Key takeaways:

- Asset owners and investors have a critical role to play in staving off the worst effects of climate change

- Climate investment solutions must pursue a dual approach to combatting climate change, with climate finance directed towards halting the rise in global temperatures (mitigation), as well as reacting to the effects of climate change that are already upon us (adaptation)

- There are alpha-generating investment opportunities for financial institutions (FIs)1 willing to commit to climate investing

Introduction

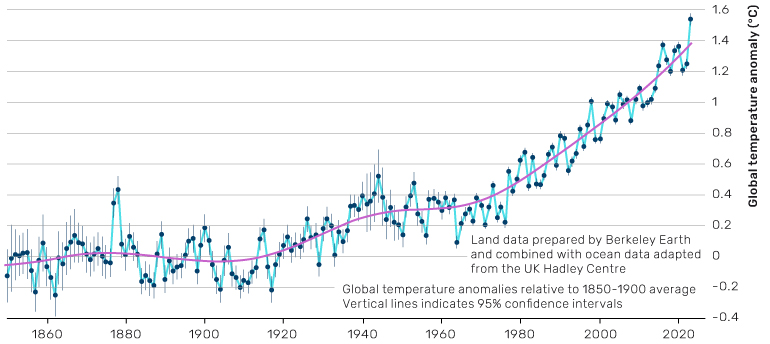

Working from a pre-industrial baseline, the impact of the last 150 years or more of human endeavour (i.e., energy usage) has categorically contributed to a significant rise in global temperatures (Figure 1).

Figure 1. Global average temperature 1850-2023

Source: Berkeley Earth.org, https://berkeley-earth-wp-offload.storage.googleapis.com/wp-content/uploads/2023/03/03232329/HR_Global_Average.png. Data as at December 2023.

The overarching goal of the Paris Agreement2 is to hold “the increase in the global average temperature to well below 2°C above pre-industrial levels”, and to pursue efforts “to limit the temperature increase to 1.5°C above pre-industrial levels”. If we accept the goal of the Paris Agreement as vital in staving off the worst effects of climate change, then we must also accept the critical role that asset owners and investors need to play through climate finance.

According to the World Meteorological Organization (WMO), the January-September 2024 global mean surface air temperature was 1.54°C above the pre-industrial average.3 2024 has now been confirmed as the hottest year on record,4 joining 2023 as the two hottest years on record. Long-term warming, measured over decades, remains below 1.5°C – but for how long?

Limiting warming to 1.5°C would greatly curb climate change impacts compared to 2°C. But the more important truth is that every fraction of a degree of warming contributes to sea ice loss, sea level rise, terrestrial and marine ecosystem impacts, heatwaves, shifts in the hydrological cycle, and other effects. Any reduction in greenhouse gas emissions and warming is highly meaningful.

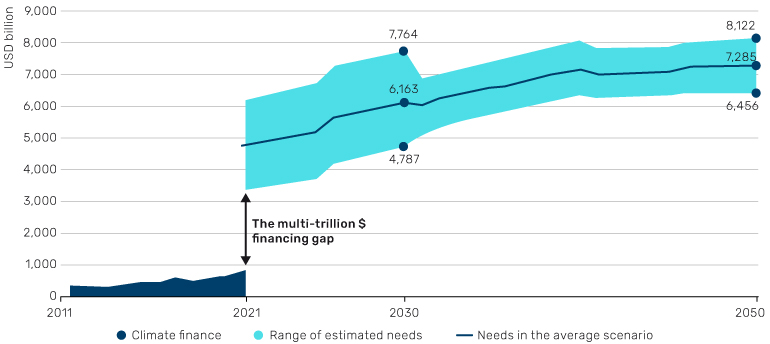

Meanwhile, a recent study from the Climate Policy Initiative (CPI), shows that annual climate finance needs to increase at least fivefold to maintain a 1.5°C pathway.5 Whether it is 1.5°C or 2°C, adherence to the overarching goal of the Paris Agreement will require vastly more climate finance flows – almost USD 200 trillion (or USD 7.3 trillion per annum) in total between now and 2050 (Figure 2).

Figure 2. Global tracked climate finance and estimated annual climate finance needs through 2050

Source: Climate Policy Initiative, How Big is the Net Zero Financing Gap? (San Francisco: Climate Policy Initiative, September 2023), https://www.climatepolicyinitiative.org/wp-content/uploads/2023/09/How-big-is-the-Net-Zero-financing-gap-2023.pdf.

The cost of not meeting these climate finance needs will also be borne by our global financial systems and the companies that drive them. The CPI’s report details the cost of inaction, estimating that projected economic losses by 2100 will be five times greater than the climate finance that is needed by 2050 to stay within a 1.5°C warming scenario.

To combat climate-related impacts on economic outcomes, climate investment solutions must pursue a dual approach, with climate finance directed towards halting the rise in global temperatures (mitigation), as well as reacting to the effects of climate change that are already upon us (adaptation).

Mitigation versus adaptation

Figure 3. Mitigation versus adaptation

Source: Schematic illustration.

Mitigation and adaptation are the complementary approaches that we need to adopt globally to combat climate change (Figure 3):

- Mitigation (or decarbonisation): Focuses on addressing the root causes of climate change. Solving the problem by slowing or minimising greenhouse gas emissions

- Adaptation: Focuses on managing the effects of climate hazards, including those exacerbated by climate change. Minimising the damage and focusing on resilience

To lessen and then halt global warming and its alarming effects, we must continue to invest in decarbonisation techniques and technologies. However, the less successful we are in mitigating climate change, the more we need to invest in adaptation, and, according to the Institutional Investors Group on Climate Change, “climate resilience goals should be pursued alongside climate change mitigation”.6

Investing in adaptation is not only crucial for long-term resilience, but also to benefit the near term, given the financial and social impacts of climate extremes, natural variability, and the global warming already realised.

We also need to acknowledge the different decarbonisation and adaptation impacts at a portfolio level and in the real world.

Distinguishing between portfolio-level and real-world implementation

Figure 4. Portfolio versus real-world impact

Source: Schematic illustration.

While acknowledging that there is room for some overlap between portfolio and real-world impact,7 we offer readers the following definition to help distinguish between the two.

Portfolio: Broadly, the concepts of portfolio decarbonisation and portfolio adaptation seek to identify the companies, sectors and countries that will be the least exposed to climate change. Asset owners and managers can then favour those issuers in their investment portfolios and measure the impact of their decarbonisation and adaptation efforts through their portfolio exposure metrics, such as weighted average carbon intensity (WACI) of a portfolio (decarbonisation) or percent of a portfolio’s holdings in locations with high exposure to extreme weather (adaptation).

Real world: By contrast, the concepts of real-world decarbonisation and real-world adaptation go a step further, confronting the challenge posed by climate change to the real economy. They do so by accommodating issuers that are more (and sometimes highly) exposed to climate change and by favouring those which are seeking to minimise the future risks by committing to a pathway of decarbonisation and/or adaptation. Asset owners and managers can measure the impact of their real-world decarbonisation and adaptation efforts through actual climate measures, such as megawatts of clean energy supplied (decarbonisation), or water used per bushel of crop (adaptation).

One reason to distinguish between portfolio-level and real-world application of climate finance is the different outcomes they produce. For example, through the efforts of FIs in recent years, the emissions intensity8 of standard market indices and the global economy have declined (Figure 5). Indeed, this is a sign of progress as net zero requires the decoupling of economic growth from emissions.

Figure 5. Emissions intensity of market indices and the global economy

Problems loading this infographic? - Please click here

Source: Prepared by the authors using S&P Trucost emissions intensity data applied to Bank of America Global Corporate Agg Index and MSCI World Index holdings, as at March 2024.

However, in the real world, total greenhouse gases continue to accumulate in the atmosphere (Figure 6). In short, while the emissions intensity of our portfolios falls, real-world carbon emissions continue to rise.

Figure 6. Atmospheric greenhouse gas levels

Problems loading this infographic? - Please click here

Source: NOAA Climate.gov, based on Mauna Loa monthly mean data from NOAA Global Monitoring Lab, as at June 2024.

We now see that within the decarbonisation and adaptation investment approaches, we need to generate and monitor portfolio-level and real-world impact. Let’s look at decarbonisation and adaptation in more detail.

Decarbonisation

As a reminder, decarbonisation (or mitigation) focuses on addressing the root causes of climate change – using climate solutions9 to slow or minimise greenhouse gas emissions. To encompass decarbonisation at a portfolio level and in the real world, FIs can employ different instruments and techniques, and monitor impacts separately.

Portfolio-level decarbonisation

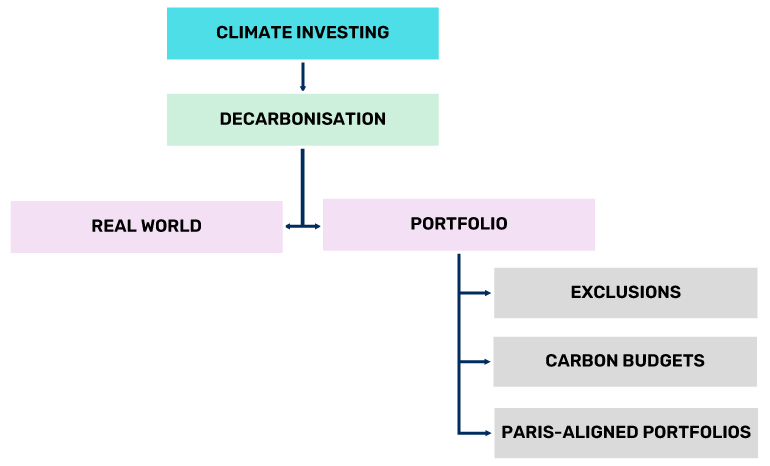

Figure 7. Portfolio decarbonisation

Source: Schematic illustration.

Established practice in recent years has been to focus on portfolio decarbonisation. Hundreds of asset owners and managers, responsible for trillions of dollars of assets globally, have committed to supporting the goals of the Paris Agreement in their portfolios, and to investing that is aligned with net zero emissions by 2050 or sooner. These efforts have had marked success at a portfolio level, with many portfolios showing significantly lower carbon emissions intensity than five or 10 years ago.

There are several approaches aiming to achieve portfolio decarbonisation (Figure 7):

- Exclusions lists - which restrict the investable universe to exclude emissions-intensive investments

- Carbon budgets - which set a target portfolio carbon intensity (usually relative to the carbon intensity of a benchmark)

- Paris alignment - which aligns investment in a portfolio to achieve net zero emissions by a target date, usually 2050

FIs are drawn to these techniques as they are easy to implement and, if the exclusion lists are reasonable, have a relatively low impact on an unencumbered portfolio.10 A byproduct of these techniques is increased exposure to low-carbon sectors like Technology, Healthcare and Financials and underweight in carbon-intensive sectors such as Energy, Materials and Utilities (recently creating a “low-carbon tailwind”).

While this commitment can be applauded, we are now seeing the unintended consequences of portfolio decarbonisation. Asset owners and managers, not wishing to be penalised for holding assets in carbon-intensive sectors (since it increases portfolio emissions), have turned, for example, to divestment as a key driver of portfolio decarbonisation.

Therefore, when it comes to mitigation, we believe that the next frontier is to move beyond portfolio decarbonisation and to drive real-world decarbonisation through climate investing.

Real-world adaptation strategies

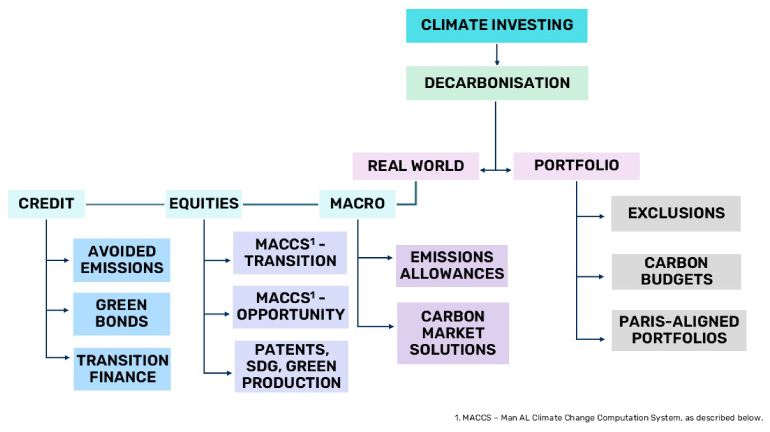

Figure 8 shows some of the investment approaches employed across asset classes to bring about real-world decarbonisation.

Figure 8. Real-world decarbonisation

Source: Schematic illustration.

In credit there are many opportunities for direct financing of real-world decarbonisation, with green bonds the purest instrument. Green bonds can be used to finance sustainable projects (usually for high emitters), combining the benefits of traditional fixed income with a positive climate impact. By using forward-looking metrics such as avoided emissions,11 credit strategies can tilt their allocation towards green bonds with high avoided emissions intensity.12

On the equity side, Man Group has developed the Man AI Climate Change Computation System (MACCS) as a way to integrate real-world decarbonisation signals into an equity portfolio. To focus on real-world decarbonisation, we need to be able to identify companies that are exposed to climate change and seeking to minimise the future risks by committing to a pathway of decarbonisation. Our climate scientists and quantitative researchers at Man Numeric have done this by developing and using MACCS to integrate comprehensive environmental, social and governance (ESG) considerations and climate alpha models into the investment process.

We fully believe that it is possible for climate investing to accelerate real-world decarbonisation, and to do so while generating new forms of alpha for investment portfolios across equities and fixed income.

Finally, at a macro level, we are also seeing new tools to support real-world decarbonisation. The voluntary and compliance carbon markets are promising, not only in their potential to drive decarbonisation,13 but also as investment opportunities.14

The Compass-FRWD framework as a solution for real-world decarbonisation

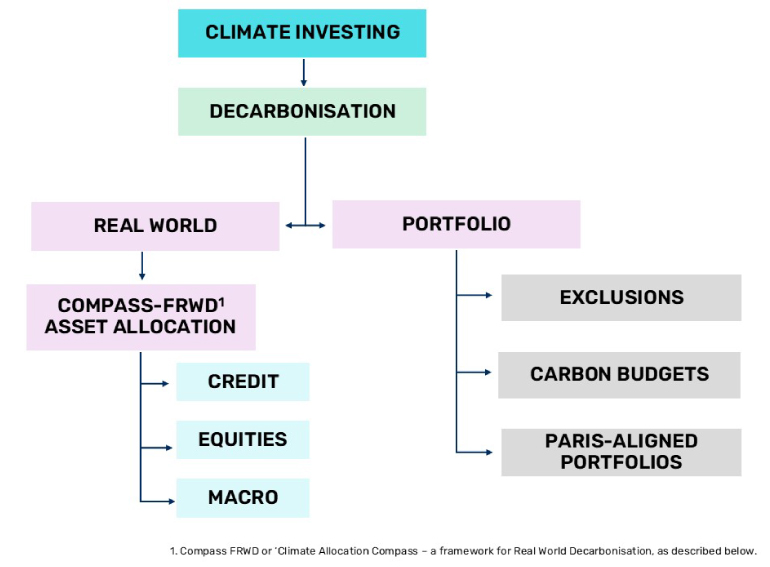

Figure 9. Real-world decarbonisation

Source: Schematic illustration.

In a joint research initiative, Man Group and the Columbia Center on Sustainable Investment (CCSI) have developed the Climate Allocation Compass – a Framework for Real-World Decarbonisation (Compass-FRWD), setting out how investors can close the climate investment gap and decarbonise the real economy.

Compass-FRWD is a step-by-step guide to asset allocation across multiple portfolios. It is designed to help investors set targets and monitor the progress of their climate solutions investments as part of a coherent cross-asset strategy, alongside traditional financial requirements. For the first time, Compass-FRWD offers allocators a clear roadmap for deliberate, dynamic and net-zero aligned investment in climate solutions.15

Adaptation

Let’s turn our attention to adaptation. As a reminder, adaptation focuses on managing the effects of climate change, minimising the damage and focusing on resilience.

We have learned how real-world decarbonisation is less well understood by FIs – and solved for through climate finance – than portfolio decarbonisation. This trend continues as we move into portfolio and then real-world adaptation. This must change – according to the CPI, there is an urgent need for investment in adaptation and resilience, to avoid “costly and catastrophic future impacts”.16

Portfolio-level adaptation

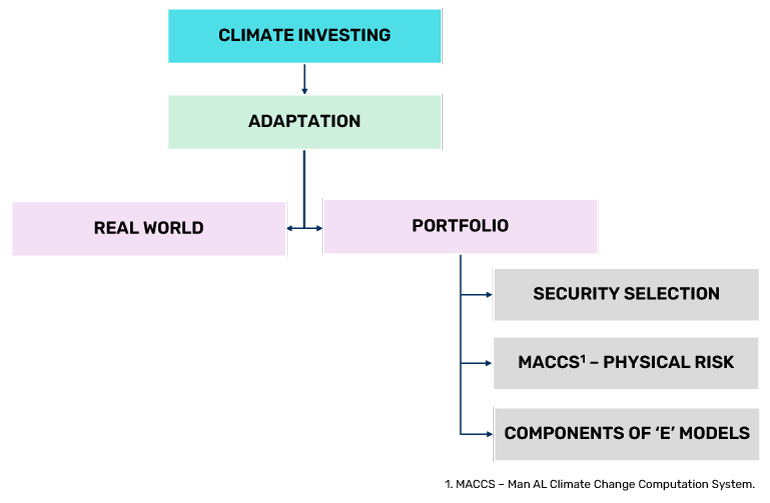

Figure 10. Portfolio adaptation

Source: Schematic illustration.

There is more overlap between the portfolio-level and real-world impact when it comes to adaptation. Building portfolios that are resilient to climate change can often have real world impact as well.

The way that companies are impacted by climate change will largely be a function of where they operate, and/or from which location they derive most of their revenue. Portfolio adaptation seeks to identify the companies, sectors and countries that will be the least exposed to climate change – or that are already well adapted – and therefore that will need to adapt the least to succeed in a warmer world. Using sophisticated climate models, asset owners and managers can integrate portfolio adaptation by honing their security selection process towards investments that are more likely to thrive in future without the need for intensive adaptation to climate change.

At Man Numeric, one way in which we integrate portfolio adaptation, is by analysing physical risk.17 This concept is also integrated into MACCS, which takes the latest climate models and tracks and projects various climate perils well into the future until 2100, and at a very granular scale (approximately 10 square kilometres) around the globe. This allows us to assess the impact of climate perils on companies’ operations (via their facility locations and supply chains) and the effect of temperature rise on economic activity, thereby targeting portfolio adaptation alongside real-world decarbonisation.

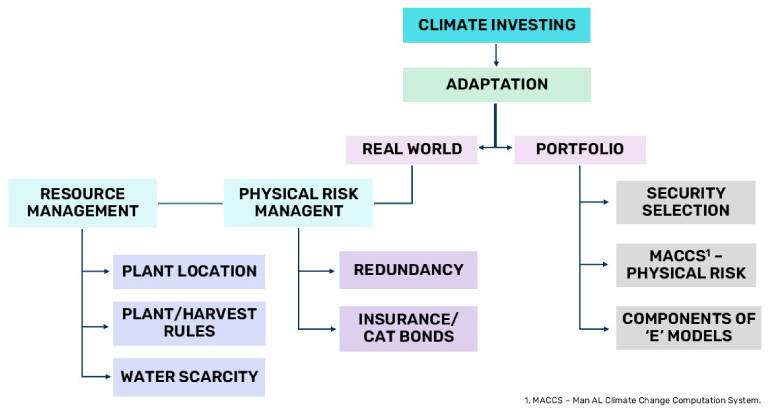

Real-world adaptation strategies

Figure 11. Real-world adaptation

Source: Schematic illustration.

Real-world adaptation is the identification of companies, sectors and countries that are actively seeking to change their exposure to the physical and resource risks of climate change. We believe that identifying ‘adaptation solutions’ such as companies that are involved in coastal defence, efficient food production and disaster management can have the biggest real-world impact.

Physical risk management refers to how adaptable an issuer is to the potential impact on it of event-driven or longer-term shifts in climate patterns. Resource risk management requires issuers to identify potential risks to the resources that they rely upon and take appropriate adaptive measures for the future (Figure 11).

We can illustrate real-world adaptation through water scarcity (Figure 11). In 2024, our in-house climate scientists conducted extensive analysis, the results of which support the hypothesis – among companies with facilities in water-stressed locations, higher water efficiency is associated with future upward earnings revisions. We have developed a long/short trading strategy, based on water intensity and geospatial water stress, and thereby advanced our real-world adaptation investment capabilities.

Before leaving real-world adaptation, we should sound one more note of caution. That is, we cannot rely solely on FIs to drive real-world adaptation. The IIGCC warns that, “the most impactful adaptation measures are likely to be public investments and reducing physical risks on natural or built environments within which economic activities take place for public benefit”.18 When it comes to adapting to the real-world impacts of climate change, state and government leadership is crucial.

The key role of engagement

To support cyclical progress in decarbonisation and adaptation, there should be a focus on adopting a multi-asset class strategy and implementing an engagement strategy (which also encompasses policy advocacy).

In our 2024 white paper on the Compass-FRWD framework19 we highlighted that, “[a]nother proactive attitude is to use the leverage of equity shareholder engagement or the covenant for fixed income to target a change in corporate behaviour toward the development of a credible and feasible plan to align with the 1.5 trajectory… active collaboration between FIs and these corporations becomes paramount to enhancing transition strategies.”20

While Compass-FRWD offers a framework for real-world decarbonisation, the comments on engagement, advocacy and collaboration apply as much to adaptation as to decarbonisation/transition.

Conclusion

As global temperatures rise, much higher levels of climate financing are needed to support real world decarbonisation and adaptation (not least to ensure that portfolios are insulated from the attendant risks).

At Man Group we have developed a broad climate framework that guides our approach to climate investing, which intentionally spans decarbonisation and adaptation as we seek to create climate investment solutions that encompass both approaches. We firmly believe in the need for more climate finance now, and in the need to expand the focus from decarbonisation to adaptation, and the impact from portfolio level to the real world.

To cope with the climate change that we are seeing needs the hard work of all players – FIs yes, but governments and state entities must lead the way. As FIs are further incentivised to invest in climate finance as a source of alpha in their portfolios, the current climate investment gap will close.

1. FIs include asset owners, asset managers, insurers, banks and other financing and underwriting counterparties. This paper focuses mainly on asset owners and managers.

2. The Paris Agreement is a legally binding international treaty on climate change, agreed in December 2015.

3. Following an analysis of six international datasets used by the World Meteorological Organization and with a margin of uncertainty of ±0.13°C.

4. Europe’s Copernicus observation agency.

5. The Climate Policy Initiative’s Global Landscape of Climate Finance 2024 report (Baysa Naran, Barbara Buchner, Matthew Price, Sean Stout, Maddy Taylor and Dennis Zabeida).

6. IIGCC’s ‘Working Towards a Climate Resilience Investment Framework’ discussion paper (September 2022): https://139838633.fs1.hubspotusercontent-eu1.net

7. For example, investing in a green utility company can have a real-world decarbonisation impact (given that company’s investment in renewable energy (such as wind or solar infrastructure)), as well as a portfolio decarbonisation impact given the company’s relatively low carbon emissions.

8. Emissions intensity is tons of carbon per million dollars of revenue for market indices and tons of carbon per unit of GDP for the global economy.

9. We can define a “climate solution” as an economic activity that contributes to emissions reductions required by a 1.5˚C pathway (adapted from: Institutional Investors Group on Climate Change, Climate Investment Roadmap).

10. https://rpc.cfainstitute.org/research/reports/case-study-carbon-budgeting-quant-managed-portfolios.

11. Avoided emissions - the reduction in GHG emissions achieved by choosing a particular investment or project over a more carbon-intensive alternative.

12. Avoided emissions intensity - the total avoided emissions per dollar value of any financial instrument.

13. See, for example, Imperial College Business School: https://www.imperial.ac.uk/business-school/ib-knowledge/finance-strategy-leadership/do-carbon-markets-work/

14. For more information on carbon market solutions, we refer interested readers to Man Institute: Carbon Markets: A Risk Assessment for Institutional Investors. https://www.man.com/maninstitute/carbon-markets-assessment-for-institut….

15. We refer to our recently published research (jointly conducted with the Columbia Center on Sustainable Investment), which offers a framework for real-world decarbonisation: https://www.man.com/maninstitute/climate-allocation-compass. We have also prepared an OMI Advisory Decarbonisation Primer on the Compass-FRWD framework and would be delighted to share this with you on request.

16. https://www.climatepolicyinitiative.org/the-topics/adaptation-and-resilience/.

17. Physical risk: Those firms whose operations are based in areas that will see either a significant increase in temperatures or a significant increase in extreme weather events will have to factor the cost of these increased risks into their business models.

18. IIGCC’s ‘Working Towards a Climate Resilience Investment Framework’ discussion paper (September 2022): https://139838633.fs1.hubspotusercontent-eu1.net/hubfs/139838633/Past resource uploads/IIGCC_Working-Towards-A-Climate-Resilience-Investment-Framework.pdf.

19. https://www.man.com/maninstitute/climate-allocation-compass

20. Network for Greening the Financial System, Connecting Transition Plans: Financial and non-financial firms.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.