What Inflation Matters Most?

When prices are spiking, it is sometimes hard to distinguish the signal from the noise. A short-term supply issue might spike the price of lumber, but may not be significant from an inflationary perspective. So which goods and services matter the most?

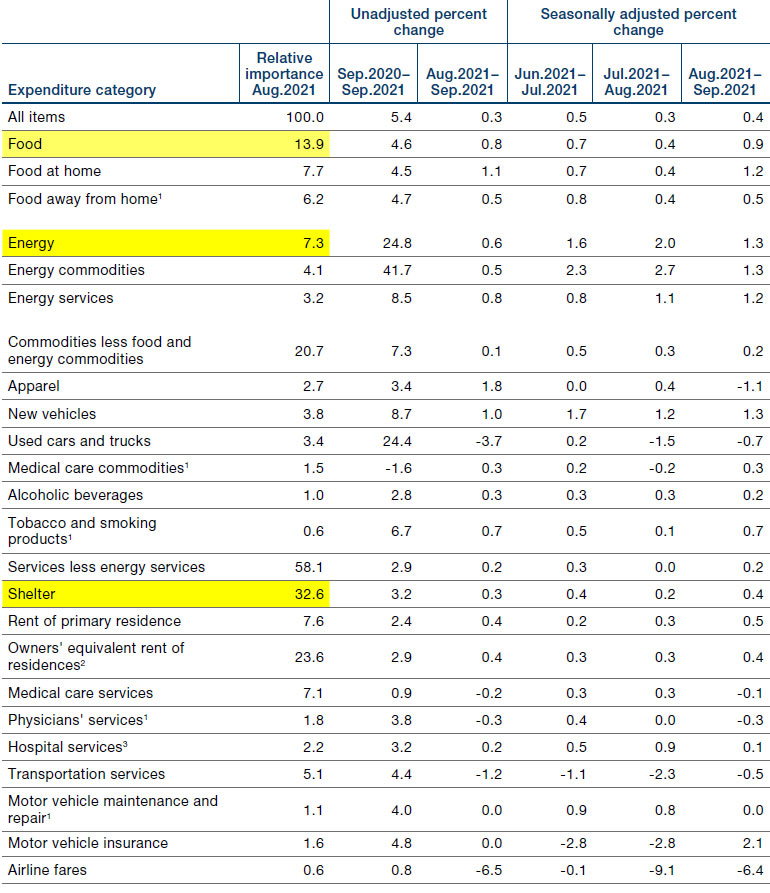

In our view, the best way to ascertain what inflation matters is to examine the weightings of the US CPI basket (Figure 1). The higher the weight, the more important the item will be when predicting the direction of future inflation.

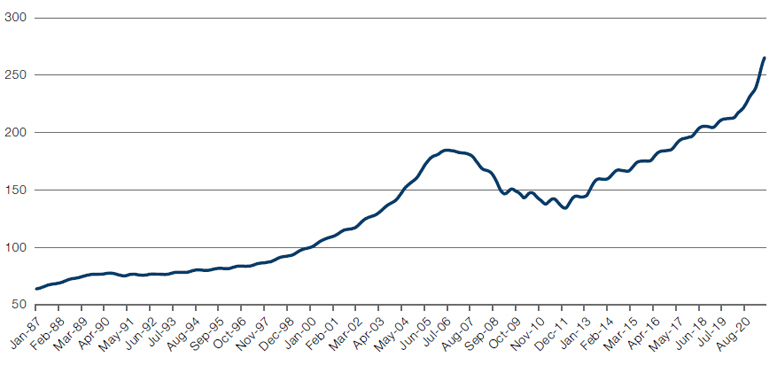

By far the biggest component of headline CPI, at 32.6%, is shelter. This in turn is comprised of rent and owners’ equivalent rent of residences – the amount of rent a homeowner would theoretically have to pay to rent a currently owned property. However, when we look at core CPI (which excludes food and energy), this figure rises to 41%. A number of deflationary factors have so far kept shelter in check, not least the pandemic – a federal moratorium on rental evictions was in place until September 2021 with state and local bans set to expire later this year. However, US property prices have spiked, with a 20% year-on-year rise in the Case-Shiller Housing index (Figure 2). This will not immediately filter through to the cost of shelter, but as housing demand starts to normalise, we are already seeing rents start to move. Owners’ equivalent rents rose 2.9% year-on-year and rent prices by 2.4%.

Inflation in other components may well fall back. Indeed, for used cars and trucks, it would be reasonable to expect a big fall next year as base effects take hold. However, for headline CPI, these items may well be dwarfed by shelter – and the picture for core CPI is even worse.

Figure 1. US CPI Weightings

Source: Bureau of Labor Statistics; as of September 2021.

Figure 2. Case- Shiller US National Home Price Index

Source: Federal Reserve Bank of St Louis; as of July 2021.

UK Rates Expectations

The Bank of England’s less-than-dovish analysis of soft economic data in September has caused something of a reaction. As is typical across developed markets when perceptions of monetary policy shift materially in favour of tightening, the yield curve has flattened sharply, implying that hikes will likely moderate long-term growth (Figure 3).

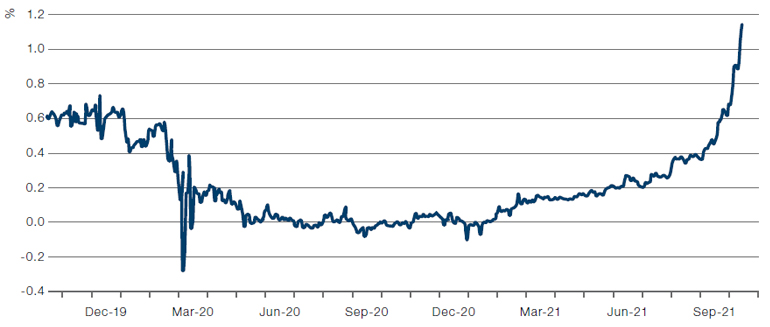

Likewise, rates expectations have re-priced sharply, with 1-year swap rates reaching 1.2% (Figure 4). On a rolling 1-month basis, this is a bigger move in UK rates expectations than seen during the taper tantrum in 2013.

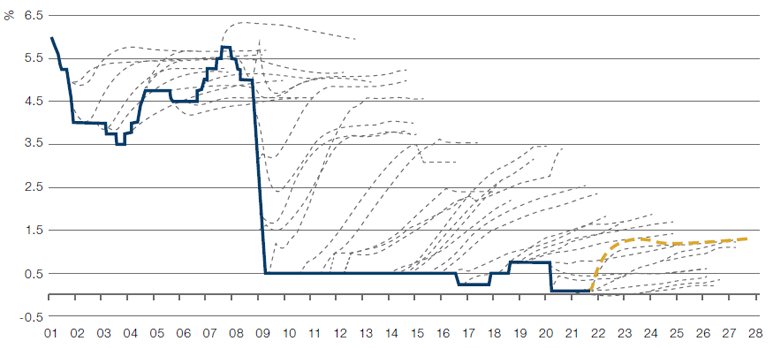

A full 1% in rate hikes is a lot to digest, particularly in the context of mounting headwinds for the UK economy – the end of furlough, the end of universal credit supplements, and the spike in energy prices. And it is worth reflecting that there is a long history of predicted rate hikes falling well short of expectations (Figure 5).

Figure 3. UK 2-Year 10-Year Yield Curve

Source: Bloomberg; as of 22 October 2021.

Figure 4. 1-Year UK Swap Rates

Source: Bloomberg; as of 22 October 2021.

Figure 5. UK Rates Predictions

Source: Deutsche Bank; as of 18 October 2021.

One for the Road…

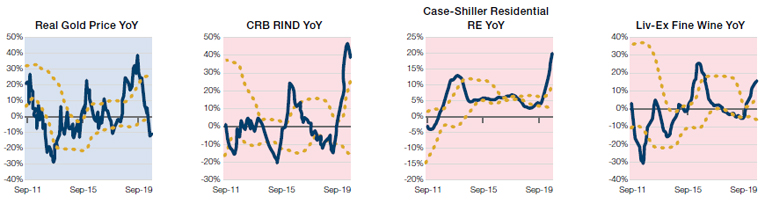

Over the past few months, we have written about the increasing prices of lumber, iron ore and coal. Indeed, a variety of real asset prices have spiked.

The CRB Rind index (which tracks a range of non-speculative commodities such as wool tops and rubber) is up around 35% year-on-year, and the Case-Shiller real estate index has risen 20% year-on-year.

Gold on the other hand, a traditional inflation hedge, has actually seen its real price decline – possibly due to the burgeoning reflation trade which has encouraged investors into risk assets rather than safe havens.

But even luxury assets aren’t immune. The price of fine wine has risen by 15% year on year. While this might not be enough to force fine wine drinkers onto the Lambrini, it just goes to show that the very few real assets are immune from an environment of rising prices.

Figure 6. Real Asset Price Action

Source: Bloomberg, Man Solutions; as of 7 October 2021.

With contributions from: Ed Cole (Man GLG, Managing Director – Discretionary Investments) and Henry Neville (Man Solutions – Analyst)

1. Not seasonally adjusted.

2. Indexes on a December 1982=100 base.

3. Indexes on a December 1996=100 base.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.