Winners and Losers: Biden’s Tax Plans

The announcement of a range of tax hikes to accompany a proposed infrastructure bill by US President Joe Biden been well absorbed by US equity markets, with the S&P 500 staying relatively flat by the end of trading on 31 March. These hikes are not necessarily a surprise; raising the corporate tax rate to 28% was a major plank of Biden’s election platform.

There may be a significant difference between the current policy proposals and the tax hikes that are delivered: Biden requires at least ten Republican senators to move to consider the bill under Senate rules1, and with the Democrats holding the slimmest of Senate majorities, there is a significant chance that proposals will be watered down or otherwise passed under budget reconciliation procedures. If implemented in full, however, these tax hikes have sector and style implications for US equities.

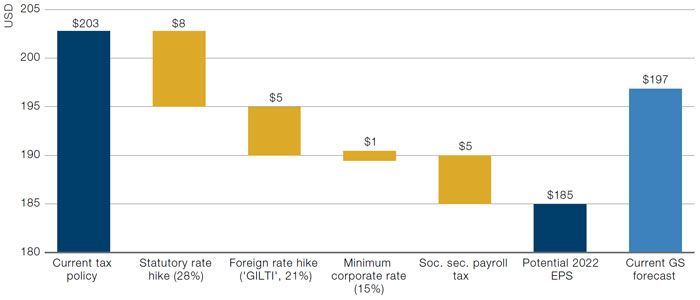

Figure 1 shows the effect of the proposed hikes on 2022 earnings per share of the S&P 500 index, as estimated by Goldman Sachs. Aside from the increase in the headline corporate rate, the major item is the increased tax on foreign earnings (third bar from the left), taking the minimum tax on income derived from foreign intangible assets to 21%.

Figure 1. Biden Tax Plan – Effect on S&P 500 2022 EPS

Source: Goldman Sachs; as of 18 March 2021.

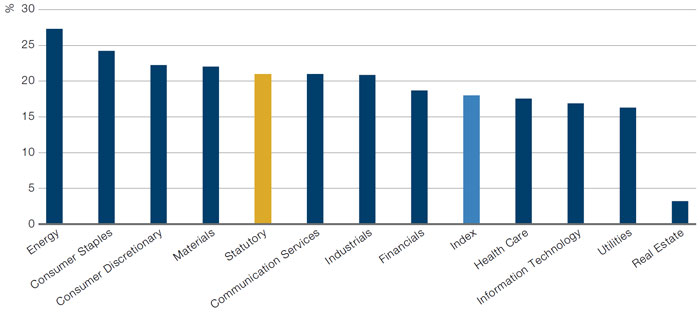

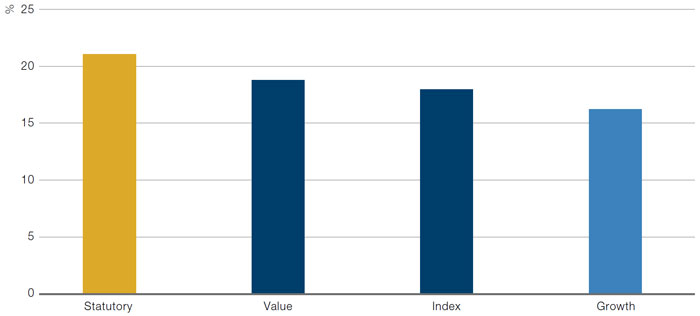

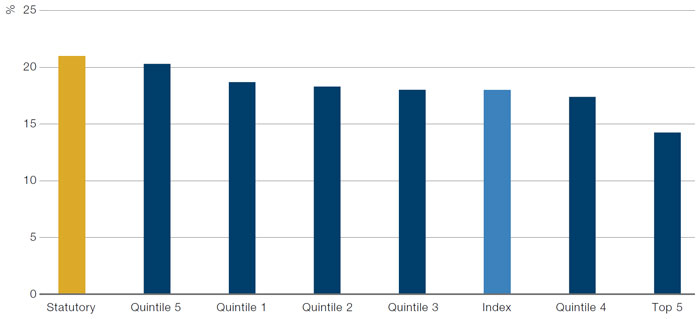

Not all companies are affected by tax equally: those companies with a high level of intangible spend, such as technology companies, pay far less tax under the current system than those in sectors with a higher reliance on fixed assets. By increasing the statutory rate and deliberately targeting tax on foreign earnings, these tax hikes will impact tech stocks and healthcare more than energy, materials, consumer discretionary and consumer staples, and Growth stocks more than Value (Figure 2-3). This has implications for tax rates by market capitalisation as well, given that the five largest US companies are tech firms (Figure 4).

Figure 2. Effective Tax Rates by Sector – Russell 1000 Index

Source: Bloomberg; as of 30 March 2021.

Figure 3. Effective Tax Rates by Value/Growth – Russell 1000 Index

Source: Bloomberg; as of 30 March 2021.

Figure 4. Effective Tax Rates by Market Cap – Russell 1000 Index

Source: Bloomberg; as of 30 March 2021.

The Great Growth Unwind?

Popular trades have had a bad March, adding more misery to an already miserable year for popular hedge fund positions.

The long/short Goldman Sachs Hedge Fund VIPs Index captures the returns to the most popular hedge fund trades (Figure 5). These are defined as positions that appear most frequently among the top 10 long equity holdings within the portfolios of fundamentally driven hedge fund managers. After a solid bounce at the end of the month, March has proven to be the third worst month in its 20-year history, and almost as large as March 2020 in the eye of the storm of a global lockdown and treasury market dislocation.

As we’ve previously written, we are experiencing a period of intense factor volatility, which often heralds a painful factor regime change. As such, poor performance from popular positions in this context suggests that rotation from prior winners into value has not fully happened yet. And that if the prevailing macro conditions persist, there is more of this unwind to come.

Problems loading this infographic? - Please click here

Source: Bloomberg, Goldman Sachs; as of 31 March 2021.

With contribution from: Ed Cole (Man GLG, Managing Director – Discretionary Investments).

1. New York Times, Biden Wants to Pay for Infrastructure Plan With 15 Years of Corporate Taxes, 30 March 2021.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.