1. Introduction

We expect the narrative to continue to rotate between inflation, growth and financial stability – leading to a continuation of this more volatile macro environment.

Our last outlook outlined our priorities for this year as diversification, liquidity and risk management. This premise was tested in the first quarter as the collapse of several US regional banks and the forced takeover of Credit Suisse led to a shift in the market’s sentiment towards bonds. Interest rates collapsed and the negative bond/equity correlation reasserted itself. Treasuries became a safe haven again, having hitherto been regarded cautiously for their sensitivity to inflation.

We expect the narrative to continue to rotate between inflation, growth and financial stability – leading to a continuation of this more volatile macro environment and reinforcing the case for the aforementioned priorities.

We believe that this more volatile macro environment will continue to provide opportunities for Global Macro traders, but be more challenging for Macro Quantitative funds, whose models may struggle to adapt with rapidly changing conditions. The picture has improved for Credit Long/Short, in our view, as dispersion in credit has increased which allows for trades across the capital structure of companies. Tighter lending standards have yet to translate into more defaults and we are staying away from directional credit risk; as such, we retain a negative view on Distressed for now.

2. Our Outlook

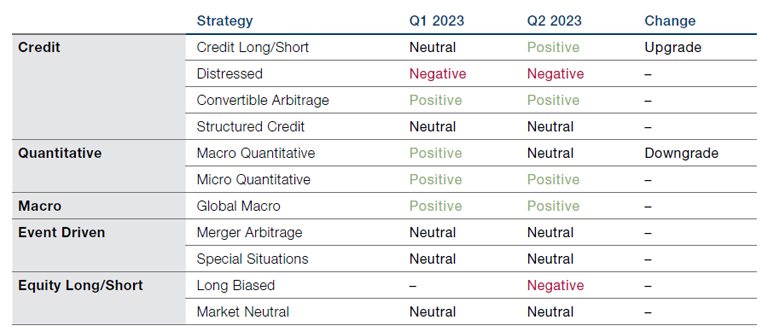

Figure 1 shows our stance on different hedge-fund strategies for Q2 2023. We are becoming more constructive on opportunities across Credit.

Figure 1. Q2 2023 Outlook Versus Q1 2023 Outlook

3. The Details

3.1 Credit

We upgrade Credit Long/Short to positive, with a focus on bottom-up manager selection.

We believe the opportunity set for credit is improving: credit spreads are wider, lower-rated issuers have underperformed, and capital access for lower-rated names has become more limited. There has also been an increase in fundamentally driven issuer- and sector-level dispersion, given pressure on profit margins and higher interest expenses, and higher yields. Elevated market volatility is additionally leading to capital-structure mispricings between equity and debt, so we upgrade Credit Long/Short to positive, with a focus on bottom-up manager selection.

Increasing default rates should eventually lead to a better opportunity set for Distressed managers (through rescue financings, Debtor in Possession financing, etc.), but until then we remain underweight. In preparation for this eventuality, however, we are focused on commercial real estate (‘CRE’) as a source of future distressed supply. The significant and rapid increase in borrowing costs over the past year will make it challenging for many CRE sectors and properties to refinance, with an estimated $2.3 trillion of CRE debt maturing over the coming years.1 The expected tighter lending standards for CRE loans given the stress in regional banks could potentially lead to a multi-year distressed and lending opportunity. There will nevertheless likely be dispersion across CRE and commercial mortgage-backed securities (e.g. between office and multifamily). Government-Sponsored Enterprises (‘GSEs’) are the primary lender in the multifamily space, which should lessen the impact there; the smaller banks that lend to office, retail, and hotel sectors could be more affected. We also expect secondary-market opportunities, such as the potential sale of loans at discounts from bank balance sheets, for funds with long-term capital.

In Convertible Arbitrage, we retain a favourable view on credit-sensitive convertible bonds (‘CBs’) given a rich opportunity set for credit selection. Around half of the US CB universe is now represented by low-delta (0-40%) yield-oriented names; this number was in the mid-20s a year ago.2 Elevated rates should also support CB primary issuance and refinancing activity , with new deals expected to come at higher yields/ lower premiums. On the other hand, we see macro headwinds while broad US high-yield market spreads are still only around historical median (and non-recession average) levels; US corporate defaults are still relatively modest, but are increasing.

Given this backdrop, the opportunity set remains idiosyncratic as we would expect a higher dispersion in manager returns in current markets based on risk profile and exposures. Generic credit exposure might not be rewarded at prevailing spreads and rising default rates, but we see opportunities emerging in the second quarter in capital structure arbitrage, some stressed names, and financial preferreds.

We are expanding our capacity options in Micro Quant strategies that trade statistical arbitrage and use machine-learning strategies, mainly in equities.

We are neutral on Structured Credit, where we are focused on a diversified portfolio approach across residential, consumer, and CDO/CLO sectors. Spreads across most securitised-product sectors are only modestly below their recent wides, and loss-adjusted yields remain elevated. As mentioned above, we expect dispersion in CRE and commercial mortgage-backed securities to create future opportunities. Historically sound consumer fundamentals and a lack of housing inventory provide a positive basis for managers in this space, but we are cognisant of potential risks from the impact of higher mortgage rates on housing affordability and demand, increasing consumer delinquencies and defaults (especially for lower-income borrowers) and a sharply lower personal saving rate. These considerations, alongside the still elevated macroeconomic uncertainty and potential for tail outcomes on rates, inflation and recession, keep us from an upgrade.

3.2 Quantitative Strategies

We maintain our positive outlook for Micro Quantitative strategies as we believe that volatility and a higher interest-rate environment should fuel expected returns. Both market dynamics increase dispersion in equities, which should create trading opportunities for these managers. We are expanding our capacity options in those that trade statistical arbitrage and use machine-learning strategies, mainly in equities.

Within the Macro Quantitative space, we downgrade our overweight – especially for slower and less sophisticated strategies, as we are concerned that these models will struggle with the more volatile macro fundamentals (as we saw in March).

We nonetheless note the value added by quantitative strategies for some investors, which is independent of our tactical outlook for the sector:

- Investors seeking variable exposure to rates in order to mitigate duration elsewhere in their portfolio can turn to trend, quant macro and systematic overlays; this is especially valuable with capacity in discretionary macro managers limited.

- The same can be said of commodities, with investors often seeking commodity exposure for inflation protection and/or to play the transition to a low-carbon economy. With fewer discretionary commodity traders in the market, we see investors seeking to use quant futures as a source of risk-managed commodity exposure, both for overlays and alpha strategies.

3.3 Macro

We are positive on Global Macro and believe economic divergence and macroeconomic uncertainty will continue to drive dispersion and create opportunities across asset classes and regions. The pricing of central banks’ policy paths remains in focus, a task further complicated by stubborn inflation in many regions and recent stress in the global banking sector. On banks specifically, the effects of the redistribution of deposits and tighter lending standards on growth and inflation – and ultimately on policymaking decisions – are unclear. This added uncertainty increases the probability of policy surprises and errors, on which skilled macro managers will look to capitalise.

Different policy responses will be required by the world’s central banks to address the diverse set of growth/inflation trade-offs in their regions – among them China’s economic reopening, a slowing US economy, Japanese inflation running at 40-year highs, and a recent improvement in the euro area’s growth prospects given the end of the Northern Hemisphere’s winter. Risks and opportunities therefore abound: the Federal Reserve’s rate projections appear disconnected from bond-market pricing, while there is a broad expectation that the Bank of Japan will exit yield-curve control imminently and shift to a stance more consistent with its inflation target.

Given how frequently the market narrative is changing, we expect choppy and range-bound markets to persist, and maintain our preference for trading-oriented strategies that can take advantage of short-term volatility.

We observe that macro funds have accordingly shifted to a more neutral stance on US fixed income, preferring shorts in Europe, while shorts in Japanese government bonds and Japanese yen longs appear the preferred expressions to benefit from a regime shift in Japanese monetary policy. In addition, as the Federal Reserve approaches the end of its tightening cycle and China’s economic reopening continues to boost global growth, macro traders believe an opportune time is approaching to lock in strong real yields in emerging markets where central banks were proactive in raising interest rates following the Covid-19 pandemic.

Insofar as March’s banking troubles increased this economic divergence and macroeconomic uncertainty, we recognise new risks posed to Global Macro managers:

- Portfolio drawdowns and volatility may lead to a period of low conviction levels and reduced risk appetite among managers, especially with evidence of some significant first-quarter losses in the peer group.

- Managers must be aware of market positioning. There have been numerous reports that the volatility in front-end yields during March was exacerbated by crowded hedge-fund positioning.

Given how frequently the market narrative is changing, we expect choppy and range-bound markets to persist, and maintain our preference for trading-oriented strategies that can take advantage of short-term volatility. We also hold a favourable view on multi-PM strategies that can leverage distinct investment themes across asset classes, styles and regions to diversify portfolios.

3.4 Event Driven

We remain neutral on Merger Arbitrage where, overall, managers face various headwinds – but spreads compensate for these risks. And, while not immune to the market environment, we note that such strategies are generally very low beta.

Starting with our concerns, ‘safe’ deals are trading much tighter – and don’t compare very well with a 4-5% cost of capital. Deal selection skills are essential, in our view. M&A activity levels are also mediocre, especially in Europe, which can result in crowding and in turn tight spreads. That said, deal levels can pick up very quickly and will benefit from market stability, so this remains a snapshot view, and there has been an uptick in pre-announced activity. There are more smaller deals in the EU, but not all managers are small enough to take advantage. Antitrust remains a hard-to-evaluate risk factor, and has led to an increase in deal failures. More insidious are the delays being caused, which mean deals take longer to close and thus become more exposed to procedural issues around stop-dates and changing sentiment.

Set against these risks, however, are the opportunities created by wide merger spreads outside the safest deals. Furthermore, these spreads are moving around a fair bit, offering opportunities to trade them. Weighted by market cap, the M&A universe overall is moving towards wider spreads, particularly as large deals face more challenges and delays. Healthcare, pharma, and tech remain the driving sources of deal activity.

We also remain neutral on Special Situations, where it feels like there are individual pockets of potential but it’s hard to separate a view from making a general call on markets at the moment. Although corporate events generally occur in stable markets – which is not the case currently – there is interesting potential for opportunistic corporate events, from both soft catalysts and non-merger hard catalysts. UK corporate broking in particular is apparently as busy as it has ever been, given the market’s large value gap to Europe and the US. There is a pipeline of UK firms seeking a US listing to close that gap, for example.

Activism, especially shareholder engagement, is also increasing. Such funds have a lot of dry powder and shareholder campaigns are now generating more traction than they used to; they are usually received in a more constructive fashion too. Soft activism is spurring bullish sentiment on the corporate-event opportunity set in Japan and Korea.

However, we are conscious that managers continue to run low levels of leverage. This implies not only fewer opportunities, but also that managers are sizing their high-conviction trades to be smaller than in the past (arguably a function of how they are assessing downside risks).

3.5 Equity Long/Short

The banking chaos of March has only reinforced our prior conviction on the importance of quality characteristics, especially balance-sheet strength.

Equities may remain range-bound through 2023, which may challenge Equity Long/ Short (‘ELS’) managers. This lends itself to our preference for less-directional managers. We have a neutral rating for Market Neutral strategies and a negative rating for directional Long Biased managers (i.e. those with consistent net exposure of 30% or more).

If anything, the banking chaos of March has only reinforced our prior conviction on the importance of quality characteristics, especially balance-sheet strength. We are living in a higher cost-of-capital world, where fundamentals should matter again. We see an alpha opportunity for longs in companies with strong balance sheets that do not need to borrow in the short term, and conversely for shorts in companies with weaker balance sheets that will need new capital. Another argument for this positioning is simply that quality companies tend to outperform in recessionary periods, as we highlighted in January. Even though 2022 was a weak year for unprofitable and lower free-cashflow companies, valuations remain stretched by 20+ year historical standards, so we think there is further room to fall.

Positive short rebates provide another tailwind, one that hasn’t been seen in many years, which may also favour managers with more active short portfolios over long-biased strategies. Prime-brokerage data3 show that ELS managers actively added to single-name shorts in the first quarter of 2023, citing a better opportunity set.

Set against this, there remains a challenging global growth backdrop with heightened recession fears. After a strong first quarter for global equities, we now see more asymmetry to the downside than to the upside. Recent moves have also caused more sector-level dispersion, with stocks in individual sectors and/or industries correlating to one, as opposed to dispersion at the company level based on fundamentals that could help ELS managers. Where there have been these sorts of widespread sector or industry selloffs (such as of regional banks in March), beta overwhelms alpha in rebound periods.

We must also consider the high degree of leverage in the system caused by the growth of multi-manager/strategy platforms. In stress periods, these firms will likely look to their equity books for liquidity, leading to sizeable flows that can spur non-fundamental price moves and/or factor rotations. This may also lead to an increased risk of short squeezes, though we note these are generally short term in nature. Managers with more diversified short books and/or a fundamental research process that incorporates awareness of short interest should be better placed to mitigate this risk.

So overall we believe manager selection is critical, as funds need to navigate an extended higher volatility period and choppy factor environment.

1. Source: Trepp, CBRE Research; as of Q3 2022.

2. Source: Man FRM; as of April 2023.

3. Source: Morgan Stanley Prime Brokerage and Goldman Sachs Prime Services; as of April 2023.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.