What Does a Bull Flattener Signal for Equities?

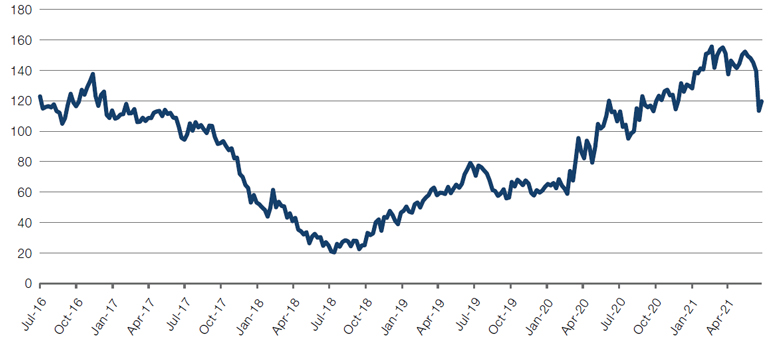

As the dust settles after the Monetary Policy Committee ('MPC') meeting, it’s worth thinking about what the reaction means – and particularly the flattening of the yield curve (Figure 1).

Yield curves flatten in one of two ways: a bull flattener, where long-term interest rates fall quicker than short-term rates; and bear flatteners, where short-term rates rise more than long-term rates.

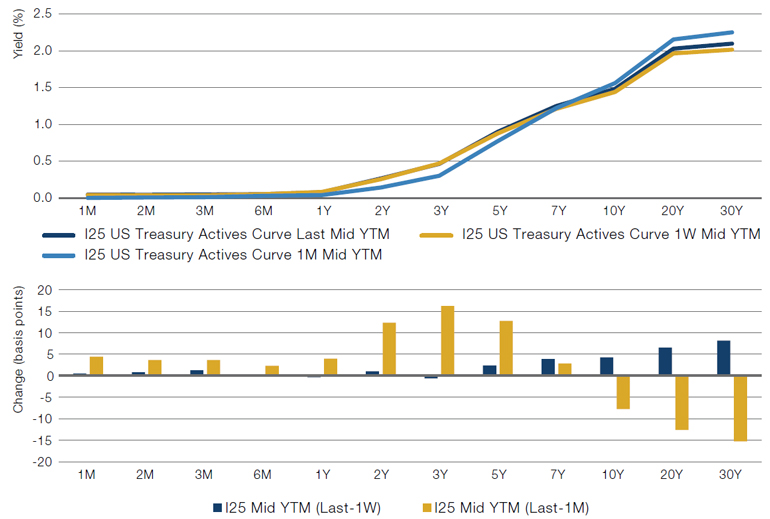

What started as a bear flattener between March and Wednesday 16 June morphed into a bull flattener beginning on Thursday 17 June as the market digested the news from the MPC (Figure 2).

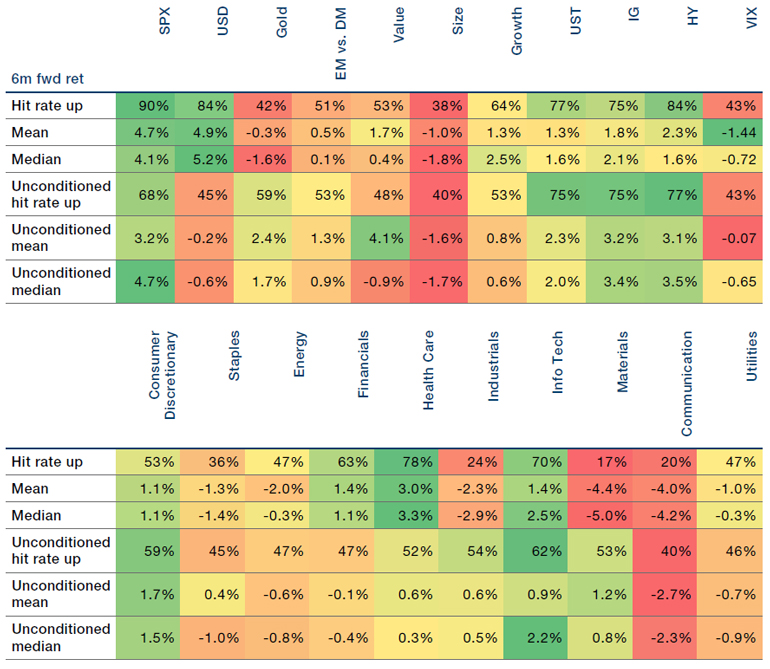

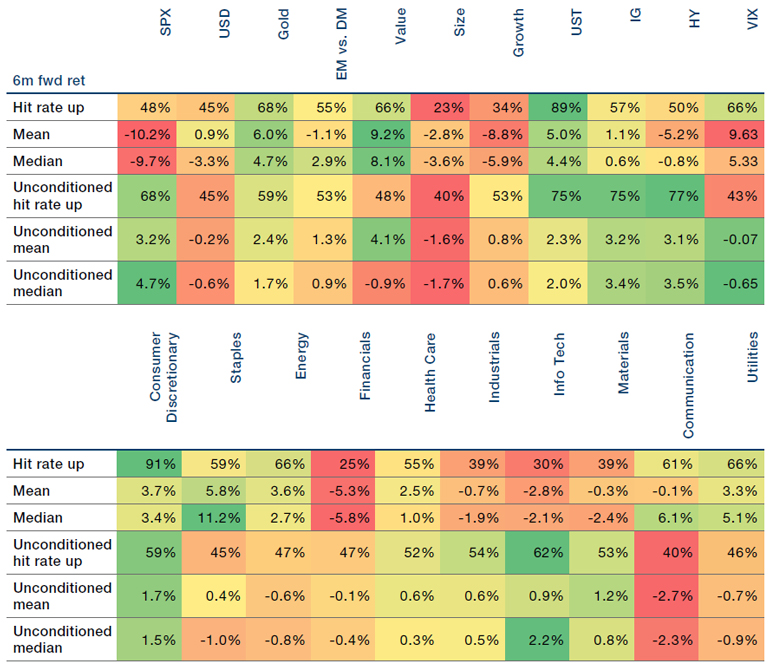

What does this herald over the short and medium term? Figure 3 shows the 6-month forward returns to a variety of assets after both bull and bear flatteners. Bull flatteners tend to be a positive signal for equities, the US dollar and Growth versus Value. Specifically, bull flatteners are good for long-duration sectors such as health care and IT. Conversely, bear flatteners are bad for equities, better for Value and good for gold.

Figure 1. US 30-5 Year Spread

Source: Bloomberg; as of 25 June 2021.

Figure 2. US Yield Curve Versus 1-Week & 1-Month Change

Source: Bloomberg; as of 21 June 2021.

Figure 3. Six-Month Forward Returns – Bull & Bear Flatteners

Bull flattener beginning Thursday 17 June

Bear flattener between March and Wednesday 16 June

Source: Man GLG; as of 21 June 2021.

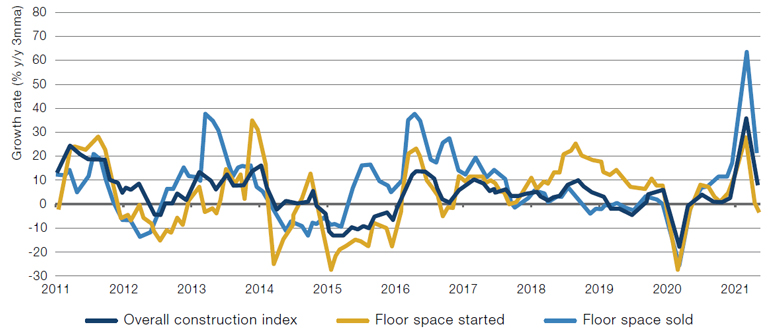

China Credit: The Property Proxy

Back in March, we spoke about how the robustness of property sector in China was sitting at odds with the slowing Chinese credit impulse (which shows the change in the growth rate of aggregate credit as a percentage of GDP): as a credit-sensitive sector, a decelerating credit impulse should result in slowing construction.

This anomaly now appears to be correcting itself: property sales by floor area rose 9.2% in May from a year earlier, while new construction starts by floor area fell 6.1% in the month (Figure 4). Indeed, new construction starts by floor area is now negative not only year-on-year, but over a 2-year lookback period, which strips out any lingering base effects from the coronacrisis.

Figure 4. China Property Sales and Starts

Source: Credit Suisse; as of May 2021.

With contribution from: Ed Cole (Man GLG, Managing Director – Discretionary Investments).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.