In focus:

What’s top of mind for us this quarter?

Market commentators have been anticipating a rotation away from US assets for some time. While European equities have largely disappointed these expectations, failing to deliver the expected outperformance, a more compelling story has emerged in fixed income markets. While not cheap at an index level, European credit and emerging market (EM) debt both offer opportunities, with dispersion remaining elevated across both markets. EM debt, in particular, is showing signs of a comeback after being out of favour for several years. We believe both offer strong alternatives to a broadly expensive US credit market.

Technical tailwinds

In EM, increasing gross supply has been met by strong cash flows, while liability management exercises have kept net issuance in check. In fact, EM corporates have recorded net financing of -US$10 billion year to date, with China the main driver of negative issuance at -US$55 billion.1 These levels of supply remain favourable relative to historical norms and offer meaningful price support although we expect a pickup in gross and net supply in the fourth quarter. Substantial dry powder sitting in yield-seeking cash should keep spreads tight and maintain the tug-of-war with yields, in our view. Should a recession materialise, however, we would expect spreads to widen significantly from current levels.

US credit is broadly expensive

Turning to US credit, which is expensive, investment grade spreads are at all-time tight levels with high yield close behind. Moreover, spread compensation per turn of leverage appears increasingly inadequate given deteriorating fundamentals, while signs of stress are beginning to emerge in cyclical sectors and leveraged loans. This environment may favour long-short approaches, as low volatility enables cheaper index and single name hedges, particularly via options, while protection against left tail events remains relatively cheap.

Dispersion creates opportunity

In both European and emerging market credit, we are observing greater dispersion, with inter-decile spreads notably wider than their US counterparts. This creates opportunities for active managers to distinguish between companies genuinely facing challenges and those being unjustifiably penalised.

Better fundamental health

In addition, EM corporates are in better fundamental health than their US counterparts. Balance sheet leverage for the former has reduced significantly since the COVID pandemic, resulting in a more diverse and fundamentally sound market that is yet to be fully reflected in valuation metrics.

Fiscal tailwinds may materialise

In the case of Europe, fiscal spending may serve as an additional tailwind for European credit. Earlier this year, Germany announced the largest economic stimulus since the aftermath of the fall of the Berlin Wall. Should this spending materialise, Europe may find new momentum through its largest economy’s fiscal expansion which we would also expect to provide meaningful support for European corporate earnings. A surge in M&A in the European banking sector is creating additional opportunities for investors, alongside continued demand for significant risk transfers (SRTs) as banks seek to improve their return on equity.

The bottom line:

The US credit market represents more than 60% of global credit indices, but may not be where the best opportunities present, in our view. European and EM credit not only offer avenues for diversification but may warrant greater attention from investors owing to supportive technicals, better fundamentals and the opportunities created by dispersion.

*Forward-looking statements: This material contains forward-looking statements. Actual results may differ materially.

In brief:

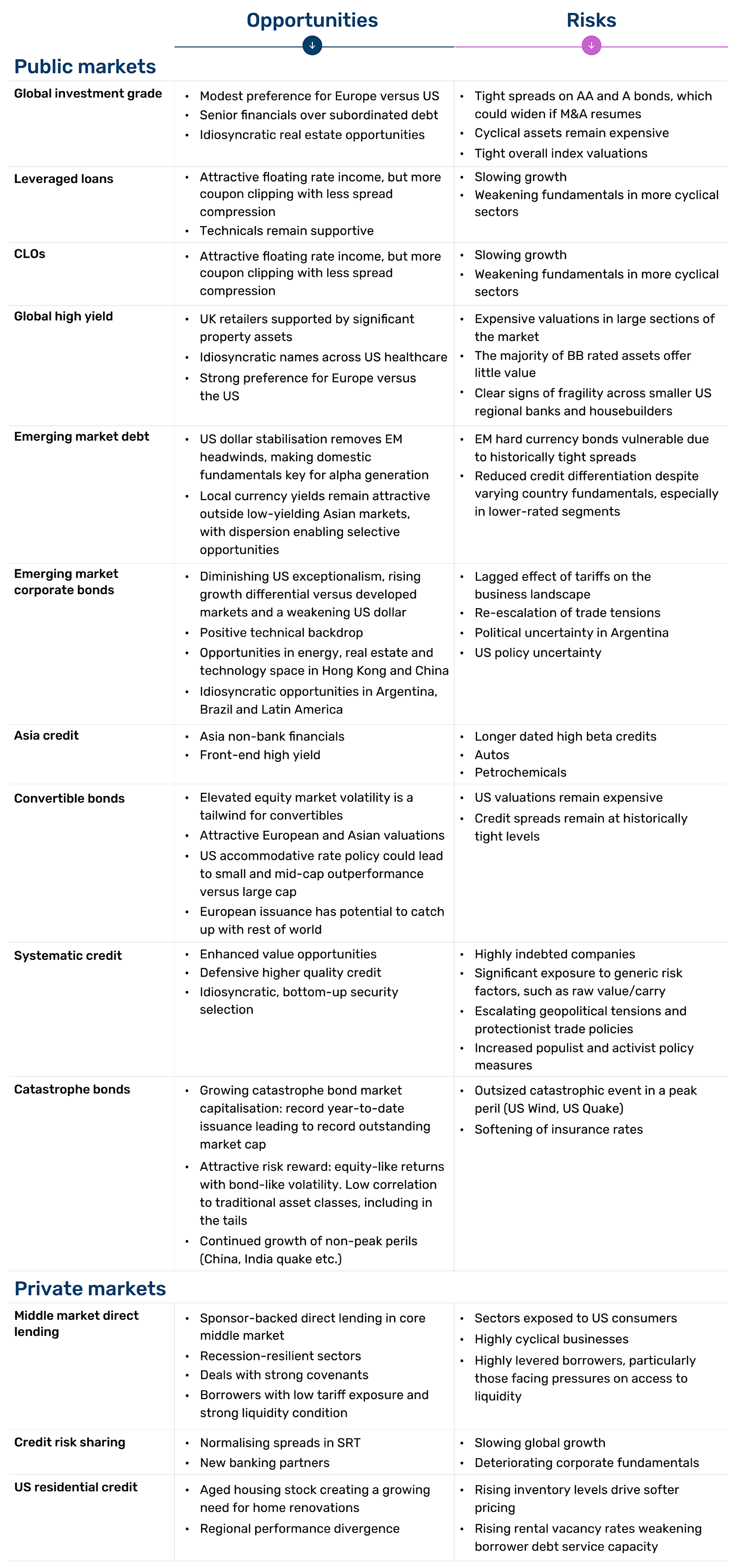

How we view credit markets around the world and across the capital structure

1. Source: JP Morgan.

For institutional use only. Past performance is not indicative of future results. All investments involve risk of loss. The views expressed are subject to change. This is not investment advice. Credit investments involve credit, interest rate, liquidity and market risks. EM investments involve additional political, economic and currency risks. Not reviewed by FINRA/SEC. Man Group is FCA regulated.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.