Introduction

Loan and high-yield issuance has been in the doldrums since early 2022, even allowing for a slowdown after the extremely high pace of 2021 (Figure 1). The explanation is unlikely to be that companies don’t need to raise cash, given the potential for an earnings recession this year.

Figure 1. Loan and High Yield Issuance, 2018-2022

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 31 December 2022.

This is the interest-cost conundrum faced by corporate management: how will they cope with the potential for double-digit interest costs during an uncertain earnings backdrop?

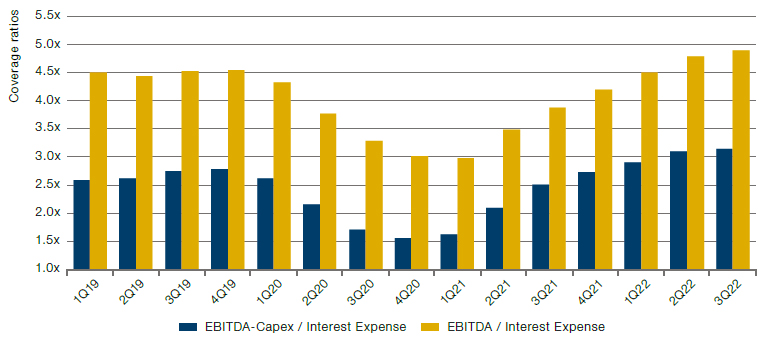

Rather, the lack of issuance seems to be attributable to companies grappling with the consequences of higher yields. This is the interest-cost conundrum faced by corporate management: how will they cope with the potential for double-digit interest costs during an uncertain earnings backdrop if they are forced to issue into today’s market? While interest-cover ratios have been at elevated levels for a few quarters now without a spike in defaults (Figure 2), we believe these have been sustained mainly by the numerator. If growth slows, companies won’t be able to rely on this support.

Figure 2. Coverage Ratios for Interest Expenses

Source: JPMorgan; as of 19 January 2023.

Can Convertibles Ride to the Rescue?

Caught between these pincers of the need to refinance and the higher cost of doing so, what options do companies have? We believe issuing convertible bonds could be a reasonable alternative for some, as they can offer companies a route to raise money with lower interest costs. A low-yielding environment underpinned the glut of high-yield and loan sales during the boom years, but the market for convertible bonds has barely moved in size through that time (Figure 3). A resurgence is now possible, in our view.

Figure 3. Size of Global High Yield and Convertible Bond Markets

Problems loading this infographic? - Please click here

Source: BofA Research; as of 31 January 2023. Reprinted by permission. Copyright © 2023 Bank of America Corporation (“BAC”). The use of the above in no way implies that BAC or any of its affiliates endorses the views or interpretation or the use of such information or acts as any endorsement of the use of such information. The information is provided “as is” and none of BAC or any of its affiliates warrants the accuracy or completeness of the information.

With rates likely to remain elevated the convertibles market is relatively well placed to see its value grow.

As is evident from Figure 3, the global convertible-bond market used to be much larger relative to the global high-yield market. The unprecedented (at the time) monetary response to the global financial crisis led to a dramatic shift lower in interest rates, significantly improving access to capital for high-yield issuers. As a result, the global high-yield market exploded in size from 2009 to a peak of $2.8 trillion in mid-2021 supported by low rates and investors hungry for yield. As rates have moved sharply higher since then, volumes in both high yield and convertible primary markets have dropped and both markets have witnessed a decline in their overall market value as a result. We believe, however, that with rates likely to remain elevated (that is, unlikely to return to extreme low levels) the convertibles market is relatively well placed to see its value grow.

Indeed, while issuance levels were disappointing in 2022 – a theme witnessed across the entire fixed income space – activity did start picking up towards the end of the year: 30% of last year’s volume came in the last two months of the year.1 While we do not expect an immediate return to the extraordinary growth witnessed in 2020 and 2021, we do firmly believe that the convertibles market is poised to see significantly more activity in the primary space this year. We expect this – combined with other factors, some unique to convertibles – to provide opportunities for investors to earn alpha.

A recovery in primary activity would be in keeping with the historical pattern, as periods of rising interest rates have typically been associated with greater issuance of convertible bonds (Figure 4). This makes intuitive sense rather than being pure coincidence: convertibles have traditionally been lower-duration securities while investors are compensated for their sometimes-lower coupons through convertibles’ embedded call option. Higher rates may also mean traditional straight debt borrowers could look to the convertible-bond market to raise capital in order to reduce their interest expense given historically lower coupons on convertible debt. We saw evidence of this during the early stages of the Covid pandemic, with high-yield issuers taking advantage of the quicker turnaround to raise rescue financing.

And while there is no immediate maturity wall to be concerned about for convertibles overall, refinancing activity picked up in 2022 and there is reason to believe that this will continue into 2023 as issuers with healthy balance sheets look to retire their outstanding debt at large discounts to their par amount, thereby realising significant savings. According to Barclays research, a firm considering issuing a straight bond yielding 6% could alternatively issue a five-year convertible bond at 1.67%, saving 433 basis points on the coupon size (assuming a 30-vol stock and 30% conversion premium, for simplicity).2 An 8% straight bond could be replaced with a 2.05% coupon convertible bond, saving 595 basis points on the coupon. Investment-grade issuers, which have pulled back from the convertible space in recent years, might also return to the market for a similar reason as rates remain elevated.

Figure 4. Proportionately More Convertibles Have Tended to be Issued When Financing Costs are Higher

Problems loading this infographic? - Please click here

Source: Man GLG; as of 23 February 2023. Average CB/HY issuance ratio calculated on a rolling three-month basis. Financing costs calculated as US 10-year Treasury yield plus high-yield option-adjusted spread.

To these long-term trends, we can now add that today premia on new deals have declined and average coupons have increased (Figure 5). This makes the market more attractive than in 2021, in our view, when more aggressive terms were priced in.

Figure 5. Average Premia and Coupons for New Global Convertible Bonds

Problems loading this infographic? - Please click here

Source: BofA Global Research; as of 31 December 2022. Reprinted by permission. Copyright © 2023 Bank of America Corporation (“BAC”). The use of the above in no way implies that BAC or any of its affiliates endorses the views or interpretation or the use of such information or acts as any endorsement of the use of such information. The information is provided “as is” and none of BAC or any of its affiliates warrants the accuracy or completeness of the information.

A further tailwind for convertible deals would be a period of relative stability in equity markets, which has historically led to increased issuance levels (Figure 6). This helps companies issue on more reasonable terms; that is, issuers are unlikely to be pressured into raising cash when their shares have been under a period of sustained weakness.

Figure 6. US Convertible Bond Issuance Versus Underlying Stock Returns

Problems loading this infographic? - Please click here

Source: BofA Global Research, ICE Data Indices; as of 31 December 2022. Reprinted by permission. Copyright © 2023 Bank of America Corporation (“BAC”). The use of the above in no way implies that BAC or any of its affiliates endorses the views or interpretation or the use of such information or acts as any endorsement of the use of such information. The information is provided “as is” and none of BAC or any of its affiliates warrants the accuracy or completeness of the information.

The convertibles market is one of the first to reopen after a sharp slowdown in primary market activity – and such early deals are usually attractively priced to appeal to investors.

For investors, we note too that liquidity remains healthy, despite the decline in market value last year. For example, in the US annual turnover (annualised trading volumes divided by market value) was circa 220% last year, comparing favourably with the equivalent turnover figure for US straight debt of approximately 150%.3 We furthermore believe the market has the capacity to absorb new paper, with by our calculations around $35 billion of 2023 maturities and another $15-20 billion likely to be called/put or possibly bought back by issuers.

In financial terms, we view new issues as another potential source of alpha. In 2022, new-issue cheapness was in line with longer-term averages (circa 0.8 points).4 Historically, and as we saw at the start of the Covid crisis, the convertibles market is one of the first to reopen after a sharp slowdown in primary market activity – and such early deals are usually attractively priced to appeal to investors.

Additionally, new issues give investors the opportunity to pick up yield versus comparable straight debt. The spread of non-investment-grade rated convertibles over B-rated debt expanded to almost 200 basis points at the end of 2022, the highest such level since at least 2012 and far in excess of the average of 54 basis points since 2012.5

Conclusion

The zero-rate environment of the past decade induced businesses to issue straight debt almost at will in the leveraged finance market. Now that we have a material cost of capital again, we expect new convertible issuance to become a more popular option. We therefore believe the next few years may see meaningful growth in the convertible bond market and create favourable trading opportunities in the process.

From an investor’s perspective, the convertible-bond asset class was affected in 2022 by its high-growth bias, soaring inflation and the material shift in global monetary policy. Rising interest rates detracted not only from bond values but also from the valuations of underlying equities. However, we believe bond floors have now found support as credit spreads have stabilised and convexity has improved markedly, in our view offering attractive risk/reward opportunities ahead for investors.

There remain plenty of opportunities to gain upside exposure to growth names that have repriced sharply to the downside.

The market now finds itself trading closer to bond values, characterised by out-of-the-money bonds offering attractive yields in the context of an environment where balance sheets in general remain healthy. We expect these bonds in particular – the so-called ‘busted’ convertibles – to be able to capitalise on a tightening of spreads while offering an attractive yield. We also believe there remain plenty of opportunities to gain upside exposure to growth names that have repriced sharply to the downside, while M&A provides further avenues for investors after an active year in 2022.

1. Source: Man GLG; as of 31 December 2022

2. Source: Barclays; as of February 2023.

3. Source: Man GLG; as of 31 December 2022.

4. Source: Man GLG; as of 31 December 2022.

5. Source: Barclays; as of 31 December 2022.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.