We believe headline US CPI peaked in June 2022 at 9.1%, and we expect it to fall by more than half at some point in 2023. That would still be double the Fed’s target, so not a comfortable place to be, but would satisfy our definition of “end of inflationary surge” as explained in our paper The Best Strategies for Inflationary Times. In that paper we studied the performance of 50 asset classes and strategies over 100 years in inflationary regimes.

Thus, we can make two observations.

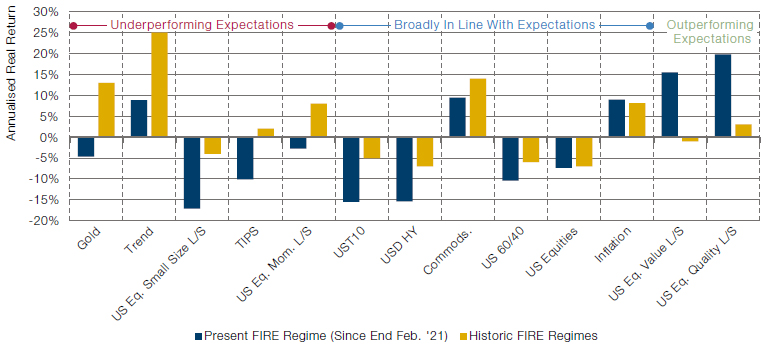

First, we can observe that performance in this inflationary surge was highly typical, especially for the main asset classes and strategies (Figure 1). Equities and bonds went down, commodities and Trend up – all moves were in line with the direction of the averages in past such regimes and, in the case of equities, with almost identical magnitude. Yes, there were some strong outliers – gold priced in US dollars was down not up, and equity Value long/short and equity Quality long/short were much better than usual – but overall the historical performance for inflationary surges was a good guide.

Figure 1. Real Annualised Returns in Current FIRE Episode (Feb 2021-Jun 2022), Versus Historic FIRE Performance

Source: Man Solutions, Bloomberg, NBER. As of 31 October 2022.

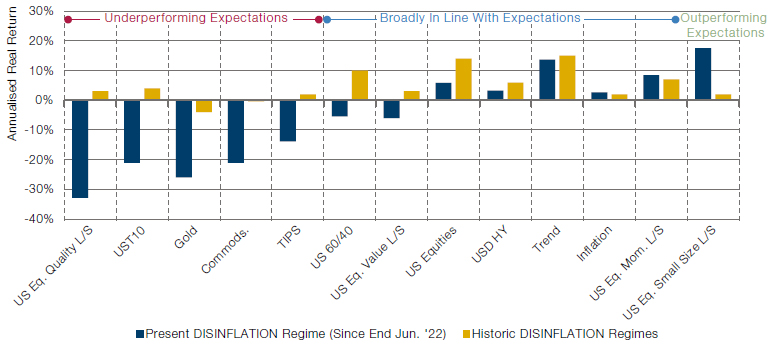

Second, we can measure performance four months into the current nascent “Disinflation” period and see where the outliers are (Figure 2). So far, equities, high yield, Trend, and equity Momentum long/short are nicely up, annualised, in line with historical such periods. The large outliers are those strategies that are down a lot since June and should recover in price if the past remains a good guide. This includes Treasuries and TIPS, gold (again, as in the latest inflationary period) and commodities, and 60/40 equity/bond portfolios.

Figure 2. Real Annualised Returns in Current DISINFLATION Episode, Versus Historic DISINFLATION Performance

Source: Man Solutions, Bloomberg, NBER. As of 31 October 2022.

So, is the answer that we should buy duration while central banks are still tightening through rates and quantitative tightening (‘QT’), and buy commodities ahead of a big downturn? These represent two uncomfortable conclusions. But comfortable investing does not lead to success. And there are multiple ways in which this would be the right strategy, including if indeed we are near maximum hawkishness in developed markets (‘DM’), and if indeed China moves away from zero covid policies in H1 2023. It is worth noting that neither of these ‘pivots’ need be accompanied by drums and yells, to quote Wilfred Owen. Policymakers may, instead, ‘creep back, silent, to still village wells / Up half-known roads’. In any case, we prefer to have the historical odds on our side.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.