Executive Summary

Whether 2023 was an active insurance year is somewhat a matter of perspective. The Atlantic hurricane season was the fourth most active on record, yet none were a particular threat to the cat bond market, as the US did not suffer a single, large hurricane event. The number of billion-dollar events was at record levels, yet the absence of single large events meant that per occurrence deals, which trigger only if the losses from a single event exceed a threshold, were largely safe. The 2005 and 2017 seasons, however, are prominent examples of both high relative storm activity and correspondingly large losses on both an annual aggregate and per occurrence basis1. Indeed, we may even find relatively inactive seasons, such as 1992, where a single hurricane (Andrew) triggered substantial losses.

The 2023 Insurance Season

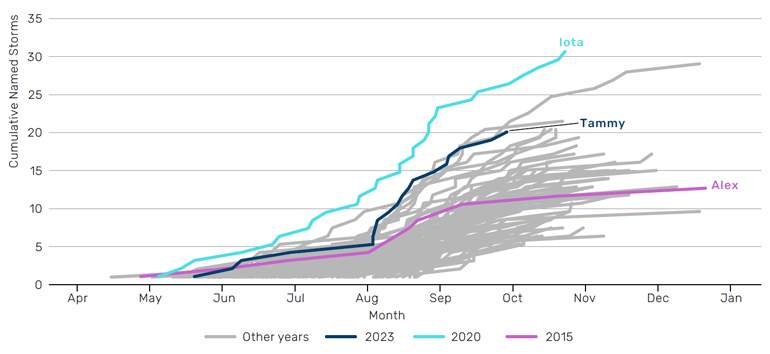

The 2023 Atlantic hurricane season yielded 19 named storms and tied for the fourth most active since 1950.

The 2023 Atlantic hurricane season yielded 19 named storms (above the National Oceanic and Atmospheric Administration (NOAA) 30-year average of 14) and tied for the fourth most active since 1950 (Figure 1).

Figure 1. 2023 tied in fourth place for the most named storms in a year since 1950

Source: NOAA/NHC, Man Group Database, as of 31 December 2023.

Insured losses, estimated at $3-5 billion, were insufficient to worry the cat bond market yet big enough to sustain demand for reinsurance.

In spite of the number, only Hurricane Idalia was of note to the insurance industry, making landfall in the Florida Big Bend near Keaton Beach on 30 August 2023 as a Category 3 hurricane with windspeeds of 125mph2. Insured losses, estimated at $3-5 billion, were insufficient to worry the cat bond market yet big enough to sustain demand for reinsurance.

More interest, perhaps, came from the Eastern Pacific basin. Mexico has been a regular purchaser of insurance cover for earthquake and hurricane cover starting with the CATMex bonds in 2006, through to the International Bank for Reconstruction and Development (IBRD) Sustainable Development Bonds in 2020. The latter are classic ‘Cat-in-a-Box’ structures: a set of points are defined so as to partition land, sea, or coastline into quadrilaterals. Within each ‘box’, a set of earthquake intensity/hurricane minimum central pressure thresholds are defined. Depending upon which constraint is breached, these parametric deals pay out some, or all, of the principal.

Pacific hurricane Lidia made landfall on 10 October 2023, having recently strengthened to a Category 4 hurricane, with a minimum central pressure of 942mb3. This was around 10mb higher than required to trigger the Class D notes. The possibility of a revision of the pressure analysis at least raised the question as to whether a bond would be triggered.

Much clearer, though, was Hurricane Otis. Making landfall near Acapulco, Mexico with 165mph sustained winds and minimum central pressure of 923mb, the rapid intensification of this hurricane (from a tropical storm to a Category 5 hurricane in 24 hours) was missed by all major weather models: described by an RMS modeller as a “monumental” miss4. Such a failure may be an irritant to anyone trying to trade off forecasts, but it is far more serious in terms of preparations and evacuations.

Figure 2. The rapid intensification of Hurricane Otis was not forecast by any of the major weather models

Source: NOAA/NHC. Tracks the path of Hurricane Otis.

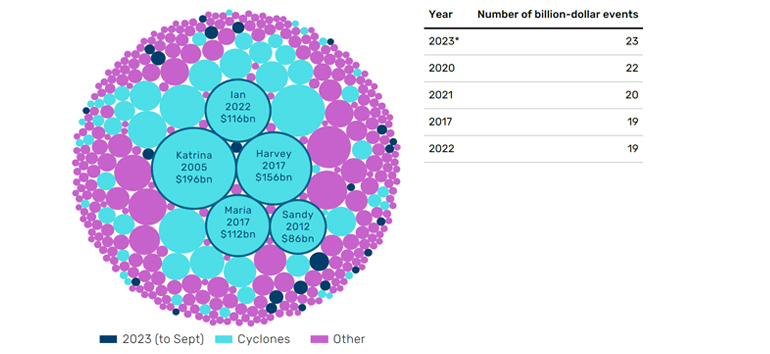

Even though the US did not suffer a single, large hurricane event, the number of billion-dollar events in 2023 was elevated.

In any case, the central pressure is currently expected to trigger a 50% payout on this $125 million note. Insured losses are estimated at $3-6 billion.5

Even though the US did not suffer a single, large hurricane event, the number of billion-dollar events in 2023 was elevated. NOAA reports6 2023 as a record, consistent with Aon’s observation7 that 2023 had the largest number of (global) billion-dollar events.

Figure 3. Not a single, large insurance event in 2023, but a record number of US billion-dollar events

Source: NOAA/NCEI, as of 30 September 2023. Circle size indicative of losses associated with each event.

An important nuance is that cat bonds coverage can be based on ‘annual aggregate’ or ‘per occurrence’ losses.

It may seem somewhat counterintuitive that despite the record number of billion-dollar events, the cat bond industry did not incur material losses. Looking under the hood at the nature of these events reveals that the 2023 season was primarily comprised of lower-level tornadoes and linear wind scenarios, which cat bonds were broadly insulated from.

An important nuance is that cat bonds coverage can be based on ‘annual aggregate’ or ‘per occurrence’ losses. In the case of the former, losses are aggregated throughout a year over multiple events, whereas the latter only triggers if the loss of a single event exceeds a threshold. The cat bond market held a greater proportion of per occurrence deals, which meant that given the absence of single, large events, losses were broadly contained. Previous hurricane seasons have shown, however, that this may not always be the case.

Indeed, it is possible to have a relatively inactive hurricane season, but still incur larger losses. Take the 1992 hurricane season as an example, which had just six named storms, yet the Category 5 Hurricane Andrew, which made landfall in southern US on two occasions, generated approximately $27 billion in damages8, triggering per occurrence deals. Conversely, the 2005 and 2017 hurricane seasons were examples of how higher activity can translate into larger losses – logging as the two costliest years on record and among the top 10 in terms of named storms. Circling back to our initial question, the correlation, or causation rather, between the level of activity and portfolio losses is not necessarily a clear cut one, with the idiosyncrasy stemming from the peril exposure and coverage type.

An additional distinction between per occurrence and annual aggregate bonds, particularly pertinent during a high activity year like 2023, relates to deductibles. As alluded to above, aggregate bonds cumulate losses over multiple events. If the cumulative total exceeds a given amount, the bond will default and trigger a payout. Deductibles provide some moderation to the computation of aggregate losses by excluding modest losses from individual, smaller events that are within the deductible threshold. This means that aggregate bonds with a low deductible are slightly more sensitive to a higher frequency of smaller events.

Parting Thoughts

High profile losses in recent years have led to improved investor discipline and demand for higher return per unit of risk.

High profile losses in recent years have led to improved investor discipline and demand for higher return per unit of risk. Insurance losses in 2023 were sufficient to maintain discipline but insufficient to materially impact portfolios, meaning that returns were positive. And while looking at 2023 in isolation would lead us to the conclusion that higher activity does not necessarily precipitate wider losses in the cat bond market, this relationship is dependent on the nature of bonds held. Per occurrence deals within cat bonds were largely safe in 2023, but the number of billion-dollar events meant that the risks for annual aggregate bonds particularly those with low deductibles, were skewed to the upside. Looking at this coverage type in isolation, one could even conclude that higher activity in fact meant higher losses.

Bibliography

1. https://www.foxweather.com/learn/most-expensive-hurricane-strikes-country-state

2. Source: https://www.rms.com/newsroom/press-releases/press-detail/2023-09-04/moodys-rms-estimates-us3-billion-to-us5-billion-in-private-market-insured-losses-from-major-hurricane-idalia#:~:text=Newark%2C%20CA%20%E2%80%93%20September%20

3. Source: Man Group database and NOAA/NHC. Available here: https://www.nhc.noaa.gov/archive/2023/ep15/ep152023.public_a.031.shtml

4. https://www.intelligentinsurer.com/insurance/major-hurricane-otis-in-mexico-a-monumental-miss-by-weather-models-34027

5. Source: Man Group database and Insurance Journal. Available here: https://www.insurancejournal.com/news/international/2023/11/15/748359.htm

6. https://www.ncei.noaa.gov/access/billions/#:~:text=In%202023%2C%20there%20were%20

7. https://www.aon.com/en/insights/reports/climate-and-catastrophe-report

8. https://www.weather.gov/news/220822-hurricane-andrews#:~:text=Hurricane%20Andrew%20is%20responsible%20for,Florida%20was%20caused%20by%20wind

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.