Key takeaways:

- Systematic investors can combine conviction with computational precision to enhance alpha across diverse assets

- Sustainable edges and sensitivity to data releases are crucial in building conviction for investment strategies

- Continuous monitoring and smart execution are essential for maintaining conviction and minimising alpha decay

High conviction in strategies that cannot be accurately forecast can pose substantial risks.

“Conviction is worthless unless it is converted into conduct."

- Thomas Carlyle

Perhaps it’s more accurate in the realm of investing to modify Scottish philosopher Thomas Carlyle’s aphorism to “Conviction is worthless unless it’s converted into alpha.”

Conviction refers to the strength of one’s belief in an investment strategy. However, high conviction in strategies that cannot be accurately forecast can pose substantial risks. Just consider how often investment banks fail to predict market returns accurately despite their conviction.

Problems loading this infographic? - Please click here

Can systematic investors be conviction investors?

In systematic investing, conviction often stems from confidence in data-driven models and algorithms used to guide investment decisions.

Systematic investors can indeed be conviction investors. They can combine the strength of belief typically seen in discretionary fund managers with the calculation power, robustness, and uniformity of model application inherent in systematic investing. This blend of conviction and systematic strategy can provide an edge in the hunt for alpha across thousands of assets.

In systematic investing, conviction often stems from confidence in data-driven models and algorithms used to guide investment decisions. These models, given sufficient data, can be applied to any asset class, broadening the scope of investment opportunities.

This primer outlines the role of conviction in systematic investment and how to incorporate it in portfolio construction.

How do we build conviction?

Building conviction involves a meticulous process, a key part of which is identifying a sustainable edge - an informational inefficiency that can be exploited for profit. However, as more investors trade based on this edge, it becomes less profitable, underscoring the importance of sustainability in your chosen edge.

Investors also need to consider the sensitivity of the strategy to data release. A strategy might perform well during the research phase but experience a slowdown in performance when the data set becomes widely used. This sensitivity could lead to a situation where the edge no longer exists once the strategy is up and running.

This underscores the need to build conviction rooted in reality, not merely based on optimistic projections.

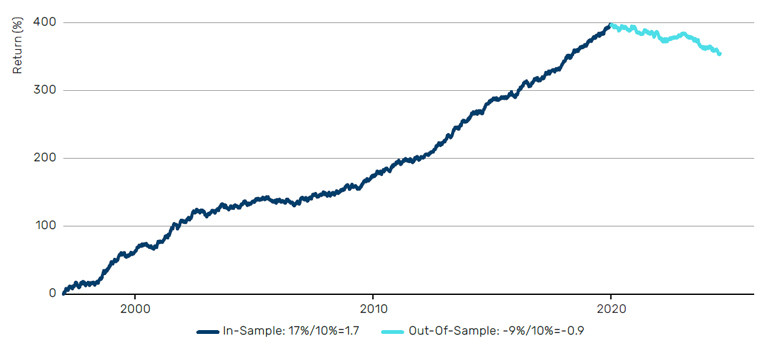

Practically that means that an investment strategy that delivers excellent back test results using in-sample data may drastically underperform when subjected to a live test using out-of- sample data (see Figure 2). This accentuates the importance of understanding the time sensitivity of investment strategies and their potential performance under different market conditions. A strategy with a high expected Sharpe ratio and low conviction might yield outstanding performance before implementation, only to stumble post-implementation. This underscores the need to build conviction rooted in reality, not merely based on optimistic projections.

Figure 2. Use a backtest to inform the future?

Simulation of a fitted random forest algorithm on S&P 500 returns

Random forest is a machine learning algorithm that combines the output of multiple decision trees to reach a single result. For illustrative purposes only. Simulated performance data and hypothetical results are shown for illustrative purposes only, do not reflect actual trading results, have inherent limitations and should not be relied upon. Please note that the performance data is not actual past or simulated past performance of an investment product. Source: Man Group database, as of 2 August 2024.

Maintaining conviction – An ongoing commitment

Maintaining conviction is a continuous effort that involves regular monitoring and assessment of the strategy. There are several factors to consider in this process:

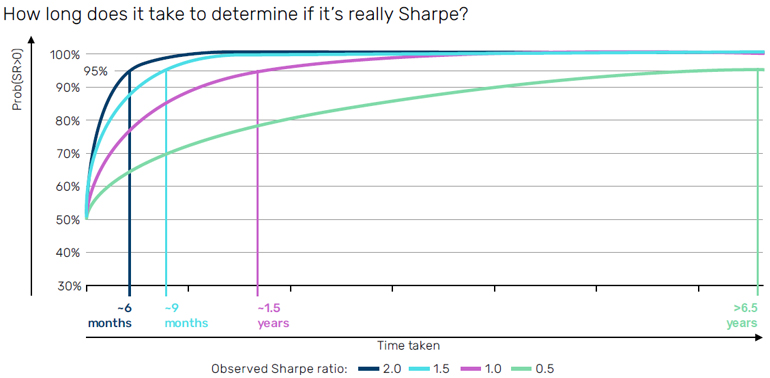

Duration: For example, a strategy with a Sharpe ratio of 2 requires at least six months to determine with 95% certainty if it’s genuinely positive Sharpe. For strategies with a lower Sharpe ratio, this assessment period could extend to a couple of years (Figure 3)

Figure 3: How do we maintain conviction?

How long does it take to determine if it’s really positive Sharpe?

Source: Shows probability that Sharpe ratio is more than 0. Man Group database, as of 30 June 2024. For illustrative purposes only.

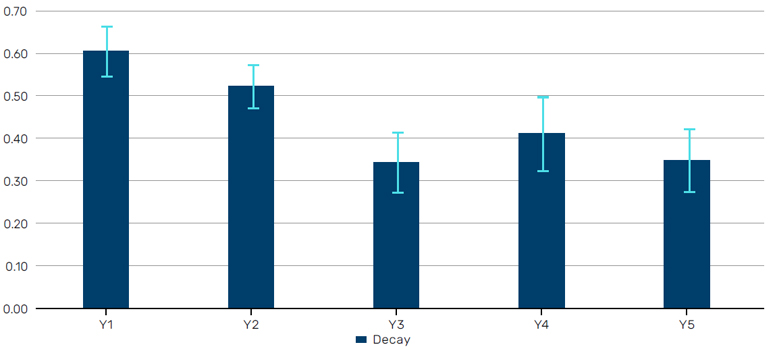

It’s crucial to ensure that alpha decay stabilises over time.

Alpha degradation: It’s crucial to ensure that alpha decay - the decline in a strategy’s ability to generate excess returns – stabilises over time, as shown in Figure 4. A strategy that exhibits constant alpha decay may need to be reevaluated.

Figure 4: Sharpe decay in years after going live

Source: Man Group database, as of 30 June 2024. For illustrative purposes only.

Monetisation: The ability to convert gross profit and loss (PnL) into net profit with minimal friction is also significant in maintaining conviction. Smart execution and allocation of trades can help avoid excessive transaction costs, keeping net profit as close as possible to gross profit and maximising returns. In Figure 5, we show an example of a quant equity trading strategy. From 2015-2021, you can see the strategy produced gross alpha (dark blue line), but the net alpha (light blue line) was flat. We believe, with much thought about portfolio shaping and execution, this gap could be narrowed to maximise gains, as illustrated in the chart on the right-hand side.

Problems loading this infographic? - Please click here

Incorporating conviction in portfolio construction

This is where the benefits of systematic investing and its infinite calculation power become apparent.

Value of change: Tracking the level of improvement in a strategy over time is another critical measure in maintaining conviction. This is where the benefits of systematic investing and its infinite calculation power become apparent. As an example, in Figure 6 we compare what would have happened if an old version of a hypothetical model (2020 Vintage) had continued to run versus an updated model (Live Fast Trading) in FICC (fixed income, currencies and commodities). It is vital to ensure that over time, there is a positive trend in the value of any changes made.

Problems loading this infographic? - Please click here

Incorporating conviction into portfolio construction is a nuanced process that starts with a correlation matrix, which serves as a proxy of risk, and some expected returns. Figure 7 shows how allocations within a hypothetical multi-strategy portfolio have been modified as conviction in content has changed over time. As shown in the lower part of the chart, this has yielded better outcomes than the original portfolio.

Problems loading this infographic? - Please click here

Problems loading this infographic? - Please click here

This approach ensures that the portfolio construction process is attuned to the realities of the market while also being guided by the investor’s conviction level.

By running multiple Monte Carlo1 simulations, we can apply a measure of uncertainty to these values and create more realistic results. This process accommodates the non-static nature of financial markets and acknowledges the inherent variability of financial returns.

Expected Sharpe ratios are drawn from a distribution, typically normal. If it’s a high conviction strategy, the distribution of outcomes will center towards the mean. If it’s a low conviction strategy, however, negative numbers will be encountered more frequently. This approach to incorporating conviction ensures that the portfolio construction process is attuned to the realities of the market while also being guided by the investor’s conviction level.

Conclusion

In summary, the hunt for alpha in systematic investing may be a data-driven, algorithmic process, but there’s still a crucial role for conviction. It’s less about human belief and more about the systematic validation of models and strategies.

Building and maintaining this conviction is a continuous cycle of testing, refining, and reassessing. It’s here that conviction leads to alpha.

1. Monte Carlo simulations are computational algorithms that use random sampling to obtain numerical results. They are often used to model the probability of different outcomes in processes that are difficult to predict due to the intervention of random variables.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.