1. Introduction

Quantitative strategies check all three boxes for us.

Based on our view that markets will likely remain as challenging in 2023 as they were last year, we will maintain our focus on our three priorities of delivering:

- diversification

- liquidity

- risk management

Quantitative strategies check all three boxes for us. We expect them to deliver positive, uncorrelated returns that benefit from the dispersion in markets, while remaining liquid and adhering to their inherent risk management.

In a year when macro risks are likely to remain preeminent, we are also positive on Volatility Arbitrage – especially trading volatility between different asset classes – and on Global Macro, as the divergence in macro economies is likely to create tactical opportunities. We expect idiosyncratic alpha from Convertible Arbitrage, where we believe ‘busted converts ’ offer value. Our outlook on Credit remains balanced for now, but we expect to upgrade it in future quarters if a distressed cycle forms.

2. Our Outlook

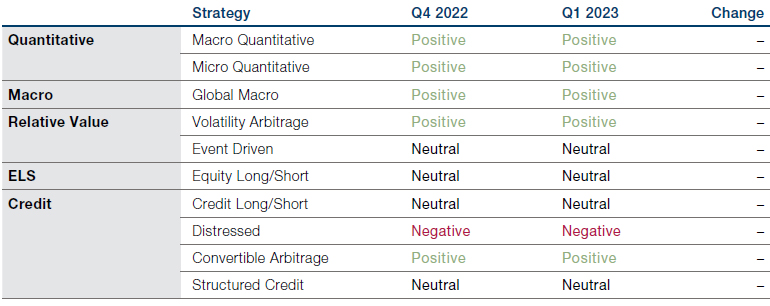

Figure 1 shows our stance on different hedge-fund strategies for Q1 2023. We have made no significant changes from the previous quarter.

Figure 1. Q1 2023 Outlook Versus Q4 2022 Outlook

3. The Details

3.1 Quantitative Strategies

Volatility generally helps quant managers as they need movement and dispersion to create trading opportunities, with less leverage needed to hit target returns.

Our positive outlook for quantitative strategies is buoyed by the higher rate and volatility backdrop, which should create interesting capacity options for 2023. Higher rates have historically been accompanied by market volatility, and – with some exceptions – volatility generally helps quant managers as they need movement and dispersion to create trading opportunities, with less leverage needed to hit target returns. Finally, there is an argument that higher rates create more pressure for securities to re-price, which reduces the time quants need to wait for alpha signals to pay off.

Good quant managers are inevitably capacity constrained, but the additional volatility generates an expansion of opportunities (without any obvious degradation in Sharpe ratio or returns). We are indeed seeing this, both with existing managers and established portfolio-management teams who are now seeking to spin off. These points underpin our favourable outlook on Micro Quantitative.

Upon reflection, our Q4 2022 outlook for Macro Quantitative strategies was too optimistic. In the first quarter of 2023, we are tempering the overweight tilt we’ve been running in slower trend strategies in favour of faster futures managers and those with models that are more sensitive to macro fundamentals. At the margin, this is because the hurdle for taking a position ought to be higher: there should be additional reliance on fundamentals, rather than just technical or trend signals. Similarly, we expect faster managers to reduce losing positions sooner. This also eases any reliance on carry themes, which can be a source of return for slower trend managers; however, these are muted now due to flatter yield curves.

We are optimistic on the progress for quantitative strategies trading Chinese markets. Reasons for quant managers to like the region include: i) the liquidity, breadth and volatility in both equities and futures; and ii) the low correlation with other major capital markets. We’ve mentioned previously that regulatory changes are allowing managers to trade futures more easily and cost effectively in China. We also believe there is an opportunity for investors with a higher risk tolerance that want to be long, albeit the recent rise in Covid infections has understandably slowed enthusiasm for this theme.

3.2 Global Macro

We continue to favour generalist, tactical trading-oriented managers who can take advantage of this increased economic divergence expected in 2023.

We expect varied macroeconomic policy responses given the diverse set of growth/ inflation trade-offs at play for different economies. Fiscal and monetary activity should provide alpha generation opportunities as the trajectory of major economic zones begins to deviate. Macro themes include views on regional markets based on their idiosyncratic economic fundamentals and political backdrop, opinions on the varying central-bank policy paths, and longer-term assessments around the impact of continued fragmentation of the global economy. So while our outlook on Discretionary Macro remains positive, we continue to favour generalist, tactical trading-oriented managers who can take advantage of this increased economic divergence expected in 2023.

Amid this activity, there is an increased risk of policy surprises and errors. We believe managers focused on the shorter term can harvest alpha and preserve capital in a choppy market environment characterised by frequently changing narratives as market participants digest financial data and policy guidance. Our preference for generalist managers over regional or asset-class specialists is similarly based on our belief that those with expertise across emerging and developed markets and fixed income, currency, equity, and commodity markets are better equipped to identify and risk-manage trade opportunities resulting from the dynamic forces driving today’s market.

3.3 Relative Value Strategies

Our view on Volatility Arbitrage is positive as the current volatility environment is elevated and dynamic, with this volatility complex driven by the uncertainty around interest rates and geopolitical developments. Rates volatility could increase further if inflation surprises to the upside. Spill-over effects into other asset classes would be likely in this scenario, which should help cross-asset volatility arbitrage managers who can exploit the wide dispersion in historical implied volatility levels and tactical dislocation opportunities. Range-bound rates and equity markets, on the other hand, would reduce the opportunity set. Therefore, we prefer cross-asset volatility arbitrage with a long convexity bias.

We have a neutral view on Event Driven strategies. We believe the opportunity set in merger arbitrage is currently average, although at the same time there are signs that special-situations opportunities are growing. However, these come with downside beta. Therefore, in our opinion, a nimble trading-oriented strategy is best placed here.

Merger-arbitrage managers are currently allocating capital cautiously, keeping their powder dry for better entry opportunities as well as a pickup in deal volumes.

Within the current merger-arbitrage opportunity set, we see higher risk and higher return as deal spreads are wide, reflecting the risk of delays, breaks and higher rates. Global activity levels are down year-on-year and, following a flurry of deal completions in the fourth quarter, mid-term pipeline forecasts imply more predictable markets, available financing, as well as strategic incentives to seek growth via acquisitions. Reflecting the uncertain outlook, merger-arbitrage managers are currently allocating capital cautiously, keeping their powder dry for better entry opportunities as well as a pickup in deal volumes. Managers are concerned that extended transactions are exposed to fragile equity markets and other bumps in the completion path.

While special situations typically have higher market beta due to their sensitivity to fundamentals, as well as catalyst-timing uncertainty, there could be attractive return drivers both from exposure to normalisation plays (i.e. the stabilisation of inflation and economic activity) as well as exploiting idiosyncratic dislocations in stressed corporate securities. Event-driven managers are increasingly entering credit opportunities that are covered by strong cash flows but still trading at stressed prices in a dislocated market. Managers are finding increasing numbers of companies that are cash-flow challenged and may be faced with insolvency or at least the need for dilutive capital raising or equitization of debt. Such situations are providing interesting capital-structure arbitrage ideas, as are bonds that have make-whole provisions in case of change of control.

We expect Japan to be interesting for special situations, as equity valuations are cheap relative to other developed markets and the relatively weak currency should result in improved cost competitiveness. China reopening is a theme for Asia-focused managers, but timing and tactical trading are critical as that market struggles to find equilibrium. US-listed ADRs have benefited from encouraging developments around the SEC being able to audit locally in Hong Kong.

3.4 Equity Long/Short

Our outlook on Equity Long/Short (ELS) remains neutral and we continue to favour low beta and diversified ELS managers as global economies and equity markets sit in uncertain territory.

As the paths of global economies become clearer, we expect that valuations and price movement will become more dependent on corporate earnings and less tied to macroeconomic data points.

Recession remains a possibility for many global economies. As such, ELS managers who emphasise quality characteristics (i.e. balance-sheet strength, high margins, and resilient businesses) in their investment analysis may be better placed in the short term. In fact, quality style factors consistently outperformed in prior recession periods between 1990 and 2020.1

Managers are expressing a gloomy top-down narrative that not all the expected damage is priced into equities, and this is reflected in exposures and capital-allocation levels. Despite a heavy bout of short covering in mid-Q4 2022, we see that ELS funds’ net exposure remains below average. Positioning in ELS lacks conviction, making it hard for us to build conviction in the opportunity set.

As we look past the first quarter and later into 2023 for ELS, we are watching for markers of an improving outlook. As the paths of global economies become clearer, we expect that valuations and price movement will become more dependent on corporate earnings and less tied to macroeconomic data points. In turn, single-stock dispersion should then pick up, which has generally been a tailwind for fundamental stock pickers. Additionally, with some of the macroeconomic overhang lifted, greater risk-taking would signal increased confidence from ELS managers.

3.5 Credit

Risk assets have generally performed better since the start of Q4 2022, helped by better-than-feared earnings, good economic data, easing inflation concerns, and a rally in Treasuries. Broad credit market spreads, while tighter over this period, remain wider on the year and issuer/sector-level dispersion has remained elevated, leading to better opportunities for credit selection.

Corporate credit managers are expected to exploit potential opportunities from a weaker economy, such as more limited capital access for lower-rated issuers and an increase in fallen angels. There is also an increase in the universe of distressed/ defaulted sovereigns, as well as potential opportunities from the overhang in the credit markets (e.g. high-yielding secured paper that banks might seek to sell at a discount). However, we see that US distress and default metrics remain fairly modest. In fact, there were no new US high yield or leveraged loan defaults in October or November 2022.2 Overall market spreads also still remain around historical median and non-recession average levels. Therefore, we continue to maintain our preference for Credit Long/Short managers over Distressed managers.

We remain positive on the opportunity set for idiosyncratic credit selection in Convertible Bonds given the significant expansion in the universe of credit-sensitive issues. According to a recent report, approximately 25% of global convertible bonds trade at less than 80 cents on the dollar and around 20% have yields to worst in excess of 10%.3 Most of these issuers tend to have low-coupon convertible bonds as their only debt; many still have significant equity market caps, with a reasonable runway to maturities in 2025-2026.

In this environment we seek to maintain an opportunistic mindset.

In Structured Credit , spreads across most securitised-product sectors remain near recent wides, driven by elevated supply and reduced demand given outflows from fixed-income funds. We see that loss-adjusted yields remain meaningfully higher given higher rates and wider credit spreads, resulting in attractive convexity. We believe consumer and residential housing fundamentals remain sound in most part – thanks to low debt balances and servicing costs, and to constrained supply – but softening is expected given the impact of high mortgage rates on housing affordability, demand and an expected increase in unemployment.

Overall, in this environment we seek to maintain an opportunistic mindset, with a balanced outlook in the near term given historically elevated macroeconomic and geopolitical uncertainty and the potential for tail outcomes on rates, inflation and recession. Unlike in previous dislocations, this opportunity set could persist for longer given the low likelihood of near-term support from central banks for risk assets.

1. Source: Jefferies, January 2023; Morgan Stanley, December 2022

2. Source: Man FRM; as of 31 December 2022.

3. Source: Bank of America Global Research; as of 17 January 2023.

You are now leaving Man Group’s website

You are leaving Man Group’s website and entering a third-party website that is not controlled, maintained, or monitored by Man Group. Man Group is not responsible for the content or availability of the third-party website. By leaving Man Group’s website, you will be subject to the third-party website’s terms, policies and/or notices, including those related to privacy and security, as applicable.