Lumbered With Permanent ‘Transitory’ Inflation?

We’ve noted a series of price spikes since the start of the year across a range of commodities. Often driven by supply squeezes, they’ve faded almost as soon as a trend seems to emerge – much to the chagrin of those who see them as an example of a new inflationary regime.

Nevertheless, the spikes have an effect: while prices fall from their speculative highs, rarely do they return to pre-existing levels. A good example is lumber, which has fallen from a high of USD1,686 per 1,000 board feet, to a more modest USD630. However, USD630 is still some 42% higher than the pre-pandemic price.

While the Fed is correct to identify supply constraints as a key factor, if prices stay elevated after the bottlenecks fade, the inflation can no longer be called transitory. Could permanent transitory inflation be the next euphemism to describe current commodity price action?

Figure 1. US Lumber Prices

Source: Bloomberg; as of 28 October 2021.

Swap Rates in Perspective

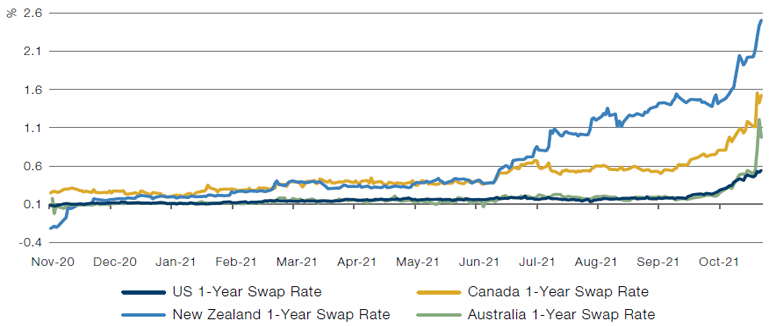

It’s not just the UK swap market anticipating rate hikes: the US, Canada, Australia and New Zealand are all experiencing large market moves.

As Federal Reserve Chair Jerome Powell indicates that it “is time to taper”,1 US 1-year swap rates have now risen 25 basis points in October (Figure 2). In other words, markets are now pricing that the Fed will not only begin tapering in 2021, but will enact a full rate hike by the end of 2022. The move has driven a corresponding rise in the US 10-year yield, which has increased by 10bps.

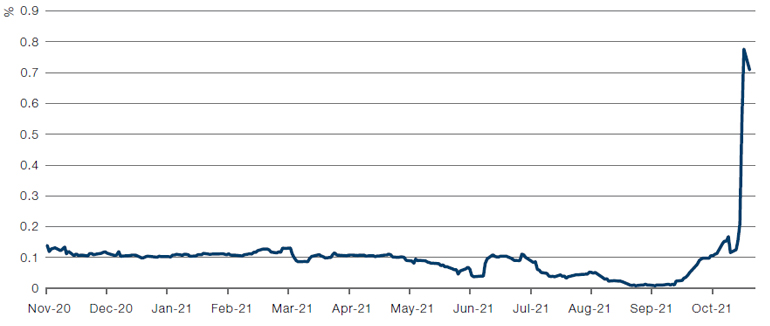

Likewise, on 29 October, the Reserve Bank of Australia did not step in to maintain its 0.1% yield target on its April 2024 note, as yields jumped to 0.8% (Figure 3). Canada and New Zealand also saw swap rates jump higher.

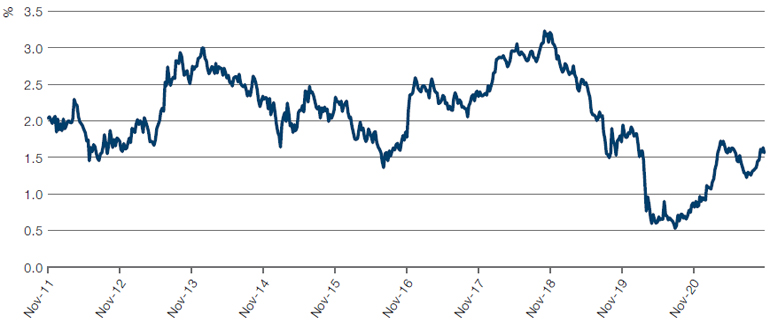

But however dramatic the charts appear, it is worth keeping these moves in perspective. In reaction to the 2013 Taper Tantrum, the US 10-year rose 130 bps (Figure 4). We would need to see a sustained move higher over the next six months to get anywhere near similar levels.

Figure 2. 1-Year Swap Rates - US, Canada, New Zealand, Australia

Source: Bloomberg; as of 28 October 2021.

Figure 3. Australia April 2024 Yield to Maturity

Source: Bloomberg; as of 29 October 2021.

Figure 4. US 10-Year Yield

Source: Bloomberg; as of 28 October 2021.

If Rates Rise, What Next for EM Debt?

If the Fed does indeed raise interest rates, what will be the consequences for emerging markets? Brazil and Turkey, two major EM economies, may offer an indication.

Prior to the pandemic, Brazil’s gross debt-to-GDP ratio had already risen from 40% to 90%. The ratio dropped somewhat in 2020, as interest rates were held at 2% – creating negative real rates as low as 8% at some points.

However, 3- to 4-year rates in Brazil are up by 600bps on the year, of which 240bps have happened over the last two weeks. Even though Brazil has experienced significant recovery this year, it is still facing a 6% budget deficit, 3% from the primary deficit and 3% from interest payments. If we see a continued rise in the interest rate to the 12% level priced by the curve, such a deficit could increase towards 10% or more as higher rates increase the interest due on existing debt. This would, at some point, lead market participants to question the sustainability of the debt.

In Turkey, inflation is running at roughly 20%. Despite that, the Central Bank of the Republic of Turkey (‘CBRT’) cut rates by 200bps on 21 October 2021 to 16%, at a time when it has substantial negative net reserves of foreign currency. With a very large amount of short-term debt coming due for the combined public and private sectors over the next year, this may force the imposition of capital controls in 2022.

Fed tightening often leads to something breaking down in emerging markets, and both Turkey and Brazil are already fragile. As the Fed starts to taper, we may well see a credit event in either economy particularly on the local debt – which may have negative consequences for the overall EM debt asset class.

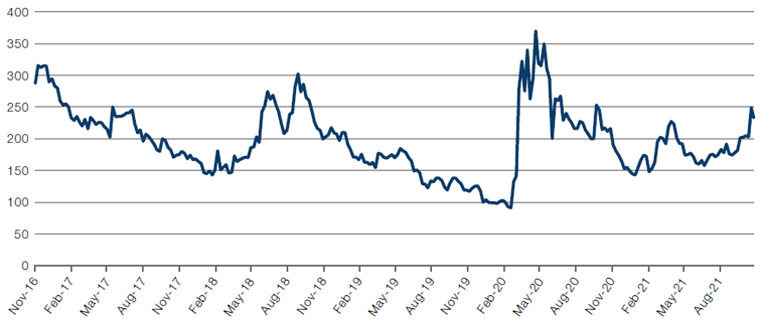

Figure 5. Brazil 5-Year CDS

Source: Bloomberg; as of 28 October 2021.

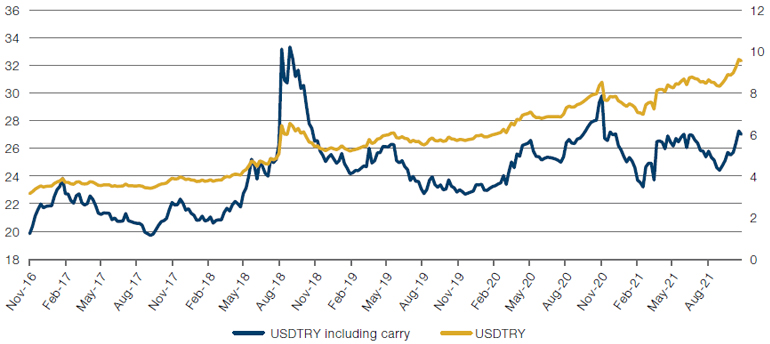

Figure 6. USDTRY

Source: Bloomberg; as of 28 October 2021.

Oil Supply Remains Low

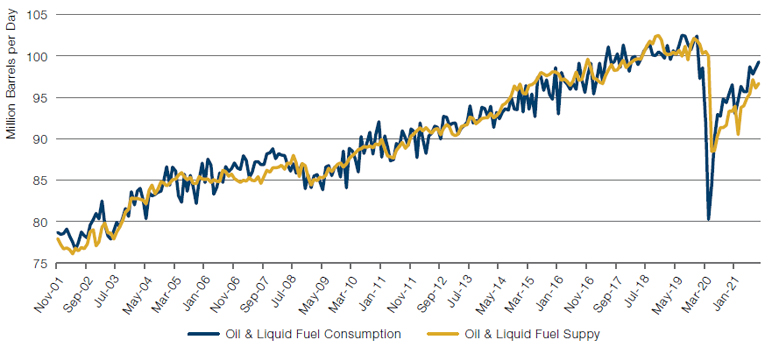

Oil supply is around six million barrels per day below pre-pandemic levels, with demand down by about three million barrels per day (Figure 6).

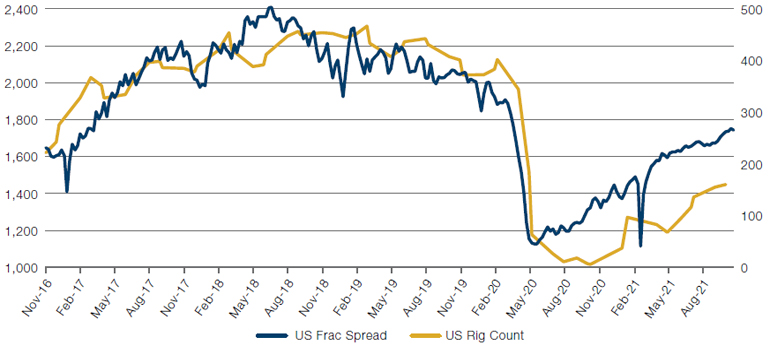

As we’ve previously written in our collaboration with the Good Judgement Project, oil companies are struggling to access capital and capital expenditures have collapsed relative to the early 2010s. Frac spreads (which count the deployment of the equipment needed to perform a fracking stimulation and connect a newly drilled well to a pipeline) are still down. Despite the recovery in oil prices, oil and gas rig deployments are still below 2016 troughs (Figure 8). This dynamic has created a scenario in which capital expenditure is low, yet free cash flow is elevated. As a result, oil firms are now using the excess cash to deleverage and increase dividends rather than invest in new supply.

It is worth making a distinction between short- and long-term price drivers. Over the short-term, making predictions about price levels may be a fool’s errand until winter demand for natural gas is better understood, and prices normalise, stabilising prices across the energy mix. In contrast, low supply and low exploration provide structural support for oil prices over the longer term.

Figure 7. Oil and Liquid Fuels – Global Supply and Demand

Source: Bloomberg; as of 28 October 2021.

Figure 8. Frac Spreads and Rig Counts

Source: Bloomberg; as of 28 October 2021.

With contributions from: Ed Cole (Man GLG, Managing Director – Discretionary Investments) and Guillermo Ossés (Man GLG, Head of Emerging Market Debt Strategies)

1. Reuters, “Time for Fed to taper bond purchases but not to raise rates, Powell says”, as of 22 October 2021.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.