This article first appeared in Forbes here.

Introduction

Food packaging is now full of nutritional information, often with intuitive ‘traffic light’ colours. A similar wealth of granular data is available for almost all funds now, from holdings to performance, albeit not often colour coded. Could there be more?

“It is easy to tell if milk is fat free,” said SEC chair Gary Gensler last year, discussing the topic of greenwashing. “It might be time to make it easier to tell whether a fund is really what they say they are.”

This reminded me of something called the sorites paradox. One variation is as follows. If you have a pile of 1,000 grains of rice and take one away, do those 999 grains cease to be a pile? No, most people would still see a pile. But what if you took away another? And then another?

This leads to the logical conclusion that even one grain of rice is a pile of rice. It can be framed the other way too. A solitary rice grain is not a pile. Adding a second grain does not make a pile either, and so on.

You can thus end up reasoning both that no number of grains can form a pile and that any number of grains can form a pile.

The puzzle is generally attributed to Eubulides, better known for his liar paradox (is someone who says “I am lying” telling the truth?), and stems from the vague or subjective meanings of many words – nouns like pile but also adjectives like tall/short or young/old can be formulated into similar conundrums. If someone’s height is seven feet on their 90th birthday, are they tall and old? I think we could agree they were both. But six feet eleven on their 89th birthday? At what point does an inch and a year change the adjectives?

A Theory of Relativity

You can find yourself seeing everything and nothing as ESG.

So the question facing responsible investors is whether ESG is like fat or like weight – a relative definition or an absolute measurement.

I think arguing in absolute terms here is extremely difficult. Are negative screens both necessary and sufficient to be ESG? What if you add positive screens? What if you add activism? And how do you do any of these? You can find yourself seeing everything and nothing as ESG.

Yet most people don’t struggle to comprehend simple ill-defined terms like tall or old. We have context, not to mention distribution curves to help us. So ESG being a relative idea need not necessarily be a problem. Part of the reason the ESG thesaurus has been written to include everything from ethics to impact is that different investors want to meet different objectives and reflect different priorities. As an industry, we have therefore sought to develop solutions that meet their diverse needs – whether that is gaining broad market exposure with an improved ESG profile or taking an active view on a specific region, sector, or security.

I appreciate that that will be an unsatisfactory answer to some investors, though. Strategies that try to balance a higher ESG score with a lower tracking error, and so include some exposure to carbon emitters or potentially suboptimal business practices, will never be accepted as responsible by everyone. This leads to inevitable accusations of greenwashing.

So what is the one true grain of responsible investing? For me, it is undoubtedly transparent data. This is what gives us confidence and authority in explaining the composition of portfolios. It’s not easy to obtain such data, though. Yes, you can buy ESG scores off the shelf from several providers, but their methodologies vary considerably – and it doesn’t feel entirely comfortable to outsource this analysis.

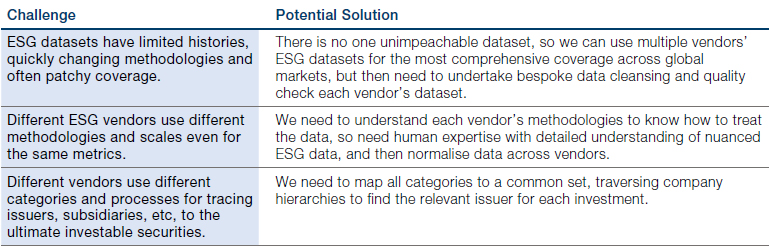

To summarise some of the main challenges and potential solutions:

No methodology or process is perfect, and they must continue to evolve. But a systematic data-led approach, enhanced by the expertise of experienced professionals, gives a robust starting point from which to communicate the full spectrum of ESG and then build strategies accordingly to meet client needs.

Beyond Jargon, Beyond Semantics

If the flow of capital towards green solutions and a just transition is impeded by debates over definitions, we will have wasted vital time.

Much of this can feel like an industry having a very technical conversation with itself, especially as asset managers address this issue in primarily regulatory terms. This is understandable as we deal with changing expectations and guidelines in multiple jurisdictions, from new labels to disclosure requirements, not to mention the antiESG backlash against them. Insofar as any new initiatives clarify approaches for clients, they are welcome.

But if the flow of capital towards green solutions and a just transition is impeded by debates over definitions, we will have wasted vital time. I have written in the past about how markets should learn to love greenflation. While I expect the pursuit of environmental and social goals to be less expensive in the long term than maintaining the status quo, we must acknowledge that these ambitions will incur short-term costs. Building renewable-energy capacity, replacing internal combustion engines, creating better working conditions – none come cheaply. The investments needed to deliver them are therefore necessarily inflationary.

For markets, I argued in that article, these dynamics open the intriguing possibility that ESG assets could be considered alongside other traditionally inflation-sensitive investments like commodities. Note that this is a more nuanced position than claiming “ESG will outperform in inflationary periods”. Clearly ESG strategies in aggregate lagged in 2022, but that is primarily because they lacked exposure to the surging energy sector (and were often overweight tech, which bore much of the selloff). Exclude oil and gas, and you will see – taking just one very broad example – that in fact the MSCI World ESG Leaders Index outperformed the MSCI World ex Fossil Fuels Index last year (albeit very marginally).

Managing ESG risks and opportunities well can undoubtedly benefit investors and the world alike. But unlocking and sustaining this potential depends on clarity and transparency, which – given the wide array of demands and expectations – are the only way to build genuinely client-centric ESG propositions.

I doubt we will ever find an ESG strategy that is unequivocally ‘fat free’ but, by being honest about ESG being a sorites rather than a binary question, we can move beyond semantic arguments to focus on what clients really want and respond accordingly.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.