opportunities between and within sectors. The steel industry accounts for over 7% of global emissions, and aluminum accounts for another 3%. It is difficult to retrofit existing steel production facilities to eliminate emissions. Instead, producers must build completely new facilities to reduce emissions, transitioning from the coal-consuming blast furnaces to electric arc furnaces which, as the name suggests, are powered by electricity.

Unsurprisingly, completely rebuilding steel production infrastructure is not cheap; European steelmakers face a steep capex bill in the medium term. But whilst this transformation will be expensive, it could generate economic benefits for the early movers. ‘Green premiums’ are slowly being adopted by the industry: the extra price paid for the lower embodied emissions of the material. These premia will either be enforced by regulation (e.g., producers paying for the carbon emitted, with the costs then passed on to customers), or by voluntary adoption (e.g., automotive original equipment manufacturers (OEMs) can sell ‘greener’ vehicles at a premium, so they are happy to pay extra for the ‘greener’ metals themselves). Decarbonisation is going to also significantly change the aluminum industry. Smelting aluminum uses a lot of electricity, so much so that the grey metal is often dubbed ‘solid electricity.’ The source of electricity therefore has a large impact on the embodied emissions of the aluminum: if the smelter is connected to a coal-fired power plant, then it can produce upwards of 20 tonnes of CO2 for every tonne of aluminum produced, versus just two to four tonnes of CO2 for those connected to hydropower. If producers have to pay for that carbon, it could add US$2000 per tonne of cost to a metal whose price is only US$2500 per tonne today (assuming a US$100 per tonne carbon price). Like steel, the low carbon producers could have a significant competitive advantage.

6. Emergence of the circular economy

Unlike consumable natural resources like fossil fuels (which disappear forever once used), metals and materials do not go away – every ounce of gold and pound of copper mined is theoretically still in existence somewhere. The development of a circular economy for materials is important, not just from a sustainability angle but as demand increases, the renewal, re-use and recycling of materials will be a vital source of supply. Indeed, for something as essential as copper, it is hard to imagine a future scenario where recycled scrap is not a significant part of the metal’s global supply.

However, the economic demand for recycling and reusing must be driven by viable technologies, as well as economic business models. Price will serve as the biggest driver of recycling. In a future where supply struggles to keep pace with demand for many materials, price signals will drive greater investment in new technologies, such as renewable plastics, and incremental capacity expansion. This journey starts with an understanding of how important materials are to our everyday lives and global economic health.

Conclusion

What role will materials play in solving the world’s sustainability challenges, and where are the opportunities for investors?

The materials sector is at a critical juncture. As demand accelerates due to the global push for renewable energy, reshoring supply chains, and decarbonisation, investors face both risks and rewards. Supply shortages, resource nationalism, and technological shifts will complicate the picture, but they also open doors to innovation, from lithium extraction breakthroughs to advances in recycling.

For investors, success will depend on navigating cyclical volatility while identifying winners in long-term secular trends. Materials are not just vital to economic growth; they are at the centre of humanity’s ability to innovate and move towards a better future.

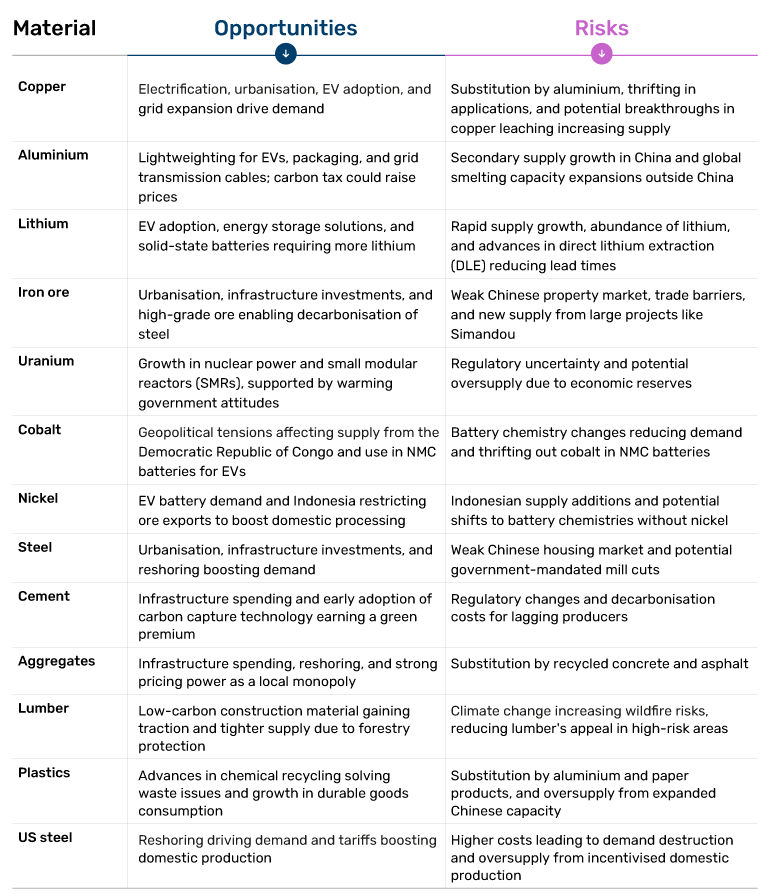

Figure 2: In brief – Commodities investment opportunities and risks

All data Bloomberg, unless otherwise specified.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.