Macro Signals Suggest Risk-On Continues

History never repeats itself, but it does often rhyme. Understanding the drivers of returns in previous market regimes can help investors to project history forward and maximise the probability of successfully capturing alpha. In July, we detailed how our MacroScope algorithm could use this understanding of history to explain why markets remained bullish in the second quarter despite many investors’ expectations that stagflation and rapid-fire interest rate increases would take the wind out of the global economy’s sails.1

Nearly a full quarter and some US, Eurozone, and UK rate hikes later (even if the Federal Reserve and the Bank of England held their fire in a hawkish pause last week), the US bond market has continued to flash recession signals with the yield curve remaining inverted for over 200 straight trading days2 So what does the market think now?

By looking at similarity measures, our models still see the markets currently behaving least like the global financial crisis era of late 2008 meltdown, and most similarly to more benign periods such as early 2013, the end of 2016 and late 2019.

In addition, recently developed machine-learning algorithms that help guide our top-down positioning mostly point to a risk-on regime where it is momentum and beta themes overwhelmingly driving market returns currently, with typically defensive themes like earnings yields being out of favour. However, they also suggest adding a little diversification through themes such as investment quality or size (Figure 1).

Figure 1. Risk-on styles dominate current market

Problems loading this infographic? - Please click here

Source: Man Numeric, using MSCI Barra factors.

Supervised Macro Scope (SMS) is another supervised machine learning algorithm we use that adds a more dynamic and opinionated view of the current macroeconomic environment to further guide the weights within positioning.

From the graph below, we can see that SMS favours momentum and beta as dominant themes but also chooses to express this risk-on sentiment with leverage. Notably, the strongest view of this model is investment quality (Figure 2).

Figure 2. More risk-on views from Supervised Macro Scope

Problems loading this infographic? - Please click here

Source: Man Numeric.

It would appear that the markets are, despite continued rising rates, still firmly in a risk-on mood, with defensive styles out of favour, but with some quality measures potentially adding performance.

Central Banks Keep Watchful Eye on Treasury Basis Trades

Last week, the Bank for International Settlement3 became the fourth institution to sound alarm bells over hedge funds’ build-up of leveraged short positions in US Treasury futures

Since May, the US Securities and Exchange Commission (SEC), the Federal Reserve (Fed) and the Bank of England4 have warned that these Treasury basis trades have the potential to seriously destabilise financial markets.

The BIS estimates that leveraged funds have built up net short positions in US Treasury futures of about $600 billion with more than 40% of the net shorts concentrated in twoyear contracts. Figure 3 shows the total net holdings of leveraged funds against the long holdings of asset managers.

Figure 3. Build-up of leveraged positions in US Treasury futures

Problems loading this infographic? - Please click here

Source: Bloomberg, asset manager holdings sum of 2-year + 5-year + 10-year net holdings, leveraged funds holding sum of 2-year + 5-year + 10-year net holdings.

How does a Treasury basis trade work?

In simple terms, a Treasury basis trade is an arbitrage trade to take advantage of price differentials between Treasury futures and Treasury cash bonds. When futures are trading rich relative to cash, hedge funds try to arbitrage this by selling futures against going long cash bonds. Since this basis is quite small, hedge funds must apply large leverage to magnify their payouts. The mechanism works as follows:

Hedge funds:

- Buy Treasury bonds

- Transfer these Treasury bonds to a repo desk to obtain financing, which they keep

- Short Treasury futures

On maturity of the futures, hedge funds deliver the Treasury bonds to settle their short future positions. From the payout, they close the financing leg and keep the difference as profit.

What are the concerns?

The issue arises when volatility in the Treasury market jumps suddenly, forcing hedge funds to liquidate and deleverage all at once. We saw this in early 2020 and earlier this year after the collapse of Silicon Valley Bank (see Figure 5 later in this piece). The illiquidity and dislocation in the Treasury market was large enough for the Fed to step in to provide liquidity and bring back order. Leveraged funds are at a comparable level of net shorts now, the BIS says.

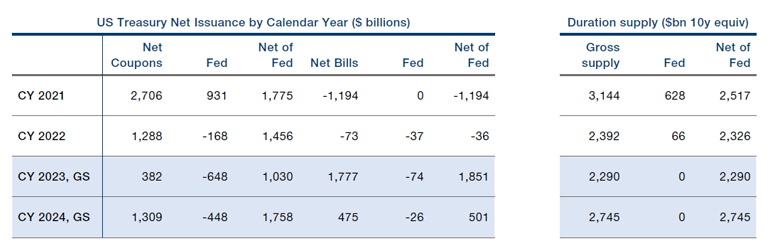

An additional big concern is the amount of Treasury issuance that is coming to the market. Goldman Sachs estimates that $2.7 trillion of 10-year equivalent issuance is likely next year, compared to $2.3 trillion 10-year equivalent for this year (see last column below).

Figure 4. Net issuance of US Treasuries will likely pick up later this year

Source: US Federal Reserve, Goldman Sachs estimates.

It’s also worth bearing in mind that this year the political stand-off over the debt ceiling prohibited the US Treasury from issuing. A large portion of this issuance will be happening in the second half of this year, after Congress increased the debt ceiling in early June.

The risk is that if the current trend of asset managers going long and hedge funds shorting Treasury futures (through the basis trade) continues as more Treasuries are issued, any unforeseen events may spark a re-run of the 2020 and March 2023 scenarios.

Figure 5. The MOVE Index which captures US Treasury bond market volatility shows how volatility spiked in early 2020 and March 2023

Problems loading this infographic? - Please click here

Source: Bloomberg.

In the current environment two scenarios could force hedge funds to rapidly unwind their basis trades: one if the market moves against them; for example, if their repo position becomes too punitive to roll. The other one would be if bond market volatility forces them to post more margins for their short Treasury bond positions.

With contributions from Eric Wu, Principal, Quantitative Alpha Integration and Strategy, Valerie Xiang, Associate Portfolio Manager, Scott Skirlo Associate Quantitative Researcher, Numeric Investment Management and Ehsan Bashi, Portfolio Manager of Emerging Market Debt Strategies GLG EM Fixed Income.

1. Views From the Floor - 04 July 2023 | Man Institute | Man Group

2. www.bloomberg.com/news/articles/2023-09-14/the-bond-market-has-never-soundedrecession-alarms-for-this-long

3. www.bis.org/publ/qtrpdf/r_qt2309a.htm

4. www.bloomberg.com/news/articles/2023-05-26/debt-ceiling-battle-brings-popular-hedge-fund-trade-fresh-scrutiny

www.federalreserve.gov/econres/notes/feds-notes/recent-developments-in-hedge-funds-treasury-futures-and-repo-positions-20230830.html#fig4

www.bankofengland.co.uk/financial-stability-report/2023/july-2023

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.