Key takeaways:

- Cat bonds offer equity-like returns with lower volatility and low correlation with traditional financial assets, making them a valuable diversification tool.

- Cat bonds transfer specific event risks from insurers to investors, with parametric triggers enabling quick payouts, especially beneficial in developing markets.

- Cat bonds have also emerged as a socially responsible investment. For the insured risk, cat bonds provide an element of risk transfer back to investors.

Introduction

Catastrophe (‘cat’) bonds are securitisations of insurance risk. Cat bonds transfer a specific set of event risks (e.g. natural disasters such as hurricanes, earthquakes or wildfire, or life/health risks such as pandemics) from the sponsor (e.g. a reinsurer) to the investor (e.g. a pension fund).

The bonds, which are freely tradable, facilitate the transfer of risk from the insurance market to the capital markets. With potential benefits for sponsor and investor alike, the market has grown steadily, with about USD45 billion of public deals outstanding1.

How does a cat bond work?

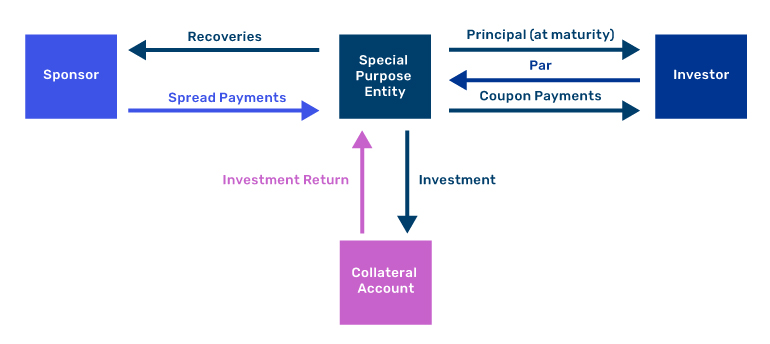

There are three main parties to a typical cat bond deal: the sponsor (who is selling the insurance risk); the special purpose entity (‘SPE’) which issues the cat bond and holds the bond collateral; and the investor (who is buying the insurance risk).

Prior to deal launch, the investor will typically receive the bond offering circular, an investor presentation, and an invitation to participate in some form of investor roadshow. These will make clear the perils to which the bond is exposed, the geographical coverage and the precise computation (the ‘trigger’) which determines whether the insured receives a payout.

When the deal launches, the investor pays par upfront for the bond. The proceeds are held in the SPE in a collateral account, which typically invests in Treasury money market funds or supranational floating rate notes. The investor then receives the return on the collateral, plus the spread payments which are made by the sponsor (under a reinsurance agreement) to the SPE. The bond is freely tradable after launch.

Provided that the bond has not triggered, at maturity (typically three years later) the collateral will be liquidated and returned to the investor.

If the bond triggers, some or all of the collateral is liquidated and paid to the sponsor, with appropriately reduced spread payments being made going forward.

Figure 1. How a cat bond works

Source: Man Group. Schematic illustration.

The trigger may reference actual losses of the sponsor (an ‘Indemnity’ trigger) or the industry (an ‘Industry Index’ trigger). Another possibility is that the trigger is computed from physical measurements as a proxy for economic loss (a ‘parametric’ trigger). For example, a proxy for storm damage may be the minimum central pressure of the storm or a function of the peak windspeed, and a proxy for earthquake damage might be a function of the peak ground acceleration. Parametric triggers have specific benefits for developing markets: they do not rely on a developed claims process; they can enable more rapid payment to the sponsor; and (particularly in the case of mortality) the trigger is apolitical.

Performance and growth of the cat bond market

The broad performance of the space can be readily monitored:

- The Eurekahedge ILS Advisors index is an equally weighted index of about 27 funds (and hence is net of fees) and has data since 2006;

- The Swiss Re Cat Bond index is a market-value weighted index of cat bonds, excluding life and health bonds. It is gross of fees and transaction costs and has data since 2002.

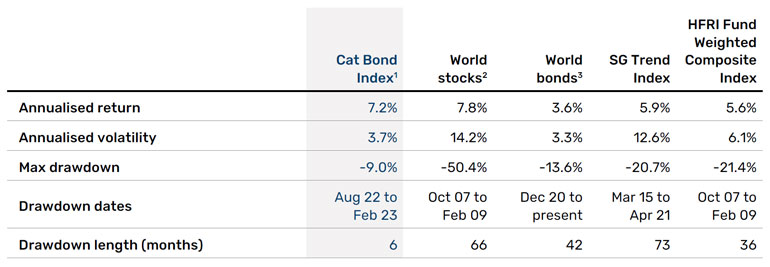

Long-term returns of the Swiss Re Cat Bond index have proven to be comparable to equity returns, while delivering lower volatility. The Swiss Re index has realised a return of 7.2% since its inception, with a monthly maximum drawdown of -9%, compared to an equity drawdown of up to -50%. (Figures 2 and 3)

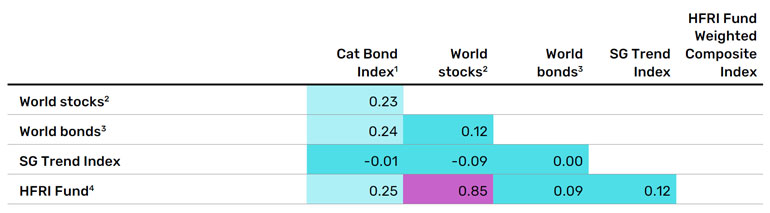

The asset class offers strong diversification benefits, with cat bonds typically having a correlation coefficient below 0.2 with equities or bonds, reflecting their independence from the business cycle (Figure 4). In addition, they may also appeal to sponsors: they may be able to obtain additional capacity, at competitive rates, offering multi-year cover and with collateralised protection.

Problems loading this infographic? - Please click here

Figure 3. Comparing returns and volatility (1 January 2002 to 30 June 2024)

Source: Swiss Re, Eurekahedge, Bloomberg; from December 31, 2005, to March 31, 2024.

*Swiss Re Cat Bond Index.

Figure 4. Correlations

**MSCI World Net Total Return Index.

***Bloomberg Barclays Capital Global Aggregate Bond Index.

As such, it is not surprising to us that the market has grown – from inception in the late 1990s to a circa USD45 billion market today. Indeed, in anticipation of further growth, several countries are trying to attract issuance of Insurance Linked Securities (ILS). For example, the UK’s ILS regulations came into force in December 2017, and the first public, UK-domiciled cat bond was issued in May 2018.

The emergence of cat bonds as an impact investment

The stable return profile of catastrophe bonds and their historically low correlation with broader financial markets has traditionally been the main reasons investors considered an allocation of cat bonds into their portfolio. However, more recently investors have started recognising catastrophe bonds for their social impact.

In essence, catastrophe bonds provide elements of disaster recovery for the insured risk and thus transfer weather and catastrophe risk from the insured entity to financial investors willing to bear that risk.

Furthermore a new breed of cat bonds has emerged, aimed at preventing disaster and extending coverage for low-income countries unable to mobilise proper financing to fight a looming disaster.

Risk transfer and disaster resilience

The UN defines resilience as “the ability of a system, community or society exposed to hazards to resist, absorb, accommodate to and recover from the effects of a hazard in a timely and efficient manner.”

The cover that catastrophe insurance provides sits firmly within this definition. Not only does it compensate for losses, but the use of parametric triggers can mean that payments are made more quickly than if actual losses had to be assessed (particularly in emerging markets where the claims process is generally less well developed). Named storm cover for Jamaica, earthquake cover for the Turkish Catastrophe Insurance Pool and the Pacific Alliance are examples that illustrate how cat bonds aid in risk transfer and disaster resilience.

Jamaica Named Storm Cover

Jamaica is highly vulnerable to hurricanes. Historically, the financial burden of disaster recovery has fallen heavily on the Jamaican government. In 2024, following previous similar initiatives, the International Bank for Reconstruction and Development (IBRD) issued a catastrophe bond to support Jamaica's disaster risk financing strategy. The objectives of this bond included:

- Reducing the government's financial sensitivity to climate change and increasing social safety nets;

- Complementing other strategies in relation to the fiscal strain of natural catastrophes. The bond features a parametric trigger to enable a prompt payout.

In addition, proceeds from the bond sale are earmarked for the IBRD's Eligible Sustainable Development Projects, which aim to achieve positive social and environmental outcomes. This aligns with IBRD’s goals of eliminating extreme poverty and promoting shared prosperity.

The Turkish Catastrophe Insurance Pool (‘TCIP’)

Turkey is heavily exposed to earthquakes. With a low historic insurance take-up, the reliance on the state to finance household reconstruction has posed a substantial burden on state finances. For example, the Kocaeli and Düzce quakes in 1999 are estimated by Swiss Re to have cost the Turkish economy USD20 billion, with only USD1 billion being insured. In this context, and with the assistance of the World Bank, the TCIP3 was formed. Its objectives include:

- The provision of affordable insurance cover;

- Reducing citizens’ dependence on the government to finance reconstruction (and therefore the governments’ exposure to earthquakes) by transferring risk to the reinsurance markets.

Catastrophe bonds have played their part. The first public deal for the TCIP was launched in 2013 and a second in 2015, with a total cover of USD500 million. Both employed a parametric trigger.

Conclusion

Cat bonds provide an efficient route for insurers and reinsurers to access the capital markets.

Investors traditionally considered this asset class for its stable return profile and historically low correlation with broader financial markets.

Now, cat bonds are also emerging as a socially responsible investment. For the insured risk, cat bonds provide an element of risk transfer back to investors.

As a sign of confidence in this asset class, the market capitalisation is growing at an impressive rate. New, innovative bonds are emerging as a very effective tool in providing a new kind of social benefit, while helping generate uncorrelated risk-adjusted returns for investors.

All data Bloomberg unless otherwise stated.

1. Source: Man Group Database

2. https://www.eurekahedge.com/Indices/IndexView/Special/635/Eurekahedge-ILS-Advisers-Index

3. http://www.tcip.gov.tr/

4. https://www.worldbank.org/en/news/press-release/2018/02/07/world-bank-affirms-position-as-largest-sovereign-risk-insurance-provider-with-multi-country-earthquake-bond

5. https://www.worldbank.org/en/topic/pandemics/brief/pandemic-emergency-facility-frequently-asked-questions

6. https://www.worldbank.org/en/news/press-release/2017/06/28/world-bank-launches-first-ever-pandemic-bonds-to-support-500-million-pandemic-emergency-financing-facility

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.