The Anatomy of a Tantrum: Negative Convexity and MBS Hedging

If there is anything guaranteed to make our risk teams wake up in the middle of the night in a cold sweat, it is self-reinforcing events, such as the quant equity unwind in 2007, or the VIX blow-up in 2018.

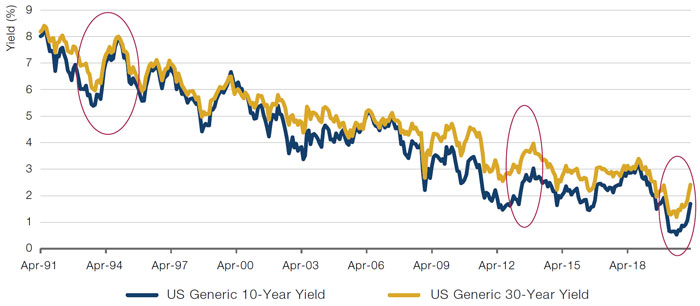

One such self-reinforcing event could be the increase in US Treasury yields that we are curently experiencing. Previous examples where a spike in Treasury yields caused havoc would be the 1994 Great Bond Massacre and the 2013 Taper Tantrum, both of which caused significant volatilty in both equity and bond markets (Figure 1).

Why are US Treasury yields such a concern now? The answer lies in the negative convexity of the mortgage-backed security (‘MBS’) market.

Most standard bonds have positive convexity, meaning that as yields rise, values fall, but at a decelerating pace. Vice versa, as yields rise, prices fall. However, for bonds with negative convexity, the shape of yield curve is concave. As such, their price can decline as yields fall.

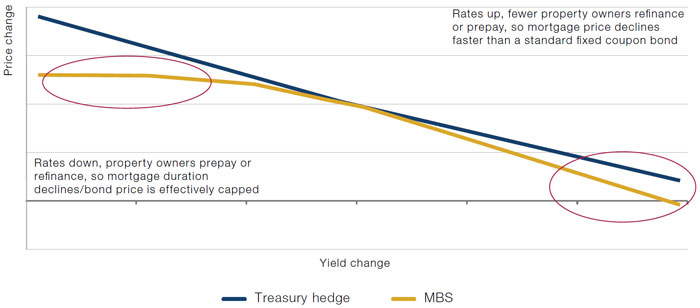

MBS tend to have negative convexity: when rates fall, more US property owners choose to repay or refinance their mortgage. This reduces the duration of MBS, forcing owners of these MBS to reinvest their money at a lower rate and denying them the benefit of future cash flows at an above-market rate of interest. On the other hand, when rates increase, fewer property owners refinance their mortagages or prepay, resulting in the price of MBS deteriorating faster than a standard fixed-coupon bond (Figure 2).

Most MBS owners choose simply to bear prepayment risk, and hedge their duration exposure using US Treasuries. When yields rise, such MBS owners are forced to re-hedge their interest-rate risk by selling US Treasuries. This selling pressure drives Treasury yields higher, which means fewer homeowners refinance. This creates a self-reinforcing vicious circle which requires more selling to hedge positions.

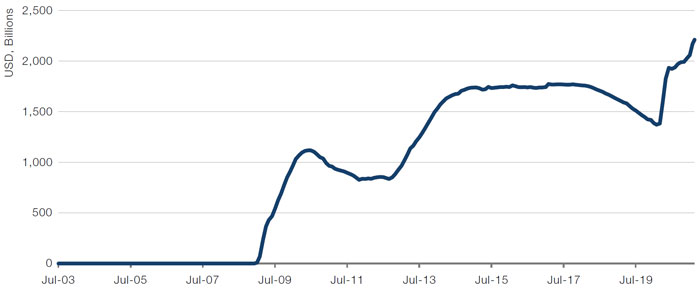

Fortunately for our sleep patterns, unlike previous crises, the Federal Reserve balance sheet is well-stocked with MBS (Figure 3). As the Fed does not hedge its MBS, some of the sting is taken out of the hedging cycle, as there are vastly fewer market participants who need to hedge their MBS risk.

Figure 1. Yield Spikes and Crises

Source: Federal Reserve Bank of St Louis; as of 22 March 2021.

Figure 2. Negative Convexity – Hedging MBS With Treasuries

Source: Man Group. For illustrative purposes only.

Figure 3. Fed MBS Holdings

Source: Federal Reserve; as of 22 March 2021.

Actions, Not Words

China property sales soared in the first two months of 2021. Property sales by floor area surged 104.9% year-on-year in the first two months of this year, and were up 23.1% from the first two months in 2019. This extended surge in home sales has re-raised concerns about speculative asset bubbles, as flagged in recent weeks by Chinese regulators.

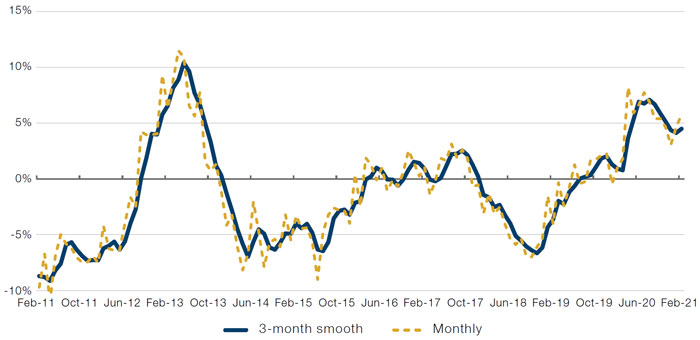

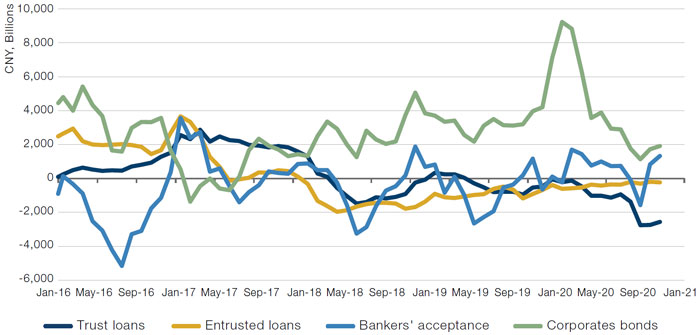

Outward concern about speculative excess now sits at odds with the underlying trends in the Chinese credit impulse (which shows the change in the growth rate of aggregate credit as a percentage of GDP): after slowing down in the third quarter of 2020, the credit impulse has now started to stabilise (Figure 4). Indeed, the underlying shadow loan categories are all starting to stabilise or move back into positive territory (Figure 5). At this point it is only really stabilisation rather than reacceleration. But, should it continue, credit-dependent activity indicators typically pick up six to nine months later.

Figure 4. China Credit Impulse

Source: Man GLG; as of 28 February 2021.

Figure 5. Underlying Shadow Loan Categories Are Starting to Stabilise

Source: Man GLG; as of 28 February 2021.

With contribution from: Jonny Nye (Man AHL, Head of Investment Risk) and Ed Cole (Man GLG, Managing Director – Discretionary Investments).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.