Introduction

Hedge funds generated positive performance in 2021. However, following a strong year for alpha in 2020, results for the industry were somewhat underwhelming, especially given the strong equity market backdrop. The main disappointment was the discretionary equity long-short strategy. While many allocators had a very bullish outlook for the strategy1, we had a neutral view. Instead, we were much more positive on strategies that capture traditional and alternative risk premia in a disciplined, risk-managed way.

Markets faced several challenges last year – despite the positive headline returns for equity indices. To name a few: bond markets sold off violently in the first quarter of 2021 and again in September and October; equity style factor volatility was high; some individual stock prices experienced meteoric rises due to short squeezes despite already lofty valuations to begin with; IPOs weakened dramatically with about two-thirds of companies that went public in the US in 2021 trading below their issuance price.

For 2022, we believe that a concerted focus on risk management is warranted. This entails actively managing portfolio risks, as well as reviewing invested managers and ensuring that there is no exposure to undue risks. We believe that this is very important because of the Federal Reserve’s monetary policy pivot. With CPI inflation at highs not seen since the 1980s, the Fed is taking liquidity out of the market. Monetary and fiscal stimulus has been the twin engine that has boosted markets since the onset of the pandemic. As the Fed reduces the thrust, markets are likely to experience more turbulence. The risk of a policy mistake is high – remember 2018?

At the same time, we don’t see a reason to overreact. Investors should not lose sight of opportunities to make money. Strategies that we are positive on in the first quarter, while not adding significant market risks to the portfolios, are: quantitative strategies, convertible arbitrage and merger arbitrage. Quantitative commodity and alternative trend are our favourite systematic strategies. Hedged convertible books are exposed to implied volatility that is cheap to recent realised volatility with minimal credit risk. Our view on merger arbitrage is constructive as high deal activity continues amidst buying power by private equity. We are cautious on equity long-short due to ongoing market rotations and have a muted outlook on long-biased credit funds (such as distressed) given the poor relationship between the opportunity set and downside risks.

Hedge Fund Outlook

Digital assets are a growing opportunity for managers.

Our outlook for hedge funds is constructive, but driven by our overarching risk focus. We see interesting innovation amongst strategies, first and foremost in quantitative strategies. Of course, discretionary talent also has a role, as we believe that it will be valuable to help navigate the macro policy shift away from ultra-easy financial conditions. However, our bar remains high for discretionary equity long-short managers. Traditional arbitrage strategies have, in our view, the potential to add alpha. We are cautious about strategies with excessive leverage as it exists in fixed income relative value.

Before we address our outlook on hedge funds in more detail, we wanted to share some of the findings from our research in the fourth quarter:

- Clearly, some hedge fund strategies have natural challenges when it comes to responsible investment (e.g., quantitative strategies due to breadth of equity exposure and scope of futures contracts). However, we have found – encouragingly – that most managers have made enhancements, compared with 12 months ago. We expect to see more progress in this area, which will aid investor solutions;

- We believe digital assets are a growing opportunity for managers. Innovation in crypto is already a focus for many quantitative firms that have the necessary specialists in computer science, mathematics, cryptography and network effects. We anticipate that relative value and macro strategies will become interesting applications too;

- We are excited about opportunities presented by quantitative managers in China – both in equities and in futures. The latter is largely a commodity story;

- Lastly, given the continued use of trend following as a source of both gains and risk management for many portfolios, we completed a review of the strategy by looking back over the last two decades of CTA investing. We concluded that the space is stable, with assets under management at approximately USD300 billion and not heavily influenced by flows. Our bias is towards the innovative alternative trend offerings, but this does not preclude the fact that traditional trend following remains a very important risk management and diversifying component of many portfolios.

Quantitative Strategies

Overall, there is no significant change in our constructive view for the opportunity set presented by quantitative managers. We believe some sub-strategies should be fruitful while others are more challenged.

Micro Quantitative Strategies

We have a positive view on alternative risk premia, which continues to navigate volatile equity style factors and has shown its diversification benefits with equities and – importantly – bonds in 2021.

For some years, we have discussed the various challenges to quantitative equity strategies – mainly from its broad-scale adoption and the subsequent dominance of platform and multi-strategy managers – which has made quantitative market neutral and statistical arbitrage much more difficult for smaller players. We continue to view quantitative equity as lower priority, especially when reviewing managers using traditional approaches that are now very widely ‘trawled’. Having said that, 2021 was a much better year for performance in quantitative equity, particularly in factor-based strategies. Our focus in equities remains with specialists in machine learning and alternative data.

We have a positive view on alternative risk premia, which continues to navigate volatile equity style factors and has shown its diversification benefits with equities and – importantly – bonds in 2021.

Quantitative credit struggled in 2021, with managers citing the lack of dispersion and junk rally as the primary drivers. Though the outlook is muted, we continue to believe in the diversification benefits offered by quantitative; however, outside of that we do not advocate allocations until circumstances improve.

Macro Quantitative Strategies

We are enthused by the opportunities in quantitative commodities and alternative trend. Despite asset volatility forcing some managers to reduce exposures dramatically, we believe that diligent risk managed long positions in gas, power and other energy contracts can yield more upside in the first quarter. In fact, the shortage of natural gas in Europe may extend further into 2022, but the situation is very fluid.

We are neutral on traditional trend following. Whilst notoriously hard to forecast and certainly at risk of being whipsawed in choppy markets, if inflationary forces continue to drive markets, then trend managers should be able to profit.

We are negative on quantitative macro. Given our outlook for markets to exhibit more volatility, we think directional quantitative macro is at risk of being stubborn to integrate changing themes. We favour discretionary managers more than systematic managers. The exception is relative value opportunities in quantitative macro that benefit from increased dispersion.

Equity Long-Short Strategies

We maintain a neutral view on equity long-short, while keeping an eye on pockets of more specialised opportunities (i.e., health care, ESG and Asia).

Equity long-short alpha was uninspiring in 2021. The HFRX Equity Hedge Index returned +12.1% in 2021 – good performance on an absolute basis, but disappointing in the context of strong global equity markets. More dissatisfying was the performance of US funds, with the average manager only capturing roughly 40% of the upside of the S&P 500 Index, despite having run net exposure greater than 60% throughout most of the year.2 The equity long-short cohort was challenged by different factors throughout the year. The ‘meme stock’ rally tested shorts in January 2021; however, managers were able to recover short alpha by year-end. Long alpha turned out to be the bigger issue in 2021, with crowded names underperforming the broader market. Selloffs in high-growth, TMT and consumer discretionary stocks in March, May and late in the fourth quarter of 2021 all represented significant pain points for equity longshort managers. Chinese regulatory tightening was a key factor that drove weakness in the third quarter of 2021 as Chinese ADRs were widely held by not just Asia-focused managers, but TMT sector specialists and global generalists as well. The fourth quarter of 2021 kicked off a significant rotation in managers’ exposures: a gradual shift from Growth to Value, and from TMT to cyclicals, which has persisted – if not been amplified – in January 2022. With the Fed shifting policy, we believe that factor risk will trump idiosyncratic risk. We are thus maintaining our neutral outlook.

Shifting to opportunities in equity long-short, health care is one sector that is interesting.

Shifting to opportunities in equity long-short, health care is one sector that is interesting. It has notably underperformed the broader market over the past year after biotech in particular saw increased attention from retail and generalist investors last year. Aside from an attractive price entry point, the sector has both structural and secular tailwinds: an aging population, technological innovation, patent cycle and pentup demand post Covid. Growth-levered biotech companies are only one part of the sector; managers have a large sandbox to play in that shouldn’t be negatively impacted by rising interest rates. Though we state plenty of catalysts for positive re-rating, a rising tide will not lift all boats and we believe that sector specialists are best-placed to extract short alpha by identifying the laggards in such a complex sector.

The sustainability megatrend presents opportunities for thematic equity managers focused on environment, social, and governance (‘ESG’) factors. Emphasis on decarbonisation and the energy transition have started to create a clear divide between the ‘winners’ – companies that have adapted or are showing progress – and the ‘losers’ on the other end of the spectrum. One level down, there are long opportunities in companies in the supply chain with the products and/or technologies that are enabling this process. Outside of the thematic tailwinds, a focus on ESG and diversity, equity and inclusion policies may help companies keep ahead of the regulatory curve as well as mitigate governance issues. As such, we expect ESG to become increasingly linked to valuation and continue to be an important risk factor for equity long-short managers to consider in their fundamental analysis.

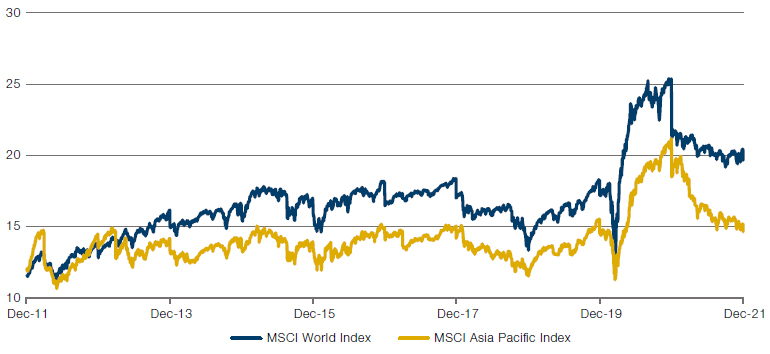

Asian equities are trading at a significant discount to global equites, representing potentially another opportunity for managers. The MSCI Asia-Pacific Index’s forward 12-month price-to-earnings (‘P/E’) ratio stood at 14.3x at year-end versus the MSCI World’s P/E ratio at 18.3x3, representing a discount of more than 20% (Figure 1). China has dominated the headlines around the Asian markets in 2021. From the government’s increased regulations on technology companies to the Evergrande debt crisis, a few different issues have rattled Chinese equities. The opportunity set in the country appears to be more uncertain in the short-term, with the economy adjusting to a new normal and regulatory developments expected to continue. This opens the door to opportunities in other Asian markets that have been flying under the radar; for instance, India – with rising exports and expected post-Covid recoveries in the agricultural and service sectors – as well as Japan, where stocks tend to be more levered to cyclical growth.

Figure 1. Forward 12-Month P/E Ratios – MSCI World and MSCI Asia Pacific

Source: Bloomberg; as of 31 December 2021.

Credit Strategies

We maintain a neutral outlook on credit long-short and a negative outlook on distressed.

There is no drastic change in our view on the opportunity set for corporate credit managers over the past quarter and as such we maintain a neutral outlook on credit long-short and a negative outlook on distressed.

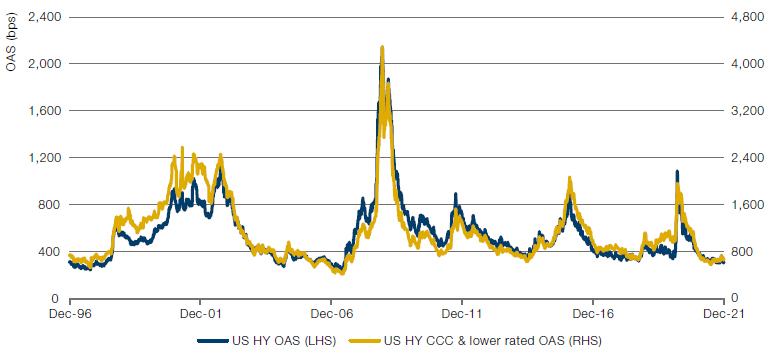

The fourth quarter was one of the more volatile quarters of 2021 as the emergence of the Omicron variant and the market repricing of Fed tapering and rate hike expectations led to wider spreads (c.50 basis points) for the US high yield market in November (Figure 2). However, these concerns largely dissipated in December with the market recovering all of the spread widening from the prior month. For the quarter, the US high yield market was actually modestly tighter (-5 bps) while the lower-rated CCCs were modestly wider (c.25bps).

Figure 2. US High Yield and CCC & Lower-Rated Spreads

Source: Bloomberg; December 2021.

Credit spreads are largely lingering around the lower end of historical ranges and, in our view, there is little room for further significant spread tightening. In this environment, the risk/reward for meaningful outright credit risk, especially lowerrated credit exposure, continues to be unfavourable. Any pickup in market volatility, increased dispersion, and/or repricing of risk driven by a tighter monetary regime or macro factors should lead to better opportunities. For now, we are holding onto our underweight.

Meanwhile, credit long-short managers are staying nimble. Active primary markets and strong ongoing rising star activity continue to be areas of select opportunities on the long side. Similarly, managers are selectively allocating to credits (either outright or long credit versus short equity capital structure arbitrage trades), largely in Covidimpacted sectors, that are still trading wide to pre-pandemic levels and are expected to benefit as the economies around the world continue to reopen.

Tight spread single-name credits, particularly companies that might face challenges in a higher cost of capital world, as well as select emerging-market sovereigns that might suffer in a rising rate environment remain areas of interest on the short side.

We have a negative view on distressed as we believe that managers will struggle to recycle capital once the current pipeline of bankruptcies and restructurings plays out.

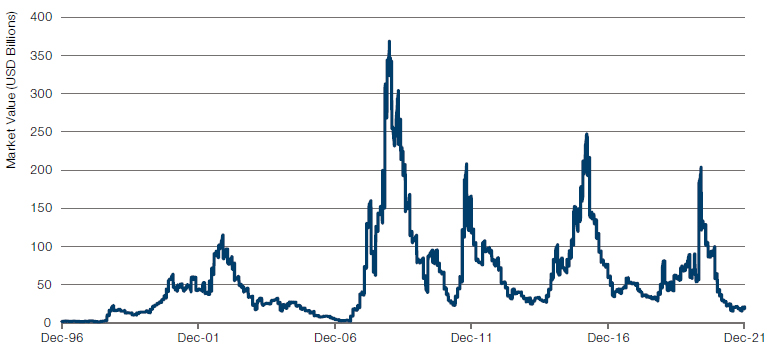

Not surprisingly, the unprecedented level of market liquidity as a result of the monetary and fiscal support in place resulted in very modest default activity in the US credit markets. In 2021, only 13 companies defaulted on bonds and loans and eight completed distressed exchanges for the lightest total volume (USD13 billion) since 2007.4 Including distressed exchanges, the US high yield default rate finished the year at 0.29%, a record low. We have come a long way in the economic recovery.

Given the relatively low levels of outstanding US high yield distressed debt (Figure 3) and open capital markets, as well as many weak companies having already defaulted in 2020, default expectations remain benign in the medium-term. As such, we have a negative view on distressed as we believe that managers will struggle to recycle capital once the current pipeline of bankruptcies and restructurings plays out.

Figure 3. US High Yield Bonds Trading Over 1,000 Basis Points

Source: Bloomberg; December 2021.

In stark contrast to the relative calm across global levered credit markets, there is a massive ongoing dislocation in the Chinese high yield market. More specifically, the property sector in China has come under significant stress on tighter liquidity conditions post the government’s crackdown on the excesses in the housing market. The collapse of the property developer Evergrande has been labelled by some as China’s ‘Lehman Moment’. We, however, neither see as severe a contagion risk nor the opportunities that the 2008 failure of Lehman Brothers presented. In fact, there is currently only USD3 billion par of distressed debt ex-China in the ICE BofA Asian Dollar High Yield Corporate Index5, i.e., distress/defaults are concentrated in Chinese real estate developers.

While we do expect some credit managers to be selectively involved, China currently remains a difficult place to invest. Until very recently, only a few distressed names had actually defaulted as the companies had been paying coupons by the end of the grace period. Some managers believe actual defaults could lead to more selling, and hence have been patient in adding any meaningful exposure. In addition, offshore bonds are at the back end of huge capital structures and unpaid liabilities and there is still a lack of clarity of the Chinese bankruptcy process.

We remain favourable on the opportunity set for convertible arbitrage over the medium term; however, a meaningful pickup in systemic risk could be a near-term headwind as broad markets are trading close to estimates of fair value6 and as discussed above, credit spreads are relatively tight. A significant increase in rates and/or dramatically weaker equities could potentially lead to selling from outright investors, which we would view as an opportunity to add risk.

As mentioned in our last quarterly update, we see the increase in the size of the convertible bond market over the past two years (~54% increase in par value of US convertible bonds versus December 20197), as well as a broader issuer base (~30% increase in issuer count over the same period) as a plus. Primary issuance is expected to stay above average in 2022, but subside from the elevated 2020/2021 levels.8 This should continue to present managers with opportunities to not only generate shortterm profits from new issues, but also an ability to add new positions across industries, many of which could be in companies that have gone public recently with meaningful equity cushions and limited, if any other, debt.

We believe numerous potential catalysts remain in place for an elevated post-pandemic volatility regime to continue. In such an environment, we see value in a portfolio of hedged, in-the-money, volatility-sensitive and good credit-quality convertible bonds, especially if managers are able to source ‘cheap’ implied volatility versus listed/ realised vol.

We have a neutral outlook for structured credit managers. Spreads across most securitised products sectors largely maintained a flat-to-tighter trajectory over the quarter, supported by continued favourable fundamentals for residential and consumer debt. The one exception has been the agency derivatives sector, which has seen meaningful spread widening and wider bid/offer spreads as investors recalibrate their expectations of prepayment speeds in light of the Fed tapering and higher interest rate volatility. This could be an area of potential opportunity for managers into the new year. Home price appreciation is expected to remain strong and delinquencies low in 2022. Similarly, consumer balance sheets should remain solid, supported by high savings rates and potential wage gains as the labour market is expected to remain tight. However, despite this positive backdrop, we expect credit spreads to be rangebound to only modestly tighter as many sectors are trading at the lower end of their historical range. Returns will be largely carry-driven, with managers expected to add value through credit selection and sector rotation. A meaningful backup in rates could be a potential headwind in the coming months.

Relative Value Strategies

In relative value, we remain positive on event arbitrage as merger arbitrage benefits from deal spreads that are wider than pre-Covid levels.

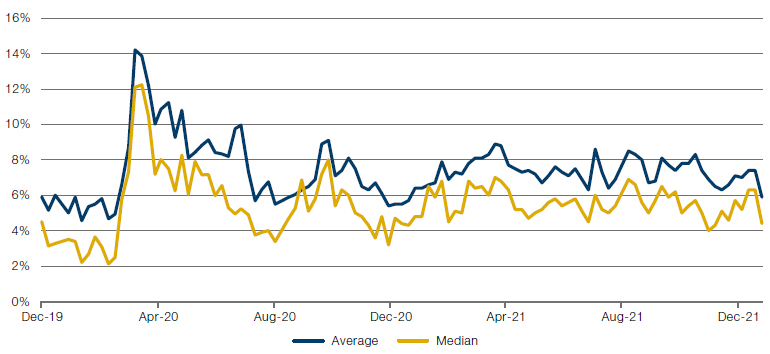

In relative value, we remain positive on event arbitrage as merger arbitrage (the core sub-strategy) benefits from deal spreads that are wider than pre-Covid levels (Figure 4) – although spreads finished the year at the lower-end of the 2021 range – as well as from deal activity reaching new record levels, which is notably diversified across all major regions. The list of US mega cap deals has shrunk and may start to challenge the ease of allocating capital for the largest managers. However, the growth in smaller transactions provides compelling opportunities for managers who can generate alpha in potentially under-researched companies and transactions.

The key fundamental drivers for merger arbitrage essentially remain healthy, especially the availability of abundant financing, as well as apparent business optimism in the C-suites. Merger agreements have also evolved to better reflect the effects of the pandemic and close loopholes whereby buyers could walk from deals, thus supporting future deal closures.

Figure 4. Annualised Merger Spreads (US)

Source: Bloomberg, September 2021.

The largest wild card remains antitrust risk. This is very real for the US, with the new administration flexing its regulatory muscles. However, 2022 may see blocked transactions defended in court, with Amazon’s proposed acquisition of MGM Holdings9 a potential future bellwether case. Interestingly, hedge funds have very different views on US antitrust risk, ranging from being extremely cautious to more welcoming of the additional complexity, which could potentially give them an ability to generate alpha. Outside of the US, various antitrust authorities continue to evolve, e.g. around national security interest thresholds, but they appear to be evaluating deals in a predictable fashion, with even the more mercurial Chinese SAMR10 authorities having recently approved deals largely as expected.

We are also positive on broader event strategies, especially in Europe, due to increasing structural corporate activity and growing actionable themes for hard and soft catalyst investments. Opportunistic event-driven managers have the flexibility to rotate into and take ad hoc advantage of special situations across the capital structure.

We are also positive on broader event strategies, especially in Europe, due to increasing structural corporate activity and growing actionable themes for hard and soft catalyst investments.

Asia is also offering interesting opportunities for local managers. Japan is continuing to evolve its shareholder stewardship and corporate governance codes, along with greater acceptance of corporate activism, as well as the willingness of companies to sell to private equity funds. China carries higher risks, with significant lingering uncertainty following recent regulatory interventions and swift sentiment changes. However, there are a lot of differing views on the outlook for China, and many market participants believe that any further regulatory measures would be more limited, as the government has a strong desire for economic and social stability in a year that will feature both the Winter Olympics, as well as the 20th National Party Congress in the fall. In addition to domestic politics, international geopolitics may influence investments in China as well: while US-China relations had already been fragile, the recent US financial pressure on US-listed ADRs of Chinese firms has been an additional contributor. However, while this pressure might lead to the delisting of a large number of ADRs in the coming year(s), the subsequent relisting of the firms in Hong Kong and also domestically should offer equity capital market related opportunities for Hong Kong- and mainland Chinafocused managers.

Global Macro Strategies

Despite recent underwhelming performance, we remain positive on the outlook for discretionary macro strategies. While last year saw limited capacity available across the peer group amid strong demand for macro exposure from allocators, we expect to see more launches and fund re-openings in 2022.

We believe the macro sector is well placed to trade the key market themes ahead and we are particularly optimistic about strategies that are capable of rotating thematic exposures across asset classes in fast-moving markets. However, we have reduced our return expectations for highly leveraged fixed income relative value strategies given the prospect of less central bank intermediation in bond markets alongside the unprecedented disparity between current yields and inflation. Managers anticipate a continuation of episodic bond volatility and liquidity issues akin to what was observed in the fourth quarter of 2021, as central banks begin to pull back on quantitative easing – which previously acted as a volatility suppressor for yield curves.

The macro sector is well placed to trade the key market themes ahead and we are particularly optimistic about strategies that are capable of rotating thematic exposures across asset classes in fast-moving markets.

Into 2022, we are seeing managers continue more active trading with an eye on adding exposure to longer-term themes. With current inflation levels far above what many predicted 12 months ago, the removal of central bank accommodation is a key theme as policymakers look to build some room in preparation for the next recession. Positioning is set for higher interest rates in economies experiencing high inflation, and the market’s pricing of terminal policy rates is also under scrutiny, with sizeable deviations between the rates currently implied and peak policy rates of previous hiking cycles in various countries.

Diverging approaches pursued by central banks to steer economies towards their long-term goals should see FX volatility increase from recent low levels. China is seemingly travelling in a different direction to most, with monetary loosening expected to counter recent deleveraging in the real estate sector. Improving liquidity in onshore bond markets and easing geopolitical tensions could see more Chinese duration added to macro portfolios this year, alongside other Asian receiver positions. Asia-Pacific’s approach to tackling the Omicron variant could also be pivotal; investors are looking for a shift away from the strict ‘zero-Covid’ policy, which should encourage risk-taking in the region and provide support for EM assets.

Further, we expect to see more environmental themes across the macro space amid increased signaling towards net-zero goals at the COP26 summit and the prospect of more fiscal spending tilted towards clean energy. Managers are monitoring longer-term aluminum and platinum options on the back of increased demand for electric vehicles.

1. Morgan Stanley reported that investors’ expectations for Equity Long-Short in 2021 were the highest since 2016 based on an investor survey conducted at the end of 2020. Source: Morgan Stanley Prime Brokerage, 2021 Year-end recap + Set up into 2022, December 2021.

2. Source: Man FRM database.

3. Source: Bloomberg. As of 31 December 2021.

4. Source: JP Morgan, December 2021.

5. Source: Bloomberg, January 2022.

6. Source: BAML, December 2021.

7. Source: BAML, December 2021.

8. Source: BAML, December 2021.

9. Source: Bloomberg, September 2021. The organisations and/or financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

10. State Administration for Market Regulation.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.