Introduction

Much was written about the Magnificent Seven – Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta and Tesla – in 2023, as these stocks all rebounded from a difficult 2022 and most of them benefited from their ties, direct or indirect, to artificial intelligence (AI). For active equity investors, there may be no more important question in 2024 and beyond than what to do with this group of stocks, given they currently constitute 28% of the S&P 500 Index.1 Will they continue to lead the market? Or will they suffer from outsized expectations and be too large to outgrow the broader market?

Current valuations of the Magnificent Seven2

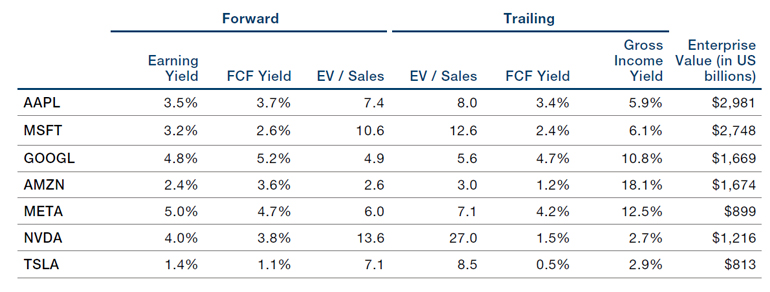

While it is difficult to argue that these stocks are “cheap”, it is not clear that they are outrageously valued either. They (mostly) generate a significant amount of free cash flow (FCF) which has (generally) been growing. Table 1 shows some forward- and backward-looking valuation metrics for the Magnificent Seven.

Table 1. The Magnificent Seven in numbers

Source: Man Numeric and Bloomberg, as of 28 December 2023.

Tesla appears to be an outlier from a valuation perspective, trading at fairly high levels relative to prospective profitability and FCF generation. Outside of that, while perhaps elevated, the valuations are much closer to a reasonable range, with trailing FCF yields ranging from 1.5% to 4.7% and expected (forward) FCF yields ranging from 2.6% to 5.2%. While NVIDIA has led the AI craze and appears very expensive at 27x EV/sales on a trailing basis, its growth has been nothing short of astonishing and trades at a not unreasonable 3.8% expected FCF yield. Some comparisons have been made to Cisco during the TMT bubble back in 1999 and 2000, but Cisco traded in excess of 100x forward earnings at the peak of the bubble (versus NVIDIA at 25x today).

Can the Magnificent Seven generate 10% annual returns?

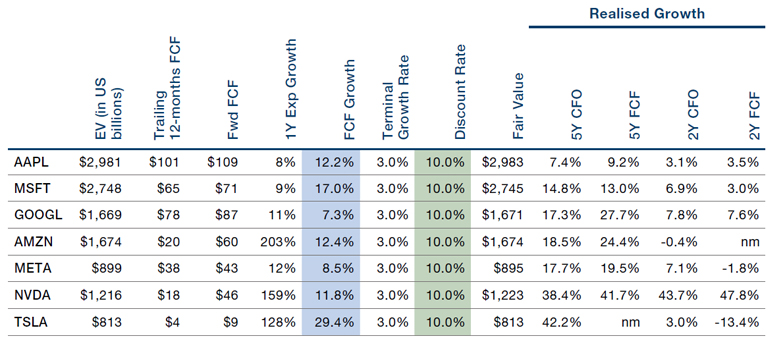

We apply a simplistic discounted cash flow (DCF) model to estimate what kind of FCF growth would be necessary from years two through to 10 to produce a 10% annual return (and assume that this next year of FCF growth is a given). We are also assuming that these stocks are fully equity-funded, which is not a terrible assumption, but is also not strictly true as each of these companies carries a small amount of debt. Table 2 presents the data and assumes a 3% terminal growth rate (which is slightly aggressive). It also shows the realised CFO and FCF growth over the last five and two years, respectively.

Table 2. What would be necessary to produce a 10% annual return?

Source: Man Numeric and Bloomberg, as of 28 December 2023.

In terms of expected FCF growth over the next year, four of the stocks (Apple, Microsoft, Alphabet and Meta) are in “steady-state” mode and expected to grow their FCF between 8% and 12% this next year. Microsoft growth would arguably be higher but it has guided for higher capital expenditures to invest in its AI capabilities. Two of the companies (NVIDIA and Tesla) are expected to significantly grow their FCF over the next year; NVIDIA expects outstanding growth in its business, while Tesla is operating off a relatively small base of FCF to begin with. Amazon is a bit of an outlier here, expecting large growth but mostly through increased discipline and significant financial flexibility.

But taking these near-term expectations for granted, the required FCF growth for five of these companies over years two to 10 ranges from 7.3% to 12.4%, which is aggressive, but plausible? Microsoft would need a higher level of FCF growth at 17% annually, while Tesla would require 29.4% annually. This may overstate the issue slightly, as again Tesla is operating from a fairly low base so near-term improvements could make it a bit more achievable. Looking at realised growth over the last five years3, outside of NVIDIA, growth has slowed significantly due to the high base post- Covid. Generally speaking, the required FCF growth to generate 10% annual returns appears aggressive. For example, Apple would need 12.2% FCF growth annually, while it has only averaged 9.2% over the last five years, with the pace slowing further more recently. Microsoft has had an incredible growth run of late, but forward FCF growth would have to exceed realised by 400 bps annually over the next decade. Superficially, NVIDIA’s required growth seems plausible, but revenues are expected to be up by an estimated 700% from 2019 to 2024, raising the bar significantly on what kind of future growth is possible from that point.

At current valuations, double digit returns appear unlikely (though certainly not impossible) for most of the Magnificent Seven. So, what is a more realistic expectation?

The expected return of the Magnificent Seven (using conservative/realistic expectations)

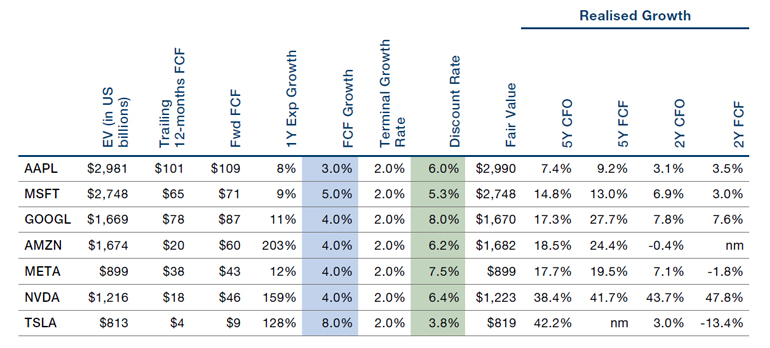

Let us go through the same exercise, but rather than determine the FCF growth necessary to justify a 10% annual return, we can determine an expected return given an expected level of FCF growth. We will also assume a more conservative terminal growth rate of 2%. Table 3 presents this data, and again we are assuming that the next year of expected FCF growth will materialise.

Table 3. What might investors realistically expect?

Source: Man Numeric and Bloomberg, as of 28 December 2023.

Again, we would describe these as realistic and/or conservative assumptions. And depending on your point-of-view, they may be very conservative! Using these assumptions, the discount rate is the expected annual return for these stocks. The range of expected returns is from 3.8% (for Tesla) to 8.0% (for Alphabet). We do not claim to have a crystal ball here; it is certainly possible that some of these companies will outperform our assumptions, and also quite likely that at least one or two will do materially worse. It is also possible that returns in the 6 to 8% range are competitive with the overall equity landscape, especially if interest rates stay at current levels or fall further.

Conclusion

Normally one would think that size is an enemy of growth, in that it can be hard to sustain high growth rates when a company becomes too large. In fact, at one point, the small cap anomaly (the theory that smaller firms tend to outperform larger firms) was believed to be a feature of equity markets. While that is possibly still the case, at a minimum, we can say that the small cap anomaly has been hibernating in recent years. Indeed, size and its concomitant network effects, have proven to be an advantage to most (or all) of the Magnificent Seven. So, while it is still likely the case that these companies cannot grow materially faster than the market in perpetuity, they all do appear to have a semblance of an economic moat that could allow them to sustain above average profitability for some period of time.

There is of course regulatory risk that could involve either breaking up some of these companies and/or encouraging healthier competition. This risk has been well known for some time, and there have been some actions by governmental agencies, but to date, nothing material has stuck.

These stocks are highly idiosyncratic, but some are also quite tied to each other. NVIDIA’s four largest customers are Microsoft, Meta, Amazon, and Alphabet. Alphabet pays Apple a very healthy sum to be the default search engine on the iPhone. One could argue that Apple is past its growth heyday and has now become a pseudoconsumer staple, with a higher valuation, lower growth, and a more bond-like return Views From the Floor | 4 profile. Tesla is clearly an option on a range of future technologies and its charging infrastructure, as it sports an incredible valuation premium relative to the rest of the automotive industry. NVIDIA almost appears cheap based on its recent and near-term growth prospects; the primary questions are how big will the AI market become, how cyclical will it be, and will there be effective competitors?

Purely from a valuation perspective, Tesla is a clear outlier on the expensive side, while Alphabet is the cheapest by a modest amount over Meta. Amazon may have the most levers to pull on the financial side, as it serially “under-earns” to invest in its business, while NVIDIA is arguably the biggest wild card, as it boasts a reasonable prospective valuation with an unclear amount of runway going forward.

Returning to the question at hand – will the Magnificent Seven continue to lead the market? – our analysis points towards a somewhat boring prediction, which is that these companies in aggregate appear to be valued to produce mid-single digit returns over the next decade. While that is not particularly exciting, it runs counter to the two loudest arguments of the day: A) investors need to buy these stocks today as they will continue to drive growth and to capitalise on the AI opportunity; and B) these stocks are egregiously valued and should not be owned in 2024.

With contributions from Daniel Taylor, CIO, and Ben Zhao, Quantitative Researcher, at Man Numeric.

1. As of 28 December 2023.

2. Data as of 28 December 2023. All data sourced from Man Numeric and Bloomberg.

3. Note we also consider CFO here which excludes the impact of capital expenditures and is a cleaner metric of cash flow generation.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.