Introduction

The first quarter was challenging for traditional portfolios as both equities and bonds were down. We expect further periods of market volatility in the coming months, driven by global monetary policy adjustments and prospects for ongoing geopolitical tensions.

Indeed, the geopolitical situation is more dangerous than many of us can remember, while markets are dealing with inflation not seen in at least 40 years. We believe investors should carefully navigate this environment with portfolios that emphasize simplicity over complexity; and liquidity that allows portfolios to adjust to risks quickly.

Despite the challenging overall market outlook, we see attractive investment opportunities in the following hedge fund strategies:

- Quantitative strategies: We have high conviction in trend following and quantitative commodity strategies, which are well-positioned to benefit from more volatility and further rises in both interest rates and commodity prices. We also like Alternative Risk Premia (‘ARP’) as a diversifying portfolio tool;

- Convertible arbitrage: Market volatility should enable a portfolio of hedged convertible bonds to perform well, in our view, barring a meaningful pickup in systemic risk;

- Global macro: We like managers that can rotate across asset classes and lean on their trading expertise to capitalise on market reactions to new economic or political developments.

We have downgraded our outlook for event-driven managers. In our experience, an aggressive market selloff, which can cause a run for liquidity, typically generates losses for event-driven trades – even those with hard catalysts.

Hedge Fund Outlook

We have a positive outlook on quantitative strategies, which can capture macro trends, especially in commodities and bonds. Ongoing evolution in this space continues to be exciting, particularly in niche areas such as Chinese markets and digital currencies.

Our view on equity long-short remains neutral. We are focused on global markets that have the potential to be under-researched compared to the US. The marginal improvements that we see for corporate credit managers do not yet warrant an upgrade from neutral. Convertible arbitrage remains an area that we favour in a highly volatile environment like the one we are in.

Within relative value, we are now more cautious on event-driven managers given the risk of downside beta in stress periods.

Finally, we are positive on global macro, which is somewhat of a consensus view amongst investors that makes accessing quality capacity at the right terms more challenging.

Quantitative Strategies

We are optimistic on macro quantitative strategies as they can exploit opportunities the inflationary economic trend has offered.

We are optimistic on macro quantitative strategies as they can exploit opportunities the inflationary economic trend has offered. The micro quantitative space is less exciting to us – while dispersion is a positive, ‘over-trawling’1 is a concern. We are confident that innovation in the space has the potential to lead to higher conviction in the future. We also have a positive view on ARP given its valuable diversification benefits.

Digital assets have become a focus, carving out enormous opportunities for both discretionary and quantitative managers in this space. Within quant, we anticipate the macro quantitative space will adopt this asset class due to lower operational hurdles for trading mainstream digital assets via listed futures.

Macro Quantitative Strategies

Inflation, tight supply and volatility in commodities are driving the opportunity set for macro quantitative strategies.

With the backdrop of the EU gas shortage and the various subsequent drivers of demand for oil, the current environment has exacerbated the favourable skew properties inherent in commodities and helped the opportunity for nimble and well risk-managed quant commodity managers to perform well. Both the upward spikes in commodity prices and the current high, ambient level of commodity volatility have been beneficial. Likewise, general liquidity has remained high.

This has expanded capacity in what was always typically a tight space, aiding portfolio construction, increasing capital efficiency and reducing costs of transactions.

Beyond commodities, the likely persistency of inflation causes us to be more confident about classic trend and quantitative macro. These quant managers are now predominantly long commodities, short bonds and flat equities and as such, offer risk management from further inflation.

Otherwise, in macro quantitative strategies, there are two niche areas which we believe have significant potential:

- Chinese commodity futures: Notwithstanding the positive commodity trend discussed above, commodities futures traded in China are interesting due to their diversifying nature and strong momentum. We anticipate that investment barriers will be reduced later this year, which would allow offshore hedge funds to invest directly on exchanges through Qualified Foreign Institutional Investor (‘QFII’) programmes;

- Digital assets: The institutionalisation of the crypto currency space has been rapidly progressing, leading us to believe that this will become an exciting new opportunity.

Micro Quantitative Strategies

Our neutral outlook on micro quantitative strategies is unchanged. While the current environment of equity dispersion is supportive for machine learning funds, challenges (such as crowding) remain in place for traditional statistical arbitrage approaches. Additionally, the strategy is exposed to unwinds that stresses in cross-sectional stock correlations could trigger.

However, on a more positive note, we continue to monitor interesting developments that may result in promising investment opportunities in the future; specifically, strategies that enhance their systematic trading programmes with discretionary skills – a sensible departure from the belief that quantitative models work over the long run and therefore are not to be interfered.

As we wrote last quarter, systematic Chinese stock exposure has continued to be a focus for us.

Equity Long-Short Strategies

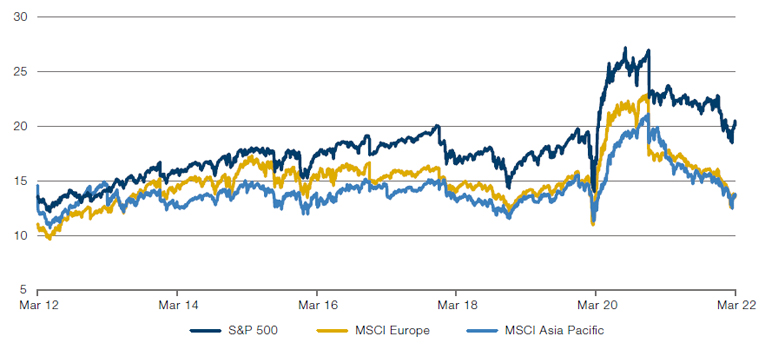

We maintain a neutral view on equity long-short and have a bias towards trading-oriented, diversified and liquid managers. Additionally, we believe that there is a greater opportunity with managers focused on a global perspective given the effects of crowding in the US, the relative undervaluation of equities outside the US (Figure 1), and under-researched nature of equities in many of these markets.

Figure 1. Forward 12-Month P/E Ratios: S&P 500, MSCI Europe and MSCI Asia Pacific Indices

Source: Bloomberg; as of March 2022.

We have a strong conviction today that low net managers will be better-placed to both take advantage of short opportunities and benefit from hedges.

Given our concerns about continued volatility, we believe that short equity exposure will provide value to portfolios. While we have never preferred long-biased or beta-heavy managers, we have a strong conviction today that low net managers will be better-placed to both take advantage of short opportunities and benefit from hedges. Similarly, managers that actively manage their overall net and gross exposures or have a holistic macro element to their research process should be better poised to navigate a market environment in which macro factors trump the fundamentals.

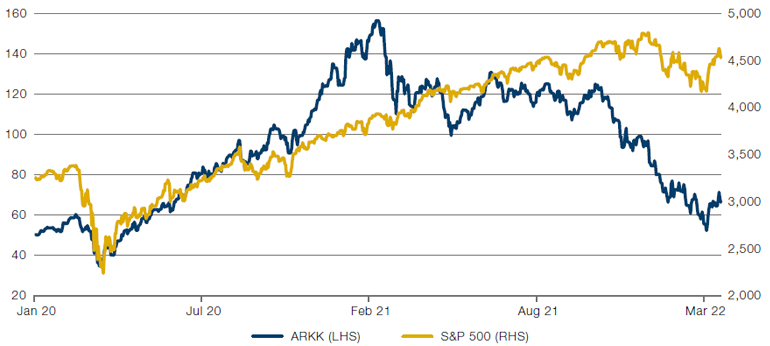

There has been a very sharp correction in long-duration Growth assets over the past several months (Figure 2), which some market participants view as a buying opportunity. However, given the macro backdrop of rising interest rates and increasing inflation, we believe that Value-oriented or more balanced portfolios are poised to outperform in the short to medium term.

Figure 2. ARKK Versus S&P 500 Index

Source: Bloomberg; as of March 2022.

Ark Innovation ETF (‘ARKK’) used to represent Growth assets. The organisations and/or financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

Something that has been on our radar since last year is an increase in hedge fund participation in the private markets – generally in late stage, pre-IPO equity. We believe it is prudent to avoid these ‘hybrid’ strategies and focus on more liquid strategies for now for two reasons. First, more liquid managers can pivot their portfolios easier in volatile periods or sharp dislocations, whereas those with private allocations may be restricted in their access to capital. Second, much of this ‘crossover’ in equity assets can be seen in higher-Growth funds i.e., technology sector specialists.

As has been seen in high-growth public equities, rising rates may continue to temper multiple expansion, a potential headwind to private equity valuations which will eventually need to reflect market conditions. Where managers are not adequately resourced, there may be a risk of distraction from the inclusion of an additional asset class. Our conclusion is that this exposure is best left to private equity and venture capital to manage.

Credit Strategies

Balancing current risk/reward leaves us with a continued neutral outlook on credit long-short managers and a negative outlook on distressed.

In our view, the opportunity set for corporate credit managers has improved on the margin since our last update. However, balancing current risk/reward leaves us with a continued neutral outlook on credit long-short managers and a negative outlook on distressed.

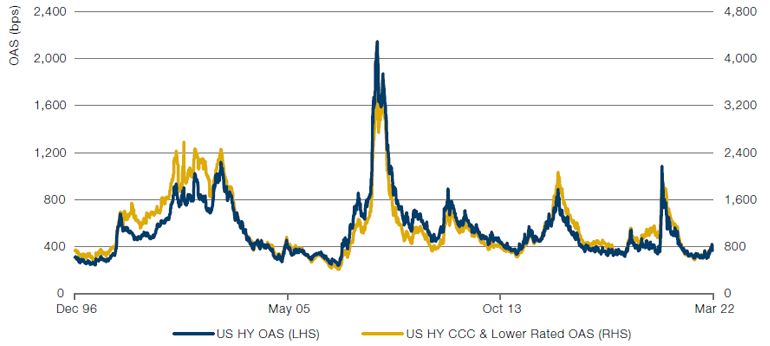

US high yield (‘HY’) spreads have widened by about 60 basis points (Figure 3), while the lower-rated CCCs have widened c. 90bps. However, as it has been the case over the past few quarters, credit spreads remain fairly compressed compared to historical standards. US HY trading inside of 400bps is c. 100bps tighter versus historical median levels. Similarly, spreads for CCCs inside of 800bps are c. 200bps tighter, leaving little room for further significant spread tightening and contributing to our continued unfavourable view on meaningful outright credit risk, especially lower-rated credit exposure.

Figure 3. US High Yield, CCC and Lower-Rated Spreads

Source: Bloomberg; as of March 2022.

Given the current uncertain geopolitical and macroeconomic backdrop, credit longshort managers are generally defensively positioned with a focus on idiosyncratic, catalyst-driven opportunities. These managers should be in a good position to take advantage of any market weakness, but more muted returns are expected in a benign market environment.

Some emerging areas of potential opportunities include:

- Tactical, trading-oriented positions in (long-duration) investment grade cash bonds that have seen meaningful declines due to the selloff in interest rates;

- Financial preferreds and hybrids, particularly fixed-rate preferreds that have been impacted by rising rates as well as wider credit spreads;

- Busted convertible bonds (see the section on convertible arbitrage below);

- Sovereigns and corporates that have been impacted by direct or indirect exposure to the Russia/Ukraine conflict and resulting sanctions; and

- Shorts in credits that are expected to be adversely impacted by sustained high inflation.

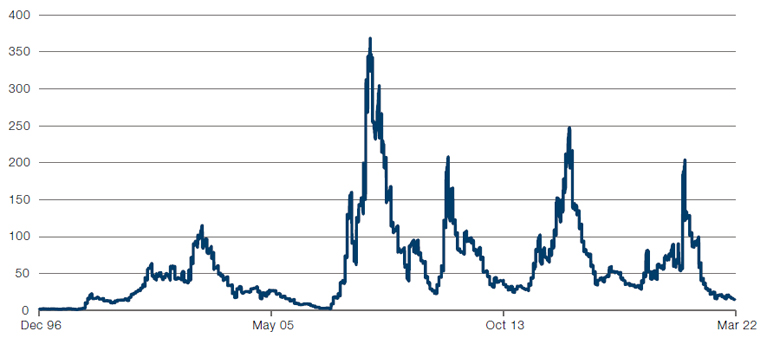

Recent market volatility has resulted in a significant slowdown in the pace of US HY issuance, but other credit indicators and fundamentals remain stable. There has been a reasonably good pace of upgrades this year – credit dispersion has been increasing but remains low, and relatively low levels of outstanding distressed/defaulted paper persist (Figure 4). Indeed, the par-weighted US HY default rate, including distressed exchanges, was at a record low of 0.32% at the end of February.2 We retain our negative view on distressed as we do not yet see tangible signs of a sustainable pickup in the pipeline of bankruptcy/restructuring opportunities.

Figure 4. US HY Bonds Trading More Than 1,000 Basis Points

Source: Bloomberg; as of March 2022.

We remain favourable on the opportunity set for convertible arbitrage managers over the medium term. Broad markets have cheapened over the past quarter and credit spreads have widened due to the sell-off in growth/tech names and retail outflows.3

There has also been a meaningful slowdown in primary issuance due to increased market volatility and uncertainty. This should lead to more investor friendly terms when the markets open and, in the meantime, be supportive of the secondary market, which has experienced significant expansion over the past two years. There is a healthy and diversified outstanding global universe of convertible bonds, which should present managers with ample idiosyncratic opportunities.

Convertible arbitrage managers held up reasonably well in the first quarter despite the market cheapening as managers were able to monetise volatility and take advantage of gamma trading opportunities. As we expect a heightened volatility regime to continue, we believe that a portfolio of hedged, low-duration, volatility-sensitive and good credit quality convertible bonds should perform well. The first-quarter selloff in underlying equities has also resulted in an increased number of convertible bonds trading below par, presenting managers with yield-oriented and credit-sensitive opportunities. A meaningful pick-up in systemic risk that leads to cheaper valuations remains a potential near-term headwind, which we would view as an opportunity to add risk.

There is no change in our balanced outlook for structured credit managers. Credit spreads across securitised product sectors, particularly for higher beta credit risk transfer (‘CRT’), collaterised loan obligations (‘CLOs’) and commercial mortgage-backed securities (‘CMBS’), have widened in sympathy with corporate credit. Spreads across most sectors generally remain at the lower end of historical ranges. The fundamental backdrop for US housing, despite the recent increase in mortgage rates (which are still relatively low on an absolute basis), remains positive given the lack of supply and favourable demographics. The US consumer, who has been a beneficiary of wage inflation, maintains low leverage and has reduced debt service since the onset of the pandemic. However, the positive credit fundamentals are largely reflected in the pricing of securities, with less room for further significant spread compression. A further meaningful backup in interest rates, hawkish Fed policy surprises, flows out of fixed income given the volatility in rates markets or a new Covid variant could also be potential headwinds in the near- to medium-term, which is why our forward-looking return expectations are more modest.

Relative Value Strategies

We have downgraded our outlook for event-driven strategies to neutral.

We have downgraded our outlook for event-driven strategies to neutral as a result of various indicators and a deterioration in the opportunity set:

- While M&A deal activity remains healthy, levels have reduced from 2021;

- There are various headwinds to contend with, such as US antitrust interventions, which are damping traditionally large transactions in technology and health care;

- In Europe, the Russia-Ukraine war and related supply shocks have triggered uncertainty around consumer demand, leading to a risk-off sentiment and a pause in new transactions;

- One of the most important leading indicators for corporate activity in general is corporate confidence, and while confidence indices and surveys indicated a strong desire for business initiatives earlier in the year, this has since cooled;

- Higher market volatility has increased the risks of softer catalyst trades, as the downside in scenarios where the catalyst fails or is materially delayed can be more severe;

- Merger spreads have widened considerably, reflecting these complexities since the beginning of the year to levels last seen in May 2020.

However, there are also positive drivers – hence our overall neutral outlook. For example, one could argue that the wider spreads reflect the higher risk to some extent. Further, M&A activity could benefit from pressures on corporates to actively address challenges around themes like ESG, post-Covid reopening and supply chain deficits through corporate deals.

Other relative-value strategies, like index or share class arbitrage, have similarly seen shifts in risk-reward, as more volatile markets and more extreme sector rotations are harder to trade. Capital structure arbitrage is well-placed to benefit from dislocations between equity and credit markets, which may result from inefficiencies in evaluating and trading more complex situations by market participants with more insular perspectives.

In mainland China and Hong Kong, the opportunity set around the evolving the American Depository Receipts (‘ADR’) market is likely to be sustainable, as pressure to delist from the US and relist in Hong Kong or mainland China results in material changes to shareholder compositions, minority buyouts, new security issuance, and related dual listing arbitrage. All else equal, A-H spreads should widen as the supply of public equity grows, particularly in Hong Kong. Event managers in Asia are also closely monitoring policy rhetoric, and we believe there is potential for accommodative actions to generate catalysts.

We are positive on volatility arbitrage, as shifts in volatility regimes across asset classes and regions should enable specialised investment managers to generate positive and uncorrelated returns in most elevated and/or fast-moving volatility environments. Flexibility to trade different asset classes adds value, as these can strongly interact, but also offer idiosyncratic opportunities. Volatility arbitrage as a strategy generally benefits from market dislocations and associated imbalances in volatility pricing. Currently, there are many such potential scenarios, e.g., geopolitics or central bank policy errors.

Global Macro Strategies

We are positive on discretionary macro strategies and expect managers to continue their recent run of improved performance.

We are positive on discretionary macro strategies and expect managers to continue their recent run of improved performance, especially those that can rotate across asset classes and lean on their trading expertise in a volatile and uncertain market environment. We also view access to expertise on emerging markets (‘EM’) favourably, where geopolitical uncertainty and developed-market policy tightening could offer attractive opportunities. Key macro themes around policy divergence, inflation and commodities have broadened out to new regions and expanded the opportunity set.

After some less-than-reassuring comments from policymakers, markets eventually got clarity during March that geopolitics would not derail hiking intentions. Since then, anticipating central banks’ reaction functions has been the primary focus for managers, with funds ratcheting up bets on the degree of policy tightening expected this year. However, stagflation risk puts central banks in a difficult situation as they embark on the task of engineering a soft landing in their economies – now materially harder given the complexities that sanctions and de-globalisation pose to the global growth outlook.

In the US, we see the focus being on the pace of rate hikes and the end of the cycle. Following the significant front-end repricing we’ve seen so far this year, the question whether this time is different or not is causing increased divergence among macro managers’ thinking. Recent comments and projections from FOMC officials have stoked expectations for policy rates to reach ‘restrictive’ territory during this cycle, and the quantity of hikes priced for the remainder of the year infers larger increases than the 25bps to which the market is accustomed.

Some managers point to the recessionary risks that recent curve inversions signalled and have little faith in the economy’s ability to handle the level of tightening currently priced. This is buoying profit-taking in front-end shorts and the addition of longs further out on the Eurodollar curve, with the belief that the market is too hawkish and the Federal Reserve will reserve some optionality later in the year. The other cohort sees plenty of room left for current front-end shorts to generate further profits and is scouring areas of the curve where cuts are implied for further shorting opportunities. We have seen a handful of managers position for terminal rates to rise above ‘neutral’, prior to recent forward guidance, expecting the Fed to do ‘whatever it takes’ to bring inflation down towards target and ultimately restore some credibility they perhaps lost by deeming inflation as ‘transitory’. Support for this argument is likely to remain as long as inflation risks are skewed to the upside and growth kickers (such as a tight labour market and healthy corporate sector balance sheets) encourage optimism that a soft landing is possible.

The policy pivot theme is back on in Europe as the European Central Bank, during its March meeting, signalled more focus on price stability than the potential downside impact to growth from the war. The macro sector had reduced European exposure on fears the war would slow down rate hikes. Even so, we are seeing shorts in Euribor futures and the German yield curve – around the 2- and 5-year points, alongside peripheral spread wideners – being restored as managers position for near-term tightening in the Eurozone. However, the effects of the conflict are dragging on the growth outlook – the path the ECB chooses to take if and/or when the policy rate turns positive remains highly uncertain.

With Russia being a significant commodity producer, the war related sanctions have given fresh impetus to the extraordinary rallies we have seen multi-asset managers capitalise on. Aside from outright expressions that benefit from continued commodity tightness, new themes are forming based around the reliance of commodity imports. Managers have taken a bearish stance on currencies that rely on Russian energy (such as the Japanese yen), though they are more optimistic about the near-term prospects for countries that are large commodity producers (such as the Brazilian real and New Zealand dollar).

Brazil may become a popular place to add long duration over the coming months.

Short positions in emerging-market rates where central banks have been ahead of the curve (and ahead of the Fed) have produced strong results over the past year. Longer-term themes for EM-focused managers are easing inflation and a turn in forward guidance. However, the conflict in Ukraine has delayed the normalisation of inflationary pressures in many regions. Therefore, we expect managers to remain short while they narrow their focus to net commodity exporting countries where positive real yield buffers are anticipated. In line with this, Brazil may become a popular place to add long duration over the coming months, after the Central Bank of Brazil chief’s signal that monetary tightening could end in the second quarter.

1. We use this term to describe the notion that there are many groups fishing for similar alpha in the same waters – which hampers returns. It is slightly different than the term ‘crowding’, which is more of a risk factor suggestive of similar positions held at any point in time.

2. Source: JPMorgan

3. Source: Bank of America Merrill Lynch; February 2022.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.