In focus

After a year dominated by geopolitical disruption and macroeconomic uncertainty, markets have recently fixated on a different concern: private credit. Recent high-profile defaults and fraud allegations have underscored the critical importance of distinguishing between credit market segments. Notably, the broadly syndicated loans at the heart of these cases operate with markedly different underwriting standards, documentation practices and lender oversight compared to core middle-market direct lending.

An equally important consideration is the timing of these events. Questionable structures typically emerge during economic booms, when underwriting discipline weakens and capital flows freely. They unravel during downturns, when the refinancing lifeline that sustained them dries up. Does this foreshadow broader stress in 2026?

Public credit markets have round-tripped

A glance at public credit markets, at least, would suggest not. Despite pronounced volatility throughout 2025, public credit markets have largely round-tripped – ending up close to where they began. Global high yield spreads currently stand at 304 basis points (bps) over government bonds, virtually unchanged from 305 bps on 1 January, despite widening around tariff uncertainty. Earnings multiples have exhibited a similar pattern: falling significantly in April before making a steady recovery. While spreads are not cheap across many areas of public credit, all-in yields remain healthy and fundamentals do not point to an imminent default cycle, barring a material deterioration in growth or employment.

Figure 1: Global high yield spreads are close to where they began

Problems loading this infographic? - Please click here

Source: Bloomberg, ICE BofA Indices – HW00 Index. Spreads are represented as option-adjusted spread for the ICE BofA Global High Yield Index over government bonds. As of 30 November 2025.

Figure 2: Earnings multiples have also made a steady recovery

Problems loading this infographic? - Please click here

Source: Bloomberg, as of 6 November 2025.

A weakening consumer

We see some cracks emerging, however. US real wage growth has slowed across all sectors except healthcare, eroding consumers’ purchasing power. The bigger risk we see, heading into 2026, is a slowdown in the wealth effect, compounded by persistent inflation. US consumers have enjoyed a substantial wealth boost driven primarily by home prices and equity markets. But given the froth in equity valuations and potential downward pressure on house prices in 2026, we expect consumers – particularly in the lower income deciles – to face continued pressure, likely resulting in slower consumption growth.

Figure 3: Slowing wage growth across sectors

Problems loading this infographic? - Please click here

Source: Bureau of Labor Statistics, employment by industry, monthly changes. Data as of August 2025.

Figure 4: Record levels of household wealth driven by home prices and equity ownership

Problems loading this infographic? - Please click here

Source: Bloomberg, based on data from 30 September 2019 to 30 June 2025. Wages based on ECI SA Index (Bureau of Labor Statistics Employment Cost Civilian Workforce QoQ SA); home prices based on FHFA (Fannie Mae) US House Price Index SA, S&P 500 based on SPX Index (price only) and inflation is US CPI Consumers index.

US regional banks remain under pressure

This environment has sharpened our view on financials. While we maintain a constructive outlook on European financials, the easy gains are gone after two years of strong performance and increasingly crowded positioning. The best opportunities have shifted to small- and mid-cap issuers, where valuations remain attractive and M&A activity could serve as a catalyst for outperformance.

By contrast, we remain cautious on US regional banks. Elevated exposure to commercial real estate presents a persistent headwind, compounded by potential weaknesses in broader loan portfolio underwriting. Notably, total criticised assets – loans or investments that regulators have determined to have a higher-than-normal risk of non-repayment or default – have been trending steadily upward and now sit well above 2020 levels, signalling deteriorating credit quality that warrants close monitoring. In general, the US is expensive and could be the epicentre of volatility should we see signs of slowing growth.

Figure 5: Rising problem loans in US banks

Problems loading this infographic? - Please click here

Source: Bloomberg, as of 30 September 2025.

What is our data telling us?

Our participation in significant risk transfers (SRTs) – which allow banks to reduce regulatory capital burdens and transfer some portion of credit risk to outside investors – provides an additional vantage point on credit market health. There, we have observed a modest uptick in defaults within leveraged finance, alongside increased pressure in the chemicals space. While risk premiums in industrial cyclical sectors have been relatively muted, intensifying competition from Chinese supply is creating new pressure points. Data also points to weakness in large-cap leveraged finance opportunities, as shown in Figure 6.1

What we find particularly striking amid these pressures is resilience in small- and medium-size enterprise lending. Specifically, European companies focused on domestic services have continued to operate strongly despite recent volatility.

Figure 6: Large corporate transactions are deteriorating more than SME and mid-corporates

Problems loading this infographic? - Please click here

Source: Man Group database. Based on Man Group's proprietary analysis and portfolio experience. As of November 2025.

Positioning for 2026

Looking ahead to 2026, we are optimistic about absolute yield levels in credit markets, but continue to believe all-in spreads at index levels look less attractive. This environment favours unconstrained approaches that search for value, rather than broad market exposures, particularly as many sectors remain vulnerable to significant widening should growth slow.

We believe three strategies merit consideration. First, focus on niche areas of private credit such as SRTs and core middle-market direct lending, which may sidestep concerns now percolating in broader markets. Second, for investors keen to capitalise on volatility, an allocation to opportunistic credit – which should thrive as volatility grips public and private markets – makes sense at this juncture. Finally, long-short credit strategies offer another avenue to build in some downside protection at cheaper prices given lower implied volatility.

In brief

In depth

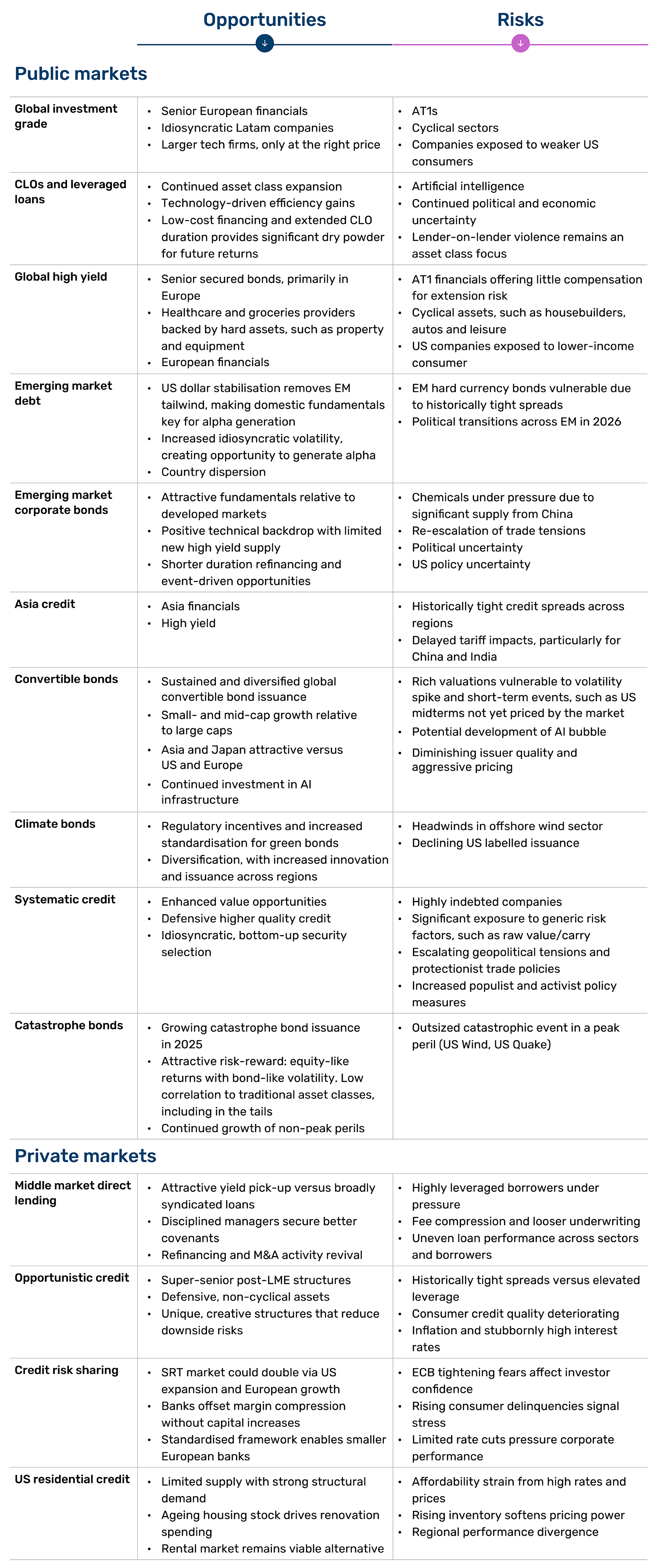

At Man Group, we have no house view. Portfolio managers are free to execute their strategies as they see fit within pre-agreed risk limits. With that in mind, click below to expand the 2026 outlooks from our different credit teams.

Public markets

2025 was the year the tech bros finally muscled their way into the bond market. Bumper deals from Oracle, Meta and Alphabet capped off approximately US$200 billion of issuance as the AI giants sought financing to power their infrastructure projects. Additional diversification is welcome, but it remains to be seen whether bond investors will be as receptive to smaller firms attempting to tap the market.

Returns were healthy across investment grade (IG) in 2025, with falling rates and tightening spreads supporting valuations. We have also seen the spread differential between European and US corporates normalise. Pockets of value have emerged in traditionally overlooked areas such as Latin America, where select US dollar denominated issuers reached over 400 basis points of spread above Treasuries during Liberation Day.

Looking forward, we believe it will pay to be defensive, particularly as other areas of credit are exhibiting signs of weakness. There’s little compensation for cyclicality; curves have steepened but fully reward investors for buying longer maturities while the pick-up for subordinated versus senior debt is minimal. 2026 will likely see further US rate cuts, even if inflation remains higher than anticipated, and spreads will likely widen. Spreads are once again below the 90bps mark, but they typically don’t stay this low for long.

Figure 7. The last 10 years: when IG spreads fall below 90bps, they rarely stay there for too long

Problems loading this infographic? - Please click here

Source: ICE Data Indices. Based on ICE BofA Global Corporate Index (G0BC), as of 3 November 2025.

In fact, the last time they did was April 2003 to July 2007, and we know what happened next…

We are set to eclipse another record year of CLO issuance and overall growth within the leveraged loan asset class in 2025. Leveraged loans continue to blur the lines between broadly syndicated and private credit, while pushing boundaries on duration and verticals-like infrastructure. Wider adoption has enhanced the size, scale and breadth of current offerings. The flexibility of the loan financing structure has underpinned this growth.

CLOs now exceed US$1.5 trillion globally, with US$161 billion issued in 2025 year-to-date. Broadly syndicated, private credit/middle market and European issuance have increased 14%, 24% and 55%, respectively, in 2025 to date. AAA execution, a bellwether of underlying market demand and structural health, has dropped below 120bps, creating a strong backdrop in 2026 with low-cost liability financing for loan issuers.

The asset class enters 2026 from a position of strength, with a significant increase in long duration and low-cost capital to deploy against disparate economic pressures. Key factors for 2026 include rate tailwinds, resilient US macro conditions, potential shifts from low global growth, structural eurozone weakness, and a resumption of M&A activity. Weakening consumer balance sheets and low employment growth present headwinds. Coupled with near term fiscal and regulatory policy uncertainty, the setup for 2026 remains dynamic.

Against this backdrop, we expect growing pains in 2026. The largest CLO managers have faced scrutiny, as the search for liquid investments has created similar portfolios while large defaults reverberated across managers and have increased the focus on underwriting standards and the chase for scale assets to meet demand. Increasing liability management exercises across the US and Europe, and to a lesser extent private credit, have masked default performance and created adverse or extended losses while extending optionality for private equity.

Additionally, intensifying AI spending leaves investors tasked with pre-selecting winners and losers. AI has added incremental complexity to credit selection, as AI efficiency also stands to drive productivity and margin enhancement for many companies. At the same time, uncertainty around AI deployment has increased fears of business disruption. We expect this narrative to intensify in the coming year, with strong technology adopters likely to outperform.

We expect 2026 to provide many opportunities for investors as technology, politics and global debt weigh on the varied potential paths forward. We believe the asset class is well-positioned, with sufficient dry powder and liquidity to drive returns.

Like investment grade, index-level high yield spreads appear to offer inadequate compensation for risk when compared to historic levels. However, the health of the global high yield market has improved markedly over the past decade and limited supply has kept spreads well contained. Despite tight spreads, dispersion remains prevalent across the market. This is particularly true in Europe, where we see opportunities created in debt secured on hard assets, such as property and equipment, and in sectors which remain cash flow generative even in times of stress, such as healthcare.

Our main area of concern remains the US, particularly those firms exposed to an increasingly stretched consumer. Auto repossessions are at their highest level since 2009, and loan delinquencies are rising across all markets. Markets aren’t paying for cyclicality and therefore we are avoiding sectors most exposed to a slowdown, including smaller housebuilders, chemicals and leisure. It is likely that poor credit underwriting across these sectors, as well as US regional banks, could lead to further pain in the new year.

Despite ongoing uncertainty, we remain positive on the ability of certain parts of the high yield market to deliver positive outcomes in 2026. The majority of Euro non-financial HY issuance in 2025 has been senior secured. This has been trending higher over the past decade, while areas of the private market have seen covenant protection move in the opposite direction.

Figure 8: Senior secured issuance has been trending higher

Problems loading this infographic? - Please click here

Source: JP Morgan, as of October 2025.

At this juncture, we favour simplicity: consistent cash flow and security. We prefer grocery providers backed by large property portfolios, and healthcare debt secured by specialist equipment and land, to deliver solid returns.

The Federal Reserve's (Fed) policy shift to easing, manageable global growth slowdown and subdued market volatility have created a benign backdrop for emerging market (EM) debt in 2025 to date. However, the Fed faces challenges as US growth may slow while inflation remains above the 2% target, with tariff pressures adding risk. EM dynamics in 2026 will also be influenced by key elections in Colombia (March and May), Peru (April), Hungary (April), and Brazil (October).

EM hard currency sovereign spreads continue to trade at the tighter end of their historical range, given positive developments such as stronger EM currencies improving external debt metrics, resumed inflows to the asset class and benign market conditions that have reduced repayment concerns for lower-rated sovereigns. Reduced spread dispersion and positioning analysis indicate the high yield segment remains particularly crowded. However, valuations and positioning can shift quickly in response to idiosyncratic factors, as demonstrated by Argentina following its elections in October. We continue to focus on country selection, favouring sovereigns with strong balance sheets, floating FX regimes that can adjust to restore macroeconomic balance and service external debt, and willingness to engage with multilaterals or countries of geopolitical importance to the West, particularly as global tensions rise. Looking ahead to 2026, we welcome increased volatility in the asset class as an opportunity to generate alpha.

For EM currencies, the tailwind from US dollar weakness is likely nearing exhaustion. While some hawkish repricing for 2026 occurred following the October FOMC meeting, this process is expected to accelerate as we enter 2026, providing support for the dollar. This shift will likely create a more range-bound trading environment where EM domestic fundamentals and valuations become increasingly important for generating idiosyncratic alpha. Given expectations for continued EM economic resilience, we believe EM FX carry will likely be the outperforming theme.

In local EM rates, local currency carry remains attractive when excluding several large, low-yielding Asian markets. EM central banks retain easing capacity given positive real rates and subdued domestic demand, which support lower inflation trajectories. Nonetheless, inflation pressures are rising in certain economies, including Brazil, Chile, Colombia, Romania and Hungary, prompting some central banks to adopt a more cautious stance. The dispersion in individual country yields enables selective targeting of compelling opportunities. Given fiscal risks are adequately priced in EM bonds, we favour EM high yield versus EM low yield allocations rather than an outright overweight to EM rates.

As 2025 has progressed, EM credit has demonstrated resilience despite tariff headwinds and isolated defaults among larger issuers. While cracks may be emerging in global risk assets, we believe EM credit is fundamentally stronger today than during correction fears in late 2021. The sector offers diversification opportunities and return potential, supported by improved credit quality, reduced China dependence and healthy demand/supply technicals.

Credit spreads in Asia have remained tight in the second half of 2025, underpinned by easing US-China trade tensions and supportive technicals. While the US-China relationship remains pivotal for EM flows and currently appears constructive, we would be surprised if President Trump and President Xi’s October meeting marked an end to policy volatility and would therefore caution against over-concentration in China. Nevertheless, we welcome the opportunities these calmer waters present.

In Latin America, political volatility in Argentina appears to be subsiding with President Milei’s surprising midterm victory, and we expect this to support corporate and municipal hard currency inflows. Defaults and stress in larger Brazilian credits, while initially concerning, appear to be outliers rather than precursors to broader distress. Importantly, fears about a repeat of the 2023 turmoil in Brazil have been put on hold, with defaults like Braksem and Ambipar stemming from issuer or industry-specific factors.

We believe European names offer limited value relative to LatAm and Asia, with the ongoing Ukraine conflict creating persistent uncertainty. In the Middle East and Africa, we are cautious on the health of select energy names and await price stability. We believe EM offers superior value and higher dispersion versus developed markets, creating opportunities for nimble active managers. As bottom-up investors, we see strong fundamental data underpinning EM corporate valuations.

Robust primary market conditions in both hard and local markets, combined with solid revenue growth, have enabled further debt reduction and maturity extensions. Notably, nearly 30% of 2026 EM high yield corporate maturities (ex-China) have already been refinanced or extended this year, significantly reducing near-term refinancing risk.

Overall, EM credit's improved fundamentals, meaningful regional diversification, and favourable technical backdrop position the asset class attractively, particularly as developed markets appear increasingly stretched.

Asia credit fundamentals remain robust following post-COVID deleveraging across key sectors. Credit quality has strengthened significantly, with rating upgrades outpacing downgrades at a 2.9x ratio year-to-date versus a 10-year average of 1.0x, reducing overall default risk. We expect upgrades to continue outpacing downgrades in 2026, led by high yield credits. While Indian airports and non-bank financial companies (NBFCs) show positive momentum, downward pressure remains on Korea chemicals/steel and EV battery producers.

Year-to-date performance has been strong, with Asia investment grade and high yield delivering 6.5% and 9.1% total returns, respectively.1 However, direct tariff exposure, particularly for China and India, poses risks that warrant monitoring.

That said, to date, India has maintained strong fundamentals despite US tariff exposure equivalent to 2.3% of GDP in exports. Macroeconomic stability is evident with sub-3% inflation, over US$600 billion in FX reserves, and a 0.6% current account deficit. S&P upgraded India’s sovereign credit rating to BBB, reflecting its improved governance and infrastructure.

China shows resilient headline growth amid structural headwinds. Growth in 2025 is running at 5% with a strong first half, though it is expected to slow to 3.5-4% by the end of the decade due to demographics and slowing property-led growth. Trade uncertainty and tariff risks persist, yet China retains 28% of global manufacturing output with stable local bonds and FX.

USD issuance is recovering significantly year-to-date, tracking toward US$180 billion, but it is still not yet at the pre-COVID annual supply level of US$300 billion. Strong technical support from reinvestment demand (maturities and coupons) has led to attractive pricing for issuers. Incremental demand is expected from three key sources: home-based investors returning to the market, US credit investors seeking Asia diversification, and China Southbound flows. The primary market has shifted notably from high yield to investment grade issuance and from EM Asia toward developed market (DM) Asia (Japan/Australia).

We favour high yield over investment grade given favourable carry-to-risk under positive credit momentum.

1. Source: Bloomberg. Asia IG based on JACIIGTR Index; Asia HY based on JACINGTR Index.

The convertible bond (CB) market has experienced a resurgence this year, delivering asymmetric returns. It has captured 75% of equity upside in rallies, such as the post-US election surge, while limiting downside to less than 46% during the Liberation Day-induced dip.1

At the time of writing, global CB issuance has reached US$125 billion for 2025, exceeding 2024’s year-end total of US$119 billion. We expect issuance to remain robust throughout the end of the year as November and December have historically been strong months for new issues globally.

Despite the recent fall in interest rates, the convertible market remains a source of lower-cost debt financing for companies seeking capital. Technology, Healthcare, Financials and Internet/Data companies have led issuance, with increasing participation from investment-grade firms. We believe capital needs for AI infrastructure investment will sustain current supply levels, provided the AI bubble does not burst, while continued AI growth could amplify the value of embedded equity options.

Small- and mid-cap growth stocks, which dominate the convertible universe, have driven gains alongside sectors such as Technology and Semiconductors. In particular, several small- to medium-sized convertible issuers tied to AI infrastructure, cryptocurrency, and aerospace, which do not have meaningful weightings in the equity indices, have contributed to the solid performance of convertible securities.

Looking ahead to 2026, we see the landscape for convertible bonds as broadly positive, supported by several structural tailwinds. Issuance growth and relative value versus credit (or equity in downturns) position the asset class well, assuming there are no severe macro shocks.

We believe small- and mid-cap growth continues to offer a multi-year tailwind to the asset class, though we do not think the current valuation gap is sustainable over the long term. At current relative valuations, the market is underestimating the productivity gain over the next decade across these businesses derived from AI adoption and the impact on margins and return on invested capital.

1. Based on MSCI World Index and ICE BofA Global 300 Convertible Index, as of 30 November.

The climate investment landscape has undergone a fundamental reassessment in 2025. US offshore wind faces continued pressure from policy uncertainty, elevated financing costs and supply chain constraints. The International Energy Agency's 25% downward revision to offshore wind forecasts – primarily reflecting US cuts – signals a recalibration period. However, European commitment remains robust, underpinned by energy security imperatives and policy support through the Wind Power Action Plan.

In the nuclear space, growing recognition that AI-driven electricity demand cannot be met through renewables alone is driving policy shifts. Spain's major utility companies’ pursuit of nuclear plant extensions exemplifies this pragmatism. As a result, we expect green bond issuance backing nuclear projects to increase in 2026, with EDF's successful nuclear green hybrid demonstrating investor appetite. Notably, we do not observe any premium on green bonds financing nuclear projects compared to those financing renewables.

Regulatory incentives are also materialising. Hong Kong's reduced capital charges on green bond holdings follow China's lead, creating structural demand drivers. The EU's taxonomy alignment push and Partnership for Carbon Accounting Financials’ (PCAF) proposal for use-of-proceeds carbon accounting could significantly differentiate green bonds from vanilla issuance, enhancing their value proposition for institutional investors.

Green bond markets are evolving with diversification across issuers, sectors, and regions. Whilst we have seen a drop in issuance from the US, European, Asian and emerging market issuance is offsetting this. Beyond traditional green categories, Tokyo's pioneering resilience bond and emerging blue instruments addressing water scarcity represent an evolution toward climate adaptation financing. This innovation broadens the investable universe while addressing previously underserved environmental challenges.

Sustainability-linked bonds (SLBs) face a new crossroads. ENEL, the pioneer and primary advocate of SLBs, announced it would no longer issue SLBs given that all climate KPIs have been met. Going forward, the company will only issue plain vanilla bonds. Rather than signalling obsolescence, we believe this validates SLBs as transition instruments. For hard-to-abate sectors and emerging market issuers lacking green project pipelines, SLBs remain essential financing tools. We expect modest growth, with increased focus on credible KPI structures.

Sustainable finance markets are entering a maturation phase characterised by realism over euphoria. Growing nuclear acceptance, regulatory incentivisation, instrument innovation and geographic diversification create a more resilient ecosystem. While offshore wind faces near-term headwinds, the broader sustainable finance infrastructure is strengthening, positioning the market for sustainable long-term growth.

The longest US government shutdown in history loomed well into the fourth quarter, casting further doubt on the effectiveness of negotiations across partisan lines for the year to come. The full economic impact from the shutdown and tariffs is yet to unfold, injecting additional uncertainty into Fed and global central bank policy decisions. Meanwhile, dispersion remains relatively tight, with credit spreads near their tightest levels across both investment grade and high yield through early November.

We believe credit markets are currently grappling with how to balance fiscal and political dysfunction against the resilience of corporate fundamentals and still-supportive financial conditions. Following the Fed's easing cycle that began in late 2024, front-end yields have stabilised, but the re-emergence of term premia – driven by elevated fiscal deficits – continues to influence spread behaviour and curve dynamics.

In this environment of heightened uncertainty, geographic and sectoral risk management will be critical. We believe the focus should be primarily on bottom-up security selection informed by company fundamentals, rather than significant top-down positioning in countries, sectors or duration exposures.

Our models are currently highlighting opportunities in defensive, high-quality credit. Given the uncertain macro backdrop, 2026 could see a return to the longer-term expectation of higher-quality companies outperforming, especially if inflation remains stubborn or growth disappoints, negatively impacting companies with more debt on their balance sheets that we tend to avoid.

With that said, heightened uncertainty creates both volatility and mispricing opportunities that can be exploited through active trading. Managers well-positioned to capitalise on the ongoing evolution toward electronic credit execution may be able to generate alpha through agile trading strategies with sufficiently low transaction costs.

Cat bond issuance for 2025 was the highest on record (over US$18 billion to 30 November 2025),1 propelling the outstanding notional to a record high of approximately US$55 billion.2 Industry insured losses for the first three quarters of the year were circa US$110 billion,3 with around US$40 billion attributable to the LA wildfires and US$57 billion to convective storms. Aside from the wildfires, other notable events included:

- An M8.8 quake (the sixth strongest on record) off the coast of eastern Russia

- AWS suffering a circa 15-hour cloud outage

- Atlantic hurricane Melissa making landfall in southwest Jamaica as a Category 5 hurricane, the strongest hurricane on record to hit the country

The LA wildfires may have been expected to push some aggregate deals to suffer losses, but a generally benign Atlantic season meant that bond prices largely recovered. The location of the Russian quake meant that it posed no threat to the insurance market, and the AWS outage did not affect any cat bond cyber deals. By contrast, Melissa was catastrophic for Jamaica, with the death toll tragically reported as at least 45,4 extensive wind and flood damage, and extensive power outages. Jamaica has cat bond cover in the form of IBRD CAR 136 (XS2806459314) as part of its disaster risk financing strategy. This US$150 million parametric deal has triggered and paid out in full to Jamaica.

Cat bond returns have historically had little correlation to rates, credit, or equities. 2025 was no different, with cat bond returns being largely immune to the financial market moves that we have seen, particularly around Liberation Day. This, plus positive returns, has helped maintain investor interest as we approach year-end.

On the supply side, we anticipate a very healthy issuance pipeline, with repeat deals interspersed with new sponsors and novel perils. We remain positive on the growth of cyber as a peril. However, of the US$805 million cyber bonds outstanding, more than 50% mature next year.5 As a result, we expect only modest growth of the peril in the short term but remain positive on medium-term growth.

1. Source: Man group database.

2. Source: Man Group database.

3. Source: Gallagher Re.

4. Source: The Guardian, Jamaica Information Service.

5. Source: Man Group database.

Private markets

We expect private credit to remain an important source of yield and diversification in 2026, with seasoned investors pointing to its relative value and outperformance during the zero-rate environment.

We see 2026 as a year of differentiation. The mislabelling of high-profile bank loan failures as private credit alongside mounting pressure amongst highly leveraged borrowers, underscores the importance of selection. Quality middle market lending, particularly sponsored deals with robust covenant packages, continue to offer attractive yield pick-up relative to the broadly syndicated loan market.

Items to watch:

- Origination and pricing discipline: With banks and some public lenders stepping back intermittently, managers with established sourcing networks and disciplined underwriting can secure better covenant packages and advantageous yield per turn of leverage

- Refinancing and repricing windows: As M&A and sponsor activity revive, opportunities to originate refinancings and add-on financings should increase. They are a source of attractive yields for active lenders with differentiated deal origination channels

- Structure matters: Growth in private debt AUM supports continued institutional interest despite idiosyncratic credit issues. Investors have pointed to the importance of the right structure for different channels, for example, institutional evergreen vehicles have different features compared to retail-focused evergreen structures such as business development companies (BDCs) and interval funds

Key risks for 2026 and how to manage them:

- Credit cycle and issuer stress: Macro improvement notwithstanding, loan performance can be uneven. Some forecasters expect defaults to moderate into 2026 while others warn of sectoral upticks. Investors must stress-test portfolios across rate and revenue shocks and avoid overconcentration

- Competition and strategy crowding: Fee compression and looser underwriting in search of yield can erode future returns; insist on managers' experience managing private credit portfolios across multiple cycles. Deal scarcity in the upper middle market can lead to significant name overlap across multiple managers. Transparency is important to ensure true diversification and low overlap across GPs

- Operational and structural risks: Collateral valuation, covenant enforcement and documentation quality matter – weak legal protections are expensive in downturns. Recent defaults have highlighted the importance of collateral management and air-tight documentation

2026 may herald a golden age of credit pickers, i.e. managers with disciplined origination, strong workout capability, transparent valuations and sector expertise. Carefully constructed private credit allocations are likely to remain a useful income and diversification tool for the long-term investor.

Entering 2026, the opportunistic credit landscape will face a mixture of headwinds and tailwinds, with robust technical conditions offsetting mounting fundamental concerns. High-yield bond and leveraged loan spreads hover near historic tights, at levels typically associated with benign credit environments. Yet beneath this appearance of stability, we believe some significant challenges are beginning to emerge.

While equity markets have reached record highs driven largely by enthusiasm over AI, US consumer financial health is beginning to show some signs of deterioration. Credit card delinquencies remain elevated, auto loan defaults are accelerating, and labour market momentum is decelerating. Despite these detractors to economic growth, inflation remains above the Fed's target, constraining monetary policy flexibility. Additionally, geopolitical uncertainties ranging from tariff negotiations to ongoing conflicts further cloud the outlook.

Moreover, recent high-profile defaults and fraud allegations have injected caution into the market. Banks are tightening underwriting standards and enhancing diligence protocols, while investors are demanding greater transparency. We believe this heightened scrutiny is overdue in a market where covenant protections have steadily eroded.

The liability management exercise (LME) wave continues reshaping the market. Through October 2025, distressed exchanges and LME transactions totalled US$47.9 billion across 51 events, maintaining the elevated pace from 2023 and 2024. These transactions have created bifurcated outcomes with both risk and opportunity.

In this environment, we believe 2026 will be a credit picker's market demanding patience, rigorous diligence and careful security selection. Our strategy emphasises three themes:

Firstly, we favour super-senior positions in post-LME capital structures where subordinated debt has been eliminated or significantly reduced, offering enhanced recovery prospects and structural protection.

Secondly, we are focused on defensive, non-cyclical assets with inflation-resistant or recession-resilient characteristics – such as investments in the power and energy transition sectors, music royalties, structured tax receivables and specialty finance assets with hard collateral.

Thirdly, we maintain disciplined underwriting standards, prioritising downside protection over yield maximisation when spreads inadequately compensate for risk.

While market technicals remain supportive near-term, the convergence of tight spreads, elevated leverage, weakening consumer fundamentals and geopolitical uncertainty creates an environment in which opportunistic credit investors must be increasingly vigilant and selective.

The global significant risk transfer (SRT) market has been growing exponentially in both market size and investor interest over the past decade, with 2025 looking likely to set yet another record year for issuance. Since 2016, default risk on more than €1.3 trillion of loans has been transferred using SRTs according to Barclays, with about a third of that in the past two years. The surge has been due partly to more banks using SRTs and partly to the spread of usage from Europe to North America. The proposed European framework outlined by the European Commission in June should expand their usage even further, allowing less sophisticated and smaller banks to benefit from the standardised structure. With continued growth and a nascent US market, it is plausible the SRT market could double in size over the next five years.

Importantly, in an environment of falling interest rates, banks turn to SRTs to offset margin compression, as they allow lending growth without increasing capital or lowering shareholder returns. Of course, there is caution from several corners when considering this level of growth, with the European Central Bank (ECB) looking to tighten regulation to ensure control. This is understandable, yet we have been investing in this market for 15 years and understand that the regulator moves slowly. Moreover, our banking partners are incentivised through the prolonged success of their SRT programmes to ensure tighter lending standards when taking default risk off their balance sheet. The expanded remit of reference assets and more bespoke deals mean experience and versatile underwriting approaches will be key from an investor perspective.

Overall, our focus will be on the health of corporate balance sheets and the US economy as a bellwether for defaults and loss-adjusted premiums required. Global growth firmed through the third quarter of 2025, with stable but above-target inflation and lower hiring. US GDP expectations remain high at 4% – positively impacted by a rebound in net exports following the first-quarter import surge, strong consumer spending and non-residential construction. Higher consumer finance delinquencies and a surge of home supply suggest lower-end consumers are increasingly under strain. Given reasonable growth despite sticky inflation, we expect fewer rate cuts than the six that are currently priced in before 2026 year-end. We will be monitoring growth and unemployment trends closely, as deterioration in either would pressure corporate financial performance while potentially triggering more aggressive Fed action.

We maintain a positive view on US housing, expecting slow and steady growth. As of 31 August, the Case-Shiller HPI returned +2.1% year-to-date, +1.5% year-on-year and -0.3% month-on-month. The market is supported by limited supply, strong structural demand, and growing renovation needs.

Rising home prices, high mortgage rates and the resulting lock-in effect have strained affordability, with taxes and insurance adding further pressure. However, recent equity market gains have supported continued housing growth by offsetting some rate-driven affordability challenges.

Inventory is rising from all-time lows and days on market are increasing, though both remain below pre-pandemic levels. Despite potentially alarming headlines, these trends simply reflect a return to normal market conditions. Regional performance will vary – watch the Sunbelt versus the Northeast and Rust Belt.

America's population and housing stock are both ageing. The median American has aged from 30 in 1980 to nearly 40 today, while the median home has aged from 31 years (2005) to 40 years today. Over 50% of US housing stock predates 1980, and modern consumers are reluctant to live in homes of that era. This creates sustained demand for home renovations and improvement spending. Meanwhile, residential investment represents just 3.4% of real GDP – near all-time lows.

Using the most recent data, the homeownership rate is 65% which is around pre-pandemic (2019) levels. While recent inventory gains have lifted vacancies to recent highs, available homes remain well below pre-pandemic norms, suggesting further room for inventory growth.

The rental vacancy rate declined to 7.0% in the second quarter from the first quarter’s recent peak, as the relative affordability of renting reduced empty units. Rentals remain a viable alternative for buyers priced out of homeownership. Pre-pandemic (2012-2019) rental vacancy averaged 7.4%. Regional variation is significant: South (9%), Midwest (6.6%), West (5.7%), and Northeast (5.2%).

Given limited housing supply, strong structural demand, and growing renovation needs, we continue to find attractive opportunities in US residential credit.

1. Based on Man Group's proprietary analysis and portfolio experience.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.