Introduction

In January, we discussed the longer term prospects of the Magnificent Seven1 from an expected return perspective. Our simple analysis suggested that the group was priced to generate mid-single digit total returns for shareholders over the next decade, implying neither an obvious case for outstanding forward returns nor a terribly egregious current valuation. Purely from a valuation perspective, Alphabet and Meta appeared undervalued relative to this group, Tesla was an outlier on the overvalued side, and NVIDIA boasted a reasonable valuation.

While we focused on longer term expectations, it is worth revisiting our analysis given the significant dispersion in the Magnificent Seven over the first quarter. NVIDIA was the biggest winner by far among this cohort, returning +82.5%, with Meta far behind but still up a respectable +37.2% (okay, that is way more than respectable). While NVIDIA boasted a reasonable valuation at the start of the year, below we update our view on it (spoiler alert: it is less reasonable). On the reverse, Tesla significantly underperformed the group (and the market), returning -29.3%. Tesla reported poor results in January, and terrible deliveries at the beginning of April. Apple also had a difficult quarter, returning -10.9% on concerns over China market share and iPhone growth.2 So, did the dispersion we witnessed in the first quarter materially change our views?

The expected return of the Magnificent Seven (+ Eli Lilly)3

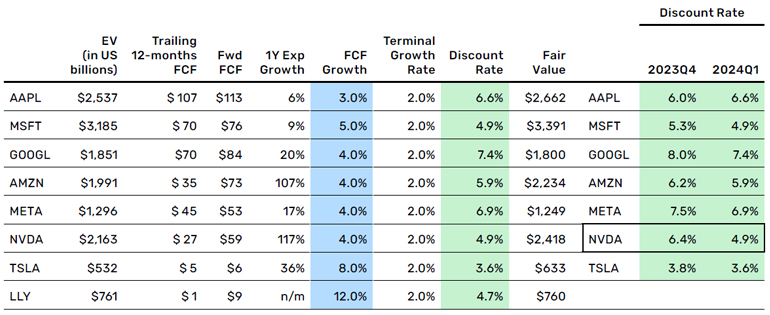

In Table 1, we update our model of the 10-year annualised expected return (the Discount Rate), given a 10-year estimate of free cash flow growth, plus a terminal growth rate.4 On the right-hand side, we show the change from the start of the year through today. We have also added American pharmaceutical company Eli Lilly & Co, a key beneficiary of the GLP-1 weight loss medication craze, that has surpassed Tesla in market capitalisation by more than a little.

NVIDIA – the clear winner in Q1 – sees the biggest drop in expected returns over the next decade, dropping from 6.4% to 4.9% annualised. While the massive Q1 rally does not make NVIDIA an obvious sell (through the lens of this framework), the potential returns going forward have been reduced. Tesla, however, looks even less attractive than it did in January, as the expected fundamentals over the period deteriorated commensurate with the drop in the stock price. The only stock in this cohort that shows an improvement in expected return is Apple, as the drop in valuation occurred with stable fundamentals. Rank-ordering the Magnificent Seven purely from this DCF model suggests Tesla remains the most expensive based on our fundamental assumptions, while Microsoft and NVIDIA are now comfortably in the expensive half of this cohort.

Table 1: What might investors realistically expect?

Source: Man Numeric and Bloomberg, as of 9 April, 2024.

Eli Lilly also appears to have low prospective returns, as the current expected FCF/EV yield is approximately 1.2%. However, profits and cash flows are expected to grow significantly over the next few years, while capital expenditures may recede following a build out to support GLP-1 sales. Thus, it is possible that free cash flow growth could be higher than our long-term assumption of 12%. In any event, it is safe to say that the market has very high expectations here, on par or even in excess with some of the expectations surrounding AI plays.

Can the Magnificent Seven (+ Eli Lilly) generate 10% annual returns?

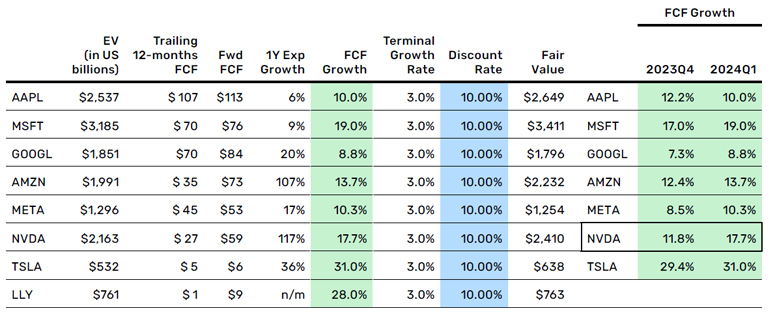

In Table 2, we update our model to determine what level of free cash flow growth would be required to generate 10% annualised returns over the next decade. Starting with Eli Lilly, we see that would require 28% annual free cash flow growth, which equates to a free cash flow of an estimated $83 billion in 10 years versus the $9 billion expected in the coming year. That is… aggressive? Similarly, Tesla would require 31% annual free cash growth, which is actually an increase from the requirement at the beginning of the year. To be clear, there is a low base issue here, so a material near term improvement in free cash flow could make this easier to achieve.

Table 2: What would be necessary to produce a 10% annual return?

Source: Man Numeric and Bloomberg, as of 9 April, 2024.

The most notable change in the first quarter was for NVIDIA. At the start of the year, NVIDIA required 11.8% annual free cash flow growth, which seemed plausible given the near-term trajectory in earnings and cash flow. Today, NVIDIA would require 17.7% annual free cash flow growth to generate 10% annual returns over the next decade. That is a substantial increase and NVIDIA does not suffer from a low base. Microsoft is also aggressively priced, with a 19% growth requirement, though as we noted last time, they have materially accelerated capital expenditures in the near term so if/when they reduce capex, that should provide a boost to free cash flow.

Amazon, Apple, Alphabet, and Meta sit in the range of 8.8% to 13.7% required growth, which seems plausible. Arguably Apple’s requirement of 10% growth is aggressive but is still significantly less onerous than the 12.2% required at the beginning of the year.

Conclusion

The first quarter produced outstanding equity returns globally, as well as in the Magnificent Seven. Within the Magnificent Seven, the dispersion rearranged some of the potential returns going forward, though overall we still appear to be at levels consistent with mid-single digit returns. While this is not horribly exciting from a total return perspective, it is also not an obvious shorting opportunity (at least from a total return perspective).

At the beginning of the quarter, we believed NVIDIA boasted a reasonable valuation. Today that valuation is much less reasonable. Eli Lilly (which rose 33.5% in the first quarter) and Microsoft, the largest publicly traded company in the world, also bake in significant growth expectations, which may be hard to achieve and lead to relatively muted returns. Tesla remains the least attractively valued of the group (conventionally) and is obviously pricing in an option on some of its technologies. As an auto company it would be uncontroversially egregiously valued.

Earnings seasons is almost upon us; will the Magnificent Seven continue to outperform the rest of the market? They may need to exceed current expectations for that to happen.

With contributions from Dan Taylor, Chief Investment Officer at Man Numeric.

1. Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta, and Tesla.

2. Returns from 31 December 2023 to 31 March 2024 on a share price basis in US dollars. All data sourced from Man Numeric and Bloomberg.

3. Data as of 9 April 2024. All data sourced from Man Numeric and Bloomberg.

4. As in our previous analysis in January, we apply a simplistic discounted cash flow (DCF) model to determine an expected return given an expected level of free cash flow (FCF) growth. We assume a terminal growth rate of 2%. We are also assuming that these stocks are fully equity-funded, which is not a terrible assumption, but is also not strictly true as each of these companies carries a small amount of debt.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.