All market data referenced below sourced from Bloomberg unless otherwise specified.

Introduction

After one of the most aggressive interest rate hiking rate cycles in decades, today’s market is awash with commentary and debate on whether the Federal Reserve (Fed) has pulled off an elusive soft landing and swerved recession. While the US economy has shown resilience thus far in the face of higher rates, arguably bolstered by massive monetary stimulus and fiscal largesse, as we outlined in a recent paper, we remain on guard for global growth to slow with credit valuations largely pricing near certainty of a soft landing. The pressures we are witnessing in some sectors are likely to broaden and create further challenges from here. While this environment, characterised by increased dispersion, may be hazardous for indiscriminate investors, it presents opportunities for investors who have the flexibility to be selective.

First small cracks

From a fundamentals perspective, we are beginning to see a slight weakening, with some companies having less cushion to pay down their outstanding debts (as shown in Figure 1 below), though notably this has not yet translated into a significant rise in defaults. With that said, defaults are a backward-looking indicator and signs of stress are beginning to surface in over-levered companies struggling to refinance in a higher for longer rates environment. As a case in point, European credit felt the impact of three large capital structures coming under pressure at the end of March, leading CCC and lower credit in European high yield to give back the majority of their gains year to date (Figure 2).

Problems loading this infographic? - Please click here

Problems loading this infographic? - Please click here

Liability management transactions provide an outlet for companies to deal with the higher-for-longer rate environment

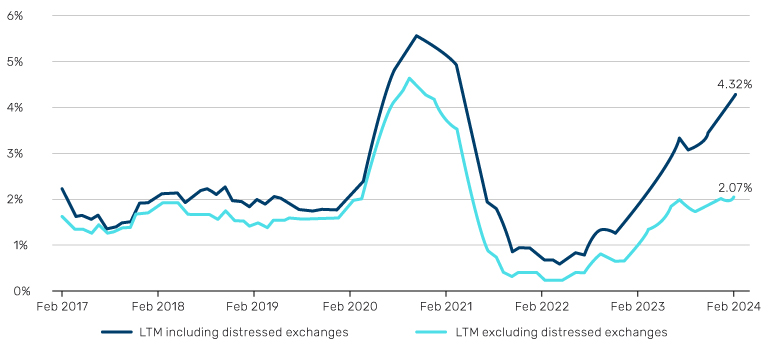

The low level of defaults and distressed ratios shown in Figure 3 fail to accurately reflect the increased burden being placed on capital structures in an environment of higher-for-longer interest rates. Where this is more visible is in the rapid increase in liability management transactions (LMTs), as shown in Figure 4.

LMTs include any effort taken by a borrower to shore up their balance sheet. Typical forms of LMT include tender offers, exchange offers, buybacks, uptiering and drop downs. Ultimately, the purpose of these transactions is to reduce debt, extend maturities and to lower interest payments. This can be preferable to going through a more thorough bankruptcy procedure as it is much less costly and can have a smaller impact on the underlying businesses.

However, it is important to understand what the motivation behind these transactions is for the borrower or lender as there are often constraints on either side, which lead to more LMTs rather than full-scale restructurings. In essence, we are seeing several companies kicking the can down the road and lenders are jostling for the best position should an ultimate restructuring occur.

Looking at it from this perspective, we are arguably already in a distressed cycle. This presents opportunities for nimble investors, not only in terms of profiting from LMTs but also pursuing more aggressive restructurings. Positioning oneself within the fulcrum security (the most senior security which has the greatest likelihood of conversion into equity ownership after restructuring) and understanding the motivations of lenders and borrowers is critical for those pursuing a full-blown restructuring.

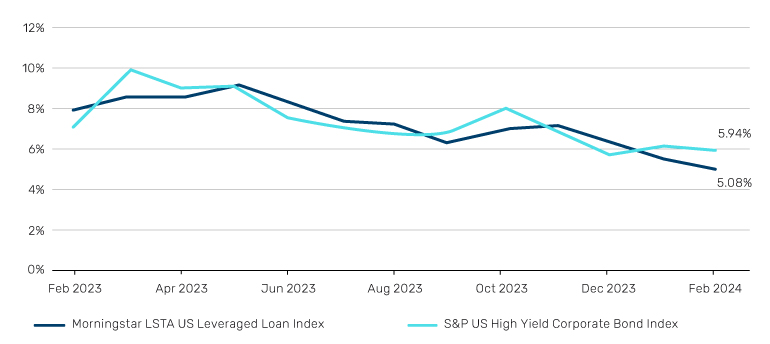

Figure 3. Low distress ratios fail to accurately reflect the increased burden of higher for longer rates

Distress ratio, loans versus bonds (by count)

Source: Pitchbook Data, Inc; LCD, a part of PitchBook; Morningstar LTSA Leveraged Loan Index; S&P US High Yield Corporate Bond Index. Data through 29 February 2024. Data has not been reviewed by PitchBook analysts.

Figure 4. Traditional payment defaults are understating the reality

Dual-track US loan default rate: issuer count

Source: PitchBook Data, Inc; LCD, a part of PitchBook; Morningstar LSTA US Leveraged Loan Index. Data through 29 February 2024. Data has not been reviewed by PitchBook analysts.

Emerging market debt: time to reconsider?

Switching gears slightly, one asset that has remained out of favour from an allocator’s perspective has been local emerging market (EM) debt. One of the attractions of the asset class today is its limited foreign ownership, with positioning much cleaner as investors have deserted dedicated exposures. As an example, Figure 5 shows a decline in the proportion of Mexican debt held by foreign owners in recent years.

Additionally, with high real rates and EMD FX valuations at near historic lows, we believe that there are several potential tailwinds for the asset class.

Problems loading this infographic? - Please click here

However, much of the argument for being long EM local rates is premised on US monetary policy, namely a dovish pivot, which has yet to occur. If policy remains higher for longer, which seems increasingly likely given resilient growth and higher than target inflation, this would be a headwind for EM rates. Additionally, because the US has kept rates higher than anticipated while EM rates have come down on the expectation of Fed cuts and/or actual cuts by EM central banks, the rate differential between EM local (as measured by the overall yield on the JP Morgan Local Rates Index) and US Treasuries are at historically tight levels. Finally, like their developed market counterparts, EM countries are facing a growing debt pile which could crowd out private investment and ultimately lead to lower growth in the future. Taking all of this together, there are some opportunities in local currency markets, but investors should remain cautious on jumping in with both feet until there is greater clarity on the Fed’s future path.

EM corporates: Tug of war

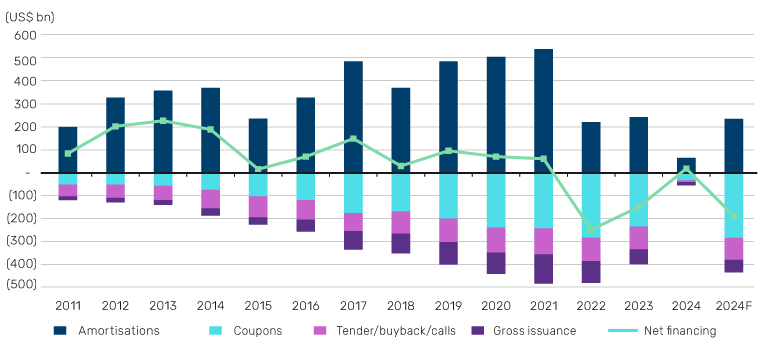

As witnessed elsewhere, EM corporate markets currently face a tug of war between yields and spreads. Yields are attractive, but spreads in certain markets have become stretched. Positive technicals remain for the asset class with negative net supply and outflows from EM corporate funds leading to a better technical backdrop. Typically, we would expect the more buoyant risk-on environment to lead to new supply, but this has not yet been the case as we have seen very little low-quality issuance in the year to date.

Figure 7. More buoyant risk-on environment has not yet led to new supply

Source: JP Morgan EM Corporate Strategy Presentation, as at 20 February 2024.

As in developed markets, maturity walls have been increasing with approximately 14% due in one year and just below 40% due over three years. In the next 12 months, Asia has the highest share of immediate maturities, while over three years, this is led by Eastern Europe.1 An interesting dynamic we have noticed is that companies now retain other sources of funding to help manage upcoming maturity walls, such as local currency markets.

Additionally, EM corporates have seen a notable amount of LMTs which has created significant opportunities particularly for debt trading at substantial discounts.

In summary, we see opportunities across credit markets, but we expect more dispersion as we move through this portion of the credit cycle. This is likely bad news for passive investors who are exposed to the entire market, but it presents fertile ground for active managers who have the flexibility to be selective and the research capabilities to take advantage.

Q2 2024 Outlook

At Man Group, we have one overriding principle: we have no house view. As such, portfolio managers are free to execute their strategies as they see fit within pre-agreed risk limits. Keeping that in mind, the outlooks below are from the different credit teams.

Demand for investment grade (IG) credit remains strong as investors have sought to capture attractive all-in yields at what appears to be the peak of the interest rate cycle. Issuance has been significant in North America and Europe, although many expect the rate of supply to slow as we progress further through the year. Despite credit spreads tightening across the board, the IG market experienced flat returns year to date as higher for longer interest rate expectations weighed heavily on fixed income markets. The spreads of real estate companies, followed by insurers and banks, narrowed the most during the quarter while capital goods firms lagged other sectors.

While fundamentals such as leverage are stable, we still view US debt as expensive compared to other regions, with European issuers continuing to provide an attractive pickup in terms of credit spread. Moreover, European financial debt still trades at wider levels than industrials and so remains a key area of focus. Finally, corporate bond yield curves are flat, if not slightly inverted, and therefore we favour shorter-dated maturities.

Overall returns from high yield (HY) remained strong in the first quarter as spread tightening combined with low duration enabled the asset class to deliver positive returns. However, it appears that the pain of higher interest rates is finally feeding through to the wider market. This was felt particularly in the large debt structures of European companies such as Ardagh, Altice and Intrum.

Despite these cracks, spreads remain tight across the market while default rates are returning to long-term median levels. At this point in the cycle, we are avoiding cyclical industries that may feel the brunt of any potential slowdown and are focusing on financials, many of which have benefited from higher net interest margins. Given the heightened uncertainty in markets, we believe investments are best made on an idiosyncratic basis rather than a pure market beta approach.

Global central banks have largely disregarded the financial easing that began in early November, following the US Treasury’s reduction in planned duration issuance and Chairman Powell’s signal of a Fed pivot. However, we anticipate that US inflation has reached its low point and is unlikely to quickly return to target levels. Despite dovish remarks from the Federal Open Market Committee, markets are pricing in fewer rate cuts than anticipated in December, with long-term yields trending upwards.

Mirroring global credit markets, EM sovereign spreads narrowed. As a result, the JP Morgan Emerging Markets Bond Index Global’s (EMBIG) spread (excluding CCC rated countries, as a measure of countries that are at high risk of default) has reached lows not seen since 2010, well below the historical average. Additionally, the rapid pace of EM sovereign primary activity appears unlikely to slow due to factors like low IG yields, high fiscal spending, upcoming elections, modest economic growth, and considerable interest expenses, even as outflows from the asset class continue.

In local currency sovereign debt markets, EM local yield spreads over 5-year US Treasuries, currently at 206 bps, offer a modest yield premium, having tightened 96 bps over the last 12-month period.2 Geopolitical conflicts add to the uncertainty, especially for inflation, clouding the outlook for impending monetary policy easing cycles, particularly for low yield currencies. EM currencies have struggled year to date, as they face challenges from US dollar volatility and narrowing rate differentials with core yields. We have seen valuation improvement mostly in Asian and quasi-Asian currencies, but current account improvements are lagging what similar valuation attained historically.

Upcoming elections in Indonesia, South Africa and Mexico, along with policy uncertainty in China, Brazil, Colombia and Argentina, increase risks to currency stability.

As discussed above, EM corporates continue to be at the coal face of the tug-of-war between yields and spreads. We think that index spreads could continue to be supported by the positive macro backdrop. Additionally, technicals remain supportive as the risk-on tone led to over $110 billion in EM corporate bond issuance, the highest in the last ten quarters, but still below the $120 billion five-year average.3 We continue to maintain a barbell approach to the market, preferring shorter-duration carry and refinancing trades given the rebound in local currency funding markets and also see selective opportunities in industrials and consumer-related sectors across Latin America and Asia.

Asia IG and HY credits have outperformed their global peers year to date with strong momentum from both credit spread tightening, as well as a tailwind from rates. Asia’s credit default trend remains stable and was at the lowest level versus other regions for the first two months of 2024, according to Moody’s. Supply/demand technicals are also supportive for Asia credits as the only emerging market registering a negative supply for January and February, according to JP Morgan.

Looking ahead, we expect strong technical support for Asia credit to continue for the remainder of 2024 as a result of the aforementioned negative supply gap, the increasing number of US and European investors we are seeing returning to the new issue market in Asia, as well as stable and supportive fundamentals for Asia credit as a whole.

Lastly, we have seen the country and quality mix in the Asia credit universe change significantly in the last few years. The weightings of higher-quality Korea and Hong Kong have increased markedly since the Covid period, while China’s weighting has declined. Indeed, the current country mix is similar to 2015. Comparing the current Asia/US spread for a similar rating and maturity bucket back to 2015, we see significant room for further compression for both Asia IG and HY.

Markets have remained resilient so far this year, despite a blip at the beginning of the year owing to geopolitical risks and hawkish comments from central banks. Although convertibles traditionally have meaningful exposure to the tech/growth sectors that have been leading equity market returns, they have lagged equities so far in 2024 – though are ahead of both IG and HY credit. The key reason for this is the narrow breadth of the equity rally which continues to be driven by a small basket of mega-cap names that are not featured in the convertible bond space. Instead, the asset class is overweight smaller-cap names that have underperformed. We believe this has created interesting opportunities for convertible bond investors, however, since several factors such as improving market breadth, positioning and an historic valuation gap versus large caps mean small caps may start to outperform large caps. On top, with equity volatility sitting close to multi-year lows, there is scope for rising volatility to support convertible bond valuations.

Activity in the primary market picked up meaningfully in the first quarter after a typically quiet start to the year in January. Issuance has been supported by the large 2024/25 maturity wall in both convertible and non-convertible credit and the pushing out of rate cut timing expectations which has driven many issuers to refinance debt now rather than wait – particularly as equity markets have been strong, making convertibles an even more attractive financing option. Indeed, around 40% of primary convertible bond deal proceeds year to date have been earmarked for refinancing. We expect the primary markets to remain supported by these factors in the second quarter and beyond, especially if risk appetite – and thus equity markets – remain elevated. Even if central banks cut rates this year as the market currently expects, the rate differential between convertible and straight debt is unlikely to shift so dramatically that the interest savings argument for issuers is undermined. For investors who currently own busted convertibles that are deep out of the money, these refinancing also offer an opportunity to gain exposure to issuers via a convertible with a lower conversion premium and yet still attractive yield.

Overall, we believe the asset class is currently very attractive. Investors can secure a healthy mix of income, upside equity exposure (to names that are not generally overextended) and downside protection. This mix is particularly compelling given the surge in broader equity indices and tightening of credit spreads – both of which suggest a degree of investor caution is warranted. Specifically, the mixture of yields and conversion premiums for convertible bonds is as attractive as it has been since at least 2016. Convertible bond investors may also be less concerned about a reversal of spread tightening since the asset class has not witnessed a significant tightening of spreads, unlike the HY space. Indeed, at the end of 2023, the spread between non-IG convertible bonds and HY bond index option-adjusted spread was close to its highest level since 2012 at 234 bps, up from 104 bps at the end of 2022.

2023 proved to be a rewarding time for US residential credit investors with dry powder available to put to work. The fallout from the most rapid rise in interest rates in four decades created the best environment for private credit investors, and US residential credit in particular, since the Global Financial Crisis. This macro environment resulted in compressed equity returns strapped to a higher degree of risk. On the flipside, our approach is to seek to provide all the structural and downside protections of debt, including an equity buffer with the property as collateral, while targeting equity-like returns through investing in IG equivalent senior debt on an unlevered basis.

The conservative posture of banks has created opportunities for private real estate credit to enter the capitalisation stack that did not exist previously and at loan-to-value (LTV) levels that were not available prior to the inflation spike. Unique from CRE and the office asset class, in particular, US residential credit is benefiting from the tailwinds of a large and resilient housing market that is supported by an overall lack of US housing supply – which has only been exacerbated by a higher interest rate environment and sidelined banks, restricting new development further (i.e. supply). We expect the current themes playing out to be a fundamental shift in the credit landscape, creating an attractive opportunity to lock in credit investments at higher than historical rates, providing a counter to a future, lower rate environment.

Issuance in the leveraged loan market came roaring back leading to the third-highest quarterly issuance over the past 10 years. Demand has been surging from retail investors and with yields remaining attractive compared to fixed rate bonds, investors are now taking a second look at the sector. The recent euphoria has led to over 40% of the US market now trading at or above par, which is the highest reading in the last two years. Amendments to extend maturities on outstanding loans set a quarterly record, although this was overshadowed by repricing activity. The higher-for-longer environment has started to lead to deteriorating fundamentals with debt/EBITDA standing at 4.8x, up from 4.5x last year. Additionally, the environment continued to put pressure on interest cover ratios which deteriorated to the lowest levels since 2007. 22% of the market now has a coverage ratio below 2x which we think warrants some caution on the sector relative to high yield.4 The demise of the asset class relative to private debt does seem overblown given the significant issuance in the year to date and with syndicated loans winning out against private credit in many cases. CLOs also saw record issuance with spreads particularly in the BBB and higher segment continuing to appear attractive relative to the tight spreads seen in IG corporate bonds.

The Basel III proposals tabled last July were widely expected to accelerate US bank engagement in risk transfer markets by intensifying existing regulatory capital burdens. The Fed has since contemplated revisions designed to lighten regulatory capital charges, prompting speculation about whether the anticipated surge in US significant risk transfer (SRT) issuance is set to be dampened. With a final decision likely to be months away, our view is that the Fed will lightly tweak the provisions as opposed to enacting a significant overhaul. In light of the string of bank failures observed of late, we expect prudence to prevail and any revisions to be light touch, with negligible impact on US issuance. It should be noted that SRT retains its dominance in Europe, continuing to serve as a crucial capital management tool for banks, eclipsing the US market from a volume standpoint. We observed extraordinary levels of CRS issuance during the first quarter and expect this to persist throughout 2024, paving the way for a standout year. Numerous transactions across large corporate, leveraged finance, CRE, fund finance, and SME portfolios from European and indeed North American banks are anticipated.

It’s clear that the SRT market is undergoing a period of transition, with numerous investors seeking entrance. That said, it remains difficult to envision traditional liquid credit investors seamlessly accessing what is inherently a private market and capturing any significant share of the deep and varied SRT volume. We see incremental demand for the largest, most liquid, and widely distributed deals exceeding supply; however, we do not see most of these new entrants having the ability to access deals beyond a few programmes.

Index definitions

J.P. Morgan Government Bond Index-Emerging Markets Global Diversified Index

The J.P. Morgan EMBI Global Diversified Index (EMBIGD) tracks liquid, US Dollar emerging market fixed and floating-rate debt instruments issued by sovereign and quasi-sovereign entities.

JP Morgan Emerging Markets Bond Index Global Core (EMBIG)

The J.P. Morgan Emerging Markets Bond Index Global Core (EMBIG CORE) tracks liquid, US dollar emerging market fixed and floating-rate debt instruments issued by sovereign and quasi sovereign entities. The EMBIG CORE is based on the long established flagship JPMorgan EMBI Global and follows its methodology closely, while offering a more liquid subset of the index by removing the instruments with smaller face amounts outstanding and the instruments that are closer to maturity. The diversification methodology limits the weights of the larger index countries by only including a specified portion of those countries’ eligible current face amounts of debt outstanding, thus providing a more even distribution of weights across the countries in the index. The Returns and Statistics are available from Dec 1997.

1. Source: JP Morgan.

2. Source: JP Morgan and Bloomberg.

3. Source: JP Morgan.

4. Source: Pitchbook Data, Inc; LCD, a part of PitchBook. Data has not been reviewed by PitchBook analysts.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.