The temperature soared through previous records during early June in parts of Europe, while China, the US and the UK have experienced blistering heatwaves so far this month.1 Through our latest research in conjunction with Oxford University, we have found evidence of a ‘climate factor’ in investing, with extreme heat adding 72 basis points of annualised volatility to US equity markets over the past two decades.2

As physical climate risks propagate through commodities and corporate operations, understanding their financial implications has become critical for navigating markets. Over 20 years, the cumulative effect of the volatility can become substantial, particularly for sectors like materials and industrials, and assets like data centres, where climate risks directly affect operations and valuations. For long-term investors, this added volatility requires adjustments to portfolio risk management and asset allocation frameworks.

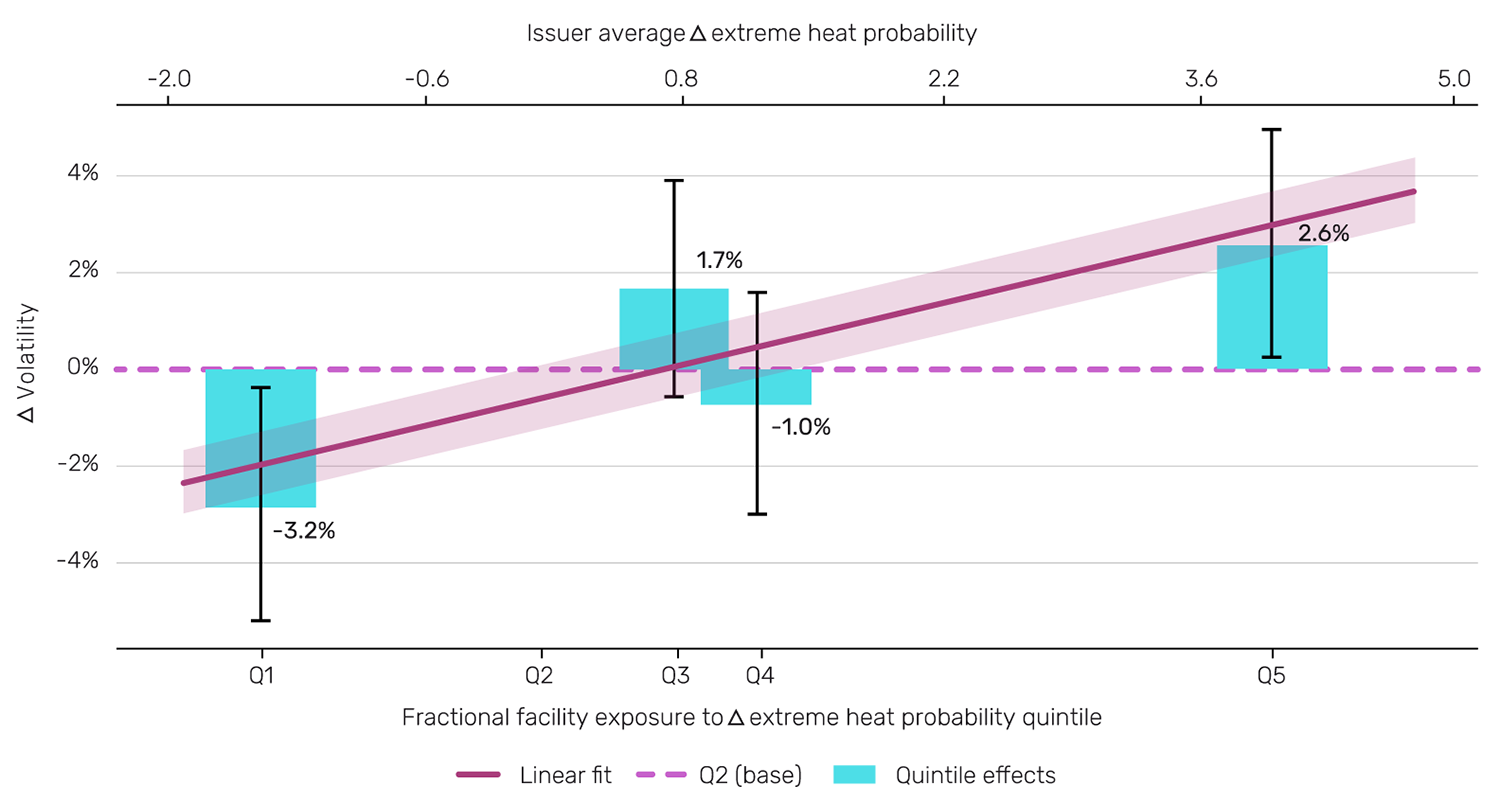

Our study mapped facility footprints of a sample of US-listed firms, all of which have at least 90% of their facilities in the continental US, against regional heat risk (Figure 1), using linear regressions and bucketed analyses.

Figure 1: Facility footprints of a sample of US-listed firms against regional heat risk

The chart above displays the impacts of summer heat events on US equity volatility. The bar graph represents the impact to volatility as a function of the fraction of facilities within quintile exposure bins. The linear relationship represents the impact of company-average extreme heat probability on volatility, with the shaded region indicating the 95% confidence interval. Source: Man Numeric, Man Group internal research, as of April 2025.

Our analysis of the behaviour of this sample of US-listed firms from 2002 to 2022 showed that those companies with facilities concentrated in heat-sensitive regions – where extreme summer heat probabilities increase more rapidly with mean warming – showed higher volatility during anomalously warm summers. After controlling for idiosyncratic factors, the warming trend alone drove a 6.6% (72 basis point) increase in total market volatility. This suggests investors viewed affected companies as riskier during heatwaves. But markets weren’t pricing this risk efficiently, as evidenced by widening spreads in future analyst earnings revisions for heat-exposed companies.

US equity markets typically exhibit annualised volatility of around 15%3 so this increase, driven by a single factor, extreme heat, is notable.

A new paradigm?

Climate risk isn’t some distant threat. It’s reshaping how we think about investments and financial risk today. While traditional environmental, social and governance (ESG) investing has often devolved into a grab bag of topics and opaque vendor scores, we see a new paradigm emerging: using hard science to price the effects of weather and climate variability on the economy.

In another example, in Brazil, a 1°C rise doubles the chance of droughts severe enough to destroy crops. Coffee production, concentrated in Brazil’s key growing regions, has already seen price shocks tied to these risks. Similar effects apply to cocoa, sugar and other crops.

Hope through innovation

That said, it's not all doom and gloom. Smart adaptation can improve outcomes even as risks intensify. Take agriculture: global crop yields have soared over the past 60 years despite rising temperatures, thanks to technological advances and improved farming practices. Yes, productivity growth has slowed in mid-to-low latitudes due to heat impacts, but continued innovation and resilience-building can enhance food security. The future isn't predetermined – it depends on our actions today.

By understanding these climate impacts, we can make better decisions that benefit both investors and society.

Authors: Matt Goldklang, Climate Scientist at Man Numeric and Jane Smyth, Climate Scientist on the Responsible Investment research team at Man Group.

Read Matt and Jane's new Substack Let's Get Geophysical here.

Central banks hold firm as inflation concerns persist

Last week saw interest-rate decisions from the Federal Reserve (Fed) and the Bank of England (BoE). Most notable for the Fed was the change in the dot plot: the June 2025 dot plot showed its core inflation forecast rising significantly by the end of 2025 to 3.1%, up from March’s 2.8% and December’s 2.5%.

For the end of the year 2026, the Fed upwardly revised its expectations for core inflation from 2.2% in the March dot plot to 2.4% in the June dot plot. By 2027, the Fed expects inflation to be at 2.1%, which is only slightly higher than the March dot plot expectations of 2.0%. Fed Chair Jay Powell acknowledged that recent readings showed inflation cooling, but the Fed expects tariff policy will likely cause an increase in inflation.

The June dot plot also showed downward revisions to expected growth in 2025, from 1.7% to 1.4%. This marks a substantial change from the December 2024 dot plot, which was at 2.1%.

Perhaps most notable for the BoE were the headwinds created by high wage growth. While the BoE expects this to ease, employers have also been hit with an increase in National Insurance for their employees, as well as a rise in the minimum wage, which is significantly adding to their costs. This raises the risk of persistently higher inflation.

Central banks united in cautious stance

There were some notable commonalities between the two central banks. Firstly, neither cut rates despite signs of weakening economic growth and, in the case of the Fed, outright pressure from the US President. Like Jay Powell, the BoE’s Governor Andrew Bailey and his deputy governor stressed the high level of uncertainty in the current environment, particularly noting added risks from the Israel-Iran conflict. The BoE, like the Fed, is clearly in ‘wait and see’ mode. What it does at its August meeting will largely depend on the data between now and then.

Author: Kristina Hooper, Chief Market Strategist, Man Group.

Read Kristina's full new weekly commentary Signals & Sentiment here.

1. Weather tracker: Europe and China in midst of record-breaking heat | Extreme heat | The Guardian

2. Based on research, as of April 2025.

3. Man Numeric calculation, based on monthly returns for the S&P 500 Total Return Index between 2001 and 2020.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.