Introduction

In April 2020, the world learned what only a few commodity futures specialists had bothered to think through – that physical delivery of crude in an oversupplied system with inadequate storage could result in negative front-month oil futures prices. On 17 April 2020, front-month West Texas Intermediate (‘WTI’) traded to -$40 per barrel. Since then, it has comfortably eclipsed pre-pandemic highs, topping more than +$80 per barrel.

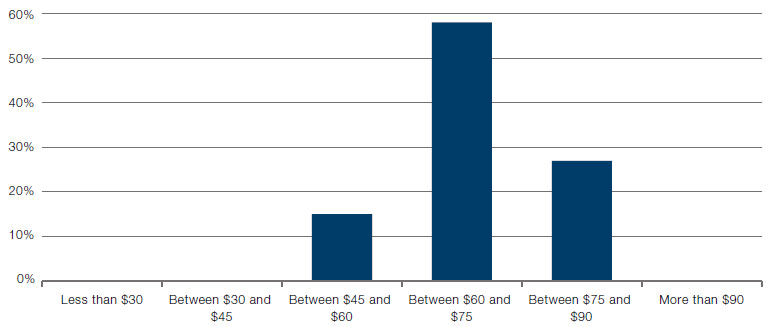

In August, in partnership with Good Judgement, we asked respondents their expectations for WTI prices for the end of 2021, against a backdrop of prices in the mid-1970s.

Where Might Prices Go?

The vast majority expect prices to be broadly where they are today.

Unsurprisingly, perhaps, given this short forecast window, the vast majority expect prices to be broadly where they are today. More interesting, though, is that the skew of other responses was almost twice as high for materially higher prices than for lower prices (Figure 1).

Figure 1. What Will Be the Closing Price per Barrel for West Texas Crude on 31 December 2021?

Source: Good Question/Good Judgement and Man Group.

Note: Survey was conducted between 1-31 August. The price of oil at the beginning of the forecast period was $74 per barrel.

Perhaps this just reflects recency bias – after all, an estimate of $76-89 captures price history in early July 2021. On the other hand, since Good Question (Man Group’s partnership with good Judgement) is all about harnessing the wisdom of a wise crowd, it is probable that this response captures something of the material longerterm supply challenges that have been building in the oil market for some years. Prior to the pandemic, the resource replacement ratio stood at just 14% – for every seven barrels consumed, one was added to producers’ resources. In 2013, before the Saudis unleashed a price war and upended the operating environment for onshore US producers, this ratio was closer to 35%. Producers have gone from a golden environment where price supported new exploration in higher cost supply, to one where access to new capital is deeply restricted. In a recent Dallas Fed survey1 of the local oil and gas industry, one of the respondents remarked (emphasis added, as if it were needed...):

Producers have gone from a golden environment where price supported new exploration in higher cost supply, to one where access to new capital is deeply restricted.

“We have relationships with approximately 400 institutional investors and close relationships with 100. Approximately one is willing to give new capital to oil and gas investment. The story is the same for public companies and international exploration. This underinvestment coupled with steep shale declines will cause prices to rocket in the next two to three years. I don’t think anyone is really prepared for it, but US producers cannot increase capital expenditures: the OPEC+ sword of Damocles still threatens another oil price collapse the instant that large publics announce capital expenditure increases.”

What this respondent did not mention, but many others in the same survey do, is that access to capital is severely impacted by ESG policies – regulators are leaning on commercial banks to factor climate change into lending decisions and investors are deeply concerned that investment into carbon projects that can become ‘stranded’ risks a negative NPV. As a result, industry capital expenditure intentions have collapsed (Figure 2). And, against the backdrop of high oil prices, this is resulting in elevated free cash flow generation (Figure 3).

Source: Bloomberg; as of 31 August 2021.

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 31 August 2021.

Problems loading this infographic? - Please click here

Conclusion: Structural Price Support

Substitution is clearly happening, but with around 1.5 billion vehicles in the global car park (versus only around 8.5 million electric vehicles), and no existing noncarbon solutions for shipping or aviation yet, that process will not be fast.

Oil demand continues to grow: pre-pandemic global crude demand grew at around 1.2% over three, five and seven years compounded. We see no scope for ESG policies and regulations to loosen. Substitution is clearly happening, but with around 1.5 billion vehicles in the global car park (versus only around 8.5 million electric vehicles), and no existing non-carbon solutions for shipping or aviation yet, that process will not be fast. The release valve over the short-to-medium term, absent a recession, will likely be price. Paradoxically, public equity in many oil producers has rarely been supported by so many positive factors. Companies are deleveraging and their unencumbered balance-sheets and free cash flow could present opportunities.

1. www.dallasfed.org/research/surveys/des/2021/2102.aspx#tab-comments

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.