Quote of the Week:

"One thing I’d say is I’m not sure it is sensible for the government to have individual equity stakes in hundreds of thousands of businesses."

Chinese Equities: Dancing to a Different Tune

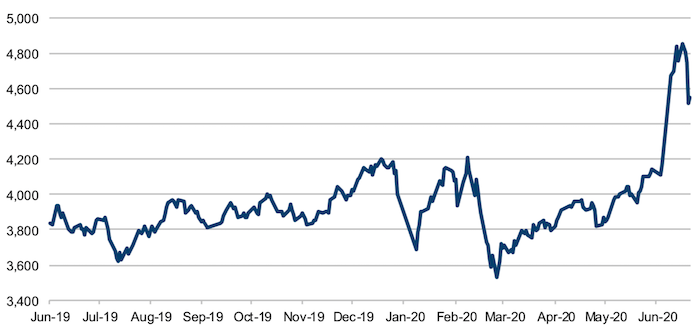

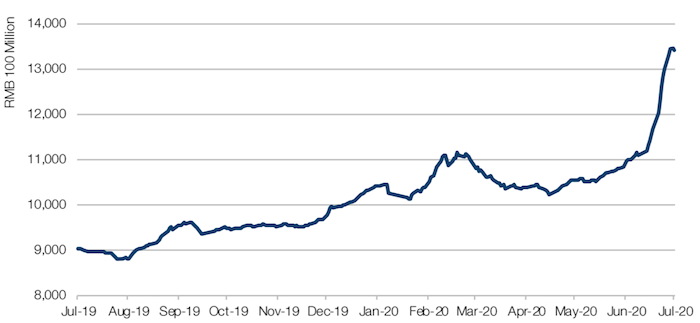

In early July, China’s state media encouraged investment in the stock market, citing a post-coronavirus economic boom. Investors reacted with alacrity, with the CSI 300 Index surging more than 10% between 6-16 July (Figure 1). The outstanding balance of margin purchase and debt repayment also saw a spike (Figure 2). This has rekindled memories of 2014 and 2015, when comments by state media also resulted in a doubling of Chinese stock markets.

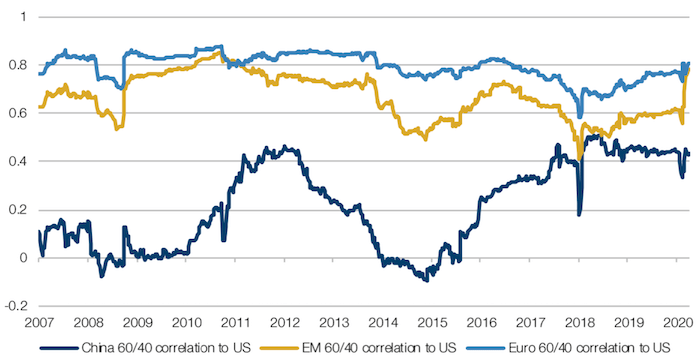

As we have written before, these movements are a reminder of how Chinese assets behave differently from the rest of the world. Indeed, from a macro perspective, Chinese assets represent a diversifier for an international allocator. Figure 3 shows 60/40 2-year correlations based on USD returns for large-cap stocks and government bonds in each region. It is notable that while mainstream emerging markets and Europe are materially and persistently correlated to US, the correlation of Chinese assets to the US differs substantially, even managing to be inversely correlated prior to the Lehman Brothers’ bankruptcy, and was so again in early 2015.

Figure 1. CSI 300 Index Rallies in July…

Source: Bloomberg; as of 17 July 2020.

Figure 2. …As Does China Margin Trading

Source: Bloomberg; as of 16 July 2020.

Figure 3. Regional Correlations

Source: MSCI, Bloomberg, Man Group; as of 17 April 2020. For illustrative purposes only.

Mortgage Confidence: A Cause for Concern

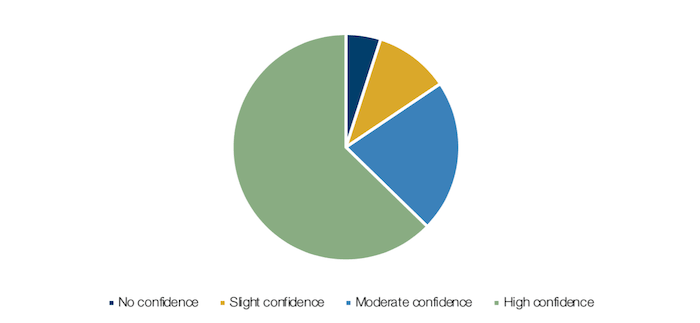

Almost 16% of the US population have slight or no confidence in their ability to pay the next month’s rent or mortgage on time, according to the Household Survey Pulse by US Census Bureau (Figure 4). Conducted between 25-30 June, the survey gathered answers from more than 98.5 million respondents.

What is striking is that the survey data was collected in June, when US government subsidies were still being offered. A rolling off of these subsidies in the longer term could be a real cause of concern for the housing market, in our view.

Figure 4. Confidence in Ability to Pay Mortgage Next Month, US

Source: US Census Bureau; survey conducted between 25-30 June 2020.

With contribution from: Ed Cole (Man GLG, Managing Director – Equities).

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.