Quote of the Week:

"You don’t realise who you are dealing with. Whatever your sanctions are, don’t be late with them."

Are Taxes Inevitable? Say it Ain’t So, Joe!

Death. Taxes. Inevitable… We all know how the line goes.

However, some investors seem to disagree – at least when it comes to taxes.

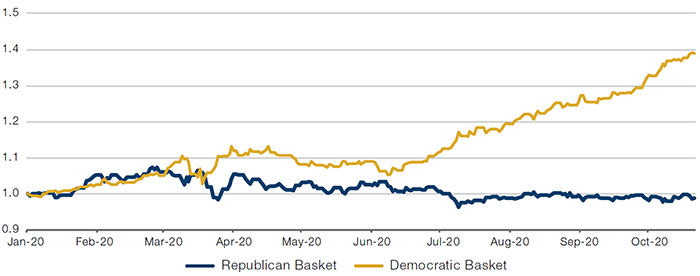

How do we draw that conclusion? Well, Goldman Sachs has created two policy baskets , both available on Bloomberg (Figure 1). GSPUDEMP is an index that tracks the performance of stocks which would benefit from a Biden presidency, GSPUREPP from four more years of President Trump – both based on the candidates’ stated policy positions. Consistent with polling, the Democrat policy basket is strongly outperforming the Republican basket, indicative that investors expect a Joe Biden presidency, and quite possibly a Democratic sweep of both the Senate and the House of Representatives.

Figure 1. Democrat Versus Republican Policy Baskets

Source: Goldman Sachs, Bloomberg; as of 21 October 2020. Both indices rebased to 100 as of 1 January 2020.

That sweep could enable Biden to push through his policy platform – of raising the US corporate tax rate to 28% and enacting a 15% tax on what his campaign describes as ‘book income’ – unchallenged. This could result in a 12% hit to the earnings of the S&P 500 Index, according to calculations done by Goldman Sachs.

So why then, if investors think it so likely that there will be a blue wave (Biden can win the presidency, and the Democrats the Senate and the House), does the S&P 500 remain close to all-time highs? FiveThirtyEight’s latest polling amalgamation gives Biden an 87% chance of victory, which could theoretically lead investors to price in a roughly 10% drop in the level of the S&P 500 (0.87 x 0.12 = 0.1044). The fact that they haven’t means investors believe that taxes aren’t inevitable, and are instead pricing in a serious dilution of Biden’s corporate tax platform. Of course, another reason could be that investors may be optimistic of a blue wave resulting in more fiscal stimulus and infrastructure investment.

Either markets are reading the room badly, and have incorrectly assessed the chances of a Democratic sweep... Or they believe that Biden isn’t a man of his word.

Either way, something will have to give.

The Persistent Brexit Discount

Warren Buffet once compared investing to shopping in the discount aisle. However, the comparison fails to work in one key way: when you go shopping, you consume the product to enjoy its relative cheapness. No further input is required – if Magnum ice-creams cost GBP1 and you bought it for GBP0.8, that’s a 20p discount realised when you eat it. But, in investing, you have to wait for everyone else to recognise that the stock you bought for GBP0.8 is worth GBP1 before you realise the value. And if they don’t, the ‘value’ remains ephemeral.

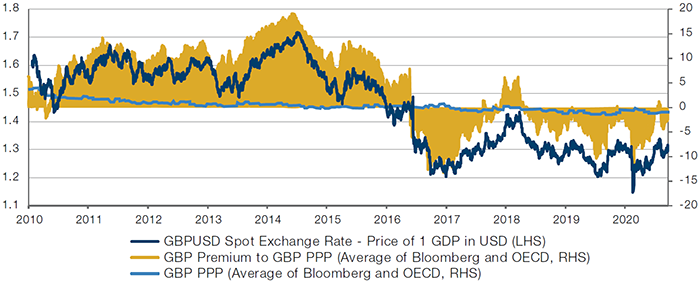

This concept is evident when we look at the discount that sterling trades at compared to purchasing power parity (Figure 2). The GBP/USD exchange rate has persistently undervalued sterling on this measure since the Brexit referendum in 2016, wiping out the consistent premium enjoyed by sterling before this date.

Persistent uncertainty as to the course of Brexit negotiations continues to weigh on the British pound. While we believe that a basic trade deal (failing to fully resolve contentious issues such as fishing rights, with these left to longer term negotiations) will be agreed before the transition period ends on 31 December, investors appear to be reducing their risk-exposure to sterling during this period of contested Brexit negotiations.

And that brings us back to value. If one does feel that the discount on sterling (and the persistent discounts on UK stocks versus history and international peers) does offer value, it is unlikely to be realised until after 31 December, when the end of the transition period forces a denouement. But at that point the narrative may well change: whilst the market has ignored the persistent Brexit discount until now, if Brexit is finally resolved, can investors afford to ignore it any longer?

Figure 2. GBP – Implied Discount to Purchasing Parity Power

Source: Bloomberg; as of 21 October 2020.

With contribution from: Rob Furdak (Man Group, Chief Investment Officer for ESG).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.