Introduction

A year-end trip to Tokyo certainly confirmed our pronouncements early last year that this time is different. Our analysis then centred on why the Tokyo Stock Exchange’s new governance framework would invigorate corporate Japan, eclipse previous efforts and predominantly benefit value stocks. The strong commitment by the Tokyo Stock Exchange, combined with the nation’s desire to finally lift Japan out of a three-decade deflation slump, resulted in a fascinating and eventful year for Japan’s economy and the stock market.

The questions often asked are ‘Is there fuel left in the Japan Value tank’ and ‘are you still finding enough buy opportunities?’ The answers are yes and yes going into 2024.

Investors (including Warren Buffett leading the charge of foreign money) took note and Japan’s benchmark indices touched highs last seen thirty years ago as the economy profited from a post-Covid bounce. Many companies made efforts to raise prices and exporters benefitted from a weak yen, the Bank of Japan took slow steps to exit its super easy monetary policy stance, wages finally started to rise, and the country’s corporate governance revolution gained momentum.

This often prompts the question “is there fuel left in the Japan Value tank” and “are you still finding enough buy opportunities?” The answers are yes and yes going into 2024. This report outlines the five reasons why the improvements witnessed so far are just the start of a long-term upward trend in economic growth, market performance and corporate reform for Japan.

1. The corporate governance revolution. A generational change for Japan.

Corporate Japan is undergoing the most radical reform in a generation and momentum continues to build. Last year the Tokyo Stock Exchange (TSE) issued an improvement order to any company trading below a price-to-book (P/B) value of 1x to enhance their capital efficiency and plans to require non-compliant companies to disclose action plans to increase the ratio.

Throughout 2023, a flurry of buyback announcements from companies with excess cash or significant cross shareholdings were made. But Japan has only just started to embark on this journey. A radical enhancement of capital efficiency, including business restructuring and the disposal of surplus assets, often takes time. This will therefore likely continue to be a long-term story. Given the scale of improvement required by Value stocks, this should continue to benefit the Value style.

In the closing months of the year, Toyota Motor announced its decision to reduce several major cross shareholdings including stakes in Denso and KDDI. Historically Japanese companies took stakes in their group affiliates or business partners, a practice known as cross-shareholding. Companies have been slowly unwinding these holdings for years but the recent requests from the TSE have accelerated the movement. Such announcements by large, influential corporates should also be positive for the whole of corporate Japan and should make conversations around cross shareholding reductions much easier.

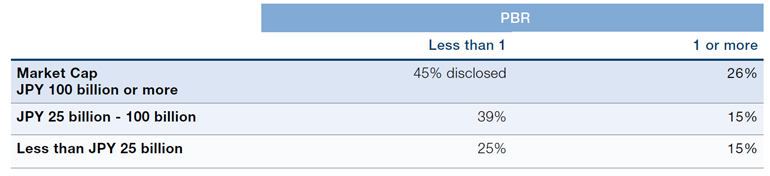

Figure 1. Disclosure Status by Price-to-Book Ratio (PBR) and Market Capitalisation (Prime Market)

Source: Japan Exchange Group.

As of mid-July, 31% of Prime companies disclosed initiatives on improving their corporate value to the TSE. The biggest impact has been on larger companies with low PBR. 45% of companies with a market cap greater than Y100bn ($709 million) and less than 1x have disclosed while high PBR and low market cap disclosure has been weaker. The TSE is determined to keep the momentum going and improve corporate governance and value even for companies with a PBR above 1x. The latest TSE initiative includes naming and highlighting companies that have already disclosed their improvement plans in addition to a request for companies to explain the significance of having listed subsidiaries and detail their efforts to ensure subsidiary independence.

This is not a box ticking exercise. Rather, the TSE is pushing for genuine change and will require a clear explanation if any corporate is not joining in.

2. A slow and steady approach from the Bank of Japan

Speculation surrounding the Bank of Japan’s short-term, incremental moves has dominated headlines in 2023. But its path of super-low interest rates is a well-trodden one; initially announcing its zero-interest rate policy (ZIRP) in February 1999. Since then, several attempts to exit its ultra-easy stance have ended unsuccessfully and despite its best-efforts stubborn deflation has persisted. Now the central bank has its best chance in decades to finally end structural deflation and Governor Kazuo Ueda will not want to miss this chance by prematurely tightening and raising rates too early.

Figure 2. Interest rates have been ultra-low for more than two decades

Problems loading this infographic? - Please click here

Source: Refinitiv Datastream.

Japan’s policy makers want to see an end to structural deflation and a more permanent shift to steady economic growth. Inflation has returned and in fact reached a 40-year high in 2023.

Japan’s policy makers want to see an end to structural deflation and a more permanent shift to steady economic growth. Inflation has returned and in fact reached a 40-year high in 2023. Business-to-consumer price hikes are steadily feeding through. Japanese newspapers have been filled with “shocking stories” on double digit price increases for food staples this year. But prices for many everyday products remain low, particularly when compared to overseas prices. A convenience store coffee in Tokyo still costs as little as 100 yen (55pence)! For a nation that has experienced three decades of persistent deflation, corporate and individual mindsets will take to time to adjust to this new environment. Our discussions with corporates have highlighted how tough the pricing environment still is, particularly on a business-to-business basis. We are still some way off a full-scale acceptance of persistent price hikes and there are no clear signs in the data yet that the BOJ needs to tighten policy significantly. While the central bank increased its 2024 inflation forecast its prediction for 2025 CPI excluding fresh food and energy remains below the crucial 2% level.

Market expectations are for a BoJ exit of Yield Curve Control (YCC) and negative interest rate policy (NIRP) sooner rather than later. However, it is imperative to focus on what comes after any initial announcement. Even if the BoJ removes YCC and moves away from NIRP, policy makers have signalled that they will tread carefully and refrain from tightening policy too quickly – meaning investors should probably prepare for a lower-for-longer regime.

Figure 3. Is this the end of structural deflation?

All Y-oY CPI data less fresh food and energy

Problems loading this infographic? - Please click here

Source: Refinitiv Datastream.

Market speculation surrounding monetary policy normalisation has fuelled the strong performance of Japanese banks which outperformed the wider market by over 75% between their 2020-low and the recent peak in November 2023. Given the more gradual approach to normalisation, better opportunities can be found within non-bank financials and other domestic assets such as railways and real estate. These are Value areas of the market that after an extended period of QE followed by the pandemic, remain attractively valued, but should also benefit from a shift towards domestic reflation.

3. The government is determined to reflate the economy through wage increases, tax cuts, asset management reforms and increased corporate investment

Prime Minister Fumio Kishida has outlined plans for a “ new form of capitalism,’’ involving a push for corporate Japan to consistently increase base wages and widespread asset management reform.

It is not just the BoJ that is striving for widespread change in Japan. Prime Minister Fumio Kishida has outlined plans for a “new form of capitalism’’ in Japan to drive future growth. This involves a push for corporate Japan to consistently increase base wages and widespread asset management reform to create a positive cycle where household assets are channelled into investments in a virtuous cycle.

And efforts have been made to boost the nation’s appeal as an investment destination for strategic sectors The Kishida government is planning a two-pronged approach to bolster investment. Firstly, domestic corporations, including small and medium enterprises (SMEs), are being encouraged to improve productivity and increase domestic capital expenditure to spur economic growth. Secondly, the government hopes to attract capital from overseas and increase new business opportunities from abroad.

The investment strategy for domestic and overseas corporations rests on Digital Transformation (DX) and Green Transformation (GX), as well investment by strategic sectors such as semiconductors1. We’ve already seen the fruits of these endeavours when last year when several global semiconductor firms announced heavy capacity investment in Japan. The restructuring of global supply chains for semiconductors as a result of rising global geopolitical risks has served as a tailwind for the bold plan. He is also keen to attract more highly skilled foreign professionals.

Still, in order to see a real change in mindset in Japan, sustainable wage increases are vital. Japanese wages have been virtually flat since the 1990s and are now well below the average for OECD members. Last year’s average pay hike of 3.58%, the biggest since 1993, did not compensate for the sudden rise in inflation and consumers are getting increasingly frustrated by higher food prices. All eyes are on the Shunto – the wage negotiations between major corporations and unions that take place every March – which provides pay level guidance for all Japanese companies and the signals are for another bumper year.

Rengo, the trade union umbrella group has already said it will demand a pay hike of at least 5% this year and a tight labour market will give wage demands an additional push. The head of major beverage maker Suntory Holdings Ltd, for example, plans to offer employees pay increases of 7% in 2024 for the second straight year, to retain talent and offset rising inflation, Reuters has reported.2 Likewise, Meiji Yasuda Life Insurance Company said it will raise pay 7% on average, while electronics retailer Bic Camera is set to raise 4,600 full-timers’ pay by up to 16%.

4. A new generation of domestic investors is encouraged to buy stocks and shares

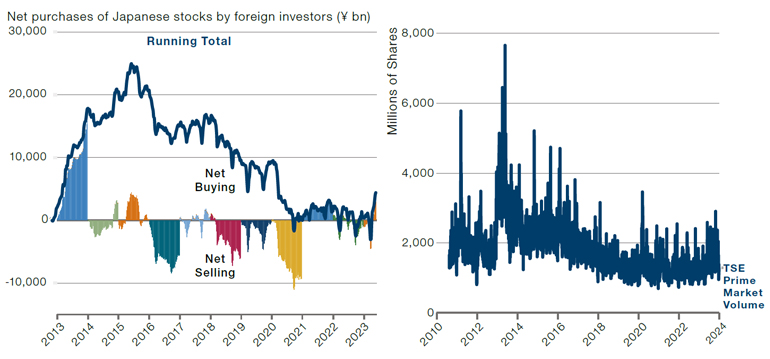

Last year foreign investors rediscovered Japanese equities and 2024 may see an influx of domestic retail investors boosting the market. Japan’s benchmark indices, the Topix3 and the Nikkei 225, were among the top performers last year, rallying over 25% in local currency terms. One key driver of market direction in the first half of the year was the return of foreign investor, who currently trade around 70% of daily volumes in Japanese equities, despite owning just over 30% of the market. The rally was sustained through the rest of 2023 thanks to a weak yen, speculation that monetary policy may soon normalise, as well as continued improvements in corporate governance and relatively attractive valuations. The Topix Index in USD terms, however, is not particularly extended and despite these foreign-led inflows through 2023, overall volumes remain low compared to the Abenomics period.

Figure 4. Net foreign investment in Japanese equities soars but overall volumes are still low

Source: Bloomberg.

Overseas investors may be joined by an army of retail investors seeking bigger returns on their assets. If structural deflation has truly come to end in Japan, households will be incentivised to move cash into the market to prevent eroding pricing power. One step in the government’s plan to reform Japan’s asset management industry has seen an overhaul of the existing Nippon Investment Savings Account (NISA), hoping to turn Japan’s savers into investors. Changes will come into effect in January 2024. Prime Minister Kishida has made NISA the pillar of his vision for a “new form of capitalism,” which emphasises concepts such as better wealth distribution and a virtuous cycle of growth.

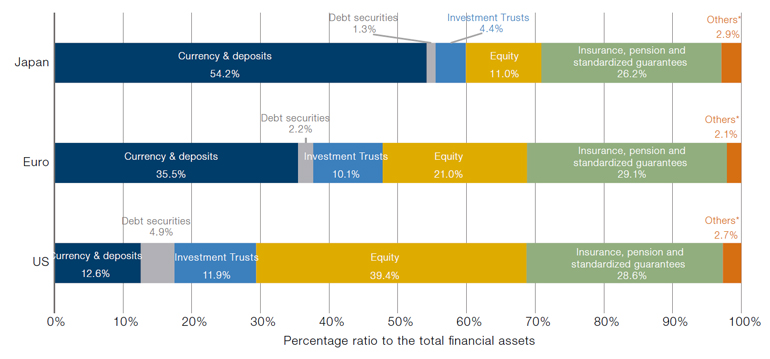

The scale of this potential catalyst should not be ignored. Japanese households currently hold 53% of their wealth in cash and 12.7% in equities. This compares with the US where consumers hold 14% of their assets in cash & 39% in equities.

Figure 5. Financial Assets Japan

Source: Bank of Japan.

5. Despite the market rally, Japanese equities remain attractive. This is notably the case for Japan Value

The Japanese market remains depressed relative to the US. Valuations are more compelling and contrarian. Almost half of the TSE Prime Index continues to trade below 1x P/B, compared to just 3% of the S&P 500, according to our calculations.

There are several reasons why, despite the strong market performance in recent years, Japanese equities remain an interesting and compelling opportunity:

- The Japanese market remains depressed relative to the US

In 2023, the Nasdaq had its best year since 1999. The “Magnificent Seven” tech stocks fuelled US market performance and now make up 29% of the S&P 500’s market capitalisation our calculations show. The weight of these seven stocks in the MSCI World Index is now equal to the combined weight of the Japanese, the UK, the Chinese, the French and the Canadian markets within the same index.4

Towards the end of 2023, market consensus shifted towards a view that global inflation has peaked out and rate cuts from non-Japanese central banks are now likely. This added to the tailwind behind these richly valued technology and growth stocks, pushing them towards new highs. Given where valuations are, this appears to be an incorrect conclusion. A return to the level of monetary easing witnessed at the peak of global QE is unlikely. In this environment, a systematic win for the Growth style will also be more challenging. Valuation and price matter once again.

The Japanese market therefore remains depressed relative to the US. Valuations are more compelling and contrarian. Almost half of the TSE Prime Index continues to trade below 1x P/B, compared to just 3% of the S&P 500, according to our calculations. Fundamentals are improving as corporate Japan remains unique in its exposure to the TSE-led revolution focused on corporate profitability and efficiency.

Figure 6. The Japanese market remains very depressed relative to the US

Source: Refinitiv Datastream.

- The Japanese market in USD terms is not extended

The Bank of Japan’s divergent monetary policy pushed the yen to a historically low level. A side effect of the continued weakness of the yen is that the Topix Index is not particularly extended in USD terms, making it an attractive equity market in foreign currency terms.

Figure 7. Topix in USD terms not as fully extended as in the 1990s

Problems loading this infographic? - Please click here

Source: Bloomberg.

Despite the underperformance of Growth relative to Value through 2021, 2022 and 2023, the valuations of Growth stocks, as measured by multiples such as price-to sales, remain well above their longer-term averages.

- The valuation of Japan Value remains attractive relative to the wider market

Japan has historically tended to be known as a Value market and there has typically been more mean reversion. This is partly because, on average, Japanese balance sheets are stronger and management generally work hard on their recovery during challenging operating periods.

Despite the underperformance of Growth relative to Value through 2021, 2022 and 2023, the valuations of Growth stocks, as measured by multiples such as price-tosales, remain well above their longer-term averages. As discussed, the improvements in corporate value, driven by the corporate governance requirements, should continue to support the performance of Japanese Value stocks going forward.

Figure 8. MSCI Japan Value and MSCI Japan Growth based on price to sales ratio

Problems loading this infographic? - Please click here

Source: Bloomberg.

- Given the strength of Top Cap Value in 2023, an interesting contrarian opportunity has opened for Mid Cap Value

Just like the US, Japanese market breadth has been narrow. However, performance has largely been driven by a select number of Top Cap Value stocks, rather than technology names. As discussed, one notable driver of Japanese market direction in 2023 has been the growing interest from foreign investors. Their buying focused generally on familiar, liquid names within Top Cap Value. With the strong outperformance of some of Japan’s largest Value stocks, the stretch between Top Cap Value names and Mid Cap Value names has therefore now widened.

Figure 9. Top and Mid-Cap Value Relative to Value Style

Problems loading this infographic? - Please click here

Source: Refinitiv Datastream.

As a result, from a contrarian perspective, some of the most interesting opportunities within Value could well lie outside of this year’s best performing Top Cap Value stocks. Greater room for improvement for Mid Cap Value stocks relative to Top Cap Value stocks could also positively influence the future relative performance of Mid Cap Value.

Conclusion:

2023 marked an exciting chapter in Japan’s evolution into a country with a steadily growing economy, with sustainable inflation and a strong and improving corporate sector. The corporate governance revolution, relatively attractive valuations, a weak yen, rising inflation and ultra-loose monetary policy helped propel the market to a 33-year high. With these trends only just starting to bloom, the medium-term outlook appears positive. But as with all fascinating stories, there will be twists and turns along the way. The fragility of Japan’s developing cycle of rising prices and wages, the influence of China’s economic recovery on Japan and an upcoming US election could all spark macro volatility in 2024. The challenge now is for Japan’s long term improvement story continue to build momentum and provide the resilience to carry it forward.

1. ps.asia.nikkei.com/meetmeti3/index.html

2. www.reuters.com/markets/asia/japans-back-to-back-wage-bonanza-would-open-door-boj-exit-2023-11-19/

3. The Topix is the Tokyo Stock Price Index, a capitalisation-weighted index of all the companies listed on the First Section of the Japanese stock exchange in Tokyo, comprising the larger companies in the index. The Nikkei 225 is a price-weighted index made up of 225 of the most prominent listed companies in Japan.

4. https://www.msci.com/documents/10199/8d97d244-4685-4200-a24c-3e2942e3adeb

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.