Now that we’re all back to work after a festive holiday season, I couldn’t help but think about the ongoing crypto saga through the lens of one of my favourite Christmas movies. Personally, I love the Jimmy Stewart classic from 1946, It’s a Wonderful Life. If you haven’t seen it, the concept of the movie involves a man who wishes he was never born, and then gets the life-altering opportunity to observe how the people in his life would have turned out without him. It’s quite a touching film.

The part of the movie that I kept coming back to is the scene where there is a run on the Bedford Falls Savings & Loan – a bank owned by the main character, George Bailey. Depositors in the town rush to the bank to pull their money out before it’s all gone. This run-on-the-bank scenario is one that occurred much more frequently decades ago, before the FDIC created deposit insurance, but I believe it’s also an apt analogy for what happened to FTX.

A 2022 Exchange Collapse Through the Lens of a 1946 Film

FTX, in this analogy, is the Savings & Loan. Customers gave them money, and in return they were permitted to make leveraged bets on crypto currencies on the exchange. In the movie, when one of the characters is demanding his deposits back in full, it’s explained to him that his money wasn’t physically sitting in the safe at the bank; most of it was being lent to other depositors as loans (mortgages, for instance).

Now, imagine if instead of having lots of small depositors, you had one really big one. To maintain the movie analogy, let’s imagine someone closely connected to the bank – George Bailey’s Uncle Billy, a bank employee – was one of the biggest borrowers of cash to speculate on assets. But in this example, unlike in the movie, let’s assume Uncle Billy’s risk appetite was massive. Let’s say he borrowed $500,000 not for a mortgage but to buy a racehorse – a very speculative and risky asset. George Bailey (the bank president) should have made sure Uncle Billy had his loan nearly fully collateralised (i.e., having other assets/deposits at the bank that could sell to cover losses if something happened to his racehorse), but he didn’t do that. Maybe he was just trying to give his family member good terms. Maybe he was grossly negligent. We don’t know. But if Uncle Billy’s racehorse breaks a leg and becomes worthless, he wouldn’t have enough assets pledged to the bank to cover his $500,000 loan.

The selloff in crypto assets created a tailspin for FTX when customers came looking for what was left of their money.

Alameda Research, the hedge fund started by Sam Bankman-Fried (‘SBF’), is in my view akin to the “Uncle Billy” in the FTX debacle. The fund was closely connected to FTX and – alongside allegations regarding the fraudulent use of client assets – borrowed massive amounts of money (the amounts are still unclear, which is part of the problem) without being required to post the necessary collateral to cover losses. When crypto currencies started to sell off in 2022, and amid the collapse of several other coins and firms, it put Alameda underwater on its trades and created an effective “run on the bank” for the rest of FTX’s customers. By allegedly not properly segregating assets for their customers and not properly managing the collateral accounts for highly leveraged trades, the selloff in crypto assets created a tailspin for FTX when customers came looking for what was left of their money.

A Case Study in How (Not To) Manage Risk

Apart from the allegations of fraud, the collapse of FTX/Alameda Research is, for me, a case study in poor risk management. They seemingly didn’t fully comprehend or even properly measure how much collateral their counterparties should be required to hold. SBF apologised to his customers. Figuratively, he pulled his pockets out to show that they are empty and there’s nothing he can do about, but that was little solace for investors who just had their holdings fall to zero (or close to it).

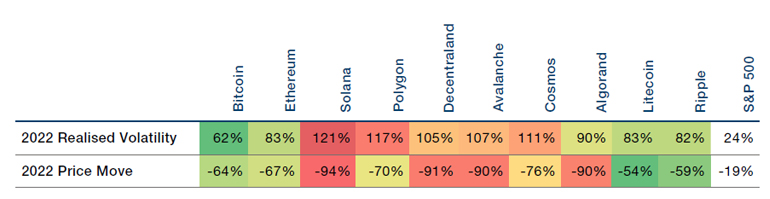

Just how broad was the selloff in crypto assets that helped this train down the tracks towards a wreck? The answer is nastier than you may have realised. Looking at a selection of crypto currencies that have been some of the largest and most liquid over the past two years (Figure 1), we can see that the “best” of them had a drawdown of -54% (Litecoin). Down 54% – and it’s the best of the bunch! How scary is that? The worst performer of the group was down 94% (Solana).

Figure 1. 2022 Crypto Volatility and Drawdowns

Source: Man FRM; as of 31 December 2022. The financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

The levels of volatility in crypto assets have been astonishing.

The levels of volatility in crypto assets have been astonishing too. The least volatile of the selection that we looked at was Bitcoin, and it had a realised annualised volatility of 62% in 2022. Remember, that is the least volatile crypto asset in this space that we considered. Some of the other crypto currencies were realising 110%+ annualised volatility. Compare that to a realised volatility for the S&P 500 Index of 24% and its 2022 drawdown of -19%.

Have Multiple Crypto Assets? Don’t Fool Yourself into Thinking You’re Diversified

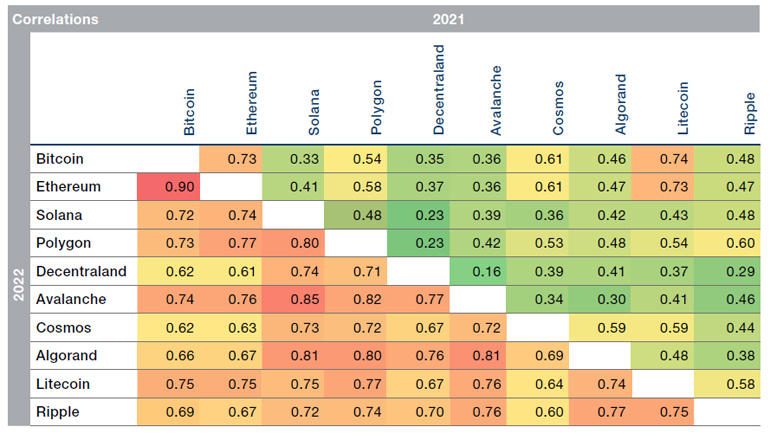

As if volatility and huge drawdowns weren’t hard enough to stomach, we noticed that the crypto space has become much more correlated in 2022 compared with 2021 (Figure 2).

Figure 2. Crypto Correlations, 2021-2022

Source: Man FRM; as of 31 December 2022. The financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

The average pairwise correlation from the 10 crypto currencies that we observed in 2021 was 0.45 – positively correlated on average, but not overly correlated. Fast forward to 2022, and that average pairwise correlation jumps to 0.73 – considerably more correlated. The range of the correlations between these assets has also changed over the past two years. In 2021, the two least-correlated currencies had a correlation of 0.16 (Decentraland and Avalanche) and the highest was 0.74 (Bitcoin and Litecoin) – a fairly large range which implies that some of these assets weren’t nearly as correlated as others. In 2022, that range has shrunk to the point where the lowest correlation was 0.60 (Cosmos and Ripple) and the highest was 0.90 (Bitcoin and Ethereum).

The problem with these crypto currencies is that even holding a diversified wallet with all 10 of those highlighted here would not have been diversified from a risk standpoint.

Often with riskier assets, managers will want to be diversified across numerous holdings, rather than piling into only one or two. The problem with these crypto currencies is that even holding a diversified wallet with all 10 of those highlighted here would not have been diversified from a risk standpoint. If correlations trend to 1.0, you’ve effectively only got one trade. You may be asking yourself: does all of this mean that FRM Investment Risk has a hard “no” when it comes to investing in crypto? It may be surprising to some given the preceding analysis, but we are okay with it…with some major caveats.

Even though holding highly volatile, highly correlated assets without strong risk management and appropriate volatility targeting is a recipe for drawdown, we can accept managers investing in crypto – but only in a small size and with a quantitative approach of scaling down exposures when they become more volatile. In addition, we need to ensure there is appropriate liquidity (can you sell the asset at or near the current mark?) and that there are no operational risk concerns. Managers need to have strong risk management around collateral maintenance and stop-losses to prevent cash-management issues. To learn more on this topic, we encourage you to read our colleagues’ guide to crypto.

According to e-cryptonews.com, 10,024 crypto currencies had been launched through May 2022. Of those, at least 2,400 (~24%) have already failed – and this doesn’t include all those crypto shops that have shuttered their doors since May last year. This makes me wonder about the line from George Bailey’s daughter in It’s a Wonderful Life: maybe instead of “every time a bell rings, an angel gets its wings,” it could be updated to the 2022 version “every time a bell rings, a crypto clips its wings.”

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.