Man Group. Always evolving.

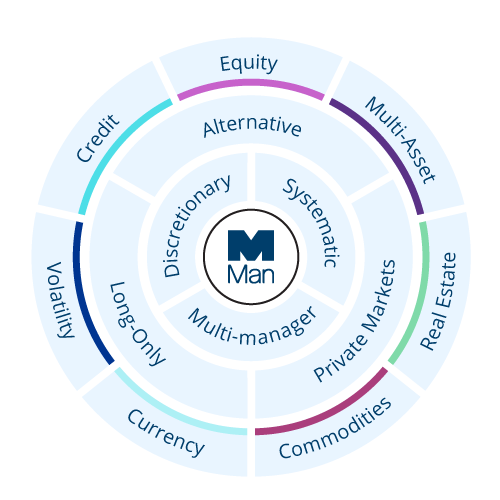

Technology-empowered active investment management focused on delivering performance and client portfolio solutions.

Diversified Offering. Institutional Framework.

Man Group. Founded 1783.

With a heritage in aiming to deliver attractive performance and tailored client solutions, Man Group is a highly active investment manager, powered by cutting edge investment technology. As a manager of millions of savers’ capital, we have a responsibility as stewards of those investments to create a better, more sustainable future for investors and society. Our quantitative expertise and data-driven culture means we believe Man Group is in a unique position to uncover the opportunities of the future.

We continuously invest in talent, technology and research as we strive to deliver the best results for our clients.

Man Institute

We believe that the best way to extract value from leading minds is to encourage a thoughtful exchange of ideas in an open environment

You are now exiting our website

Please be aware that you are now exiting the Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Group related information or content of such sites and makes no warranties as to their content. Man Group assumes no liability for non Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Group.