The Hiking Club

With central banks starting to discuss tapering, markets are looking beyond the end of this year, and starting to think about rate hikes.

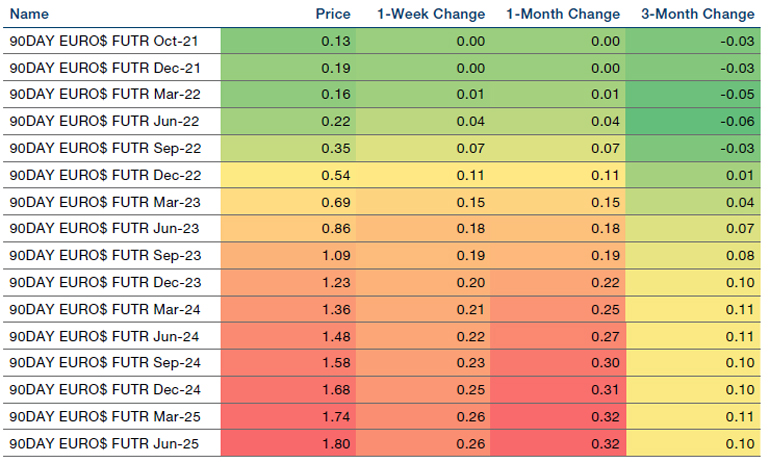

In response, we’ve seen the US yield curve steepen enough to fully reverse all of the flattening which had occurred earlier this year (Figure 1) out to 7-years tenor in just one week, before falling back. Eurodollar futures have moved similarly, implying the Federal Reserve’s first rate hike will come in the fourth quarter of 2022, with around two-thirds of a further rate hike priced in by March 2023 (Figure 2).

But it isn’t just the Fed which is expected to start hiking. Figure 3 shows that 2-year implied policy rates for almost every central bank anticipate a rise in interest rates, with the sole exception of Japan. Expectations are largest for emerging-market economies such as Brazil (465 basis points) and India (193 bps).

However, expectations of normalising rates means something of a reversal of normality for equities, with the steepening curve providing support for Value versus Growth. If we do see central banks join the hiking club, we can expect far more volatility in equities – and it won’t just be confined to the US.

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 1 October 2021.

Figure 2. Eurodollar Futures

Source: Bloomberg; as of 28 September 2021.

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 27 September 2021.

Coal’s Perfect Storm

Why have Newcastle coal futures recently gone vertical (Figure 4)? Well, it’s something of a perfect storm of a lack of supply and high demand.

On the supply front, Chinese domestic coal production has been constrained, both for environmental reasons and because of mining safety standards (Figure 5). Despite the release of 10 million tonnes of coal from national reserves in July, the lack of supply has resulted in planned power outages for businesses (and some consumers) in China, with more than half of provinces limiting energy use.

In addition, a hot, dry summer across much of China has reduced hydroelectric power production. With a Chinese ban on Australian coal still in place, non-Australian coal production is facing high levels of Chinese demand to replace the lost power. Likewise, rising gas prices have forced other nations to increase the use of coal in their energy mix, leaving them scrambling to secure supply.

This has implications for energy-sensitive sectors – power generators and metal producers have been impacted by power outages. But there is also a ripple through semi-conductor manufacturing and technology sectors. With no spare capacity in semis, the single-digit percentage share that Chinese fabricators have in the global supply of logic semis could have a disruptive impact if outages last. Price spikes in individual commodities are idiosyncratic, and may not necessarily last, but each spike can have a knock-on effect to other sectors – meaning that inflation starts spilling from one commodity to another.

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 1 October 2021.

Problems loading this infographic? - Please click here

Source: National Bureau of Statistics of China; as of 16 September 2021.

Pricing Power and Cyclicals

Despite a backdrop of price rises and concerns about the increasing cost of labour, managers remain very confident that they will be able to pass costs onto consumers. Indeed, this is nearly as confident as managers have ever been, according to Evercore.

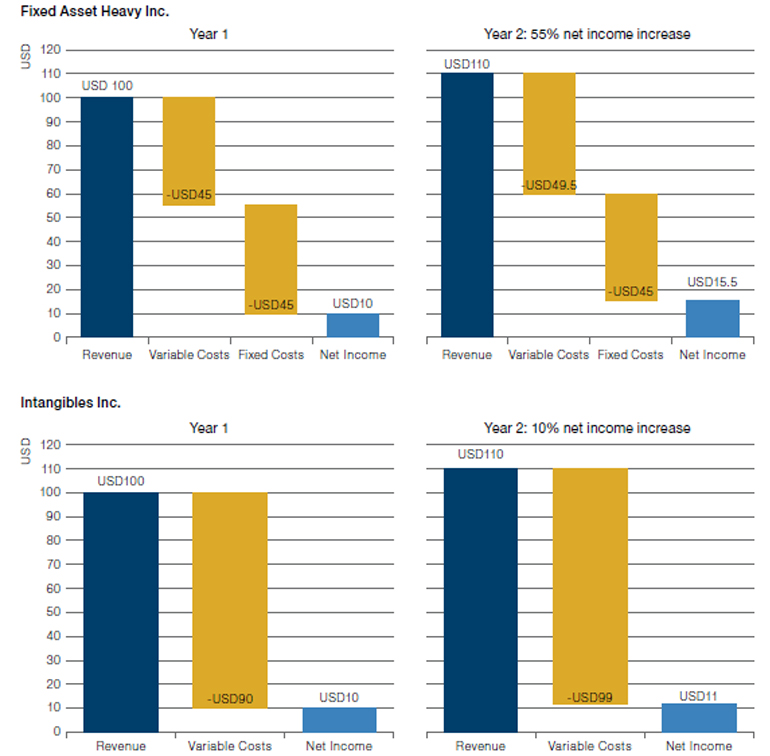

If this confidence persists, then it bodes well for businesses with a high level of fixed capital compared to intangible assets. All things being equal, firms with fixed capital have a higher percentage of fixed costs, via depreciation expenses which are relatively stable over time. Assuming that firms increase sales and variable costs in line with inflation, firms with a higher percentage of fixed costs are likely to see greater margin expansion than those with intangible assets, whose cost base is skewed more towards inflation sensitive line items like salaries. The schematic below demonstrates how this would work in practice (Figure 6).

Figure 6. Hypothetical Impact of 10% Inflation on Corporate Profits (Fixed Costs Versus Variable Costs)

Source: Man Group; as of 1 October 2021.

With contribution from: Ed Cole (Man GLG, Managing Director – Discretionary Investments)

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.