Introduction

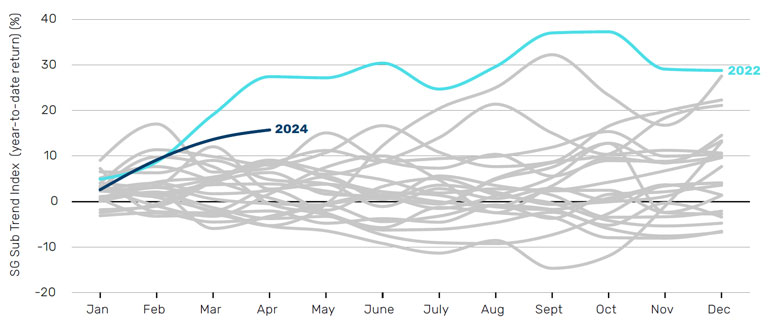

At the time of writing, major world conflicts dominate headlines, US inflation is proving sticky and interest rate cut hopes are fading, AI stocks just had a wobble, and both trade wars and meme stocks seem to be making a comeback. Those are just some of the more obvious concerns dominating today’s world, but in the background there are even more (we’ll get to that)! Not quite the 99 problems referenced in the title of this article, but it’s not exactly a rosy backdrop. A tough time to be an investor, right? Apparently, no! For one, hedge funds have had a blistering start to 2024. Just take a look at Figure 1.

Problems loading this infographic? - Please click here

As Figure 1 clearly shows, there aren’t many hedge funds making losses so far this year. We should underscore that the chart above shows performance to the end of April, and hedge fund performance has been weaker in May – but from what we can see so far, most funds are still well into positive territory for the year to date.

So what gives? How could it go wrong? And importantly, what can we do about it?

Momentum has rarely worked this well

At least part of the answer to what is driving performance is that both styles of momentum (time-series/price momentum and cross-sectional momentum) are simultaneously having a very good year.

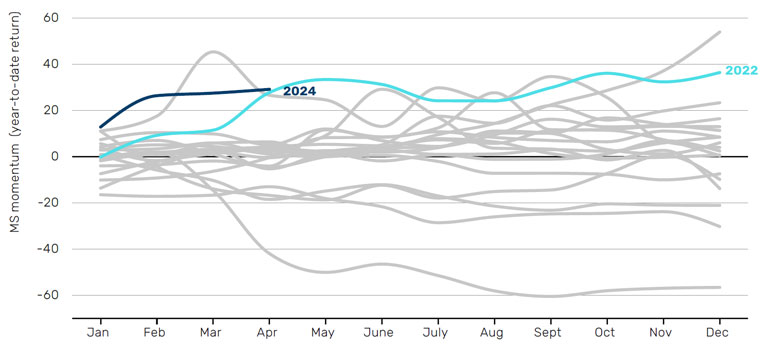

Figure 2. Momentum is performing similarly to 2022

Time series momentum: second best start since 2000

Source: Société Générale, Bloomberg, as at 30 April 2024.

Cross sectional momentum: on par with best start since 2004

Source: Morgan Stanley, Bloomberg, as at 30 April 2024

As a reminder, time-series momentum is exploited by trend-following strategies and it can also appear in other quant macro type strategies while cross-sectional momentum can appear in strategies such as equity long-short and statistical arbitrage.

This Financial Times article nicely summarises some of the successes for trend-following so far this year. Other helpful factors include:

1. Volatility across most major markets has been low and falling for much of the year – besides a blip in April.

2. Diversification across asset classes has been good.

Low volatility and good diversification feed into hedge funds’ measures of risk taking (such as value at risk (VaR) or ex-ante volatility), supressing these metrics, and therefore allowing for larger exposures whilst remaining within risk parameters.

There are other reasons why varying hedge fund strategies are working well – but themes such as momentum, crowding and volatility are the ones we’re particularly focused on.

So, what could go wrong?

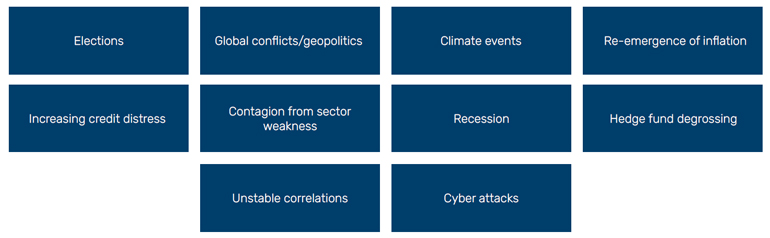

This is the question a Risk Manager is always asking themselves, and at the moment there seem to be several answers. Let’s start with the list of largest risk concerns for 2024 that the Man Investment Risk team compiled at the start of the year.

Figure 3. Biggest risk concerns for 2024

Source: Man Group.

On top of these, some more topical observations that make us nervous include:

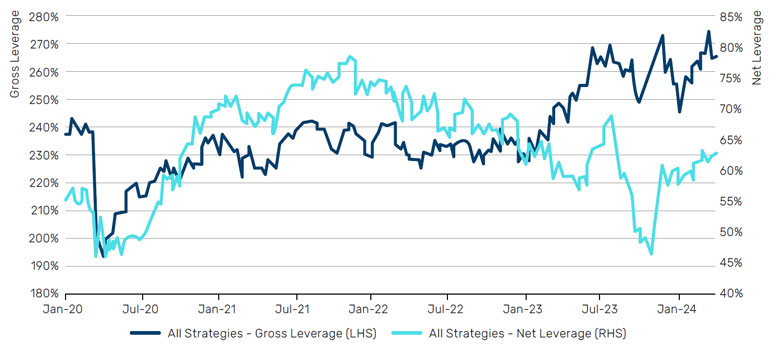

1. Gross exposures are high – as reported by prime brokers (see Figure 5).

2. Long momentum stocks may be crowded.

3. Whilst VaR and ex-ante volatility metrics look subdued (due to relatively low volatility and good diversification across asset classes), stress testing metrics are elevated.

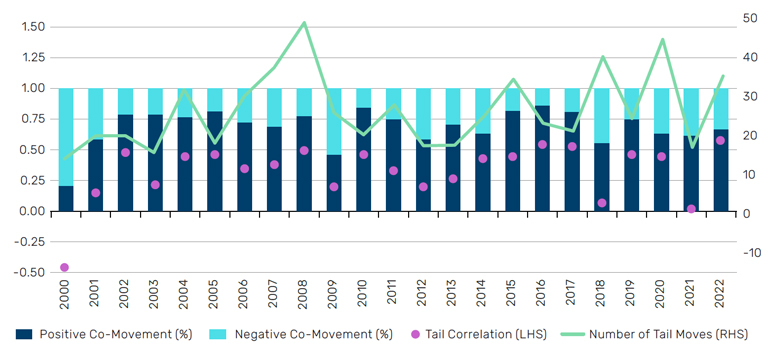

4. Hedge fund portfolios are substantially long both styles of momentum at present, which we know tend to sell-off together (see Figure 6).

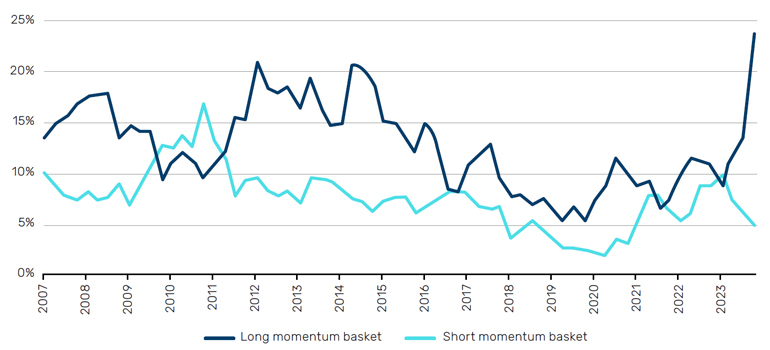

There is currently a record overlap between long momentum and hedge fund holdings, according to Morgan Stanley.

Figure 4. Record overlap between long momentum and hedge fund holdings

Source: Morgan Stanley, as at 12 March 2023. Represents overlap between hedge fund holdings, as reported in 13F filings.

Figure 5. Gross exposures are much higher than usual

Source: JP Morgan, as at 28 March 2024.

Figure 6. Both styles of momentum tend to be hit at the same time

Co-movements in momentum tails, returns normalised by rolling one-year standard deviation

Source: Man AHL; as of 24 November 2022. The periods highlighted are exceptional and the results do not reflect typical performance. The start and end dates of such events are subjective and different sources may suggest different date ranges, leading to different performance figures.

What can investors do about it?

In short, in an environment like the one we are operating in today, we believe there are three main priorities:

1. Be fast. History has shown us that strategies that cut risk more quickly tend to have shallower drawdowns than those that move slowly.

Take for example the below illustration of speed of risk cut versus monthly P&L for a number of macro quant strategies in March 2023 when the regional banks crisis took place. In short, those that cut fastest lost less.

Problems loading this infographic? - Please click here

When we look at overall risk taking in hedge fund portfolios, we therefore believe it is wise to bucket the risk taking by the speed at which the underlying managers operate. Indeed, there is some comfort to be taken from knowing most of one’s directional risk is coming from managers known to cut risk quickly.

2. Trim the most directional exposures. We mentioned that trend strategies are off to a great start to the year and that exposures are high. So it’s important to be disciplined and trim back allocations to/under long term targets as they grow as a proportion of an overall portfolio (through positive performance).

3. Hedging. The flipside of volatilities being on the low side is that hedging isn’t too expensive. Downside protection is a valuable tool when used very selectively.

Conclusion

Performance in hedge funds has been good so far in 2024, despite a long list of potential tail risks. We worry that some of the drivers of that strong performance may not last so we believe it is wise to take action to curtail the impact if the proverbial hits the fan.

Even when everything appears to be working well, just remember; you can never please a risk manager.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.