We expect convertible bonds to be well placed to outperform other fixed-income assets if rates continue to move higher.

As has been well documented, risk assets have been under heavy pressure this year as central banks around the world attempt to root out inflation through tighter financial conditions. Convertible bonds have not been immune to this weakness. Ordinarily at this point in the cycle – with rates going up and volatility remaining elevated – convertibles would be an intuitive choice, in our view. Despite current market conditions, we believe right now is no exception.

Firstly, with the lowest duration among mainstream fixed-income asset classes (not only now but also historically, as shown in Figure 1), we expect convertible bonds to be well placed to outperform other fixed-income assets if rates continue to move higher to fight persistently high inflation.

Figure 1. Duration for Selected Fixed Income Indices

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 30 June 2020. Indices used: Global convertible bonds - VG00; Global investment grade - G0BC; Global high yield - HW00; Global government bonds - W0GI.

This is the only part of the fixed-income market not structurally short volatility.

Secondly, given plenty of macro uncertainty, equity volatility continues to trend higher (Figure 2). This ultimately supports convertible bond valuations, in our view, as this is the only part of the fixed-income market not structurally short volatility, by way of its embedded call option that helps compensate investors for an often-lower coupon than is available from traditional bonds.

Figure 2. VIX Index

Problems loading this infographic? - Please click here

Source: Cboe; as of 19 July 2022.

In addition to these structural tailwinds, we believe there are some tactical reasons why convertible bonds could be an attractive prospect for investors right now. To begin with, the steep selloff in risk assets that began in late 2021 ranks among the largest market drawdowns in history; we are now in a position where starting valuations have been lowered dramatically. Furthermore, the convertible market has been reshaped by this, with the high-growth-focused names that dominated primary market activity since 2020 the most severely impacted by rising rates and broader macro weakness. Such primary deals, which came with record-low coupons and record-high conversion premia back in 2021, have seen their bond prices fall dramatically in unison with their underlying shares. Many are trading below their originally marketed bond floors due to their high sensitivity to rising rates and widening credit spreads.

Convertible bonds are currently trading at historically high levels of cheapness.

Such a glut of new paper over the past two years (Figure 3) was positive for the asset class in the sense that it certainly raised its profile and diversified the borrowing base into new sectors, but one downside effect was that market indigestion led to some significant cheapening in the secondary market. We believe, however, that this now presents opportunities for investors since convertible bonds are currently trading at historically high levels of cheapness relative to their fair value.

Figure 3. Primary Issuance of Convertible Bonds

Problems loading this infographic? - Please click here

Source: Bank of America Merrill Lynch; as of 30 June 2022*

The opportunity set is the most convex it has been in many years.

And so, with equity valuations having seen a sharp correction, the convertible-bond asset class is far more balanced, in our view, with less exposure to lofty growth stocks. Investors are still able to retain upside exposure to such names, but with convertibles now trading much closer to their bond floors on average, the opportunity set is the most convex it has been in many years. Indeed, based on the past 20 largest drawdowns in the US equity market, data from Bank of America Merrill Lynch show that during the following three, six and nine-month periods, US convertibles rallied by an average of 9.3%, 12.5% and 20.6% respectively.1

Convertibles are an oversold asset class within a broader credit market which itself is oversold, in our view. Adjusting for volatility differences between equity and credit markets before this current drawdown, our analysis indicates that credit markets have seen a correction twice as large as the one experienced by equity markets.

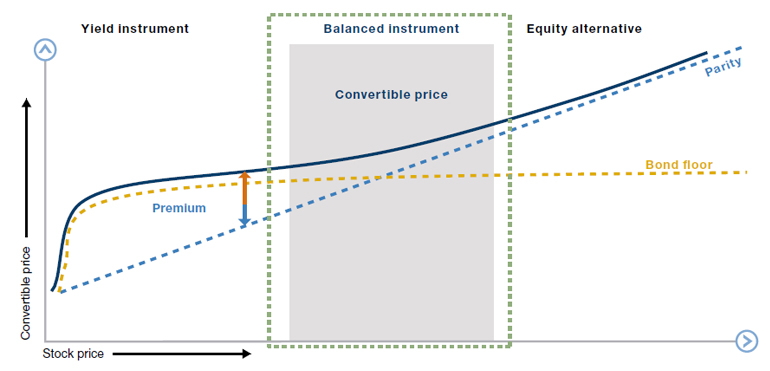

Interestingly, following this normalisation with bonds trading closer to their floors, a historically large amount of the market is classed as “busted”, whereby the embedded equity option is deeply out of the money (in the left-hand side of Figure 4).

Figure 4. Illustrative Profile of a Convertible Bond

Source: Man Group. For illustrative purposes only.

These busted convertibles, many of which are from the class of 2020 and 2021, have underperformed their theoretical deltas on the way down. In theory, at current levels they should be trading more like a traditional bond. History suggests, however, that it is these very bonds that are poised to outperform when markets recover and investors seek to benefit from their attractive yields and upside optionality. In addition, when strategists start downgrading growth expectations (as they are currently), this is usually when growth sectors have started to perform historically. Convertible bonds can give investors exposure to this dynamic.

Most of the asset class now trades with a positive yield to worst.

On the topic of yields, with such a large amount of convertible bonds in busted territory, most of the asset class now trades with a positive yield to worst – despite headlines outlining zero or very low coupons. Indeed, there are many instances where convertibles are trading far wider than the spreads of comparable straight debt (even from the same issuer). This could provide some very interesting opportunities for traditional fixed-income investors seeking to diversify into convertibles, as they are able to gain exposure to companies with either more upside potential or simply to companies who are not active in other parts of the fixed-income space. Most convertible issuers have only convertible debt on their balance sheet, for example.2

After the bumper levels of issuance in 2020 and 2021, there is no imminent maturity wall for convertible issuers to be concerned about; in general, we see them as well placed from a liquidity standpoint. Indeed, according to Bank of America Merrill Lynch data in June, around two-thirds of the market isn’t due until 2025 or after. There is plenty of time, therefore, for markets to stabilise before companies need to refinance. And as mentioned, with most convertible issuers having only convertible debt on their balance sheet, convertible investors have full control over their capital structure. Furthermore, while some have suggested that primary activity has been muted this year due to the inability of firms to access capital, we believe that it is more a reflection of a present unwillingness to tap the primary market following the massive financing activities of 2020 and 2021, which left firms in a favourable position.

Even if we end up in a recession in the near or medium term, we believe that the downside will be more limited than in the past. Firstly, we saw a wave of defaults in 2020 and in essence the time since the prior downturn has been too short. Companies have not had enough time to shake off their cautious stance and therefore have not yet levered up to excessive levels. This is evidenced by the low levels of activity in the primary fixed-income markets this year as firms remain happy to sit on their existing cash piles. Secondly, inflation means that firms are able to grow out of their debt even in recessionary environments. Debt is fixed in pre-inflated terms while their revenues (and profits) are in nominal dollars. Both of these factors make us confident that default rates will not reach their normal cycle peaks of 12-15%.

Convertible investors typically see strong gains from M&A as the embedded ratchet mechanism boosts conversion terms.

One final point worth highlighting is that takeover activity has been elevated in the convertibles space this year, after 2020 and 2021 were spent focusing on strengthening balance sheets. We expect to see more of these oversold companies (with good products but weak or negative earnings) being acquired by their larger competitors or strategic buyers. In particular, investment-grade-rated firms may look to use their significant capacity for additional debt to fund organic growth, while also remaining in the investment-grade bucket. Recent examples include the acquisition of US software firm Zendesk by an investment consortium for five times forward sales and the acquisition of video-game developer Zynga by Take-Two. Convertible investors typically see strong gains from M&A as the embedded ratchet mechanism boosts conversion terms, while conversely investment-grade approaches may see negative impacts from this trend.

1. Source: Bank of America Merrill Lynch, June 2022.

2. Source: Bank of America Merrill Lynch, June 2022.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.