Introduction

For investors in bank-capital instruments getting the details right is meaningful and shines light on where market inefficiencies may hide in plain sight.

Switzerland’s Federal Department of Finance (‘FDF’), the Swiss National Bank (‘SNB’) and the country’s Financial Market Supervisory Authority (‘FINMA’)1 decided on Sunday 19 March 2023 to write down Credit Suisse’s Additional Tier 1 (‘AT1’) securities. This launched a firestorm of what was, in our view, largely fatuous and self-serving commentary from the press, securities analysts and, especially, junior subordinated creditors.

Few people enjoy reading bond-offering memoranda, and even fewer enjoy reading banking regulation, so misunderstanding and misdirection are to be expected. But for investors in bank-capital instruments, and especially credit risk sharing (‘CRS’), getting the details right is meaningful and shines light on where market inefficiencies may hide in plain sight – or where protections may drive substantial value in the event of default or resolution.

Starting a Resolution

In default or resolution, we believe bank creditors need to take three separate approaches to understanding priority:

- Contractual: the offering documentation stating the bond’s priority;

- Statutory: the local legislative language detailing creditor hierarchy; and

- Structural: which entity in a group structure issued the debt.

In the case of Credit Suisse (‘CS’), AT12 creditors have focused on a misunderstanding of their contractual priority. Investors should, by now, understand that AT1 come with two different conversion features covering when they are: 1) convertible to common equity and 2) written down to zero. Investors may also know that AT1 securities have Common Equity Tier 1 (‘CET1’) triggers, usually between 5-7%3, upon which conversion or write-down takes place. Additionally, they also have “point of non-viability” (‘PONV’) event language4 that allows for the regulator to mandate conversion under numerous scenarios – of which rapid and uncontrollable deposit flight clearly ranks toward the very top.

As for CS specifically, outflows of deposits (Figure 1) strongly suggest they were in need of extraordinary liquidity support, which we believe constitutes a clear non-viability event. The Swiss regulators’ write down of AT1s appears watertight, in our view.

Figure 1. Credit Suisse Deposits

Problems loading this infographic? - Please click here

Source: S&P Capital IQ; as of 31 March 2023.

On the other hand, claims that the absolute priority of AT1 creditors ranks ahead of CET1 and was not respected seem…suspect. The reason, if it’s not obvious, is basic mathematics: conversion (regardless of type) at any trigger above zero means, by definition, that AT1 will at best be treated equivalently to CET1 – and not ahead.

Figure 2 gives two basic examples, of an illustrative bank with a 12% CET1 ratio and 3% AT1 (with a 7% trigger) outstanding prior to a >5% loss event.

Figure 2. Illustrative Example of Conversions and Write Downs

Problems loading this infographic? - Please click here

Problems loading this infographic? - Please click here

Source: Man GPM. For illustrative purposes only.

In the convertible panel, CET1* refers simply to AT1 creditors converted to shareholders owning 30% of the business post-conversion. Mandatory conversion, though still extremely problematic from a conversion-event standpoint, is at least intuitive from a creditor-rights standpoint. Mandatory write down, however, gifts CET1 shareholders – who continue to own 100% of the business post-conversion – monetary value equivalent to the AT1 notional. This leaves the aforementioned “event confusion” unresolved and layers in a rather significant fairness issue: why would shareholders get free money?

Mandatory write-down AT1 securities are better viewed not as part of a bank’s capital structure, but rather as a put option.

There is almost certainly no answer to this question. Rather, it appears likely that Swiss authorities had other priorities than thinking this through to its logical end-state, despite considerable consternation from market participants following the introduction of Swiss AT1 rules.5 It turns out, regardless of intent, that mandatory write-down AT1 securities are better viewed not as part of a bank’s capital structure, but rather as a put option against two events: 1) CET1 loss in excess of an amount that reduces CET1 below the trigger level, and 2) non-viability

Compounding matters, both events are highly uncertain given management’s control of the former and supervisory control of the latter. Worse still, now that the put option “strike price” has been realised, we know they are not actually a hedge against non-viability, as the Swiss demonstrated. In short, we believe Switzerland should never have introduced the write-down (as opposed to the conversion) structure and it is little surprise it was not adopted elsewhere. At least in the rest of Europe, AT1 creditors can console themselves with scrip balances. Sadly for creditors, none of this makes their case any stronger.

Priority Banking

As noted above, contractual priority is not the sole determinant for bank-creditor recovery analysis. Contractual priority (where a security ranks relative to others) may well be less important than statutory priority (where national legislation ranks given instruments) and structural priority (which entity issued the debt).

CS AT1 creditors seemed to focus exclusively on their (weak, in our view) contractual priority rights – no creditor worse off, absolute priority, etc – because their statutory rights were obliterated by the Federal Council’s 19 March amendment to its liquidity assistance ordinance and their structural priority rights were non-existent.

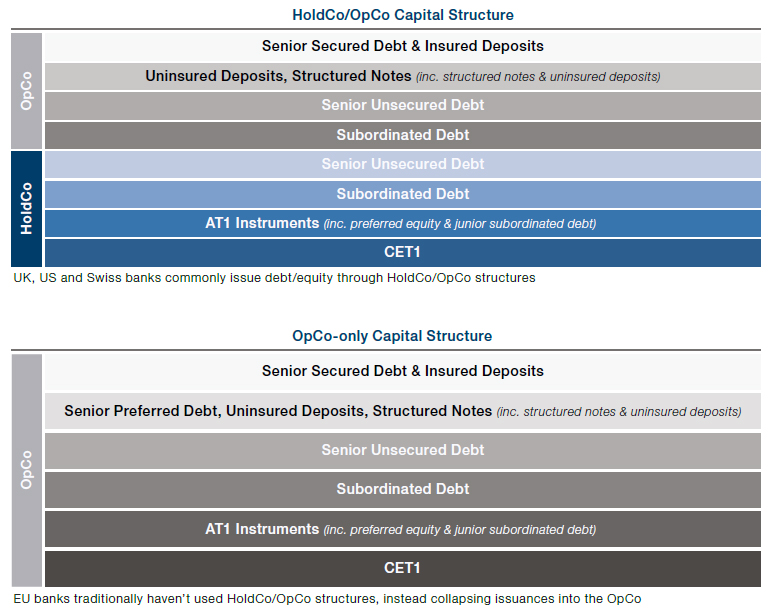

For the uninitiated, banking groups come in two types of structures: HoldCo/OpCo and OpCo-only. In resolution (the process by which supervisors restructure an institution), it’s important to understand the distinction. The HoldCo/OpCo structure has its roots in the United States, where the Federal Deposit Insurance Corporation (‘FDIC’) has a long history of managing bank resolution.6 Bank Holding Companies issue debt and equity, which they then move downstream to operating subsidiaries in return for equity ownership and subordinated debt claims. When the FDIC (or another supervisory authority) determines a bank is non-viable, usually due to a run on deposits, they can cause the default of HoldCo securities in issue without causing the Operating Bank entity to be in default. Accordingly, the operating institution can carry on its banking operations without worrying that creditors will file injunctions, often in complicated jurisdictions, that may prejudice its business prospects. The operating institution is essentially a super-debtor in possession, able to use its assets and make payments on liabilities as if no resolution had occurred.

Figure 3. Illustration of Bank Capital Structures

Source: Man GPM. For illustrative purposes only.

European banks have traditionally not used holding-company structures, making them substantially more difficult to resolve.

Bank holding companies do not prevent operating creditors from absorbing losses, but they do essentially insulate them from bail-in at resolution, allowing the operating company to be wound down in an orderly manner. Any proceeds from the sale of the operating entity (or the liquidation of its assets) are then moved upstream back to the Holding Company to satisfy creditors and, at least potentially, equity holders. Of course, often there are no net proceeds from such sales. Under such a scenario, recovery for bank HoldCo creditors is zero.

European banks have traditionally not used holding-company structures, making them substantially more difficult to resolve. This became particularly apparent during the global financial crisis, when several large European banks became insolvent, forcing regulators to confront cross-defaulting contracts of all sorts, everywhere around the world. In short, bank-resolution authorities could not bail creditors into a restructuring and therefore were largely left to recapitalise firms with public funds.

In response, EU authorities set out to codify resolution authority in the Bank Resolution and Recovery Directive (‘BRRD’)7 of 2014. BRRD provides the EU the authority to place a stay on legal challenges to resolution, thereby facilitating write-down or bailin of creditor claims. While the EU has used its BRRD powers several times since the introduction of the legislation, it has yet to resolve a Global Systemically Important Bank (‘G-SIB’) and therefore has not truly tested its ability to manage cross-border contractual risk.

Structural and contractual models facilitate the resolution of banks, but in our view neither of them is particularly applicable to guaranteeing that a bank that is too big to fail (a G-SIB) can continue to operate following resolution. To increase G-SIB solvency under effectively all circumstances, regulators adopted the Financial Stability Board’s (‘FSB’) Total Loss Absorbing Capital (‘TLAC’) construct. TLAC, or Minimum Requirement for Own Funds and Eligible Liabilities (‘MREL’) in the EU, attempts to codify minimum capital levels that will support a full Tier 1 recapitalisation following a loss event that absorbs all pre-loss Tier 1 capital.

The FSB describes the concept thus:

“After the resolution transaction, to ensure continuity of critical functions, the entity or group of entities emerging from resolution must meet the conditions for authorisation, including any consolidated capital requirements, and be sufficiently well capitalised to command market confidence.”8

The FSB goes further to define what is not TLAC:

“TLAC-eligible instruments must not include:

- insured deposits;

- sight deposits and short-term deposits (deposits with original maturity of c. less than one year);

- liabilities arising from derivatives;

- debt instruments with derivative-linked features, such as structured notes;

- liabilities arising other than through a contract, such as tax liabilities;

- liabilities which are preferred to senior unsecured creditors under the relevant insolvency law; or

- any liabilities that, under the laws governing the issuing entity, are excluded from bail-in or cannot be written down or converted into equity by the relevant resolution authority without giving rise to material risk of successful legal challenge or valid compensation claims.”9

As investors who are primarily focused on securities issued by banks but linked to balance sheet exposure, we’ve emphasised point “d” which clearly notes that structured bonds, of which credit-linked notes (‘CLNs’) are a class, issued by banks are not TLAC eligible. Similar language has been introduced into national legislation, such as Germany’s KWG Section 46f(7.1):

“…does not apply to debt instruments for which the parties have agreed that the repayment amount is contingent upon the occurrence or non-occurrence of an event which is still uncertain at the time the debt instrument is issued…”10

Section 46 of the KWG creates a division between MREL (Non-Preferred) Senior Unsecured and Senior Preferred liabilities such as structured notes. Along with explicit classification of structured notes as Senior Preferred debt, investors in German structured notes can benefit from both statutory (KWG) and contractual (intercreditor) protection.

In the United States, Federal Reserve guidance on the ineligibility of structured notes to satisfy Long-Term Debt and TLAC requirements in 12 CFR 252 (Regulation YY) goes a step further, noting:

“…investors in structured notes tend to pay less attention to issuer credit risk than investors in other long-term debt, because structured note investors use structured notes to gain exposure unrelated to the covered BHC.”11

For smaller, less-well-capitalised institutions with simpler capital structures, we view subordination to be largely insufficient to justify retaining credit risk.

Since 2018, bank creditors have a clear – albeit heterogeneous – understanding of their rank based on a combination of the three key pillars of contractual, statutory and structural priority. In all cases, structured-note investors – even when their cash proceeds remain on the balance sheet of the issuer – can benefit from super-priority status, either at the debt-issuing entity (as in the EU) or at the operating entity (as in the UK, Switzerland and the United States).

Given structured-note holders sit alongside other uninsured depositors and above substantial amounts of explicitly loss-absorbing capital, we assess this position – for G-SIB institutions – as being robust. For smaller, less-well-capitalised institutions with simpler capital structures, we view subordination to be largely insufficient to justify retaining credit risk.

Impact for CRS Investors

CRS investors, whether they realise it or not, are both bank creditors and non-bank credit investors. Even when structured “off balance sheet”, proceeds from the sale of CLNs or financial guarantees must remain in an account somewhere. Certainly, trust and custody accounts expose investors to less bank-credit risk than corporate deposit accounts, but they don’t necessarily reduce total risk. Cash must be invested, after all, and even government liabilities are not completely risk free. As with all exposures, the key is to price the risk of loss.

As evidence that many investors in CRS may not fully appreciate this fact, we would note that between 1 January 2014 and 31 December 2016, investors in most CRS transactions benefitted from effectively no statutory (CRR) or contractual (Senior Preferred) priority ranking them above loss-absorbing capital.12 In fact, during this period, cash backing “on balance sheet” CRS issued by G-SIBs was explicitly subject to bail-in under the existing resolution regulation. We saw no discernible evidence during this period that investors asked for or received incremental compensation for the increased risk they were taking. In fact, from the start of 2014 through the end of 2016, investors closed deals on some of the tightest spreads ever experienced in the market despite TLAC-eligible senior unsecured debt spreads of core issuers frequently pricing in excess of 200 basis points (Figures 4-5).

Figure 4. Spread/WARF (Weighted Average Rating Factor)

Problems loading this infographic? - Please click here

Source: Man GPM; as of April 2023.

Figure 5. Senior Unsecured Spreads

Problems loading this infographic? - Please click here

Source: Man Group and Markit; as of April 2023.

Conclusion

We believe the key to success in the CRS market is to identify and price for the whole risk spectrum – not just portfolio credit risk.

We believe CRS securities are a powerful and effective way to invest in senior corporate credit risk. Banks operate a unique model, whereby their low cost of funds and broad product development and loan-servicing platforms encourage efficient underwriting. From a bank’s perspective, however, commercial credit is a drag on average returns given the heavy equity capitalisation of such exposures. Investors, meanwhile, lack the structural advantages of the banking system, which can make diversified, capital-optimised risk-transfer securitisations an extremely efficient investment. We believe the key to success in the CRS market is to identify and price for the whole risk spectrum – not just portfolio credit risk – and then to assess and manage that risk through time.

1.https://www.finma.ch/en/news/2023/03/20230323-mm-at1-kapitalinstrumente/

2. BIS (2019). https://www.bis.org/fsi/fsisummaries/defcap_b3.htm

3. BIS - Basel Committee on Banking Supervision (2017), Basel III definition of capital.

4. Ibid.

5. Thomas Hale, ‘The Tale of the Swiss CoCo’, Financial Times (February 2016).

6. With several thousand banks in the United States, the median individual institution tends to hold relatively idiosyncratic exposures that lead to higher default rates than more diversified peers.

7. https://finance.ec.europa.eu/banking-and-banking-union/banking-regulation/bank-recovery-and-resolution_en

8. https://www.fsb.org/wp-content/uploads/TLACPrinciples-and-Term-Sheet-for-publication-final.pdf

9. https://www.fsb.org/wp-content/uploads/TLAC-Principles-and-Term-Sheet-for-publication-final.pdf

10. https://www.bafin.de/SharedDocs

11. https://www.federalregister.gov/documents/2017/01/24/2017-00431/total-loss-absorbing-capacity-long-term-debt-andclean-holding-company-requirements-for-systemically

12. Source: Man GPM; as of 25 April 2023.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.