This article was initially published in Forbes on 10 September 2021. Please note that the data below has been updated since the original article was published.

Introduction

We live in a warming world. As investors, we need to recognise this and start thinking now about how to position our portfolios for a future of higher temperatures and more extreme weather events. The climate crisis will revolutionise the way we model risk and value companies: every investment decision ought already to be adjusted for the potential impact of global heating. Few, though, have looked in depth at the practical implications for the firms they invest in of a world that is hot and getting hotter.

Hope for the Best, Prepare for the Worst

Let’s start out with the most optimistic outcome possible. Let’s say that we achieve the Paris Agreement targets and temperature rises are kept to 1.5 degrees above preindustrial levels. Let’s say that targets are met and exceeded, that carbon emissions are cut aggressively, that the planet is bailed out through a mixture of human ingenuity, collaboration and technological innovation. Even then, we will have to live with changes to global temperatures that will dramatically alter life in many countries. We are currently around 1.2 degrees above pre-industrial levels and are already witnessing the havoc that comes with global warming – droughts, floods and wildfires. As I write this, Madagascar is suffering the world’s first climate change-induced famine. All of these will become more frequent and deadly, even if we ace the transition to net zero, and many of the consequences of the heating we have already experienced are still to come: there is a time lag involved that will become clear in the years and decades ahead.

As investors, we need to be realists and to recognise that we should both hope for the best while preparing for more challenging outcomes.

Accepting global heating can feel like an admission of defeat at a time when all of our efforts are ranged against it. But, as investors, we need to be realists and to recognise that we should both hope for the best while preparing for more challenging outcomes. Because it’s not hard to imagine a situation where, because of bad luck or bad policy or any number of unknown unknowns, we don’t achieve emissions reduction targets and are faced with dramatically increased temperatures and violently unpredictable weather. The truth, I imagine, lies somewhere between the two, but it’s worth repeating: even in the best of all possible worlds, we have to prepare for some level of global warming: indeed, it’s already here.

Global Warming: Implications for Investment Portfolios

It’s crucial to understand that temperature rises will not be uniformly distributed globally – some countries will see little change in temperatures, others will be profoundly impacted even in optimistic scenarios. And this has implications for investment portfolios.

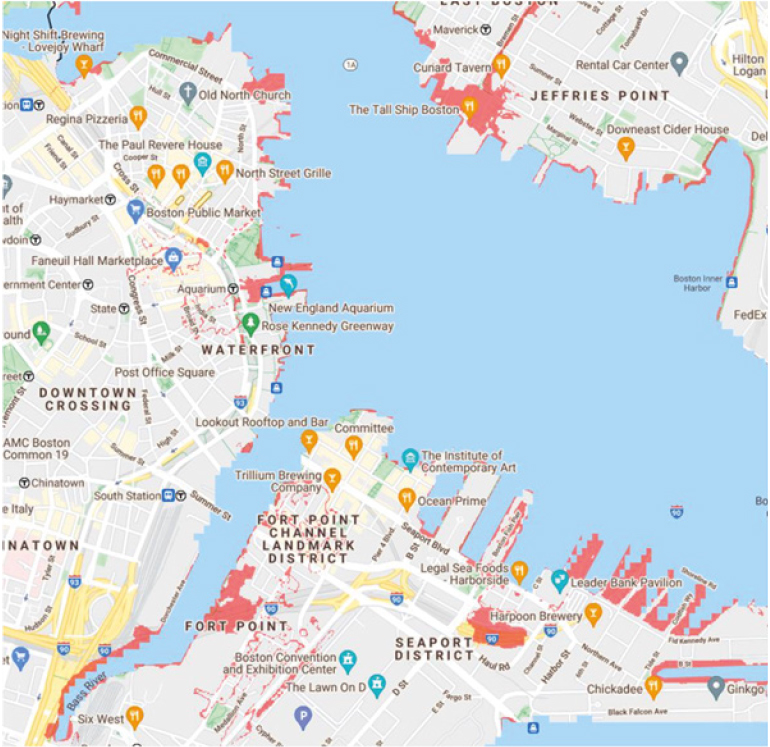

My colleagues Ashok Muthusamy and Matt Goldklang have been working on modelling the portfolio implications of rising temperatures. Partly, you feel, there’s something personal at work here. Ashok is based in our Boston office, in the Seaport District. Figure 1, from Climate Central’s SeaLevel project, shows Boston in 2050 – just 29 years away. All the areas in red, including the location of the Man Group office, are underwater.

Figure 1. Boston in 2050

Source: Climate Central – SeaLevel; as of September 2021.

Investing in a warming world requires investors to manage a number of risks. Firstly, there’s the cost of natural disasters. Researchers estimated that the catastrophic floods that hit Germany and China earlier this year were up to 200 times more likely because of the 1.2-degree change in climate we have already experienced. Similarly, the devastating heatwave that hit the Pacific Northwest this past summer was statistically impossible absent higher temperatures. Insurance premiums will rise sharply, real estate prices will see climate-related adjustments, new risks will have to be factored into the ways we do business. Investors should look at firms whose operations are concentrated in areas particularly exposed to natural disasters and adjust valuations accordingly. This can be done at a highly localised level – we model climate risk for individual facilities, recognising that different countries face very different risks.

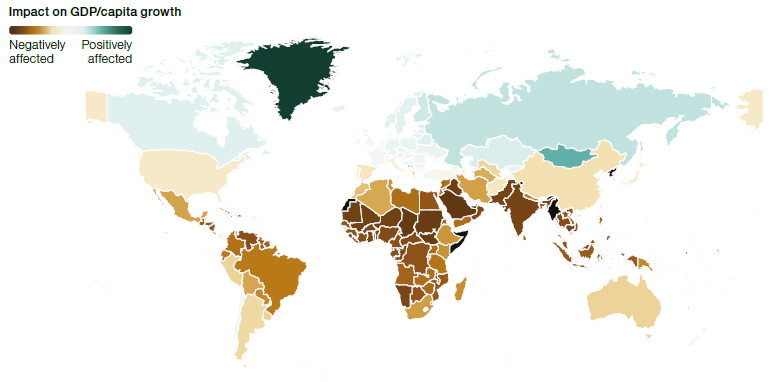

Then there’s the economic cost of rising temperatures. Figure 2 uses data from our in-house climate model to estimate the impact that global heating will have on different countries in 2100, presuming temperature rises are kept to less than 2%. This ranges from around an 80% drop in GDP/capita growth in countries including Saudi Arabia and India, to a markedly positive impact for countries including Finland, Russia and Canada. The clear message here is that inequalities between less developed and developed nations will be accentuated by climate change, leading to greater migration, civil unrest and, necessarily, lower earnings for firms operating in these countries.

Figure 2. Estimated Impact on GDP/Capita Growth due to Climate Change in 2100

Source: Burke, Hsiang, Miguel (2015). Climate projections from Man AI Climate Change Computation Systems (MACCS) using CMIP 6 SSP1-26 scenario, covering developed, emerging and frontier markets; as of 13 October 2021.

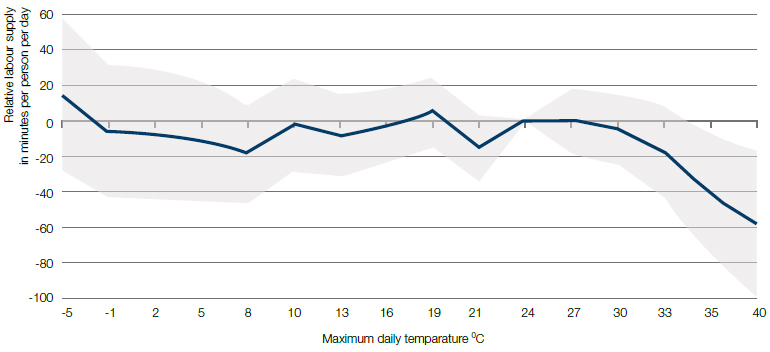

The corollary of this analysis is the impact of temperature on firms’ workforces. Figure 3 illustrates how the supply of labour changes under different temperatures. This analysis draws on the work of the American Time Use Survey and the paper ‘Temperature and the Allocation of Time: Implications of Climate Change’ by Graff Zivin and Neidell in The Journal of Labor Economics. It shows that there appears to be a series of sweet spots for economic activity in the mid-to-high teens, while productivity declines precipitously once temperatures rise above 30-degrees Celsius (86-degrees Fahrenheit) or sink beneath 10-degrees (50-degrees Fahrenheit). Here we look principally at the ‘high-risk’ industries of fishing, agriculture, forestry, manufacturing, utilities, mining and transportation. These will be hit hardest, but the relationship holds to a lesser extent for all industries.

Figure 3. Labour Supply Risk in High-Risk* Industries

Data Sources: 2003-06 American Time Use Survey (ATUS); World Bank; Following the work of Graff Zivin J, Neidell M (2014) J Labor Econ 32(1):1–26. *High-risk industry is defined as agriculture, forestry, fishing, and hunting; mining; construction; manufacturing; and transportation and utilities industries. Everything else is considered low-risk industry.

While the picture painted so far is a bleak one, we should not lose sight of the fact that there will be those who benefit from the change in temperatures. Large swathes of Russia and Canada, which were previously more or less uninhabitable because of their cold winters, will now be economically viable – Figure 2 shows clearly that those in far northern latitudes will see a positive economic impact from rising temperatures. There will be new routes opened up for ships through the Arctic Ocean, cutting transportation times for freight between Europe and Asia by up to a week.

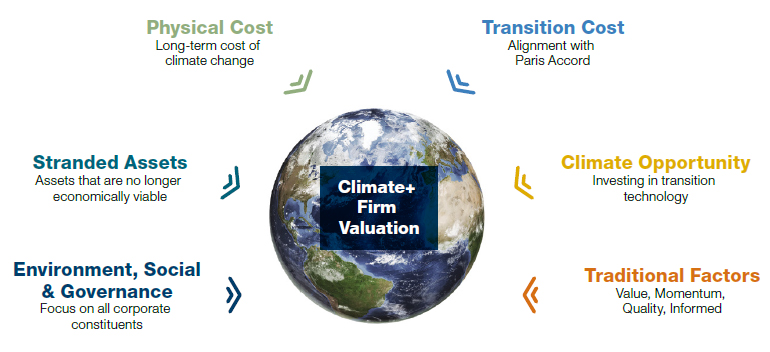

Figure 4 shows how we think investors should go about constructing a climate positive portfolio. Alongside the more common metrics of ESG (environmental, social and governance) performance and traditional valuation models (Value, Momentum and so on), we believe investors should look at a number of other factors. Many firms will have assets valued on their balance sheets that are ‘stranded’ – rendered worthless by the move to a zero-carbon future. This will be particularly common in the energy and mining sectors. The physical cost of climate change is the revenue and labour force implications of a warming world twinned with the impact of more frequent and catastrophic natural disasters. The transition cost represents the investment required to overhaul companies’ business models to operate in a world radically altered by climate change – this incorporates both the move to zero carbon and the geographical changes required to adapt to a new economic order. Finally, there are the opportunities presented by climate change, whether this be green technology, new shipping routes or the economic viability of areas previously too cold for humans.

Figure 4. Factors to Consider When Constructing a Climate Positive Portfolio

Sources: Man Group. For illustrative purposes only.

Conclusion

In the end, this analysis should leave us all with two key takeaways. The first – and this should go without saying – is the absolutely necessity of addressing the climate crisis before it’s too late. The second point is a more subtle one: that as stewards of capital and long-term investors, we need to be clear-eyed about the fact that change is coming and we need to prepare our portfolios accordingly. There will be winners as well as losers in the great climate revolution and new tools are required to negotiate a world whose priorities will alter unrecognisably.

Want to read more on how to position your portfolio for a warming world? Download our white paper here.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.