Introduction

Patience is a virtue.

And it’s especially true for Japanese Value investors, who could have been forgiven for giving up. After all, it hasn’t been a pretty few years.

However, for those who have stayed the course, Japanese Value may be about to reward their persistence. In our view, a combination of a less crowded market, cyclical resurgence, valuation stretch and market inefficiency has made Japan the most attractive equity market in the world for active managers focused on Value. As investors endure rising volatility and a possible factor rotation in the US, we would argue that there is now, finally, an alternative: Japanese Value stocks.

A Less Crowded Market

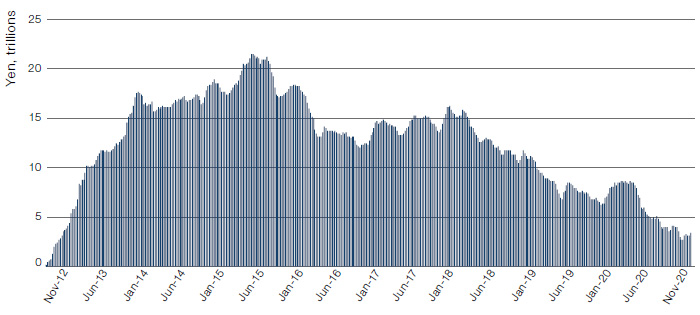

Ever since the collapse of the Japanese property bubble in the early 1990s, investors have been slow to enter and quick to exit Japanese equity positions. The Japanese market is currently less crowded than at any point since 2012, the year the election of Shinzo Abe as Prime Minister triggered a wave of inflows (Figure 1).

Figure 1. Foreign Investor Holdings of Japanese Equities

Source: Citi; as of 1 December 2020.

Cyclical Resurgence

Part of the reason for such flighty behaviour is the weighting of Japanese indices towards old economy stocks and away from the sectors which have thrived during the last few years, such as technology. The weighting away from tech and towards manufacturing gives Japanese equities a pro-cyclical and Value tilt. As such, listed firms tend to have lower operating margins, higher fixed cost bases and a greater degree of operating leverage than those in other regional indices.

While these cyclicals have been punished during the coronavirus pandemic, the rapidly improving global economic environment should boost performance as world trade continues to open up in its aftermath – and should go some way to reversing the outflows of foreign investment.

Additionally, the bull case for the pro-cyclical and Value stocks is bolstered when we consider rising US bond yields (Figure 2). An environment of rising yields would tend to benefit old economy stocks and heavily penalise Growth names, as it would raise the discount rate applied to future earnings. Given current US Growth valuations are only tenable if we assume continued high earnings growth with a minimal discount rate, Japanese equities are likely to benefit on a relative basis.

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 9 April 2021.

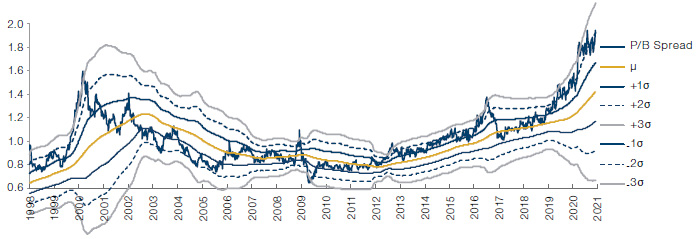

Just how much Japan sets to benefit from a Value rally can be seen in Figure 3 which shows that the valuation gap in price-to-book (‘PB’) terms is the highest seen this century. As such, it is reasonable to expect some form of correction – indeed, this is already occurring, with Japanese Value outperforming Growth year to date (Figure 4). While we could have made a similar point about valuation stretch during 2018-20, it is the combination of both factors – the stretch and a few months of Value resurgence – which makes the case for 2021 being the time to reconsider Japanese Value.

Figure 3. Valuation Stretch

Source: Goldman Sachs; as of 1 December 2020.

Note: Spread between most expensive and least expensive quintile stock in Topix, based on PB ratio.

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 9 April 2021.

Note: Normalised to 100, as of 1 January, 2021.

The Sweet Spot: 8% ROE

If Japanese equities were simply a levered macro play, one could be forgiven for giving them a miss. After all, most asset managers don’t attempt to predict the macro cycle. However, Japan’s recovery represents a unique opportunity for alpha as well as beta, because any cyclical recovery will be unduly influenced by a quirk of the country’s corporate governance regulation.

The adoption of a new Stewardship Code in Japan in 2014, closely followed by the Corporate Governance Code in 2015, has led to an unintended consequence: the paradox of the 8% return-on-equity (‘ROE’) target. Since 2016, corporates have been directed to aim for an 8% ROE ratio, with shareholders encouraged to vote against the reinstatement of boards which fail to reach this target three years in a row. This has resulted in a wildly bifurcated environment (Figure 5). In all other regions, the PB ratio moves in a linear fashion with ROE: as ROE increases, so does the multiple. In Japan, businesses which achieve the exalted 8% figure enjoy a disproportionate PB premium; those which don’t have their multiple crushed.

Problems loading this infographic? - Please click here

Source: JP Morgan; as of 18 January 2021.

There is no economic rationale for this behaviour. It is a completely arbitrary quirk of regulation (although equity owners are benefitting from the renewed focus of Japanese management teams on delivering shareholder returns). For a stock picker, this represents something close to nirvana – a huge, highly predictable market anomaly without high levels of foreign inflows which would compete it away. Most importantly, the likelihood of a cyclical uplift means that a number of stocks with high levels of operational leverage are likely to be able to raise their ROE above 8%, presenting opportunities for active managers. These tend to be old economy stocks such as manufacturers or banks, although we would stress that the premium paid above 8% ROE is itself sector neutral.

The irony is that achieving the hallowed 8% is not even that hard. Management teams have a number of levers to improve ROE – such as negotiations with suppliers, share buybacks and reducing unnecessary expenditure such as travel costs – but have traditionally shrunk from pulling them. The pandemic has provided opportunity to move the pendulum back towards a healthy centre ground.

Conclusion: It’s Already Happening

The 8% ROE threshold and a combination of a less crowded markets, cyclical resurgence and valuation stretch has made this the most extreme environment that we have observed in Japan during our careers. Yet predicting a comeback for Japanese Value has proved to be a fruitless exercise for much of the past decade.

Why, now, should it be any different?

The stars are aligned for a resurgence in Japan Value as never before in our careers. We argue that the combination of resurgent economic growth, rising yields, the potential for foreign inflows and – most importantly – the unique corporate ROE target makes the opportunity set for active management as attractive as it has ever been. Even more positively, we are already seeing the factor performance which means that Value managers will no longer be fighting market momentum. As far as we can see, this time it really is different.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.