Key takeaways:

- Market timing1 is tactically shifting portfolio allocations to capture gains from anticipated market movements

- Far from being a speculative endeavour, market timing, when executed with skill and discipline, is a powerful tool for navigating the complexities of global financial markets

- We propose that market timing should be seen as one of the levers that allocators employ in seeking to deliver returns to their investors across the cycle

Introduction

According to John Maynard Keynes, “it is better for reputation to fail conventionally than to succeed unconventionally.” In many ways, this sums up attitudes to market timing; the practice of adjusting portfolio allocations based on anticipated market movements. It is at once the holy grail of portfolio management and treated with suspicion in academic literature.

We believe this mistrust exists because making the right call is difficult and requires a sophisticated approach. On the outside of markets looking in, academic researchers use data that is necessarily aggregated. As a result, they may miss the ability of the few because of the inability of the many.

The best market timers are not merely forecasters but risk managers – adjusting exposures not only to capture return opportunities, but also to mitigate downside risks. There are certain managers – including within Man Group – for whom timing is a large and dependable driver of returns across different market regimes.

Why, then, has market timing been so widely dismissed by academics? This paper challenges the prevailing narrative by demonstrating that timing’s effectiveness hinges on the sophistication of the approach and the granularity of data used.

Theory versus practice

Market timing has long been a subject of debate in both financial academia and professional investment practice. Conventional academic wisdom, rooted in the work of Sharpe (1975)2 and echoed in many subsequent studies, suggests that achieving consistent above market returns through market timing is, at best, implausible. The argument hinges on the idea that, given the complexities and unpredictability of markets, most managers lack the forecasting accuracy necessary to time markets profitably over extended periods.

However, as long as there is a range of skill in investing, we would argue there is plenty of room for skilled investors to generate alpha. What unites effective market timers is the recognition that markets evolve in response to a combination of economic fundamentals, behavioural dynamics, and structural shifts in risk. Done successfully, it’s a continuous process of weighing probabilities, adapting to evolving conditions, and integrating diverse sources of information to optimise portfolio positioning – all of which requires constant adaptation of models and signals. Market timing must at once be fluid, and highly disciplined; forming a fundamental element of the investment process.

The process assumes different forms depending on the type of investor. Allocators3 such as pension funds, sovereign wealth funds, and endowments tend to use market timing to make tilts in portfolio allocations based on longer-term economic and financial cycles. These shifts may, for example, involve reducing exposure to risky assets when systemic risk indicators flash amber. Being able to anticipate changes in the risk regime enables sophisticated allocators to mitigate drawdowns and maximise returns.

Hedge funds, on the other hand, approach market timing with a high degree of granularity. Many hedge fund strategies, particularly global macro and quantitative approaches, rely on identifying short- to medium-term market dislocations and adjusting exposures accordingly. This may involve rotating between asset classes, sectors, or factors based on predictive models, sentiment indicators, or real-time market data.

The prevalent academic models used to evaluate market timing often rely on monthly or quarterly data, which can obscure the short-term dynamics and rapid shifts that skilled managers seek to exploit.4 As research by Marta Vidal at the University of Madrid has shown,5 employing daily data significantly increases the detection of timing skill, revealing that a considerable proportion of managers – up to 35% – demonstrate persistent market timing abilities that are masked in coarser datasets.

Many studies aggregate results across a wide spectrum of managers, diluting the impact of a small subset of managers who consistently outperform through market timing. Early studies underscore that successful market timing is indeed possible, albeit concentrated among the top quartile (or even decile) of skilled managers.6 These managers harness a nuanced understanding of market conditions, blending macroeconomic analysis, volatility measures, and cross-asset signals.7

The key to market timing is to fully understand the drivers of market pricing. In our approach, we are always adding and removing models and indicators from our suite of tools. This fluidity is a feature of a sophisticated timing approach. A static model, in contrast, can quickly become obsolete.

Models for market timing

Data and sample selection

The contemporary landscape of financial markets is defined by an abundance of data, which enables a more refined analysis of market-timing skill than was previously possible. For the purposes of our research into market timing, our analysis draws primarily on multiple datasets of daily returns from actively managed funds across various global markets.

Additionally, the analysis incorporates alternative data sources, volatility indices, high-frequency trading data, and measures of market liquidity and spreads. These provide an alternative view of market dynamics, particularly in periods of heightened uncertainty, and enable the identification of short-term signals that can inform timing decisions. By blending these diverse data sources, we can explore how different indicators interact and, more importantly, how their combinations can yield more reliable signals for market entry and exit.

Combining market and risk models

Unlike traditional studies that mainly rely on linear models and simple investment rules, our analysis also covers alternative statistical techniques such as regime-switching models, machine learning-based pattern recognition, and time-varying volatility estimation. These methods can be used to detect patterns in market movements that may not follow the linear assumptions of older models.

For instance, we find that timing models which incorporate both momentum signals and macroeconomic variables (like yield spreads and credit conditions) outperform those relying on a single class of signals. This suggests that the value of market timing lies not in the use of a particular indicator but in the ability to combine diverse signals and adapt them as conditions change. It is here that human insight becomes crucial, guiding the selection and weighting of indicators, and interpreting their signals in context.

By combining skilled human insight with advanced analytical tools and the depth of available data, the path to effective market timing becomes clearer. The key to success lies in synthesising insights from multiple models - models that capture valuation signals and risk models that assess the probability of extreme events.

Incorporating risk models such as volatility forecasts can help to identify periods when markets are likely to experience heightened risk, even if long-term valuations remain attractive. By dynamically adjusting the portfolio in response to changing volatility conditions, managers can reduce their exposure during high-risk periods and increase it when conditions stabilise. Thus, signals are turned into weights by taking volatility into account.

Harnessing behavioural and macroeconomic signals

While market and risk models provide a solid foundation, effective market timing also involves leveraging behavioural and macroeconomic signals to capture shifts in market sentiment and underlying economic dynamics. Behavioural signals, such as those derived from investor sentiment indicators, can often anticipate turning points that traditional valuation metrics miss.8

In addition to sentiment-based signals, macroeconomic indicators provide a crucial dimension of insight. For example, yield curves, such as the spread between the 10-year Treasury yield and the three-month yield, have long been recognised as indicators of economic cycles.9 An inverted yield curve has historically been a reliable predictor of recessions, suggesting a forthcoming downturn in equity markets. Similarly, credit spreads – differences between yields on corporate bonds and risk-free Treasuries – can indicate rising credit risks, often a precursor to broader market stress.

Advanced market timers combine these indicators to create more robust signals. For example, a sharp widening of credit spreads alongside an inverted yield curve might provide a stronger indication of economic distress than either indicator alone. Conversely, when sentiment indicators show excessive pessimism while macroeconomic indicators stabilise, this could suggest a contrarian opportunity to increase exposure before a market recovery.

Implications for market (in)efficiency and active management

Market inefficiency provides opportunities for certain managers to extract signals from the noise. The persistence of mispricing suggests that markets are complex, adaptive systems where information is processed unevenly – and it provides trading opportunities, including through market timing.

Remarkably, driven by two forces, the market might be less efficient today than it was 20 years ago. The first force is the rise of index funds. The goal of these funds is to buy at the capitalisation weight, with no attention paid to whether a stock might be overpriced or underpriced (thereby offering no contribution to price discovery).

The second force has to do with the paradox of decreased transactions costs. On one hand, you would think that decreased transactions costs would be a positive force for market efficiency. However, there has been a dramatic increase in the share of trading volume from retail investors. These investors do not have access to big data and sophisticated models’ intra-day information, making them easy to pick off by skilled traders. The rise of the retail investor provides opportunities that did not exist 20 years ago.

If a (small) percentage of managers can add value through timing strategies, the presence of such skill challenges the narrative that passive investing is universally superior. Findings also suggest that active management is most relevant in market environments characterised by complexity and rapid change – conditions under which passive strategies may fail to respond quickly enough.

Time-varying risk

Equally important, and arguably less understood, is the role of time-varying risk. Financial markets are not static; they oscillate between periods of stability and turbulence, with changes in volatility, liquidity and correlation structures often occurring rapidly.

Predictability in financial markets arises not only from valuation-based inefficiencies but also from the persistence of certain risk dynamics. For example, volatility tends to cluster, with periods of low volatility often preceding sharp increases. Market timers who can identify such inflection points gain an edge by dynamically adjusting their exposures. This approach allows them to manage drawdowns during high-risk periods while positioning for outsized returns when conditions stabilise.

Furthermore, changes in the risk environment can have profound implications for asset correlations, cross-market relationships, and liquidity. During periods of elevated systemic risk – such as a liquidity crisis or monetary tightening cycle – correlations across risky assets often converge, rendering static allocations ineffective. The ability to foresee and adapt to these changes transforms market timing from a speculative endeavour into a disciplined approach to risk management.

Studies such as those by Moreira and Muir (2017) have shown that dynamically adjusting portfolio beta in response to volatility forecasts can significantly enhance risk-adjusted returns. By recognising the dual importance of mispricing and risk in generating predictability, market timers can adopt a more holistic framework that responds to the complex interplay of valuation, sentiment, and systemic pressures. This dual focus on risk and return underscores the sophistication required to execute timing strategies effectively.

Skin in the game

Man Group and market timing

Man Group employs market timing approaches throughout the organisation, across a variety of discretionary and systematic strategies. In the micro systematic business, these are split into four key signals, which are then combined in our market timing model. These are: macroeconomic signals; technical signals; flow data and fund positioning; and sentiment analysis.

In the macro systematic business, we use timing models to indicate periods where our strategies either increase or decrease exposure. As an example, we reduce risk when short-term (one-month) volatility spikes above long-term (12-month) volatility.

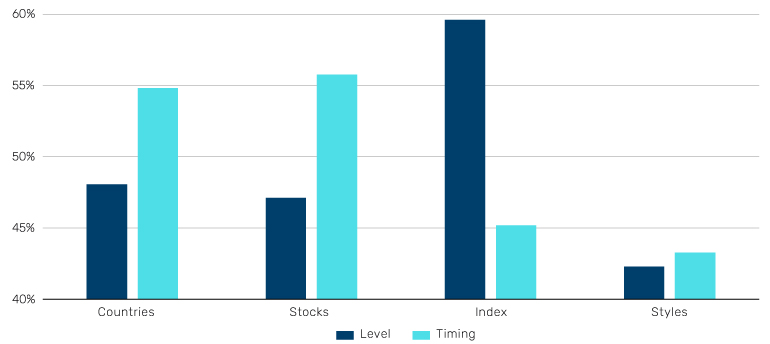

For our discretionary teams, we can drill down into the timing performance of different managers. In writing this paper, we looked at data across 104 Man Group discretionary equity managers going back a decade. Over that time, we decomposed performance into what we call ‘level’ and ‘market timing’. The market timing component reflects moves away from longer-term allocations (level) that either positively or negatively impact returns. We further disaggregated these performance indicators into four separate categories: countries, stocks, indices, and style factors. Figure 1 below shows that the timing of stocks and country allocations is one of the key drivers of returns, at least for this cohort.

Figure 1. Hit rate of level versus timing (104 market-neutral equity portfolio managers)

Source: Man Group. 1 January 2018 - 31 December 2024.

We then selected the manager who had produced the highest Sharpe ratio over the 10-year period. The results were striking: the manager derived most of its performance from timing decisions.10

Indicators and their role in market timing

Usually, approaches to market timing are informed by a diverse set of indicators, broadly categorised into four key signal types:

- Macroeconomic and policy signals: these long-term strategic indicators help forecast broad economic trends and structural shifts in financial conditions, forming the foundation for long-term asset allocation adjustments

- Valuation and fundamental signals: these medium- to long-term indicators assess whether assets are over- or undervalued relative to historical norms and earnings fundamentals

- Market and liquidity dynamics: these short-term and tactical indicators focus on near-term shifts in risk appetite, liquidity conditions, and volatility structures, informing tactical allocation adjustments

- Sentiment and behavioural indicators: these identify short-term turning points, by capturing shifts in market psychology, which often precede inflection points

By integrating these long-term and short-term indicators, we construct models that balance structural trends with tactical responsiveness. For instance:

- A macro-driven timing model might combine GDP nowcasting,11 central bank policy shifts, and credit spreads to guide exposure adjustments across economic cycles

- A volatility-regime model could integrate VIX term structure, market liquidity stress indicators, and equity leverage to manage exposure dynamically based on changing risk conditions

- A behavioural-driven rotation model might use investor sentiment extremes, option market positioning, and financial stress indicators to identify tactical entry and exit points

Conclusion: Innovating to improve and refine

Market timing, long looked at askance in both academic and professional circles, emerges from our analysis as a viable strategy – when it is approached with the requisite nuance. While the prevailing literature highlights the difficulty of achieving consistent outperformance through timing, it often overlooks the meaningful returns that a subset of highly skilled managers can generate. Our findings support a reframing of market timing discussions to acknowledge the role of advanced, dynamic strategies that go beyond simplistic signals.

Our empirical work, particularly the granular analysis of Man Group managers, provides compelling evidence that timing decisions can serve as a critical driver of returns. The success of these managers reflects not only their individual skill but also the amplifying effect of institutional resources, emphasising the importance of platform capabilities in executing sophisticated timing strategies.

Our analysis of market timing also underscores the need for continuous innovation in market timing methodologies. The most successful approaches are fluid, allowing for the ongoing refinement of models and the incorporation of new data sources.

In conclusion, while market timing is not a universally attainable skill, it isn’t the impossibility that traditional narratives suggest. For those willing and able to rise to the challenge, market timing – far from being a speculative gamble – is a potentially transformative component of portfolio strategy.

1. We define market timing as the practice of adjusting portfolio allocations based on anticipated market movements, seeking to enhance returns and/or manage risk by dynamically shifting asset allocations.

2. Likely Gains from Market Timing on JSTOR.

3. One of the authors of this paper is the CIO of a major pension fund.

4. Although it should be noted that shorter-term data has lower signal-to-noise, meaning that there is a payoff involved.

5. Market Timing Around the World | Portfolio Management Research.

6. The Market-Timing Performance of Mutual Fund Managers on JSTOR.

7. A good example of the sophisticated combination of signals used by the most evolved market timers can be found in Harvey et al,: Detecting Repeatable Performance by Campbell R. Harvey, Yan Liu :: SSRN.

8. For example, the term structure of the VIX - analysing the spread between short-term and long-term volatility - can offer insights into whether market participants are becoming increasingly fearful of near-term risks relative to the longer-term outlook. A steeply upward-sloping VIX curve can suggest that investors are bracing for short-term volatility, a potential signal to reduce equity exposure.

9. See Harvey 1988, 1989.

10. In fact, were it not for their skill in timing markets, this manager would have actually derived a negative return from their stock selection.

11. Nowcasting in economics is the prediction of the very recent past, the present, and the very near future state of an economic indicator.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.