Key takeaways:

- Markets’ enthusiasm following the Federal Reserve’s (Fed) rate cut overlooks emerging signs of strain among consumers and some companies

- Cyclical segments of the market have not yet translated recent data into wider credit spreads, warranting a careful approach to security selection in the coming quarters

- We see select opportunities across both public and private credit where investors can lock in attractive yields relative to declining money market yields

In focus

The last quarter was an eventful one, culminating in the Federal Reserve’s (Fed) surprise 50 basis points (bps) rate cut. Risk markets responded favourably, at least initially, but we believe this overlooks the uncertainty arising from recent economic data prints and earnings downgrades.

The slowdown in employment in the US and other economies, as well as declining wage growth, is leading to signs of strain among consumers. Household finances have deteriorated from lofty levels in the immediate era since the Covid pandemic. As shown in Figure 1, the percentage of credit delinquencies greater than 90 days is at near-term highs and is in fact approaching 2007 levels across both credit cards and auto loans.

Problems loading this infographic? - Please click here

We are also seeing signs of stress at the company level, with US discount retailers, sub-prime auto lenders and the global automotive sector all issuing significant earnings downgrades over the third quarter. Shrinking consumer demand is not solely a US phenomenon; there is increased evidence of growing pressure on both European and Chinese consumers. One potential glimmer of light is the Fed’s rate cutting pathway, which could help to unlock further easing from other markets, notably China, and this could alleviate some of these growth concerns.

Nevertheless, we are cautious about where we allocate within cyclical segments of the market, which have not translated some of the recent economic data into wider spreads (although we have seen significant repricing in equity markets). Indeed, credit volatility remains at very low levels. Against this backdrop, we believe investors need to adopt a careful approach to security selection on the long side, with more opportunity to implement convex shorts in the coming quarters.

Problems loading this infographic? - Please click here

The tug of war goes on

For investors, the tug of war between attractive yields and tight spreads continues. We see opportunities across both public and private credit, where investors can lock in attractive yields relative to declining money market yields in the upcoming quarters as the Fed will likely continue to cut rates. However, we must continue to be mindful that spreads remain at first quartile valuations across investment grade (IG), high yield (HY), emerging market debt, loans, collateralised debt obligations (CLOs) and many areas of credit, as shown in Figure 4.

Problems loading this infographic? - Please click here

Problems loading this infographic? - Please click here

In depth

At Man Group, we have no house view. As such, portfolio managers are free to execute their strategies as they see fit within pre-agreed risk limits. With that in mind, the outlooks below are from the different credit teams.

US rate cuts have finally arrived. We move into the next phase of monetary policy accompanied by a glut of issuance year-to-date and mixed views as to what’s next for the bond markets. Recent history indicates that total returns are typically positive following a rate cut, while excess (credit specific) performance can be more of a mixed bag.

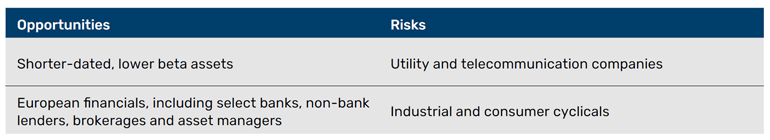

We believe that shorter dated, lower credit beta assets represent the best value across investment grade markets, while simultaneously targeting index-level modified duration. This enables our security-specific approach to build a yield advantage versus indices while also capturing the positive total return momentum associated with rate cutting phases.

In terms of sectors, we remain bullish on the health of European financials. Our focus is on banks that operate in less competitive market niches and have a low-operating-cost business model. Several UK institutions fit this bill, as well as some of the large incumbent banks which operate in smaller and more oligopolistic continental European markets. Away from banks, we have found opportunities in non-bank lenders, brokerages and asset managers, primarily. We have also begun to slowly scale back into North American firms such as business development companies (BDCs).

Conversely, we are avoiding cash-strapped utility and telecommunication companies which offer little in the way of value and face substantial capex needs.

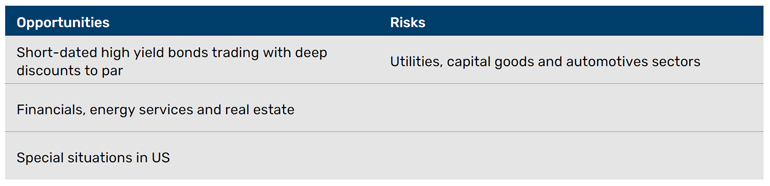

Fundamentals remain stable across the high yield market. Overall leverage remains below long-term averages although interest rate coverage ratios have slightly weakened. Defaults have been contained in low-to-mid-single-digit territory. While overall index credit spread levels appear tight, the all-in yield for the asset class continues to look attractive. There is also a significant amount of issuer level dispersion across sectors. While utilities, capital goods and automotives display relatively little spread between the companies perceived to be the weakest and strongest, real estate and media exhibit significant dispersion.

The aforementioned weakness in auto loans and credit cards is another indication that cracks may be deepening in the broader economy, and so we remain focused on shorter-term credit. Financials and even select energy firms have provided us with idiosyncratic opportunities to put capital to work. For the rest of the high yield market, we are prepared to be patient, build portfolios with significant spread advantages versus their indices and wait for better entry points into more cyclical parts of the global economy.

The market consensus for the Fed interest rate cutting path and overall risk-on mode seems driven by the belief that weak employment will outweigh US inflation concerns. We believe employment isn’t as weak as is perceived, nor is inflation as benign. Recent data defies expectations of a severe slowdown, showing stronger economic activity and inflation, with weaker employment. However, while the US unemployment rate has risen, the main driver is increased labour supply from immigration, not decreased demand. Meanwhile, inflation reaccelerated in August after a brief dip below 3% from May to July, losing the benefit of earlier oil price drops. With this benefit fading and the services component, particularly shelter, remaining high, we find it unlikely that US inflation will resume a declining trend.

Beyond the Fed’s policy, the upcoming US election poses a risk for the asset class. A Trump win could introduce risks from US trade and potentially inflationary policies, while a Harris win might lead to increased corporate tax rates, affecting the present value of financial assets and economic activity. Concerns about US fiscal health and Treasury supply are likely to persist, as neither party seems inclined to address the deficit. Escalating geopolitical tensions create further headwinds for emerging markets (EM), particularly for oil importers.

Despite challenges, our outlook for EM local-currency exposures has improved over the last quarter. In local-currency markets, more supportive EM currency valuations have helped to stabilise current account balances, though country-specific details on valuations and fundamentals remain crucial. Relative valuations have shifted, making several currencies more attractive. The overvaluation of some higher carry currencies, like the Brazilian real and the Mexican peso, has corrected or significantly reduced. Conversely, Asian currencies, which have rallied with the recent Fed move, show signs of complacency regarding the risk of tariffs that could significantly impact the region.

Additionally, with the decline in US Treasury yields, the spread between the JP Morgan Government Bond Index-Emerging Markets Global Diversified Index (GBI-EM Index) and five-year US Treasury yields has rebounded over 80 bps from the 180 bps historical low in April, reducing depreciation pressure on EM currencies from the US side.

Year-over-year inflation for EM countries in the GBI-EM Index is stabilising below peak levels. In countries like Brazil, and to a lesser extent Mexico and parts of Eastern Europe, inflation is attempting to reaccelerate, prompting some central banks, notably Brazil’s, to raise policy rates. Such hawkish moves will support EM currency performance. While this might not benefit local yield curves, we believe the primary returns for EM local bond exposures stem from interest carry and potential currency appreciation.

Turning to external debt, challenges persist given expensive valuations. The JP Morgan Emerging Markets Bond Index (EMBIG) spread is marginally wider year-to-date, but this is owing to movements in the CCC space. We believe the EMBIG spread, excluding defaulted or CCC-rated credit, provides a clearer metric for the asset class return opportunity (200 bps versus 342 bps) due to the impact of sovereign distress and defaults since the Covid crisis. However, this metric remains at historically tight levels. Given the current environment, we see limited potential for spread tightening and a significant risk of widening. Future positive returns depend on continued declines in US Treasury yields.

The Emerging Markets Corporate Credit team remains constructive on the outlook in the medium term. Defaults have been contained and activity in primary markets has largely dealt with upcoming maturity walls. Fundamentals are in good shape and on an improving trajectory - a positive story relative to developed markets. Further, a weaker US dollar and lower interest rates help to reduce funding costs and provide a positive tailwind for certain commodity-oriented countries. Additionally, the recent monetary and fiscal stimulus announced from China will likely have a positive impact on market sentiment, although it remains a little early to comment on the potential impact on the economy and business sentiment.

Supply has picked up but remains well below previous timeframes. Given the robust balance sheets of many banks, we are seeing a significant amount of refinancing through local currency markets. This has led to a reduction in the size of the EM high yield market, which has helped to keep spreads tight. Inflows in the EM debt asset class have been underwhelming over the last couple of years, so the asset is not overinvested, in our opinion. Investors continue to retain low allocations to EM corporate bonds, and we think there is room for crossover and dedicated allocations to increase, particularly if interest rates continue to fall. Importantly, a consistent rate cutting cycle could see retail investors return to the asset class.

Valuations in the JP Morgan Corporate Emerging Market Bond Index are a tad rich currently, in our view. However, given the factors stated above, and barring any geopolitical risks flaring up, we think that spreads can remain where they are or even get more expensive. We continue to maintain a barbell structure, focusing on high-quality carry in the front end of the curve alongside attractive opportunistic and special situations investments. Read more of the team’s views in their latest paper here.

Asia investment grade and Asia high yield achieved further credit compression and continued to outperform their US and other emerging market peers in the second and third quarters. The performance was mainly driven by stable credit trends and low defaults, strong supply/demand technicals (large negative supply compared to other developed markets) and favourable local government policies.

Looking ahead to the fourth quarter, we expect continued volatility from the upcoming US elections and global geopolitical conflicts, though this is somewhat mitigated by the Fed’s rate cuts. Asia credit could continue to enjoy the tailwind from its stable credit trends and supportive supply-demand technicals. The US beginning its rate cutting cycle allows Asia governments, China in particular, more flexibility in their domestic monetary policies. On 24 September, China injected further liquidity into the banking system and reduced the burden of borrowing costs, while boosting confidence in its stock market. We see more room for such measures as the Fed continues to cut rates, as narrowing interest rate differentials in turn eases the pressure on Chinese yuan devaluation. We expect more supportive measures towards the year end.

Lastly, higher carry, a supportive technical backdrop, including overall light positioning in China and Asia by global investors, should allow Asia credit to finish 2024 as an outperformer versus its global peers.

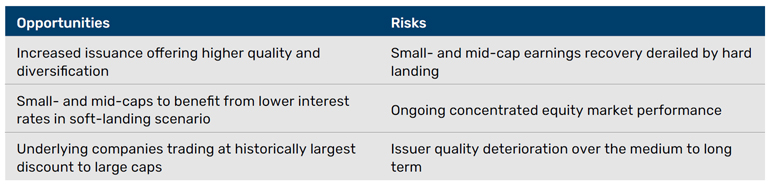

The outlook for convertible bonds (CBs) remains promising, in our view, particularly from a risk/reward perspective. Equity valuations in the convertibles universe – which is typically focused on small-/mid-cap stocks – remain attractive versus broader equities, with the Russell 2000 Index trading at a significant discount to the S&P 500 Index, for example. On top, we believe expectations of lower interest rates and a benign credit environment provide potential protection on the downside.

In the primary market, global issuance now totals approximately US$73 billion year-to-date (as of 31 August), up 40% year-on-year and on track to reach US$100-110 billion. We expect primary market activity to drive further expansion of the asset class, while an ongoing improvement in credit quality due to rising issuance of IG-rated paper (from 6% of volumes in 2022 to 38% in 2024 year-to-date) further supports the convexity profile. Despite Fed rate cuts potentially narrowing the rate spread between straight debt and convertibles, the change would have to be drastic to lower the overall appeal of convertibles for issuers.

M&A activity has also picked up in 2024 – particularly in the small-/mid-cap space and in sectors with decent exposure to convertibles such as healthcare and technology. We believe this will continue to act as a tailwind for convertibles, both from an issuance and takeout perspective as firms with outstanding convertibles are acquired (triggering embedded upside such as “ratchets” in the process).

Economic instability, elections and geopolitics, continue to create volatility, where CBs can provide value given the asymmetric characteristics of the asset class. Looking specifically at the upcoming US elections, the outcome may significantly impact CB issuers (given they are typically more domestically oriented than large-cap peers), and thus CB performance. Historical data shows better performance for convertibles under single-party control (regardless of who wins), suggesting a single-party sweep may be the most favourable backdrop for convertibles.

In short, outright convertibles remain the most asymmetric part of the credit market today, in our view. With the asset class offering a current yield of 1.7% and average premium to the bond floor of 18%, the mix of yield and downside protection is as attractive as it has been in several years. On top, investors can simultaneously retain upside exposure to small-/ mid-cap stocks that have historically performed well during rate cutting cycles and are also trading at historically attractive valuations relative to the large-/mega-cap equities which have driven headline equity index returns. The equity sell-off in early August served to demonstrate that convertibles are well placed for downside mitigation.

Direct lending middle market all-in-yields continue to remain attractive amid a backdrop of higher base rates and a relatively low level of defaults. However, spreads remain at or close to historically tight levels given the heightened competition among the broadly syndicated loan (BSL) market and direct lenders looking to deploy freshly raised capital. Direct lending middle market loans continue to demand a liquidity-driven yield premium to BSLs. Historically during periods of market disruption, the middle market premium has increased and remained higher than BSLs over a sustained timeframe. As of the second quarter, middle market direct lending term loans commanded approximately 100bps of spread premium when compared to middle market syndicated term loans, which is wider than the historical average. While the current Secured Overnight Financing Rate (SOFR) forward curve implies approximately 100bps of monetary easing by year end, which will provide modest relief to interest burdens and M&A activity, we do not anticipate interest rates returning to the zero bound – barring a severe exogenous event.

Credit selection will remain central in delivering compelling risk-adjusted returns. As we anticipate late-stage credit cycle dynamics to persist, we remain focused on non-cyclical, recession-resistant, or recession-resilient sectors in order to mitigate downside risk. These include sectors with long-term structural tailwinds such as healthcare, software and technology, and B2B services.

The middle market offers plenty of opportunities to lend to attractive businesses models with stable and potentially growing cash flows. We expect seniority within the capital structure via first lien structural protections will provide further downside mitigation of potential losses in the event of a severe economic downturn. Credit risk is mitigated further in the core middle market, as lender-friendly documentation provides greater safeguards in comparison to the upper middle market and broadly syndicated loan market, with stronger covenant packages, more frequent financial reporting, higher excess cash flow sweep requirements, and higher amortisation payments.

Last quarter, we wrote: “our approach to US residential credit remains active and capitalises on healthy underlying markets, benefiting from structural protections to insulate investors during times of macroeconomic uncertainty. We expect to see this current market dynamic persist, with compelling opportunities for investors seeking income-driven returns from low-volatility, diversified credits backed by liquid residential collateral”. This remains true today, as the Fed’s cutting cycle gets underway.

The expectation of a rate cut had already fed through to mortgage rates, with 30-year fixed rates falling to 6.2% in the days prior to the cut from 6.7% at the start of August, and the 7.8% peak in October 2023. Meanwhile, the dearth of supply means home prices continue to grind higher and affordability will continue to be a challenge for would-be home owners until rates come down significantly and the lock-in effect is reduced. On the flip side, these dynamics are supportive for residential credit, where stable home prices, low leverage and improving financing costs provide opportunities to continue to deploy capital at attractive risk-adjusted returns.

Capital has continued to flow into the space via the residential transition loan (RTL) securitisation market, with nine further securitisations issued in the third quarter (both rated and unrated) at tight spreads, while coupons on the granular, newly originated loans have largely remained flat. Looking ahead to the rest of the year, we favour levered opportunities in the RTL space and the potential to finance new construction as builders turn on supply amid further Fed cuts.

Total US CLO issuance of over US$315 billion year-to-date, when combining new issues, resets, and refinancings, has cemented 2024 as one of the busiest years on record. Although we project above average CLO deal activity to continue through year-end, we expect a deceleration in new issue CLO activity supplemented by continued robust reset and refinancing activity as deals issued in recent years, when liability spreads were wider, seek to reduce their weighted average cost of debt. Rich CLO collateral prices make the economics of new issue CLO formation challenging in the near term.

In Europe, after near-record issuance in the first three quarters of 2024, we expect CLO formation to slow. The combination of declining asset spreads, particularly the BB and B-rated components of the European Leveraged Loan Index, and decreasing new-issue loan OID (original issuer discount), coupled with CLO liability spreads that have tightened significantly since the beginning of the year, has essentially placed the Euro CLO market into the proverbial chess position of “check.”

To move out of the check position, most likely AAA spreads will continue to compress as programmatic euro AAA buyers will have less pricing power as fewer new issue CLOs come to market. A mild correction in asset prices will allow the Euro CLO market to return to more historical issuance levels.

2024 has been a very busy year for US leveraged loan issuance, with total volumes year-to-date of US$908 billion. However, net new issuance has been low, with US$115 billion of non-refinancing or repricing activity. Loan collateral fundamentals are expected to remain stable or perhaps improve as issuer cash flows increase, alongside declining SOFR rates. The reduction in SOFR will increase interest coverage and significantly benefit those issuers with low coverage ratios.

We expect opportunistic issuance to continue, with modest contributions from leveraged buyout (LBO)/M&A activity. However, significant increases in LBO/M&A activity aren’t expected until at least the first half of 2025. Despite modest retail outflows due to the shift in the trajectory of rates, CLO demand should absorb them, maintaining a stable coupon-clipping environment through year-end, barring volatility from economic data, geopolitical events, or excess short-term primary loan supply and of course, the US election. The biggest intermediate-term risk to the loan market remains aggressive liability management exercises.

The significant risk transfer (SRT) market, a form of securitised CRS, continues to exhibit strong growth fundamentals, with Pitchbook data indicating the market is set to reach an estimated US$28-30 billion in 2024, versus a then record US$24 billion issued in 2023. This is largely based on a strong second-half pipeline. The second half of the year has begun with a flurry of issuance, with collateral pools concentrated in the levered finance and mid corp range. As befits a traditional SRT issuance calendar, we expect a higher proportion of large corp, investment grade-heavy deals to come to market towards the end of the year.

Importantly, while we saw the Fed warming to the idea of SRT in the first half, over the summer, an increasing number of European banks, notably AIB and Natwest, have detailed their increased usage of SRT transactions in their first half results. Several recent reports from Bloomberg also highlight an increased pipeline with numerous deals expected in the second half for BNP, Credit Agricole, Intesa, Unicredit, Helaba, Bawag and Deutsche Bank. We are thus seeing positive sentiment for SRT globally. We are looking forward to exploring a wide range of transactions in the fourth quarter, building long-term relationships with banking counterparties across Europe, as well as the newer markets of the US and Canada.

1. JP Morgan, as at 1 October, 2024.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.