1. Introduction

We have seen alpha-focused hedge funds deliver diversifying returns.

Following two consecutive quarters that proved difficult for many assets, we believe the macro outlook still remains challenging. We are cautious about taking directional risks, especially as we enter the summer months that could see a further deterioration in market liquidity (and possibly even higher volatility if there is a dislocation). We expect this uncertainty to continue into the second half of 2022. A roll over of inflation is possible, but further cross-asset-class volatility until markets find a new equilibrium is also likely.

Against this volatile background we have seen alpha-focused hedge funds deliver diversifying returns on both an absolute and relative basis, particularly those that can react to the changing macro outlook (Figure 1).

On this basis we have confidence that our favoured strategies – including macro quantitative, volatility and convertible arbitrage as well as global macro, as detailed below – have the potential to deliver results for investors in the third quarter.

We will also look for opportunistic investments that volatility may create.

Figure 1: Hedge Fund Returns by Strategy

Problems loading this infographic? - Please click here

Source: Man Group database of hedge funds; as of 31 May 2022.

2. Our Outlook

2.1 Current Outlook

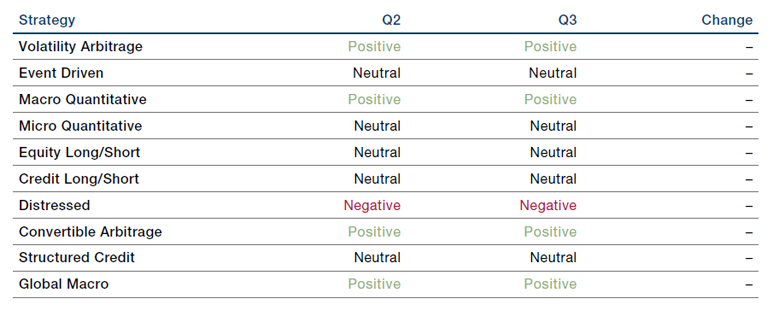

Figure 2 shows our stance on different hedge-fund strategies for the third quarter. As explained above, we have made no significant changes from the previous quarter.

Figure 2: Q3 Outlook Versus Q2 Outlook

2.2 New and Notable

The institutionalisation of the cryptocurrency space continues to progress rapidly.

Despite the high-profile issues surrounding many digital assets, we believe the institutionalisation of the cryptocurrency space continues to progress rapidly.1 Investors do not need to have a conviction on the long-term fundamental viability of any individual cryptocurrency; they can simply recognise that this market is sufficiently liquid and volatile to generate diversified returns for systematic strategies in particular. The challenge is finding the right managers and the assessment of investment and operational risks. We have been researching this space extensively over multiple quarters and, while realistically we don’t expect to invest in the next three months, we aim to identify a suitable manager in the near future.

3. The Details

3.1. Relative Value Strategies

We have a positive view of volatility arbitrage, with a net long vol bias. The volatility of most asset classes is currently elevated, and the macroeconomic uncertainty could lead to sustained or even higher volatility regimes.

Last quarter, we downgraded our outlook for event-driven strategies to neutral as a result of various indicators and a deterioration in the opportunity set, as elaborated here. We maintain this neutral outlook on the event-driven opportunity set despite acknowledging some positive developments:

- Spreads have systematically widened from earlier in the year

- There is a robust corporate-events pipeline (spin-offs, divestments, buyouts, etc)

- Managers generally have dry powder and are able to add exposure to opportunities quickly

Set against this, there is some increased fragility:

- Spreads could be volatile, in part due to large, highly levered multi-PM platforms in this space de-risking when market volatility increases

- There is an increasing share of private equity and LBO deals, which are more sensitive to financial conditions than strategic buyers

- The global antitrust environment remains challenging to navigate, albeit this is a known risk factor

Where we do consider event-driven strategies, our preference is for merger arbitrage. M&A activity remains very strong, particularly in the US but is picking up in the EU after slowing down in the wake of Russia’s invasion of Ukraine. Merger arbitrage is also an attractive short-duration strategy, able to incorporate higher rates into spreads. Soft catalyst event-driven trades can exhibit high downside beta in volatile markets and timing can be uncertain.

- In other areas of arbitrage, we remain cautious: China-focused arbitrage strategies are still vulnerable to dislocations (for example, China A vs H trading) but there is a large universe of China ADRs under pressure to de- and relist in the medium term, generating corporate events.2

- Global index arbitrage appears challenged in the volatile environment, as rebalance trades can dislocate, and the strategy remains crowded.

3.2. Quantitative Strategies

In macro quantitative strategies, we believe three areas have significant potential and drive our ongoing positive outlook:

- Quant Macro & Trend: These strategies benefit from the current environment, being able to short rates and equities and go long commodities. We continue to like this positioning for our portfolios, as well as their ability to manage risk should the market environment change.

- Commodities: We expect volatility from supply challenges will drive opportunities in commodity trading (especially during the European winter). We favour a combination of trend and machine-learning based approaches to extract alpha from this space.

- Digital Assets: We are seeking opportunities in the space, but given the risks associated with investing will tread carefully.

In micro quantitative strategies, opportunities have improved but not by enough to cause us to change our overall neutral sentiment. The main points are:

Approaches that marry the benefits of human and machine can offer more depth as well as breadth.

- Quant Equity: Positive returns to Value metrics have been driving returns. We believe that exposure to this strategy is an important component of our portfolios. However, we don’t want to pay hedge-fund fees for most applications and take this exposure via our inhouse Alternative Risk Premia strategy.

- Quant Credit: Higher dispersion in credit spreads has been a positive driver for returns. This is supportive for the core thesis behind this strategy and is encouraging. Systematic credit strategies are differentiated from fundamental managers as they tend to be more diversified, run higher leverage and have a bias towards investment grade (which we don’t tend to hold in our discretionary credit funds). We are happy with our exposure but will continue to monitor future developments.

- New Launches: There are some interesting new launches expected over the next 6-12 months, mainly from platforms and proprietary firms. It is also worth mentioning that we continue to see a growing focus on the concept of limits to diversification in micro-quant. Approaches that marry the benefits of human and machine can offer more depth as well as breadth, a theme we expect to grow in importance.

3.3. Equity Long/Short

Our outlook on equity long/short (ELS) remains neutral, although we feel that many headlines have painted a more pessimistic picture for fundamental ELS managers than is warranted. Indeed, given lower exposures in ELS funds, we expect managers to increasingly provide downside protection, albeit with more limited upside participation.

Despite having this ample dry powder to take advantage of lower equity valuations, we expect increased risk taking in ELS to be a gradual process as macro uncertainty remains high. With entire markets trading at similar valuations, we caution against taking concentrated bets in recent equity dislocations – unless there is appetite to act more directionally.

We had been critical of the increasing allocation to private investments in ELS funds before the correction in the first half of the year. We remain advocates of more liquid investment styles in the face of the challenges to ‘hybrid’ funds or those that invest across both public and private equity markets. Portfolios of illiquid funds have become increasingly illiquid, which limits these funds’ ability to allocate to liquid opportunities and concentrates managers’ time and resources on illiquids.

Within ELS, we believe that there is a more attractive opportunity in tactical managers with short-term, trading-oriented styles. While there has been dispersion at the security level, it often needs to be captured quickly as macro stories (inflation expectations, rate hikes, and geopolitics among others) continue to overwhelm investors.

3.4. Credit

Our outlook for corporate credit managers remains unchanged over the past quarter, as we retain our neutral view on credit long/short and negative view on distressed managers.

Credit spreads have widened year to date from their post-2008 lows, and market dispersion has picked up. If sustained, this should lead to a better opportunity set in the coming months. However, with spreads still around historical median levels and ongoing macro uncertainty, we do not see a substantially improved opportunity in credit long/short and remain neutral on the space. Where we do invest, we favour credit long/short managers with a focus on idiosyncratic credit selection.

Distressed supply has increased, but broad distress metrics still remain low by historical standards, so we retain a negative view on distressed strategies.

We remain favourable on convertibles. The opportunity set has transitioned from equity/volatility-sensitive convertible arbitrage oriented positions to more credit/capital-structure arbitrage oriented trades, driven by a dramatic selloff in growth and tech equities (and convertible bonds) and meaningfully wider credit spreads. As a result, there has been a meaningful pickup in ‘busted’ convertible bonds (~15% of global convertible bonds traded at less than 80 cents on the dollar, according to BAML Research as of May 2022). Higher interest rates and outflows from outright convertible-bond mutual funds have also put pressure on the secondary market.

In our view, this creates an opportunity set for idiosyncratic credit selection as opposed to broad-based market cheapness. Many issuers still have significant enterprise values, with convertible bonds as their only debt and are potentially in net cash positions, while there is potential upside from events such as recapitalisations, refinancing, exchanges and takeovers.

In structured credit, ongoing repricing across securitised products and higher rates (for floating-rate securities) have led to higher loss-adjusted yields and steeper credit curves. In the near term, we expect a continuation of positive residential/housing and consumer fundamentals given low delinquency/forbearance/foreclosure rates and low home inventories. Consumer balance sheets also remain strong, with low levels of leverage and debt service.

While we look to add risk opportunistically, there is no change in our overall balanced outlook.

However, the elevated macroeconomic uncertainty could potentially result in further downside for risk assets and yet wider credit spreads. We therefore believe it is prudent to wait and see how inflation and the Fed outlook evolve over the coming months. Hence, while we look to add risk opportunistically, there is no change in our overall balanced outlook.

Within the structured credit space, certain sectors look attractive. These include CLOs, where we see wider spreads for junior tranches (following the recent selloff in leveraged loans, while corporate margins are expected to be under pressure and default expectations are increasing). High-quality CLO BBs trade at attractive high-single to low-double-digit yields to maturity; significant defaults would be needed for principal impairment.

3.5. Global Macro

We are positive on discretionary macro, preferring managers that are trading-oriented and operate within a liquid and cross-asset-class mandate across regions. We are seeing macro themes broaden to new regions, more recently Europe where macro managers have started to shift to as the primary expression of monetary-tightening themes. We have seen profit taking from short US duration positions and risk being allocated to Europe as the ECB has signalled a hawkish shift is looming. Emerging markets also look attractive, given policy divergence, US dollar strength, the commodity rally, and inflation. We are seeing better relative-value opportunities between countries due to different economic activity and policy dynamics across regions.

1. For more, see Man Group’s recent paper An Investor’s Guide to Crypto.

2. For more, see Offshore, But Not Off the Regulatory Radar

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.