And you better start swimmin’, or you’ll sink like a stone, for the times they are a-changin’

Bob Dylan, 1964

New regime, new rules.

You only have to read Edwin Lefevre’s Reminiscences of a Stock Operator, published in 1923, to understand that many essential rules of investing have never really changed. To name a few: run your winners; cut your losses early; get out of the market if you do not understand what is going on; markets discount 6-9 months ahead. It was and will be ever thus.

Still, we believe some rules are changing in subtle but important ways. We already published Eight Things Investors Can No Longer Rely On in a recent The Road Ahead. Here are three further shifts we are contemplating.

First, Fed pivots will be slow events, not big-bang events. In recent decades, policy pivots were big events in reaction to market stress – for instance spectacular announcements of QE, rate cuts, IMF bailouts or “whatever it takes”. But that was when the Fed was proactively trying to avoid inflation. The new Fed is reactive to inflation. We think the more likely nature of the new type of pivot is slow – at some point we will look back and say, for instance – “we now know that the Fed terminal rate expectations peaked in Q4 2022”, and traditional assets will have rallied quite some way already before the market fully realises.

The implication, we think, is that those waiting for a big announcement to indicate the pivot will miss it. Our judgement, today, is that max hawkishness is this side of Christmas.

Second, inflation peaks and troughs will be even more significant than before, in determining market performance and turning points. When inflation is low and stable, little swings in inflation do not always matter that much. Indeed, in the last few decades, valuations, profit growth, and other variables were often much more important.

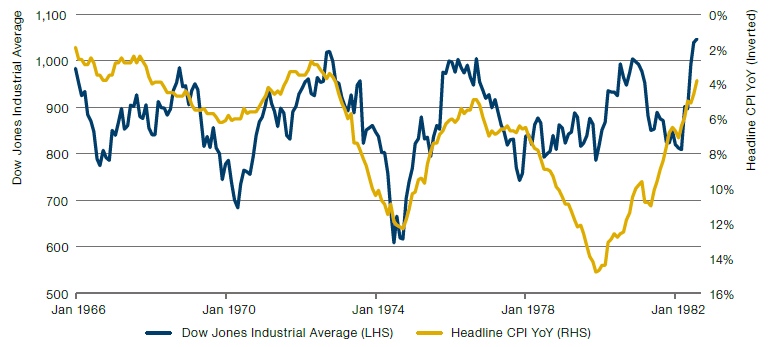

However, when inflation is volatile and represents the major threat to economies and markets, the peaks and troughs take on much more significance. Indeed, we believe that was one lesson from the 1970s (Figure 1), when equities and inflation were very closely linked. From October 1967 to December 1982 the real annualised return to US equities was -0.5%. However in the three periods during that time where inflation was falling – January 1970 to January 1972, December 1974 to November 1976 and March 1980 to December 1982 – respective returns were +7%, +18% and +15% on the same basis.

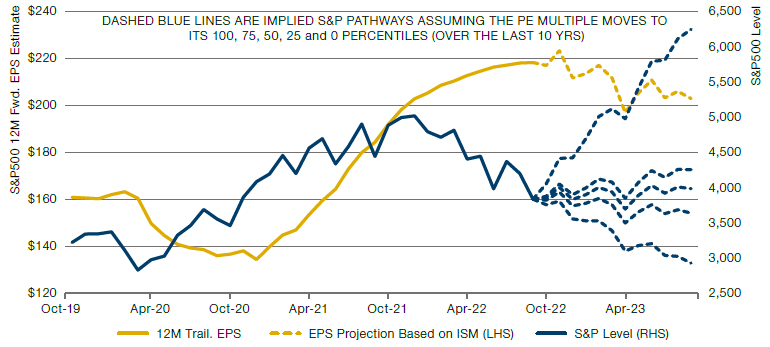

The implication, we think, is that if inflation continues on its downward path during the next few quarters, as we expect, it may well be the key driver for much more bullish markets, despite our expectation of anaemic profits. Our judgement, today, is that there may not be much downside to equities anymore from here, for now, despite the upcoming earnings recession (Figure 2). Until the next inflation wave hits, of course.

Third, the nature of recessions will change. In the last few decades we had long cycles and rare but big recessions. These recessions were always a result of a slow build-up of excesses in certain areas – for instance, TMT in the 1990s, Real Estate and Financials in the 2000s. These excesses in investment and employment were then corrected during the recessions, which necessarily took some time.

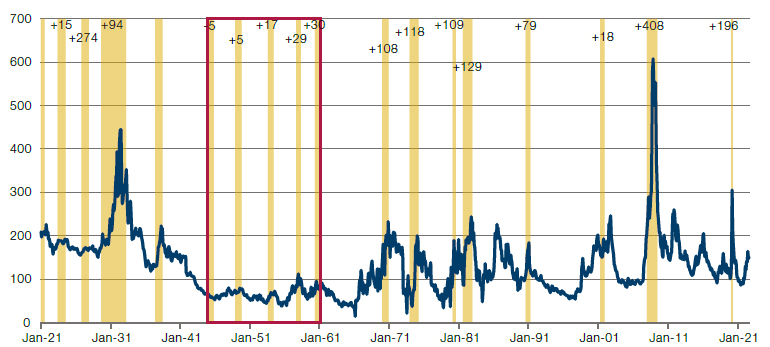

In the new world of high & volatile inflation, recessions are likely to be more frequent and shorter. Exactly this was the case after WWII – a short recession every three years, for a period of 15 years. Recessions driven by spikes in inflation, solved by falls in inflation. And for a variety of reasons, investment grade (“IG”) spreads hardly moved during such recessions as the downturns were short, nominal growth was decent, and excesses had not been built (Figure 3).

Needless to say we make this particular point with some trepidation. Given very high public and private debt levels around the world, the risk of a much worse type of recession certainly exists. But that is not our base case. To this point, we anticipate a future issue of The Road Ahead to discuss what the next severe crisis could look like.

The implication, we think, is that credit may be surprisingly defensive through recessions in the next few years. Our judgement, today, is that now is the time to increase exposure to credit, with for instance US IG yielding close to 6% and US HY yielding close to 10%, currently1. As our colleague Mike Scott points out, the spread on the much watched Markit iTRAXX Europe Crossover index is currently at 650 bps. At this level, the carry is so high that an investor would still breakeven if spreads blow out to 1000 and stay there for one year before going back to normal levels.

Figure 1. A Very Close Link Between Inflation and Equity Markets, 1966-82

Source: Bloomberg; as of 1982.

Figure 2. Perhaps 3500 on the S&P 500 is Low Enough

Source: Bloomberg, Man Solutions. As of 7 October 2022. For our ISM leading indicator, we are indebted to the work of Cornerstone Macro. The model is bullish on activity when inflation is falling, cost of debt is falling, capacity utilisation has fallen sharply, Asian stocks are underperforming, consumer names are underperforming housebuilders, early cycle companies are outperforming late cycle companies and import prices are falling, and vice versa.

Figure 3. Credit Spreads Were Remarkably Resilient in the Recessions Between 1945-65

Source: Bloomberg, Man Solutions. As of 7 October 2022.

1. Source: Bloomberg, C0A0 and H0A0 indices.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.