A year ago we quite boldly declared that ‘’This time is different1’’ after examining the Tokyo Stock Exchange’s (TSE) new corporate governance guidelines that pressed Japanese companies’ notoriously resistant management into driving greater capital efficiency and profitability.

The idea then was that it would lead to a domino effect within corporate Japan once the big players started to make changes, unlocking the investment potential within the country’s equity market and drive a broad-based change in mindset.

There had a been a number of false dawns during the ‘‘Abenomics’ period2‘’ where policy makers tried to push companies into being more efficient and towards higher levels of disclosure, so our confidence was not necessarily a given.

The corporate governance movement is firmly embedded and tangible progress has helped to propel the Nikkei and the Topix to new heights.

A year on though, we can say we were right. Even though the stock market had already started rallying, it seemed more like anticipatory sentiment buoying equities. Now it feels the corporate governance movement is firmly embedded and tangible progress has helped to propel the Nikkei and the Topix to new heights. All of this is underpinned by a pivot towards an inflationary economy following decades of deflation, prompting the Bank of Japan to exit its ultra-easy monetary policy stance last month.

These structural shifts have solidified and continue to bode particularly well for Value Stocks.

In this article we outline the progress of the corporate governance revolution on Japan’s companies over the last year and where investors will find the pockets of Value.

What is the Tokyo Stock Exchange (TSE) trying to achieve and why is this so important?

In January 2023, hidden in the footnotes of the latest TSE update on market restructuring, lay an intriguing statement: An appeal for companies with a price-to-book ratio (PBR) consistently below 1x to disclose how they intended to make improvements.3

It was a direct call to action, that in March 2023 was expanded to all listed companies across the Prime and Standard Markets. It encouraged ’’all listed companies to raise awareness and literacy regarding cost of capital and stock price/market capitalisation and promote efforts to improve them. They required that management and the board of directors properly identify the company’s cost of capital and capital efficiency”. 4

It’s a request addressing what many would have assumed to be common practice across all developed economies. In Japan this request was revolutionary. It has since sparked a oncein-a-generation effort to radically improve corporate governance and unlock the value that lies within corporate Japan.

What has happened over the past year?

This push is not a box ticking exercise. The TSE is committed to improving market health and the quality of communication between corporates and stakeholders/shareholders and has kept up the pressure on companies to change.

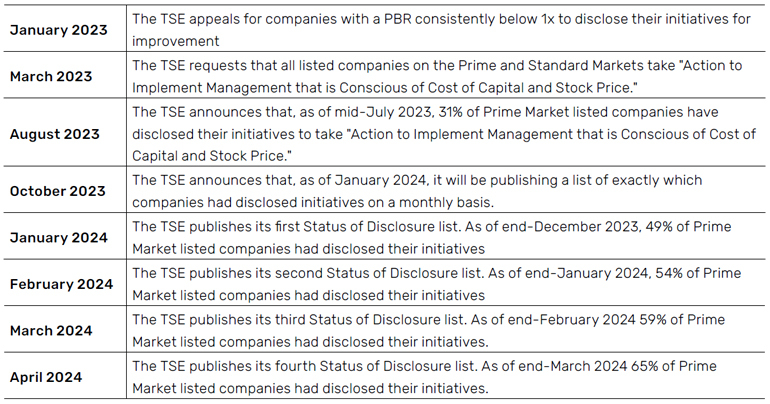

Figure 1. Timeline of TSE announcements since January 2023

Source: Tokyo Stock Exchange.

How is the TSE maintaining the momentum?

The TSE continues to work hard to communicate its expectations clearly. In early 2024, it published a detailed set of requests and a step-by-step guide on how to respond to its demands alongside case studies of companies that had made a headstart on improving their corporate governance.5

In the document the exchange asked all listed companies ’’to take the current situation, in which the expectations of shareholders and investors in Japan and abroad are rising, as a good opportunity to respond proactively and promote corporate reform, rather than simply responding to requests.’’

Examples of investor expectations outlined included:

1. Analysis and Evaluation Expected by Investors

- Considering the cost of capital/equity from an investor perspective.

- Multifaceted analysis and evaluation based on the investor perspective.

- Inspection of balance sheets to ensure their efficacy.

2. Considerations and Disclosures of Initiatives Expected by Investors

- Implementing fundamental initiatives with an awareness of the appropriate allocation of management resources.

- Being aware of the need to reduce cost of capital.

- Designing a management compensation system that provides an incentive to increase corporate value over the medium-to-long-term .

- Explanation of efforts in relation to medium-to long-term goals.

3. Dialogue with Shareholders and Investors Expected by Investors

- Proactive involvement of management and board

- Taking a tailored approach to shareholders and investors

- Disclosure of dialogue and further dialogue and engagement

So, are Japan’s corporates listening?

The progress over the last year has surpassed our initial expectations. One key reason for this is peer pressure.

The progress over the last year has surpassed our initial expectations. One key reason for this is peer pressure. The shame associated with not disclosing adequate initiatives weighs heavily on firms and executives. With the disclosure rate increasing, laggards find themselves firmly in the spotlight and must explicitly outline the reasons for not making the required changes.

Problems loading this infographic? - Please click here

Source: Tokyo Stock Exchange.

Last year, we highlighted three potential ways in which Japanese companies can improve Return on Equity (ROE):

1. Reducing excess cash and cross shareholdings

2. Increasing the profitability of their operating businesses

3. Focusing on the core businesses and shedding underperforming subsidiaries

We concluded that these and making further improvements to capital policy were the lowhanging fruit that can be achieved relatively easily in the short term. This is where we have seen a flurry of activity over the last 12 months.

All eyes are now on the AGM season in June when disclosure rates are anticipated to increase, which will further bolster investor confidence and keep the spotlight on corporate improvements.

Several interesting examples include:

Toyota: In the closing months of 2023, carmaker Toyota, which is Japan’s largest company, announced a decision to reduce several major cross shareholdings including stakes in Denso and KDDI. Given Toyota’s scale and influence on corporate Japan, this announcement was seen as an important step forward for the TSE initiative.

Obayashi: One of Japan’s largest construction companies, it announced in February 2024 that it would raise its dividend from Y21 to Y51 (based on an increased dividend on equity of 5% from 3%) and that it was targeting an ROE of 10% by FY26. Obayashi does have an activist investor, although it is unclear whether it was the force behind this latest announcement (more detail on the increase in shareholder activism further down). The reform spotlight has focused on the contractor as a result of its sizeable cross shareholdings, which were historically influential during project negotiations. The value of Obayashi’s cross shareholdings and strategic shareholdings is currently around $2.7bn (the company’s market capitalisation before the latest announcement was around $7bn, its current market cap is $8.5bn).

Kyocera: Kyocera, a manufacturer of electronic equipment (including telecommunications equipment) and components, is the largest shareholder in Japan’s telecoms giant KDDI, holding a 14.6% stake. In early 2024, at its interim results presentation, Kyocera’s President announced it’s now exploring how to utilise its stake. including the possibility of reducing the holding. An update is expected in the autumn.

All eyes are now on the AGM season in June when disclosure rates are anticipated to increase, which will further bolster investor confidence and keep the spotlight on corporate improvements. More complex initiatives, including radical improvements to underlying profitability and the successful reform of cost structures, business models and business portfolios, will take time to implement. But these longer-term solutions should extend the longevity of corporate governance reforms as an investment story.

Other agencies and activist investors are getting behind TSE’s corporate improvement drive

This drive for change is being adopted and supported by a number of other regulatory agencies and activist investors.

This drive for change is being adopted and supported by a number of other regulatory agencies and activist investors.

For example, in the non-life insurance sector, the Financial Services Authority (FSA) is pressuring companies to unwind their cross shareholdings following recent collusion scandals. The three largest non-life insurers under review did have existing plans in place to gradually reduce their almost Y8 trillion of cross shareholdings, but the FSA gave them until the end of February to come up with accelerated divestment plans. Two of them responded by announcing that they will accelerate the divestiture and are in fact targeting zero cross shareholdings. This development could also benefit other financials, like banks, life insurers, and brokers, that still hold significant crossholdings.

Since the TSE started its drive there’s been an increase in activist investors applying pressure on companies to change. Their presence and influence can be witnessed across Japan’s market cap spectrum.

In February, it was reported that an activist investor had built a 2.5% stake in Mitsui Fudosan, Japan’s largest real estate developer by market cap (approx. market cap =$25bn). The activist is now a top five shareholder and it has asked the company to sell down its 5% stake in the operator of Tokyo Disneyland, worth around $3.6bn, and launch a $6.7bn buyback.6 In early April, the company published a new medium term plan in which it pledged to increase its total payout ratio target to 50%+, outlined its target of 10%+ ROE by 2030, disclosed plans to reduce cross shareholdings by 50% and also stated that it plans to continue selling down its stake in Oriental Land when the time is right to fund new investments for growth.

Activists have been relatively successful in cases where they specifically target outsized cross shareholdings. For example, in early 2023, Dai Nippon Printing announced that it would conduct a record share buyback of around $2.2 billion and aim to generate $1.6 billion in cash through the sale of cross shareholdings. This move came after media reports that an activist investor had built a 5% position in the stock, with the goal to press for a more aggressive share repurchase and disposal of its cross shareholdings in other Japanese companies.

Problems loading this infographic? - Please click here

Source: CLSA.

How have the latest developments impacted Japan’s equity market?

The TSE policy has been one of the key drivers for Japan’s stock market rally over the last year.

The TSE policy has been one of the key drivers for Japan’s stock market rally over the last year. Since the announcement, investor attention has focused heavily on stocks with significant potential for improvement, and any positive announcements have generally seen strong, favourable reactions. More generally, Goldman Sachs also highlights (Figure 4) how companies’ willingness to respond is reflected in their share price performance. As of the end of 2023, an equal weighted basket of the 810 TSE Prime Market names that had responded to the TSE’s request outperformed non-responders by around 12%.

Source: Goldman Sachs, Factset.

Problems loading this infographic? - Please click here

That said, it’s not the only reason for the Nikkei’s record. Investors are also taking note of structural improvements such as Japan’s economy emerging from three decades of deflation and Prime Minister Fumio Kishida’s focus on the creation of a virtuous cycle of rising wages and prices.

Very much like the US, however, Japanese market breadth over the last 12 months has been narrow. Performance has largely been driven by a select number of Top Cap Value stocks as well as a select few technology-related stocks – even though these two areas of the market are expected to benefit less from the corporate reform push.

The reason is the influx of foreign investors who have focused on a small collection of wellknown Top Cap Value stocks. With restricted liquidity, only 220 stocks have an average daily traded value over $20mn in Japan vs. nearly 1500 stocks in the US. As a result, the stretch between Top Cap Value and the rest of the Value style has widened.

Compared to last year, the improvement story is now well known. Is this still an interesting investment opportunity?

We believe that this movement remains a compelling investment opportunity for both Japan and Japan Value.

We believe that this movement remains a compelling investment opportunity for both Japan and Japan Value

For Japan as a whole, while progress over the past year has been encouraging, and the market has responded well to said progress, a large portion (43%) of listed stocks on the TSE Prime Market are still trading below book value, a much higher percentage than we see in the S&P 500 and Stoxx 600.

The TSE has also emphasised the need for the wider market to focus on long term improvements to shareholder value. Although a review of the PBR distribution of the Japanese equity market provides a useful insight into its relatively low valuation, the TSE has stressed that 1x PBR is by no means its end goal for these efforts.

Problems loading this infographic? - Please click here

Source: Goldman Sachs, FactSet.

The average Japanese corporate balance sheet remains unlevered and cash rich.

As discussed, most announcements over the past 12 months have largely focused on the reduction of cash and/or cross shareholdings and enhanced shareholder returns, in order to improve balance sheet efficiency. But the average Japanese corporate balance sheet remains unlevered and cash rich. The percentage of companies with net cash on their balance sheet remains high at 46% vs. 21% in the US and 14% in Europe. That means there is plenty of work left to do.

Problems loading this infographic? - Please click here

Source: efferies, Factset.

Any policy that is generally targeting companies with low valuations should inherently benefit Japan Value stocks.

Finally, by definition, Value stocks generally trade at a lower PBR than their Growth counterparts. So, with a policy that is generally targeting companies with low valuations, any resolution should inherently benefit Japan Value stocks.

As an update on the scale of the opportunity for Japan Value, 51% of Russell Nomura Total Value Index members currently trade below book value. This compares with just 2% of Russell Nomura Total Growth Index members. That is a strong improvement from our report last year when 65% R/N Total Value Index members and 6% of R/N Total Growth Index members traded below book value.

Problems loading this infographic? - Please click here

Source: Russell/Nomura, Bloomberg.

Conclusion: This remains a long-term improvement story for Japan

Thanks to this once-in-a-generation directive corporate Japan is finally listening.

A years-long effort to improve corporate governance in Japan and increase shareholder value had been met with limited success. Until now.

Last year, we made the bold statement that “this time is different”. The reaction to the TSE’s request, not only by companies trading below book value, but by the whole of corporate Japan has been incredibly encouraging. Momentum continues to build; the TSE continues to apply force and the power of peer pressure in Japan is not to be underestimated.

Thanks to this once-in-a-generation directive corporate Japan is finally listening.

1. https://www.man.com/maninstitute/this-time-is-different

2. https://www.elibrary.imf.org/display/book/9781498324687/ch001.xml

3. https://www.jpx.co.jp/english/news/1020/p1j4l400000014ul-att/p1j4l400000014x9.pdf

4. https://www.jpx.co.jp/english/equities/follow-up/b5b4pj000004yqcc-att/dreu250000004sq8.pdf

5. https://www.jpx.co.jp/english/news/1020/u5j7e50000001bqd-att/240201en.pdf

6. https://asia.nikkei.com/Business/Travel-Leisure/Activist-fund-Elliott-pushes-Mitsui-Fudosan-to-dump-Tokyo-Disney-stake

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.