The Show Goes On

Chair of the Federal Reserve Jerome Powell took a resolutely dovish tone in his speech at the Jackson Hole conference. Reported inflation is ‘temporarily’ elevated, longer-term trends are disinflationary, tapering may occur this year but not in September, and monetary policy is ‘well positioned’ for the moment1. Rate rises remain a far-off pipe dream, until the US economy makes up the ‘considerable ground’ to achieve maximum employment and inflation moderately exceeding 2% for some time.

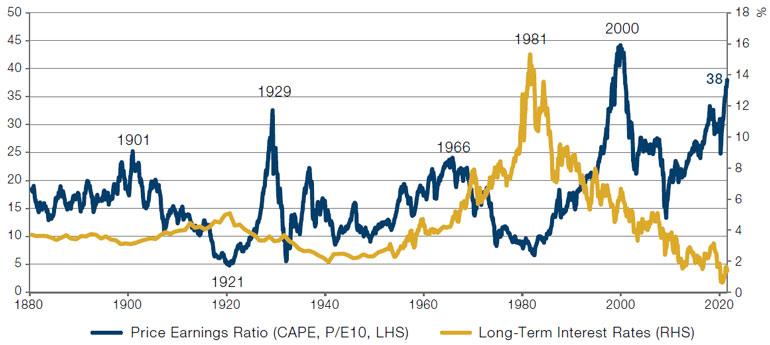

As we’ve previously written, we now live in a world of administered prices. Central bank activity crowds out normal investors and drives them further up the risk curve, so it isn’t surprising that we saw the S&P 500 index reach record highs in response to the speech: nothing is more supportive of risk assets than the Fed’s current policy stance. Until rising inflation forces the Fed to change course, equity markets may well just keep on going up. And given how expensive they are, the size of the risk management challenge increases with them (Figure 1).

Figure 1. Shiller Cyclically Adjusted Price Earnings Ratio

Source: Robert Shiller; as of 31 July 2021.

Ignore McDonald's! Wage Inflation and Corporate Margins

When McDonald's starts offering USD500 signing bonuses2, we might be forgiven for thinking two things: that wage inflation has started in earnest and that corporate margins are consequently due for a battering.

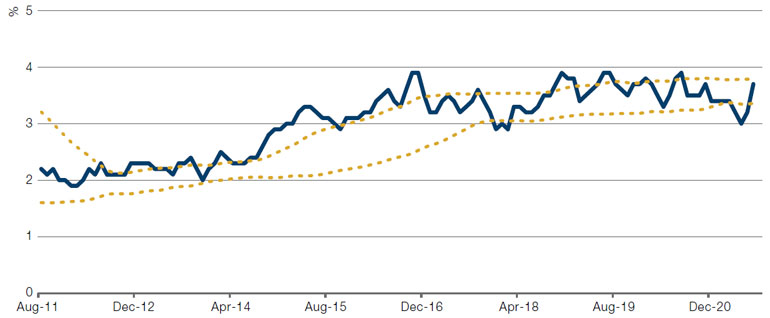

However, the data shows that despite some punchy headlines, exploding wage growth is presently anecdotal rather than general. The Federal Reserve Bank of Atlanta’s Wage Growth Tracker follows the median percentage change in hourly wages in the US, and is a preferred metric for its ability to filter out mix effects when looking at US wage growth. However, since the start of the pandemic, it has shown very little movement, staying rangebound between 3-4% (Figure 2).

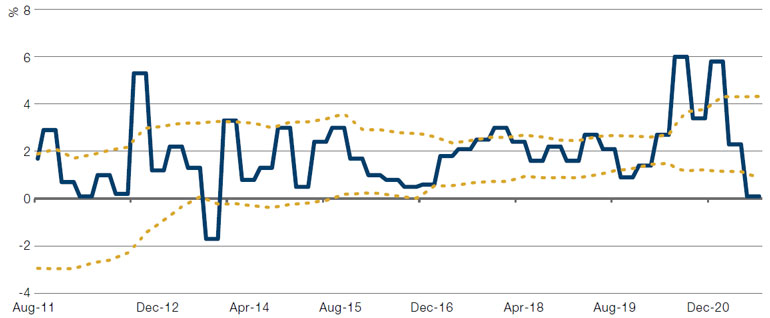

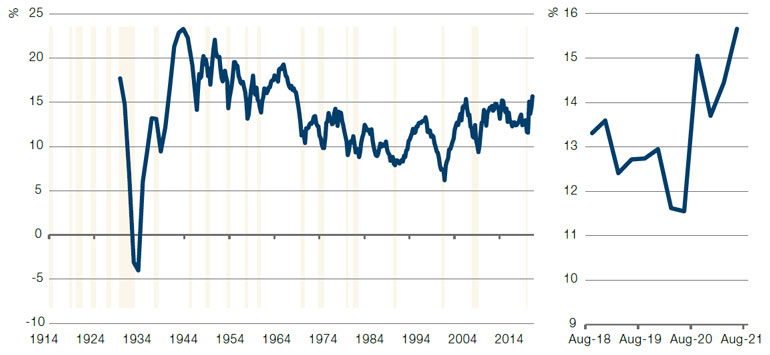

This lack of wage growth has dovetailed with productivity nudging higher, to about a 4% annualised average over the last 12 months, versus a little over 1% on average through 2009-19. Various suggestions have been put forward as to why this might be, perhaps efficiencies around the working from home revolution, perhaps manufacturers being forced to do more with less labour due to quarantines, perhaps replacement of aging capital. But whatever the reason this improved productivity combined with wages which, while buoyant, can hardly be called runaway, has contributed to a steep reduction in unit labour costs for US firms, falling to 0% year on year (Figure 3). As we might expect, lower unit labour costs have been good for corporate margins – so good in fact that, at just under 16%, the PBT margin of non-financial firms is at its highest levels since the 1960s (Figure 4).

Figure 2. US Wage Growth Tracker

Source: Federal Reserve Bank of Atalanta; as of 3 September 2021. Yellow dashed lines are moving averages +/- 1 standard deviation on a 3Y lookback.

Figure 3. Unit Labour Costs YoY

Source: Bloomberg, Man Solutions; as of 3 September 2021. Yellow dashed lines are moving averages +/- 1 standard deviation on a 3Y lookback.

Figure 4. Profit Before Tax as a Percentage of Gross Value Add

Source: Bloomberg, Man Solutions; as of 3 September 2021.

With contributions from: Pierre-Henri Flamand (CIO Emeritus and Senior Investment Advisor, Man GLG) and Henry Neville (Analyst, Man Solutions).

1. ‘Monetary Policy in the Time of COVID’ Jerome H Powell, 27 August 2021.

2. Daily Mail, ‘McDonald's offers $500 bonus to new staff, Wendy’s gives them $100 and Chipotle increase pay to $15-an-hour as fast food outlets are forced to compete with government handouts to recruit workers’, 30 June 2021. The organisations and/or financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.