Introduction

Will COVID-19 and its associated bear market interrupt the move towards responsible investing (‘RI’)? The cynic would say yes: the growing trend of responsible investing using environmental, social and governance (‘ESG’) criteria is likely to be put on the back-burner because of the bear market.

Indeed, history would support this position. During the 2008/09 bear market, for instance, investors demoted climate change and ‘green’ issues right towards the back of the priority queue.

However, we would disagree with this cynic for three reasons.

Why the Cynics Are Wrong: Performance, No Bubble and Structural Drivers

First, ESG factors have performed well in 2019 and in year-to-date in 2020.1 This can, for instance, be observed by looking at the MSCI ESG Leaders indices. However, we observe it in a more precise manner ourselves. Man Numeric has developed a set of ESG alpha signals, using a range of data providers, and its own quantitative adjustments.

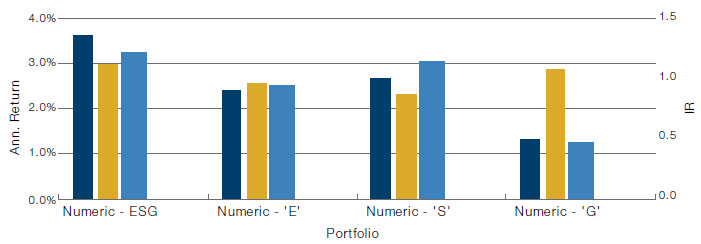

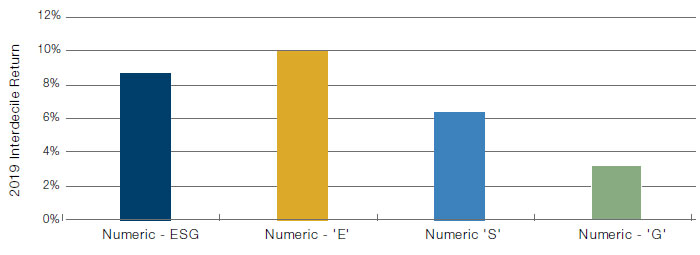

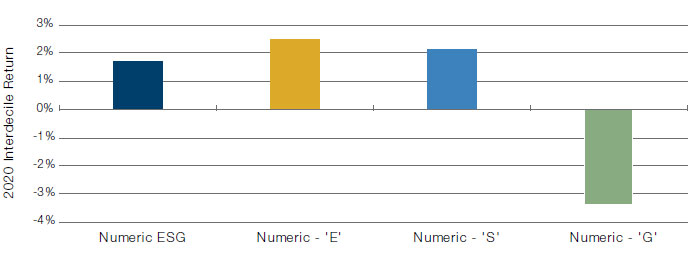

Figure 1. Man Numeric ESG Performance – Simulation 2012-19 (top), 2019 (mid), 2020 YTD (low)

Source: Man Numeric; as of 31 March 2020.

The ESG model spreads shown are provided for illustrative purposes only, do not represent any product of Man Numeric, and should be considered hypothetical. Hypothetical results have inherent limitations and should not be relied upon. Model results are gross of any fees and expenses that would be charged in an investment product.

Figure 1 shows the performance of these signals in the historical simulations, in 2019 and year-to-date in 2020 (annualised). It can be noted that the driving ESG themes in 2019 and 2020 were ‘E’ and ‘S’, which have more recently become a focus of corporate management. On the other hand, ‘G’ – which has been viewed at the only legitimate ESG factor by some – has lagged.

We view ESG factors as elements that can help achieve good risk-adjusted returns. And obviously, the need for return has by no means lessened due the bear market and the COVID-19 crisis.

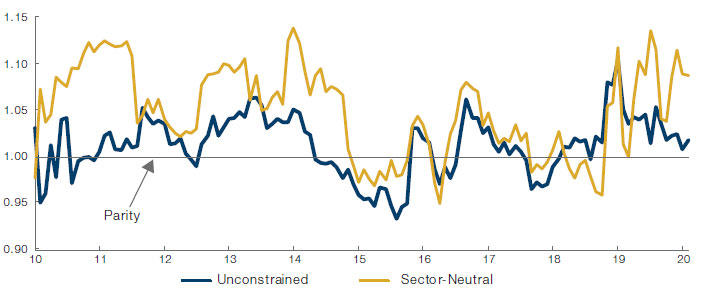

Second, we find no evidence that the growing ESG attention has reached bubble-like proportions. In fact, quite the contrary. There is a good chance, in our view, that this theme is one of the dominant factors of the coming decade, at the end of which it may well have taken bubble-like proportions. However, for now, a bubble cannot be detected. For instance, Empirical Research calculates that stocks held by ESG funds are not at a significant premium to other stocks (Figure 2). Additionally, while 2019 showed good inflows into ESG funds, it only amounted to net USD20 billion, which is very small in comparison to all flows and market cap.

Figure 2. Empirical Research ESG Premia

Source: Empirical Research Partners Analysis; as of 31 March 2020.

ESG fund ownership is the share of a stock’s capitalisation owned by ESG ETFs. Capitalisation-weighted data.

Third, some of the driving forces behind responsible investing are very much long-term structural drivers, not short-term cyclical drivers. These include, but are not limited to: diversity and inclusion to achieve better decisions; climate change as a large existential threat that needs to be addressed; and governance structures to ensure incentives are aligned with all stakeholders.

Conclusion

As such, we don’t feel that there is a bubble in RI, and don’t expect retrenchment from the ESG leaders compared to the broader market. RI has moved on since 2008 – and so should our views.

1. Through to 31 March.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.