Crypto Is Just a Rate Sensitive Risk Asset

Has the cryptocurrency’s revolutionary dream of decentralised, quasi-autonomous finance died? Is bitcoin now just another risk asset?

The rising correlations of the currency point to yes; both to the NASDAQ Index (Figure 1) and to the ARK Innovation ETF (‘ARKK’, Figure 2). As rising inflation and the prospect of rate hikes have eroded the theoretical value of long-dated cashflows, both have suffered underperformance. Bitcoin has now joined them, with its correlation to the NASDAQ Index and ARKK Innovation Equity ETF at 0.44 and 0.43, respectively.

This growing correlation may demonstrate a change in the nature of bitcoin as an asset class. Prior to 2019, bitcoin went through periods of negative correlation to both instruments. Since then, however, correlations to risky tech have turned positive. This mirrors bitcoin’s own journey along the Gartner hype cycle: from being an underground tech phenomenon, the flagship cryptocurrency is now a mainstream way for both institutional and retail investors to speculate. In our view, it is therefore unsurprising that it is becoming increasingly correlated with the very riskiest assets – equities whose value is tied to distant future cashflows. Indeed, the higher the correlations get, the more bitcoin seems to be another manifestation of a crucial facet of investing over the past decade: there is too much capital chasing too little genuine economic growth.

Figure 1. Correlation Between Bitcoin and NASDAQ

Source: Bloomberg; as of 4 February 2022.

Figure 2. Correlation Between Bitcoin and ARKK Innovation Equity ETF

Source: Bloomberg; as of 4 February 2022.

Oil and Gas Supply: Private Firms to the Rescue?

With WTI crude oil prices now at close to USD90 per barrel – a 5-year high – the Federal Reserve Bank of Dallas’ Oil and Gas Survey indicates that producers may finally be responding to incentives and increasing supply.

The survey covers roughly 200 oil and gas firms in Texas, New Mexico and Louisiana, with participants involved not just in exploration and piping, but also services. A clear majority have indicated that they expect to increase capital expenditure spending this year (Figure 3). There has also been a drastic fall in the number expecting to reduce their investment, with only 8% of respondents indicating they will cut capex spending, compared with 29% in the 2020 survey. However, not all producers are seemingly as bullish. The MSCI ACWI Index’s estimated oil and gas capex spend remains towards the lower end of its range (Figure 4). Tellingly, all of the index’s constituents are publicly listed.

In our view, this may be related to increased ESG pressures from policymakers and the market. As we’ve previously written, oil stocks have not enjoyed the benefit of oil price rises and are finding it hard to access new capital. Public firms are far more susceptible to ESG scrutiny and as such, may well be more reluctant to invest in non-renewables – even though prices may make immediate capex commitments more attractive

Figure 3. Fewer Oil & Gas Executives Expect to Decrease Capex in 2022 Relative to 2021 Expectations

Source: Federal Reserve Bank of Dallas; as of 29 December 2021.

Note: Due to rounding, response figures may not total 100.

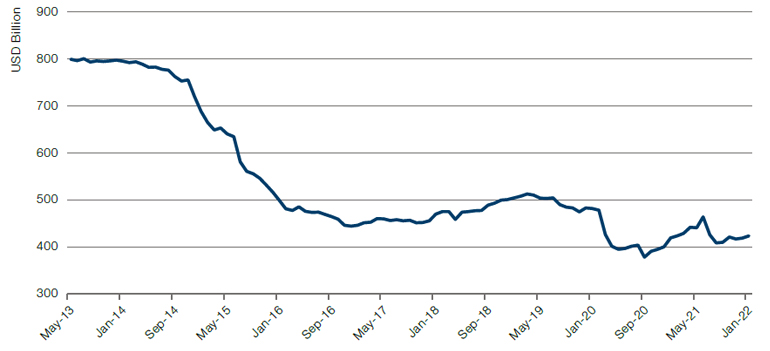

Figure 4. Expected Capex Spend – MSCI ACWI Oil and Gas Index

Source: Bloomberg, MSCI; as of 1 February 2022.

China Credit Impulse: The End of a Beautiful Relationship?

For those that monitor Chinese economic indicators, there has been one relatively simple guideline: when credit grows, so does the Chinese economy.

But as the China credit impulse rises again, will this relationship still hold true? Figure 5 shows the Chinese credit impulse – as measured by the monthly net change in credit as a percentage of GDP – against industrial inventory growth. Previously, upticks in the credit impulse have coincided with periods of low inventory growth. As credit became more readily available, industrial firms used the opportunity to restock, thus fuelling the subsequent growth of the Chinese economy.

However, we now face a different scenario. Industrial inventory growth is at decadelong highs. Chinese retail sales and housing activity indicate that domestic demand is currently weak. Without industrial restocking and strong domestic demand, the Chinese economy is reliant on export demand to maintain its growth trajectory, which may be precarious. If we do see the credit impulse rise, it is therefore not a given that growth will follow.

Figure 5. China Credit Impulse Versus Industrial Inventory Growth

Source: Bloomberg, Man GLG; as of 31 December 2021.

Breadth in Emerging Markets, Less So in Developed Ones

Following last week’s Views From the Floor , 2021 saw the return of breadth to the US equity market as a much greater number of stocks outperformed index level returns. But has this trend been mirrored elsewhere?

Globally, this hasn’t been the case. The breadth of the MSCI World Index has barely increased, with only 38% of index constituents outperforming – a rise of only three percentage points (Figure 6). However, though it was less reliant on mega-caps to provide returns than 2020, the return gap of 4% is still the second-largest in the sample (Figure 7). The return gap measures the index level return with and without the top 10 return contributors, with a low return gap suggesting that returns are relatively evenly spread amongst those stocks which outperform the index.

The situation was very different in emerging markets. Some 54% of the MSCI Emerging Markets Index outperformed, a rise of 19 percentage points, compared with 2020. This can be explained by the overall underperformance of the index, which fell by 1% over the course of 2021, driven in part by the underperformance of large-cap Chinese tech. Additionally, the return gap of 4% was similar to normal levels.

Figure 6. Percentage of Constituents Outperforming Cap-Weighted Returns

Source: Man Numeric; as of 31 December 2021.

Figure 7. Gross Returns Gap Ex-Top 10 Contributors

Source: Man Numeric, as of 31 December 2021.

With contributions from: Peter van Dooijeweert (Man Solutions, Managing Director), Ed Cole (Man GLG, Managing Director – Discretionary Investments) and Dan Taylor (Man Numeric, CIO)

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.